-

Arbitrum had the third-highest DEX volume at press time.

ARB has continued to decline for the last three months.

As a seasoned analyst who has witnessed countless market cycles, I find myself both intrigued and perplexed by Arbitrum’s [ARB] current situation. On one hand, the platform is thriving in terms of network activity, TVL, and DEX volume. It’s like having a superstar athlete consistently delivering top-notch performance on the field, yet struggling to cash their paycheck off it.

Arbitrum [ARB] continues to lead as a top player among Decentralized Exchange (DEX) platforms, holding the highest Total Value Locked (TVL) across all Layer 2 (L2) solutions within the ecosystem.

Even though the platform has shown robust growth in Total Value Locked (TVL) and leads in the Decentralized Finance (DeFi) sector, its native token, ARB, hasn’t fared as well lately, exhibiting an unfavorable trend for several months.

At the current moment, nearly all ARB token holders were experiencing a loss, as suggested by the data, demonstrating a significant drop in the token’s value.

Arbitrum continues downtrend

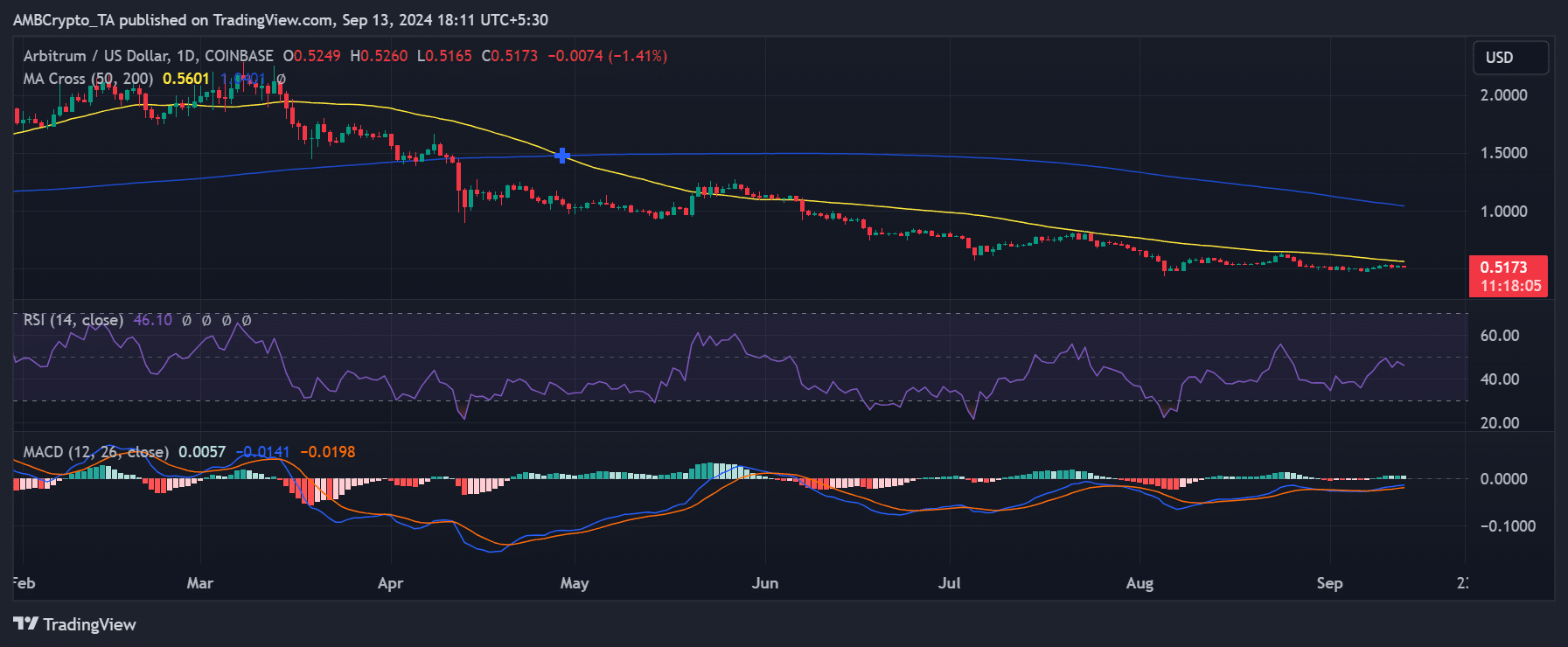

In my exploration as a researcher, I’ve observed that Arbitrum’s trading volume has been subdued on the daily chart for several months now. Concurrently, there’s been a gradual downward trend in its price.

The yellow and blue lines, acting as trend indicators, suggest that the price of ARB has been declining steadily since May.

Currently, ARB is valued around $0.51 per share, indicating a drop of more than 1% during this trading session.

In simpler terms, the MACD (Moving Average Convergence Divergence) reinforced the pessimistic viewpoint since the signal lines fell below zero.

The severity of this downtrend is underscored by the fact that almost 100% of ARB holders are now holding their positions at a loss.

More ARB holders go out of the money

A Global In/Out of the Money chart from IntoTheBlock showed that Arbitrum’s price drop had a substantial effect on its investors.

At the current moment, I find myself among roughly 1.19 million other ARB investors who are underwater, or in a situation where we’re seeing losses. This means that more than 94% of us are in this predicament at the press time. It’s a challenging scenario, but it’s important to remember that the crypto market can be volatile and unpredictable.

Approximately 98% of the token holders are not making a profit, which is one of the lowest profit rates recorded in the token’s history.

Despite this challenging price trend, Arbitrum’s network activity has remained robust.

According to insights from IntoTheBlock, Arbitrum emerged as the third-largest Decentralized Exchange (DEX) platform in terms of trading volume. It holds a market share of more than 14%, with Ethereum [ETH] and Solana [SOL] leading ahead in this ranking.

In an unusual situation, a large number of users holding at a loss, coupled with robust network foundations provided by Arbitrum, emerged.

It implies that even though the usefulness of the platform doesn’t change, the attitude of investors towards ARB might be influenced more by speculation.

Arbitrum maintains a large share of L2

According to AMBCrypto’s analysis, Arbitrum continued to lead in the Layer 2 (L2) sector.

According to data from L2 Beats, Arbitrum held approximately 39% of the total value locked (TVL) across all layer-2 networks, with a staggering $13 billion worth of assets secured within its ecosystem.

Nevertheless, although ARB has demonstrated remarkable efficiency in its network operations and a strong presence in the L2 market, its price hasn’t followed suit with these favorable statistics.

Despite the vigorous activity on the platform, the value of the ARB token hasn’t shown a favorable upward trend. Instead, it’s been marked by subdued price fluctuations and a high number of investors who are currently in a losing position.

Read More

2024-09-14 01:12