-

Another whale bought ARB tokens worth $6.15 million while MATIC did not attract such investment.

New unique transactions on Arbitrum were more than those on Polygon.

As an experienced financial analyst, I have closely monitored the Ethereum Layer 2 (L2) space and have been particularly intrigued by the recent developments surrounding Arbitrum (ARB) and Polygon (MATIC). Based on the data provided in the article and my own research, I believe that Arbitrum is currently outperforming Polygon in terms of investor interest, network growth, and price performance.

As an analyst, I would caution that if Arbitrum (ARB) has seen such significant growth in recent months, it’s essential for other Ethereum Layer 2 (L2) solutions, such as Polygon (MATIC), to stay vigilant and prepare for potential challenges.

As a researcher studying cryptocurrency market trends, I’ve observed instances where substantial investments in ARB were made, as reported by AMBCrypto. Although this buying frenzy subsided at one point, it was followed by another wave of accumulation on the 17th of May.

Based on Arbiscan’s data, a purchaser acquired approximately 4.17 million ARB tokens on the specified date. This individual has been actively buying the token since July 2023.

The total value of the tokens held by the participants amounts to $6.15 million, even after they had sold some earlier.

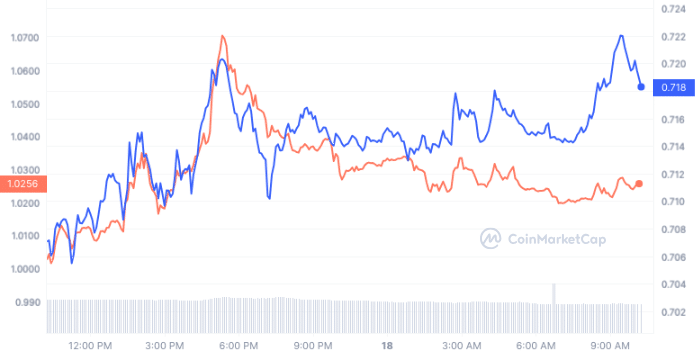

Both tokens fall, but one has the upper hand

Making such purchases indicates a strong belief in the token’s ability to perform well over an extended period. However, Polygon has faced challenges in consistently demonstrating this capability.

In terms of price reduction, MATIC has dropped by 29.23% this year to date. On the other hand, ARB experienced a more significant decrease, amounting to 40.86%, during the same timeframe.

If consistent accumulation of ARB (Autobahn) tokens in the ARB ecosystem results in a shift in its state, then the Polygon native token may fall short of keeping pace with the Arbitrum governance cryptocurrency.

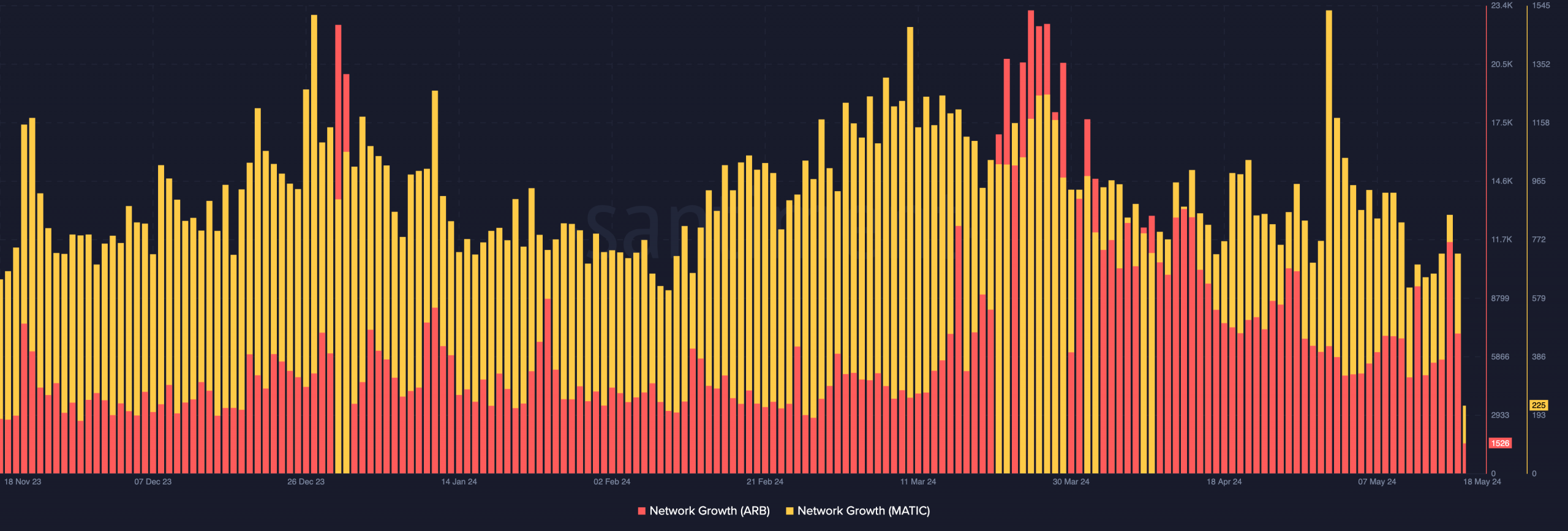

Aside from cost considerations, other features of individual ecosystems provide valuable clues about their prospective future achievements. For instance, AMBCrypto analyzed the expansion of each network in their comparison.

The number of fresh addresses engaged in transactions on Arbitrum’s network amounts to 1526 as of now.

At Polygon, the figure amounted to 225. This substantial disparity served as evidence of the growing interest among market players towards Arbitrum. Nevertheless, Polygon has yet to persuade many newcomers into conducting transactions via MATIC.

Should this trend persist, ARB‘s value is likely to see significant growth. Additionally, the token has recently broken through the $1 threshold.

As a crypto investor, I’ve noticed that ARB has been having a tough time bouncing back to its previous levels for several months now. However, given the current market conditions and the potential indicators suggesting a bullish trend, it seems plausible that the price of cryptocurrency could surge even further.

As a researcher, I can tell you that reaching the $2.39 all-time high that was hit in March is not an insignificant feat. Achieving this price level would require considerable effort.

Can Arbitrum’s market cap jump 3x?

As a researcher studying the cryptocurrency market, I’ve observed that Arbitrum, with its promising potential, may face challenges in surpassing Polygon’s current market capitalization of approximately $4.5 billion.

In contrast, Polygon had tripled in value to reach a market capitalization of $7.12 billion. For ARB to achieve similar levels, its price would need to surpass the $3.50 mark. However, this would imply that MATIC would have to halt at a price below $1.

Based on our examination, Arbitrum may keep surpassing Polygon in transaction volume. This growth could potentially lead to better results for Arbitrum’s native token compared to MATIC.

Realistic or not, here’s ARB’s market cap in MATIC terms

As a analyst, I would explain that in the long run, the prices of ARB (Arbitrum) and MATIC (Polygon, formerly known as Matic Network) could be influenced by the price trend of Ethereum, given that they are both Layer 2 (L2) solutions built on top of the Ethereum blockchain. This means that their values might be affected by the adoption, usage, and success of Ethereum.

If the price of Ethereum (ETH) increases significantly, it’s likely that the prices of tokens like Arbitrum (ARB) and Polygon’s native token would also rise. Conversely, if Ethereum’s value decreases, these tokens could experience a sharp decline in price.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- Elden Ring Nightreign Recluse guide and abilities explained

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

2024-05-19 02:15