- Arbitrum is trading within an ascending triangle pattern with strong resistance at $0.62.

- A decline in DeFi activity and whale inactivity could see prices continue rangebound trading.

As a seasoned analyst with a knack for deciphering market trends, I must say that Arbitrum [ARB] seems to be treading on a tightrope between bullish and bearish sentiments at the moment. The ascending triangle pattern suggests that buyers are gradually gaining strength, but the weak momentum and the RSI below the signal line hint at potential resistance at $0.62.

In simple terms, Arbitrum (ARB) was following the general trend of the cryptocurrency market, having risen by 1.2% over the past day, as a result of the total market capitalization increasing globally.

At the moment of reporting, Arbitrum was being exchanged for approximately 0.558 US dollars. Over the past week, the price of Arbitrum has been relatively stable, fluctuating between 0.54 and 0.57 US dollars due to a decrease in volatility.

On the day-to-day chart, the altcoin was shaping as an ascending triangle, and although it had been creating a sequence of lower highs, the price consistently met firm resistance at approximately $0.62.

This pattern is often bullish, showing that buyers are slowly gaining strength.

Nevertheless, there seems to be a lack of strong push, indicating that ARB might encounter resistance around $0.62 once more, should buyers not intervene.

The RSI (Relative Strength Index) is positioned beneath the signal line, suggesting a downward trend or bearish market movement is currently active. Additionally, the RSI value of 47 signifies that the selling pressure remains dominant.

As a crypto investor, I’ve been observing the Chaikin Money Flow (CMF) of ARB, and although it remains positive, it’s starting to trend downwards. This could indicate that buying activity isn’t as robust as before, and if sellers manage to gain control, there’s a possibility that ARB may dip to test its support at $0.48.

Besides a lack of buyers, several other factors could affect Arbitrum’s uptrend.

Whale inactivity

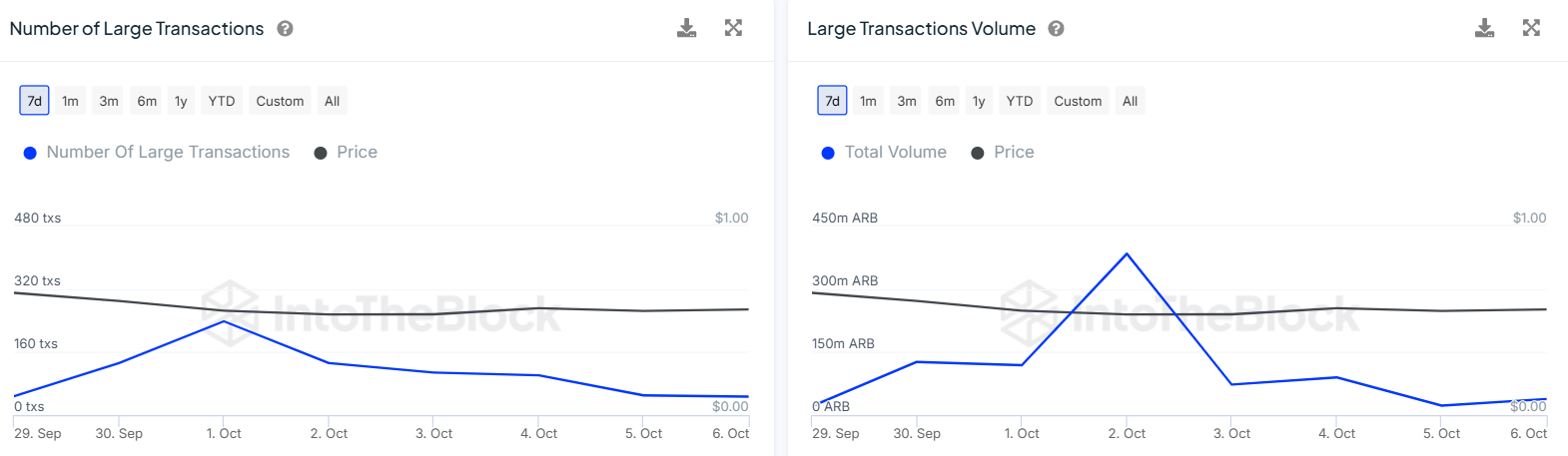

According to data from IntoTheBlock, there’s been a significant decrease in large transactions. This week, large transactions have fallen from over 200 to less than 50.

Large transaction volumes have also dropped from 342 million to 93 million.

Whales often significantly impact market fluctuations due to their massive trades. So, if these big investors stop making transactions for a while, it might lead to a period of sideways trading (trading within a narrow price range).

DeFi activity slumps

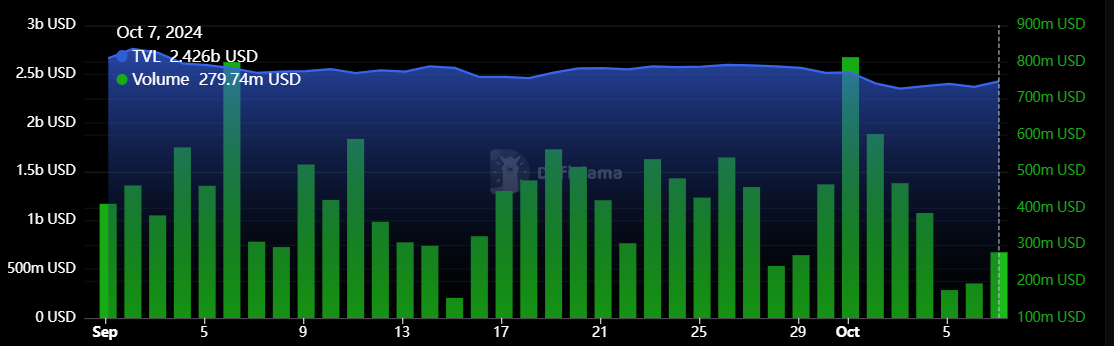

According to data from DeFiLlama, it’s been observed that the trading activity in the decentralized finance (DeFi) sector on Arbitrum has noticeably decreased over the last seven days.

Initially in the current month, DeFi transactions on Arbitrum totaled $813 million. However, this figure has now decreased to $279 million.

As a researcher, I’ve noticed a decrease in DeFi activity on Arbitrum, which may indicate waning interest and confidence. This trend could potentially trigger more sell-offs if it continues.

Analyzing Arbitrum’s liquidity heatmap

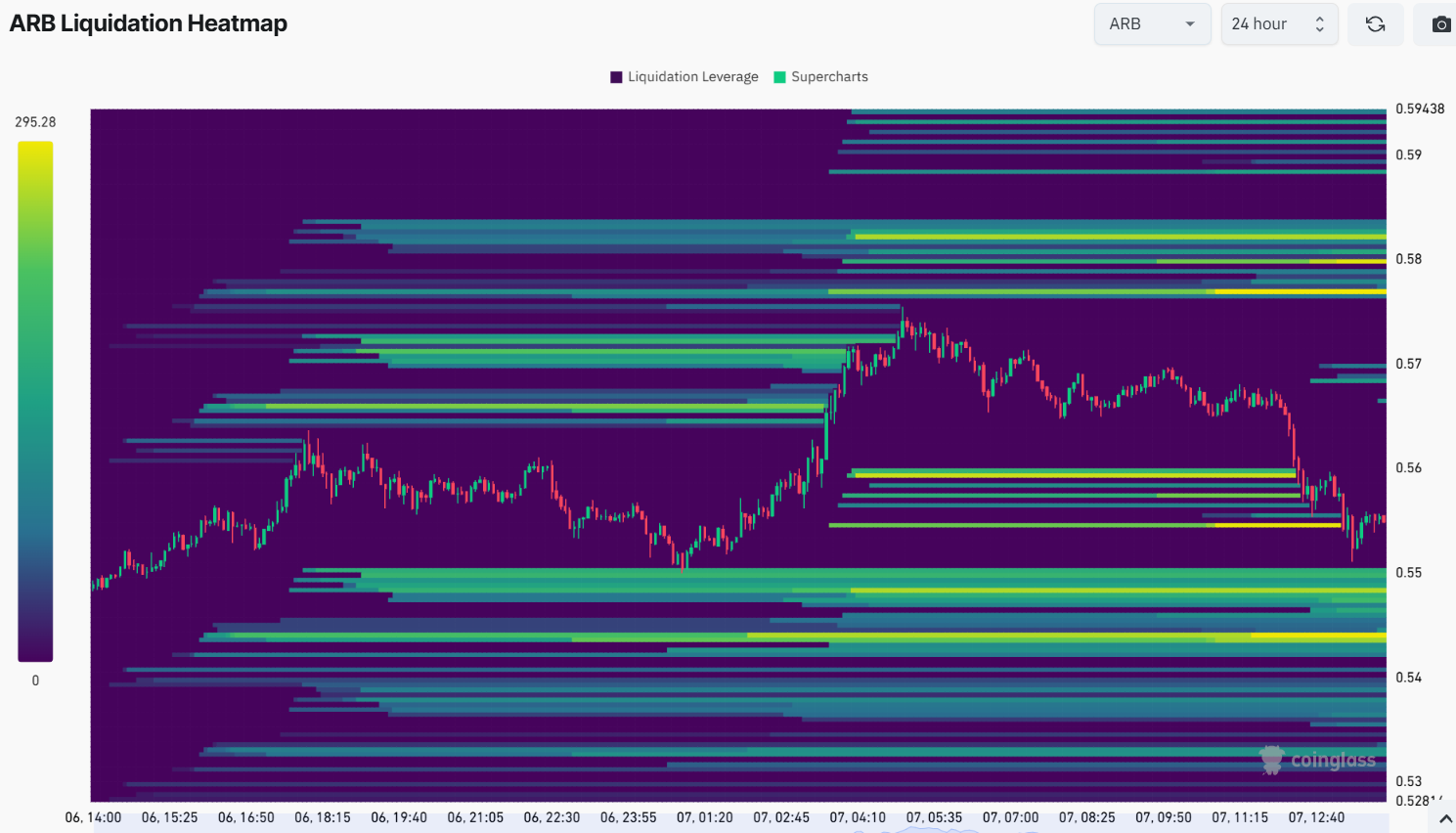

In simpler terms, Arbitrum’s liquidity map demonstrates a concentration of liquidations happening at prices lower than the current one, whereas there are fewer such events at higher prices. This suggests a predominant bearish attitude in the market, as there are more short positions (betting on price decrease) compared to long positions (betting on price increase).

If the price rises, a group of prices at which assets can be sold off (liquidation levels) that are lower than the current price might cause short sellers to be compelled to close their positions. This buying pressure could ensue as a result.

However, the bearish sentiment on Arbitrum remained strong, which could hinder buying activity.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

At the current moment, as per IntoTheBlock’s analysis, approximately 91% of the wallets were suffering losses, whereas just 5% were enjoying profits.

If the wallets experiencing a loss continue to struggle to achieve profitability for a prolonged span, they might decide to sell their holdings to limit further potential losses.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Michelle Trachtenberg’s Desperate Secret

2024-10-08 04:08