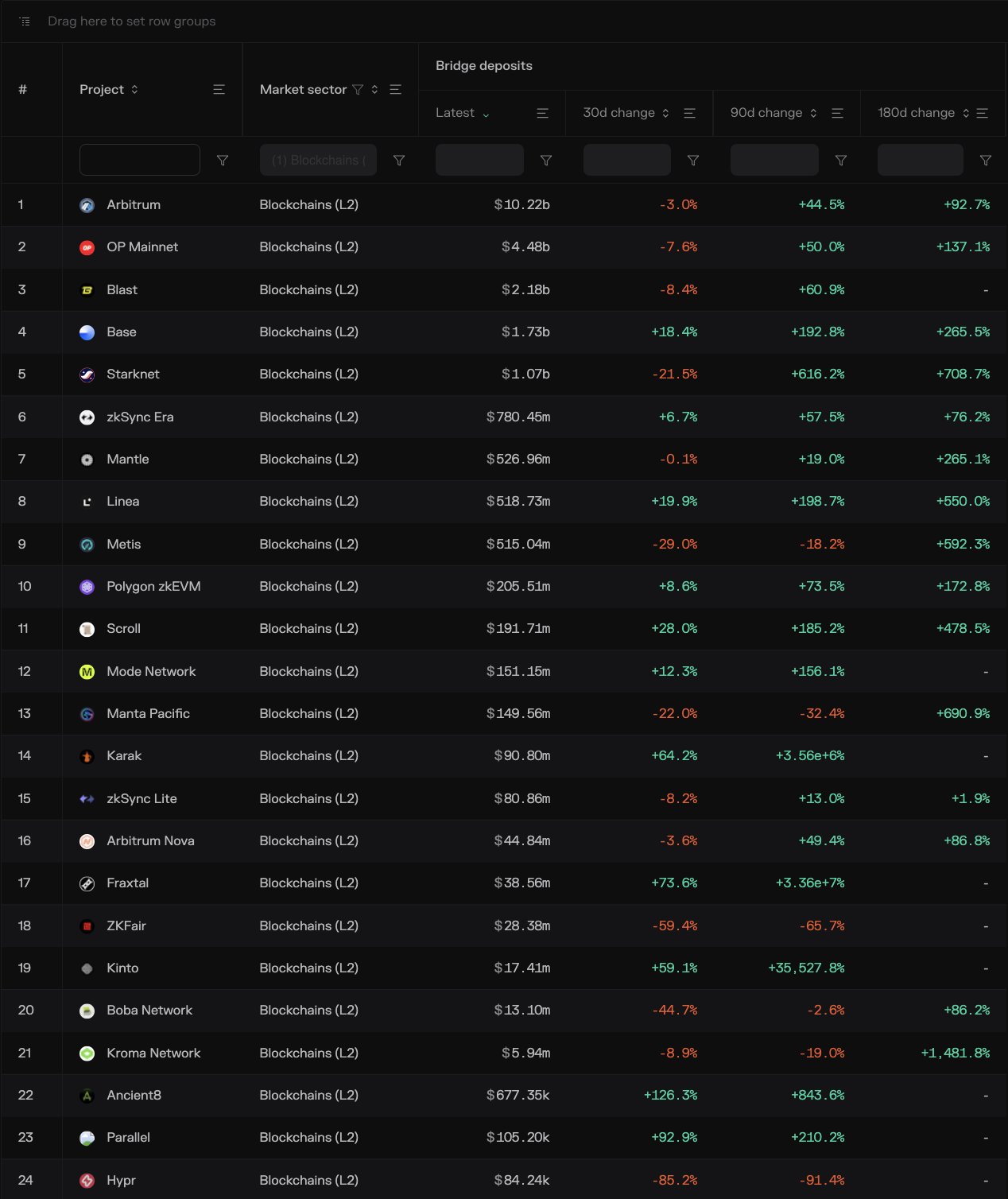

- Arbitrum outperformed all other Ethereum L2s in overall inflows.

- Activity on the network grew, but TVL continued to decline.

As a researcher with experience in the blockchain and cryptocurrency space, I have closely observed the developments in the Layer 2 (L2) sector of the Ethereum network. Arbitrum’s impressive performance since its launch has caught my attention, and I cannot help but express my admiration for its accomplishments.

Ever since Arbitrum [ARB] launched its token, it has taken over the L2 space, and how!

Despite the recent entry of new competitors, the protocol has successfully maintained its leading position in the Layer 2 market over the past few months.

Layer 2 networks see growth

Based on Token Terminal’s findings, Arbitrum has experienced significant inflows and emerged as a top competitor among other Layer 2 solutions operating on the Ethereum (ETH) network.

As a researcher examining the blockchain ecosystem, I’ve noticed that Arbitrium has been thriving with an impressive surge in activity. Analyzing Artemis’ data, I discovered that the number of daily active addresses on Arbitrium has experienced notable growth.

Over the past week, there has been a significant increase in the number of active cryptocurrency addresses. These addresses have grown from 250,000 to approximately 400,000. Furthermore, the daily transaction volume has also risen substantially and currently stands at around 1.5 million.

Some problems ahead

However, there were some problems being faced by Arbitrum on the DeFi front.

As an analyst, I’ve observed a significant decrease in Decentralized Exchange (DEX) trading volumes on Arbitrum. The figures have dropped from a peak of 2.2 billion to just 500 million in a short period.

Alongside this reduction, the Total Value Locked (TVL) on Arbitrum saw a decline as well. Specifically, since March, the amount of value locked in this platform has decreased from $3.30 billion to $2.65 billion.

The combination of these factors led to a loss of revenue for the network.

One issue that merited attention was the progress in network expansion. An analysis by AMBCrypto using Token Terminal’s figures indicated a decrease in the number of code commitments.

Additionally, the decrease in the number of core developers working on Arbitrum’s network might hinder its future expansion.

Despite temporary influences on Arbitrum’s expansion, the escalating user engagement serves as proof of the protocol’s potential for advancement, suggesting a promising future as interest remains high among network participants.

Additionally, the rising use of Layer 2 platforms like Arbitrum contributes significantly to the growing demand for Layer 1 networks, such as Ethereum.

Realistic or not, here’s ARB’s market cap in BTC’s terms

As a network analyst, I can tell you that implementing Layer 2 solutions is an effective strategy to enhance the capabilities of networks like Ethereum. These solutions enable the network to handle more transactions per second, thereby improving its scalability. Moreover, they make the network more accessible for users by reducing the gas fees and latency associated with using the network directly at its base Layer 1.

The increasing adoption of the Arbitrum protocol is certain to boost the usage and recognition of the Ethereum network.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-05-06 01:11