- Arbitrum saw a daily active address number of over 400,000.

- This was the first time in history that it saw such a number.

As a researcher with extensive experience in the cryptocurrency and blockchain industry, I find Arbitrum’s latest achievement of surpassing 400,000 daily active addresses to be an impressive feat. This is a significant milestone for any Layer 2 solution on Ethereum, indicating growing adoption and confidence from the user community.

As a researcher studying the developments within the blockchain industry, I’m excited to report that Arbitrum (ARB) has recently surpassed an important benchmark in one of its key performance indicators. This significant achievement strengthens Arbitrum’s position as a frontrunner among Ethereum (ETH) Layer 2 scaling solutions.

Although this progress is noteworthy, a closer look at a different related indicator reveals that it has not yet made a significant difference in that area.

Arbitrum sets active address record

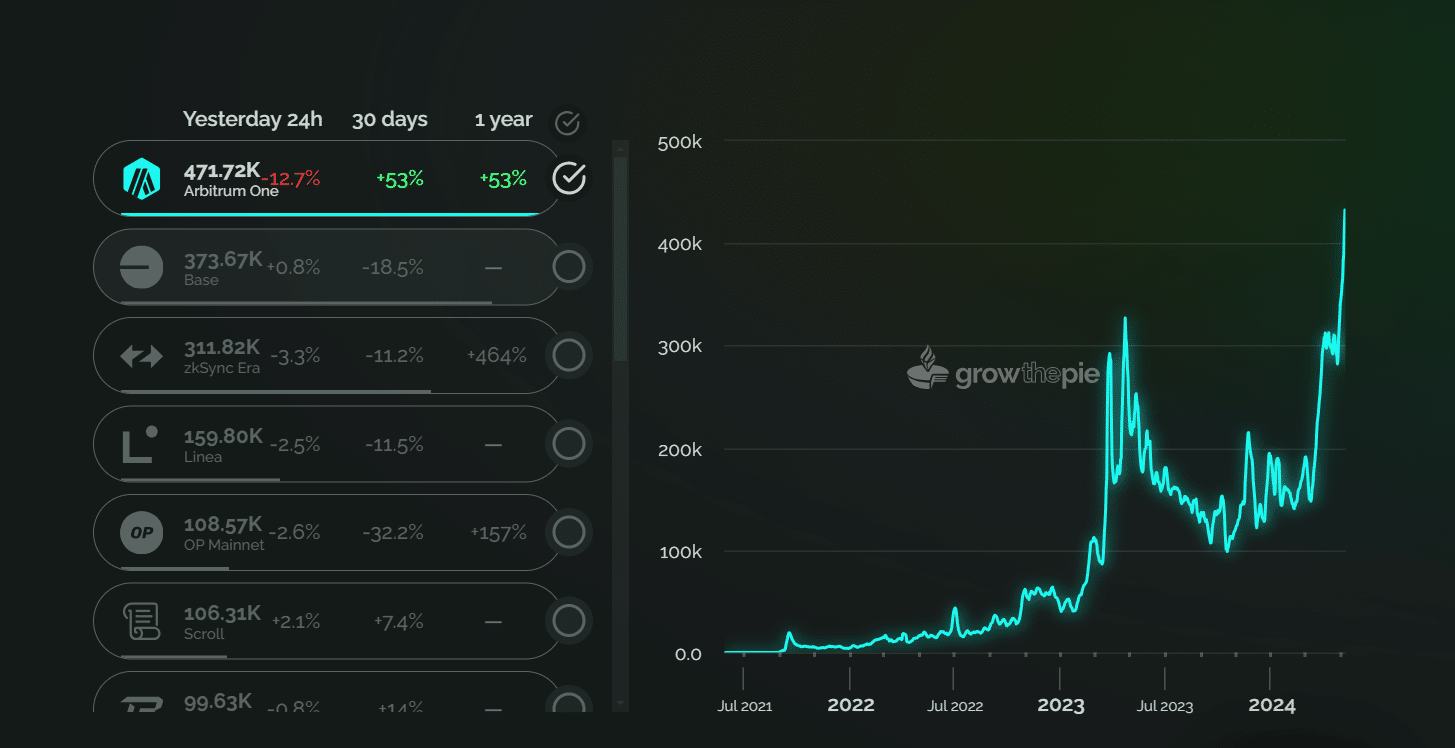

According to data from GrowthePie, Arbitrum recently set a new record for daily active addresses.

On May 8th, an analysis of Ethereum Layer 2’s active addresses chart showed a significant increase, reaching a total of 432,531 daily addresses.

This was the first time in its history that it had seen such a volume of daily active addresses.

As a crypto investor, I find it intriguing that Arbitrum stood out amongst other Layer 2 platforms with the most daily active addresses on May 8th.

The closest competitor was Base, but its daily active addresses were less than 400,000.

Arbitrum leads in TVL but is behind in transaction count

As a crypto investor, I examined the transaction chart and noticed a significant number of transactions taking place on the 8th of May. However, this number didn’t quite hit a new all-time high like the number of active addresses.

Based on the most recent information from GrowthePie, the number of transactions processed within the past day had reached approximately 2.24 million, surpassing the earlier predicted figure of 1.58 million by over 660,000 transactions.

As a crypto investor, I’ve noticed that the number of transactions recorded by Binance on the 8th of May was the second highest, coming in just behind Base with over 2.45 million transactions.

As a crypto investor, I’ve observed some noteworthy developments over the last 24 hours. Specifically, Base has surpassed Arbitrum in terms of transaction volume, recording approximately 2.26 million transactions.

As a crypto investor, I’ve noticed an increase in the number of active addresses interacting with Arbitrum within the last 24 hours. However, this hasn’t translated into notable volume growth for the platform. According to DefiLlama, the trading volume remained stagnant at $510.78 million on May 8th.

At the point of this writing, its Total Value Locked (TVL) remained unchanged significantly.

As a crypto investor, I’ve been keeping an eye on the data from L2 Beats, and I can confirm that despite recent developments, this specific Layer 2 network has managed to retain the largest total value locked (TVL) among its competitors. At present, its TVL hovers around $16.6 billion.

ARB’s negative trend struggles continue

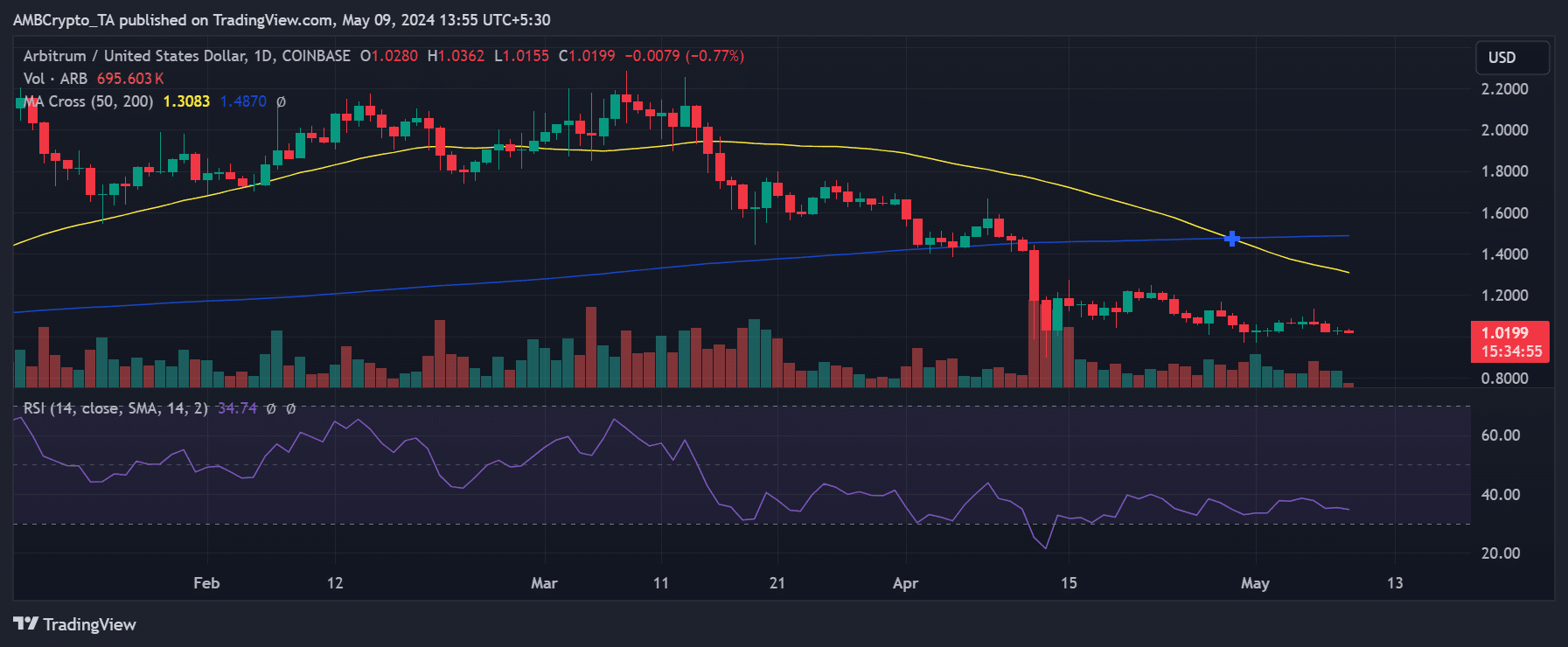

Although there have been encouraging improvements in key performance indicators, these gains failed to spark a substantial rise in ARB‘s price.

According to AMBCrypto’s analysis of ARB’s daily trend, it has remained on a downward trajectory.

Realistic or not, here’s ARB’s market cap in BTC’s terms

On May 8th, we noticed a small increase that represented fewer than 1% of the total, but the general direction has been downward.

At present, ARB is priced approximately at $1.01 on the market, marking a 0.7% decrease. Furthermore, according to the Relative Strength Index (RSI), ARB is deeply embedded in a robust downtrend.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Here’s What the Dance Moms Cast Is Up to Now

2024-05-09 21:11