- A rounded bottom pattern has emerged, with ARB targeting $2.42 after breaking $1.30 resistance.

- Market sentiment supported ARB’s bullish outlook, signaling sustained momentum.

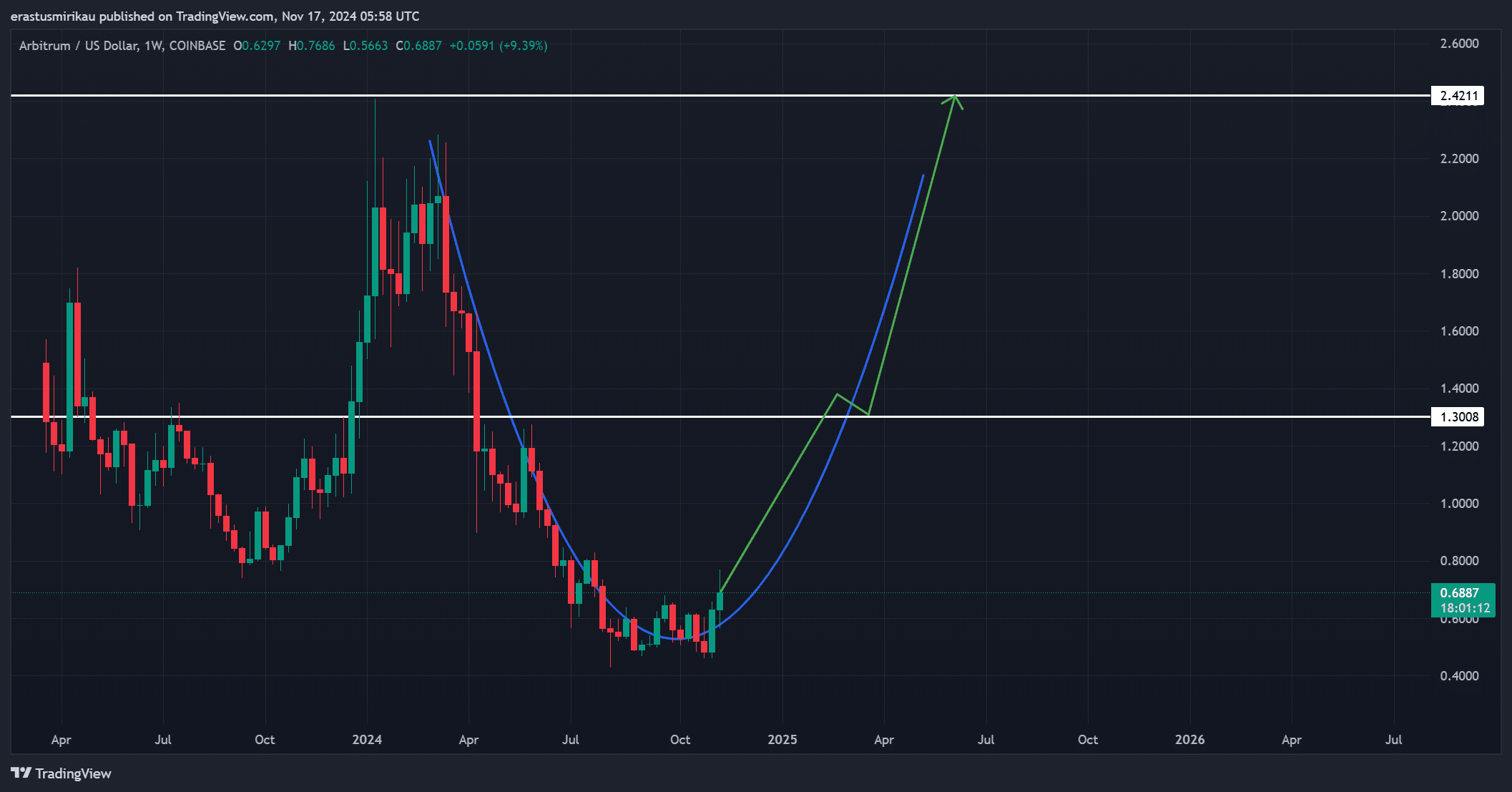

As an analyst with over two decades of experience in the financial markets, I’ve seen my fair share of trends and patterns. The current situation with Arbitrum [ARB] is particularly intriguing given the emergence of a rounded bottom pattern on its chart. It’s like watching a phoenix rising from the ashes – a symbol of resilience and potential growth.

In the bustling crypto market, Arbitrum [ARB] is drawing considerable interest. This surge can be attributed to its strong price growth and escalating trading action.

Currently, ARB is being exchanged at $0.6947, representing a 11.29% rise compared to the previous 24 hours. Notably, its trading volume has surged by an impressive 200%, reaching a staggering $1.10 billion, showcasing heightened enthusiasm from market players.

Nevertheless, it’s essential to consider whether ARB can sustain its upward trend and break through the $1.30 barrier, potentially propelling it towards $2.42 in the process.

Rounded bottom hints at potential rally

Each week’s graph displayed a hopeful outlook, featuring what’s known as a “rounded bottom” pattern. This pattern is a robust sign suggesting a potential shift in market direction towards an upward trend, or in other words, it indicates a bullish reversal might be on the horizon.

Based on this pattern, it seems likely that ARB could maintain its upward trend if it manages to surpass the immediate resistance level of $1.30.

If the price surges beyond the current level significantly, it’s probable that more investors will be drawn in, potentially pushing ARB up towards its goal of $2.42. However, if the price doesn’t manage to exceed $1.30, it might indicate a period of stabilization or consolidation instead.

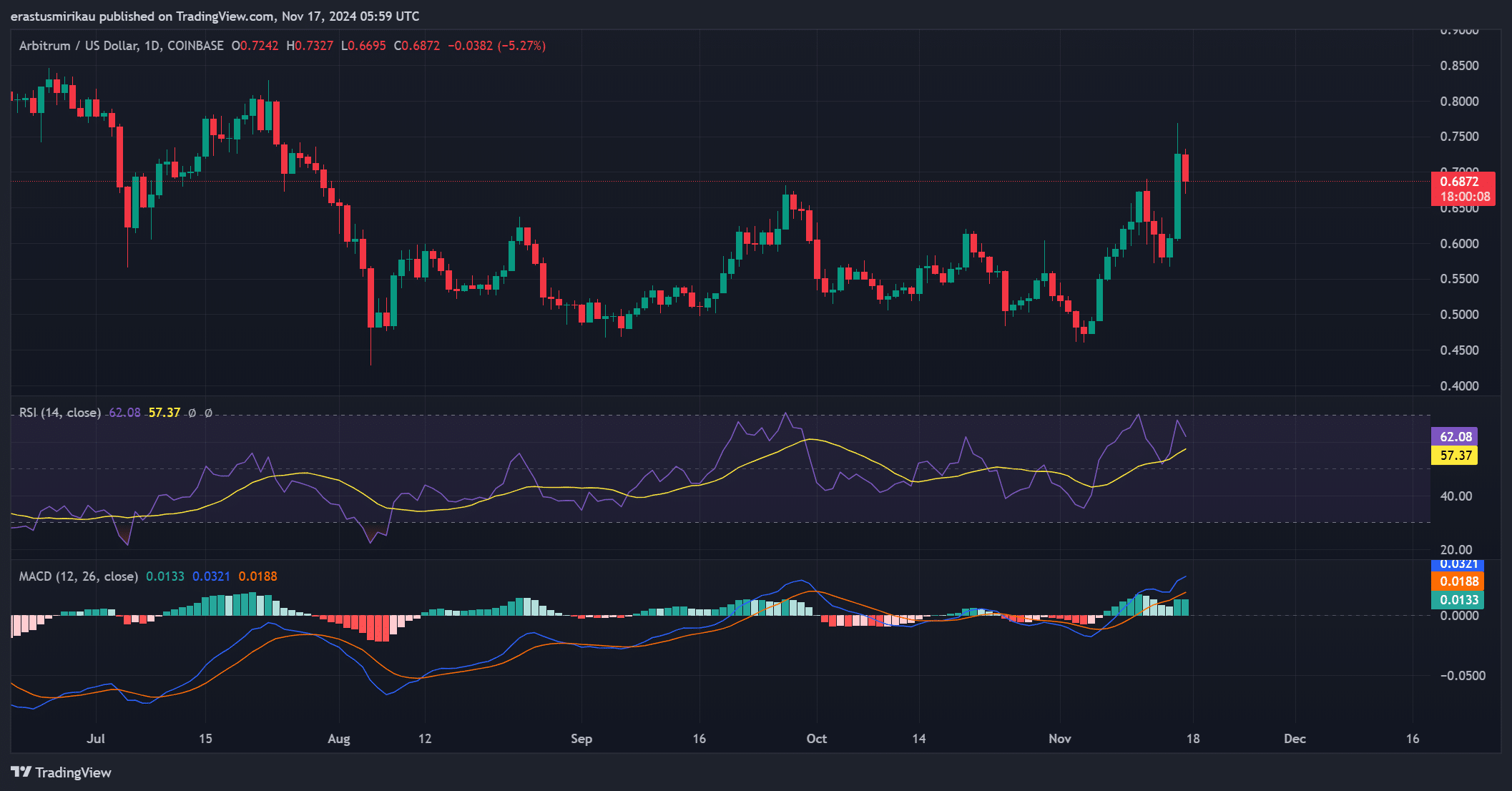

Arbitrum: Strengthening momentum

Momentum indicators further strengthened the bullish outlook for ARB.

At the moment, the Relative Strength Index (RSI) stands at 57.37 on the daily chart, suggesting a strong uptrend. However, there’s still potential for further growth as it hasn’t yet reached the point where the market is considered overbought.

In a similar fashion, the MACD (Moving Average Convergence Divergence) indicated a positive crossover, as the MACD line was clearly above the signal line. This pattern implies increasing market confidence and hints that the buyers might be taking charge.

However, any signs of weakening could result in a short-term pullback.

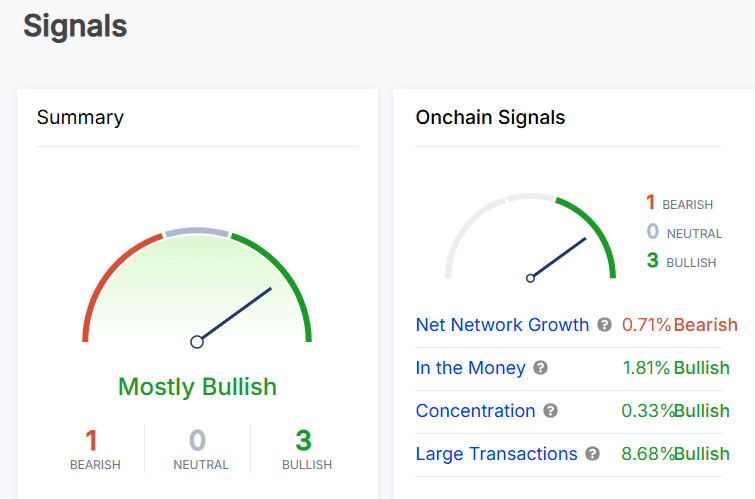

ARB on-chain signals reinforce bullish sentiment

On-chain signals largely support the bullish case for ARB.

“The ‘in-the-money’ indicator, which saw a 1.81% rise, signified an improvement in earnings for owners. Moreover, the significant 8.68% surge in big trades suggests increased investment from large institutions or high net worth individuals.

Nevertheless, the decrease by 0.71% in the expansion of the user network suggests that there’s some reluctance in attracting fresh members, which might potentially hinder continued growth.

From my perspective as a crypto investor, the 0.33% bullish concentration metric indicated that long-term investors were continuing to amass cryptocurrencies. This is a promising sign of stability, suggesting they believe in the longevity and growth potential of these digital assets.

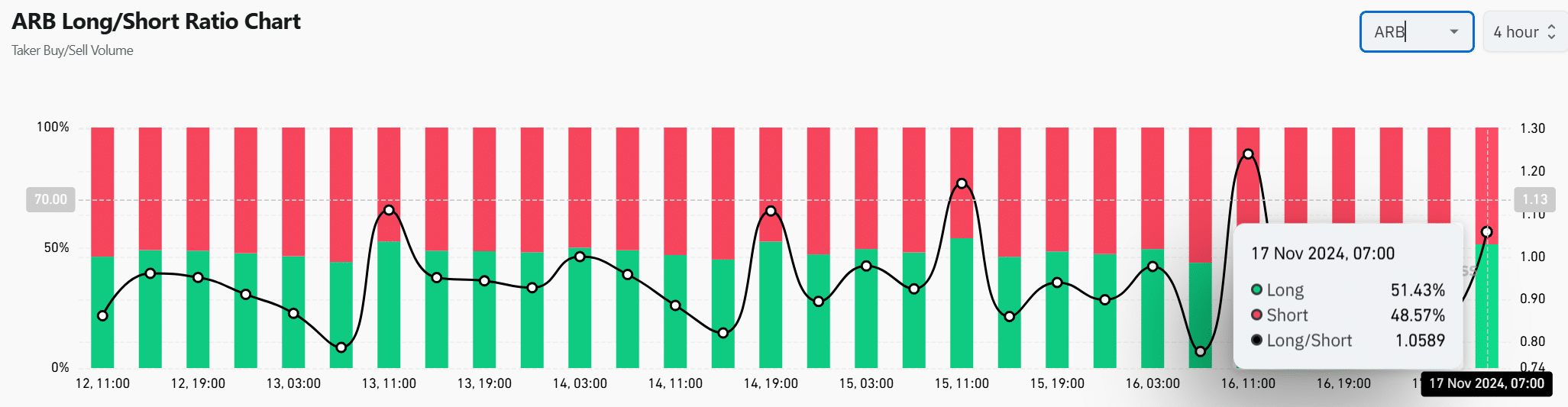

Will traders push ARB higher?

Sentiment data further emphasized cautious optimism. The Long/Short Ratio showed that 51.43% of traders had taken long positions at press time, signaling a slightly bullish tilt.

This suggested growing confidence in ARB’s ability to overcome resistance at $1.30.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

Looking ahead, ARB appears primed for potential growth, reinforced by a solid base formation (rounded bottom pattern), optimistic technical signs, and predominantly favorable on-chain analytics.

Yet, surpassing the $1.30 barrier is essential for validating its ongoing bullish trend. Should ARB successfully breach this point, the $2.42 goal may materialize in the approaching timeframe.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-11-17 23:04