- Whale accumulation and rising address activity suggest growing interest in ARB’s potential rally.

- Liquidations and cautious funding rates emphasize the importance of breaking key resistance levels.

As a seasoned researcher who has navigated through countless market cycles, I find myself intrigued by the current state of Arbitrum [ARB]. Whales accumulating over 40 million tokens in a week is certainly not a sight I’ve seen every day!

During the last seven days, there has been an increase in the ownership of Arbitrum [ARB] tokens by major market participants, totaling over 40 million tokens. This current trend suggests growing attention from influential investors. At this moment, ARB is being exchanged at $0.8442, representing a decrease of 9.73% compared to the previous day’s trading.

This substantial buildup prompts us to wonder: could ARB take advantage of this increased curiosity and surpass important resistance thresholds, leading to an upward trend?

ARB technical analysis reveals key levels to watch

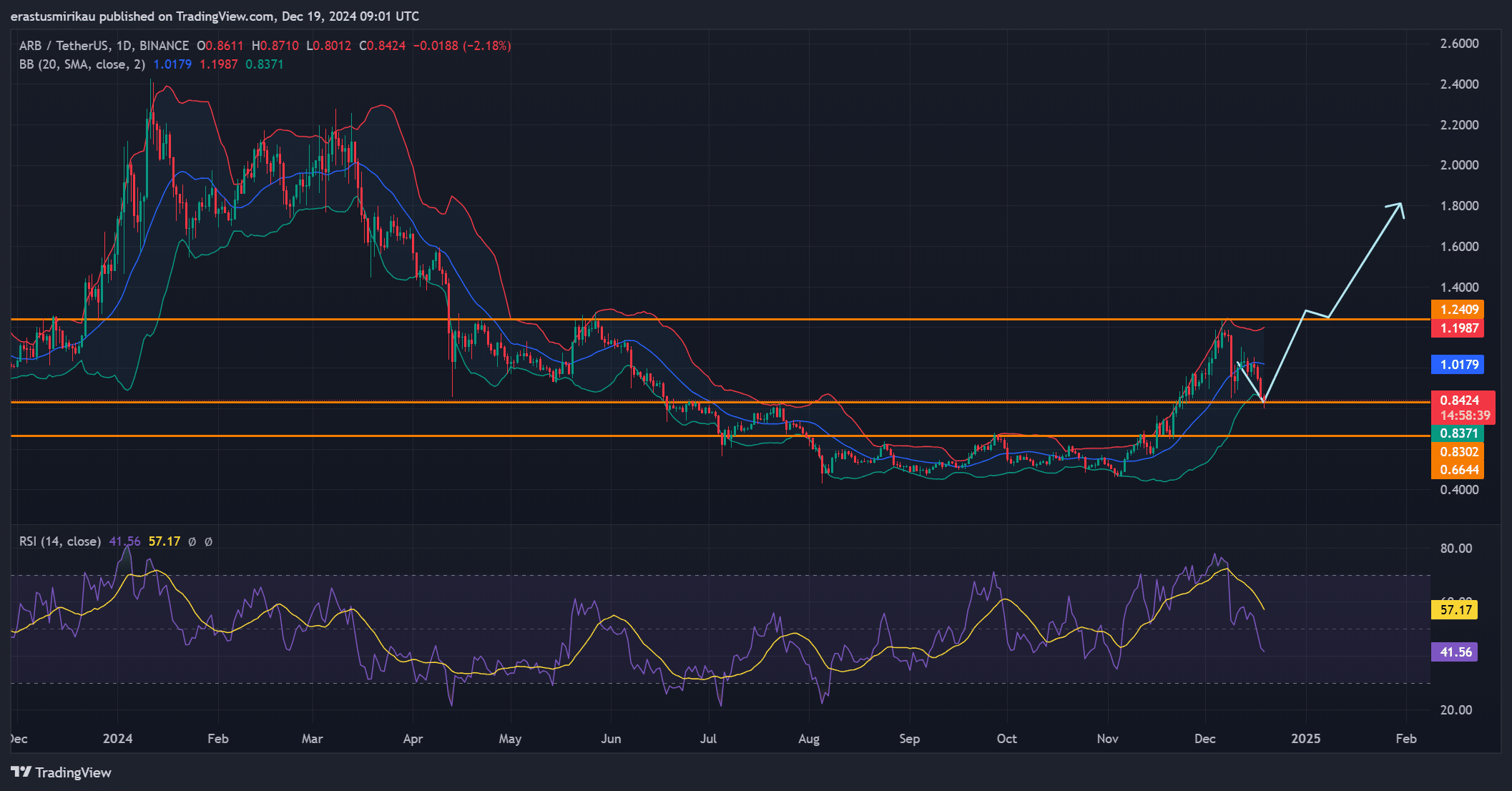

In simpler terms, the value of ARB has a significant level of support at approximately $0.8302, while it faces resistance around $1.2409. Additionally, the Bollinger Bands suggest that the price’s volatility is rising, as the price has been approaching the lower limit of these bands.

Currently, the Relative Strength Index (RSI) is at 41.56, suggesting a slight downtrend. But if ARB manages to maintain the $0.8302 support and regain the $1.0179 level, there might be signs of a turnaround. Thus, these prices should be closely monitored by traders.

ARB address stats highlight growing interest

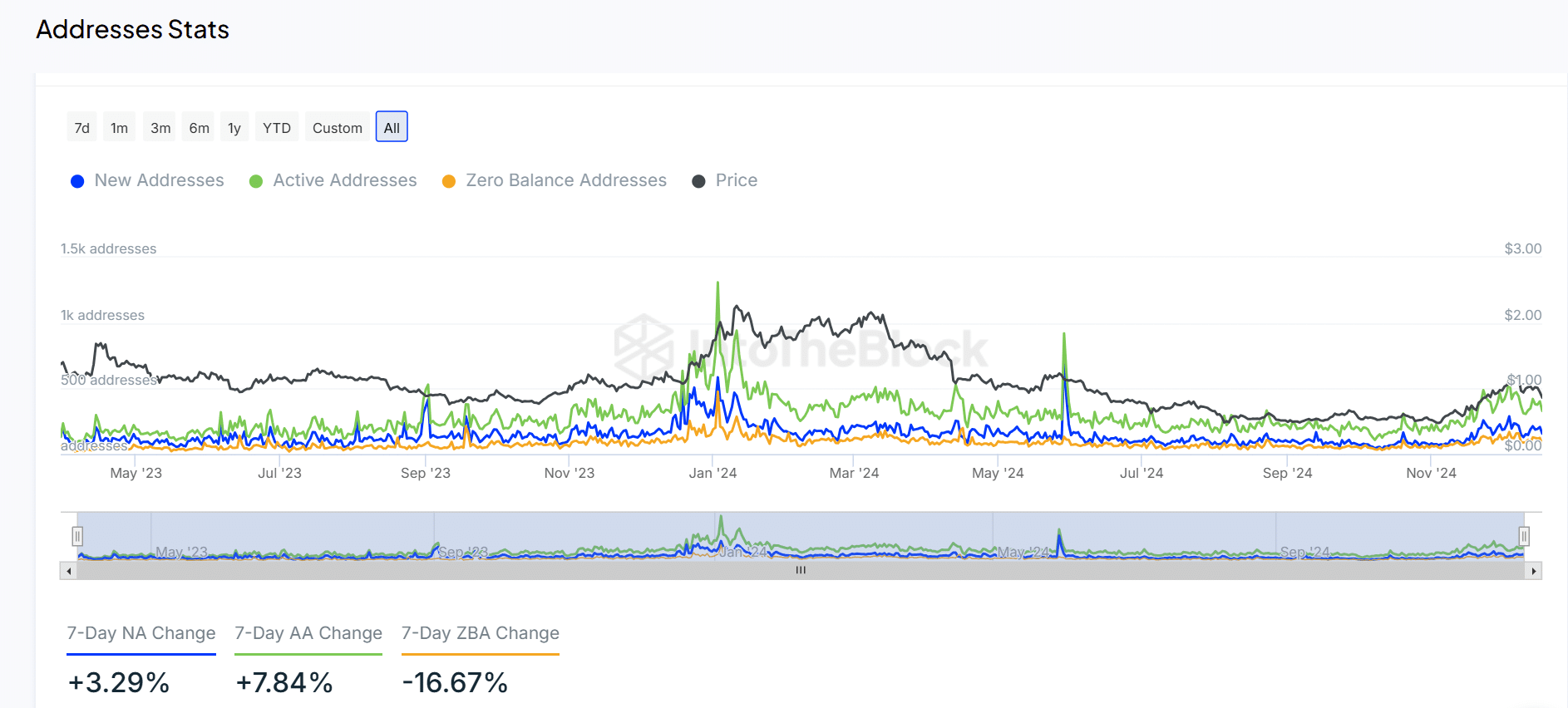

Moreover, focusing on activity points can boost user interaction. Notably, we saw a 3.29% increase in new addresses over the last week, and a significant spike of 7.84% in active addresses during the same period.

These rises correspond with increased whale activity, implying a heightened level of curiosity from not only institutional but also retail investors as well.

On the other hand, the decrease by 16.67% in the number of zero-balance addresses suggests that current token holders are keeping their tokens, which lends credence to the argument for accumulation. This downward trend might indicate increasing trust in ARB’s long-term prospects.

Liquidation data signals market imbalance

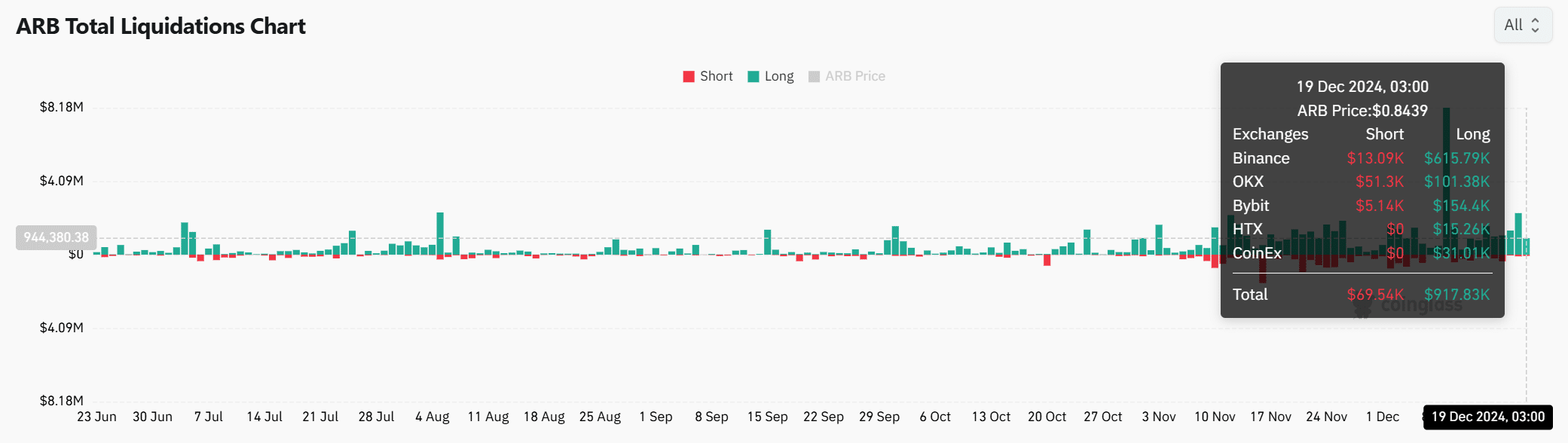

The information on liquidation indicates that a larger amount of long positions, totaling approximately $917,830, were closed out compared to only about $69,540 in short positions. This disparity underscores an excessively leveraged optimistic market stance.

Consequently, ARB needs to break through crucial resistance points and maintain its progression to prevent any more price drops. The current imbalance highlights the importance of being cautious in the near future for traders.

Funding rates indicate cautious optimism

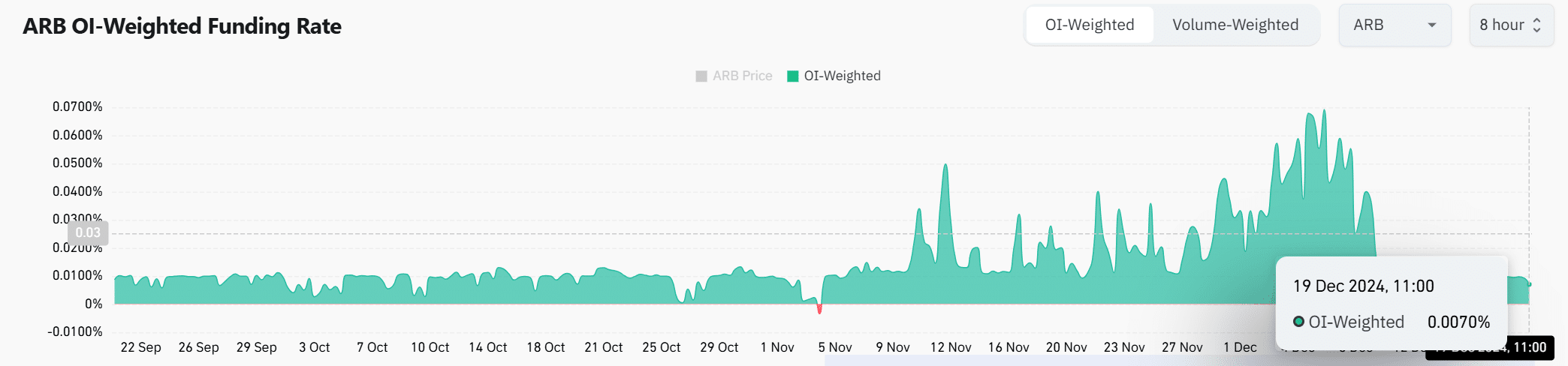

In summary, the current OI-funding rate stands at a conservative 0.007%. This figure demonstrates a degree of restrained optimism from traders, but significantly higher rates would indicate a stronger conviction in an upcoming bullish market surge.

Therefore, a shift in sentiment could depend on sustained price action above critical levels.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

ARB needs to break resistance to rally

In conclusion, while whale activity and growing address engagement are promising, ARB must overcome critical resistance near $1.2409 to trigger a sustained rally.

If this breakout doesn’t occur, the ongoing accumulation period might not show any significant changes. Thus, it’s crucial for traders to carefully watch forthcoming price fluctuations to verify a bullish trend development.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-12-20 08:07