-

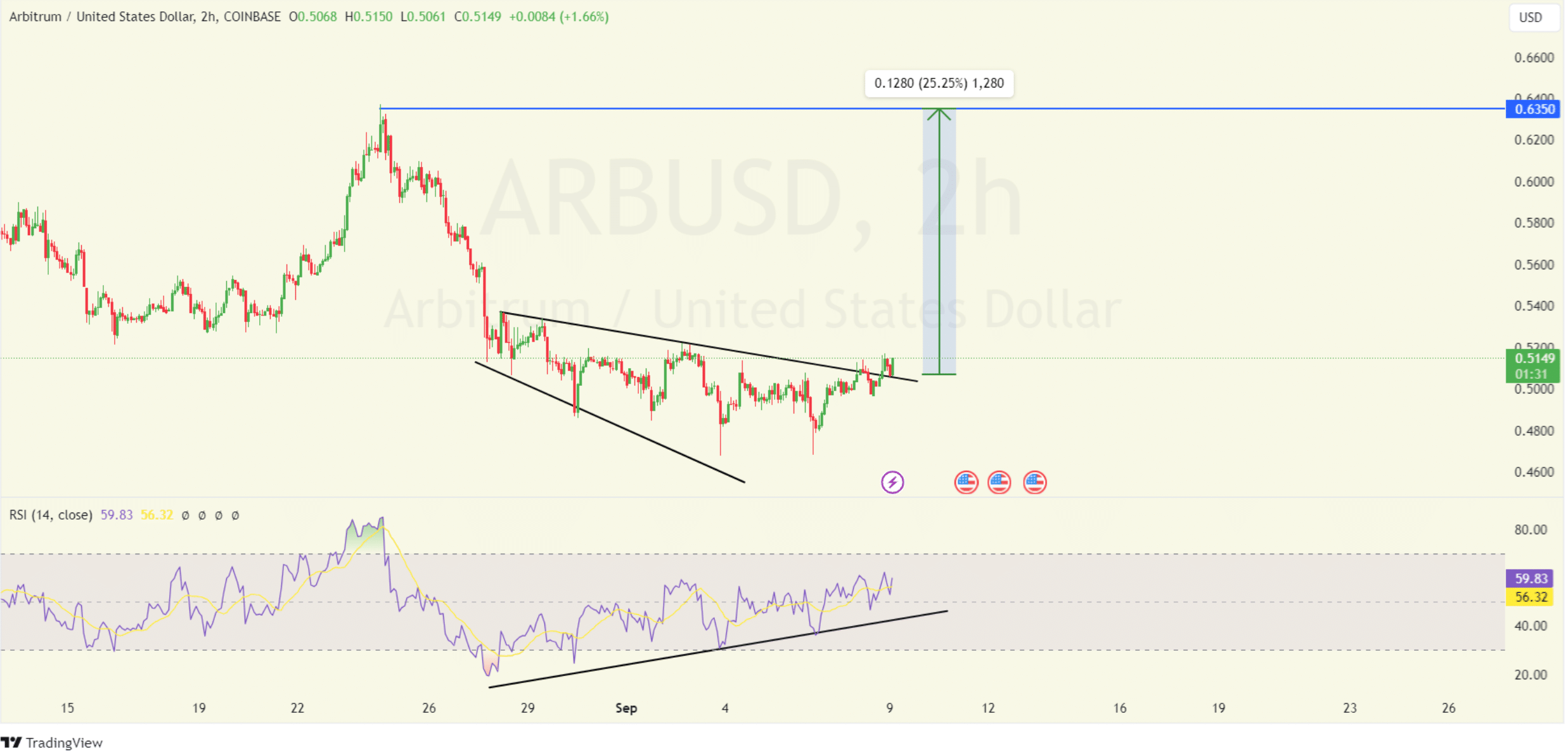

Arbitrum’s price breakout targets a 25.25% gain with rising buying interest and bullish indicators.

Increased large ARB transactions and new addresses signal growing market activity and renewed interest.

As an experienced crypto investor who has witnessed numerous market cycles and trends, I find myself intrigued by Arbitrum’s current upward momentum. The breakout from a falling wedge pattern and the bullish technical indicators suggest that ARB could indeed be on its way to reaching the next resistance level at $0.6350 – potentially yielding a 25.25% gain.

After breaking free from a falling wedge pattern, Arbitrum [ARB] appeared to be gaining traction, pointing towards potential increases in its value, indicating a possible rise in its price levels.

Currently, ARB stocks are being traded at approximately $0.5174. This represents a 1.55% growth in the last 24 hours and a 3.10% uptick over the past week. The significant jump seems to have taken place around $0.51, with the upcoming resistance level to keep an eye on being $0.6350. This potential increase could amount to approximately 25.25%.

Technical indicators suggest upward trend

As I pen down these words, the Relative Strength Index (RSI) stands approximately at 59.83. This figure suggests a bullish divergence in market dynamics, with the price trending upward while the RSI is rising. Such an increase in the RSI signifies heightened buying interest, potentially hinting at further price growth.

If the RSI continues to climb, traders may see stronger buying momentum.

Beyond the Relative Strength Index (RSI), the Bollinger Bands are indicating a contraction, suggesting decreased market volatility. At present, the price is close to the midpoint of the bands, which is around $0.5298, signifying uncertainty in the market.

If the price surpasses $0.6091, it might signal a bullish reversal, whereas falling below $0.4505 could potentially trigger more downward movement.

The MACD (Moving Average Convergence Divergence) graph showed a faint bullish signal, as the MACD line moved above the signal line. This indicates that a favorable trend might be building up, yet it’s important to note that the MACD line is still below the zero line, implying that the overall market direction remains bearish at this time.

A move above the zero line would confirm stronger bullish momentum.

The Aroon Indicator hints at an emerging bullish movement, as the Aroon Up stands at 64.29%. However, for this bullish signal to hold true, the price needs to surpass the level of $0.5298.

If ARB doesn’t manage to stay above its current level, there’s a possibility that the market may extend its downward movement in a bearish trend, particularly if the price falls under $0.50.

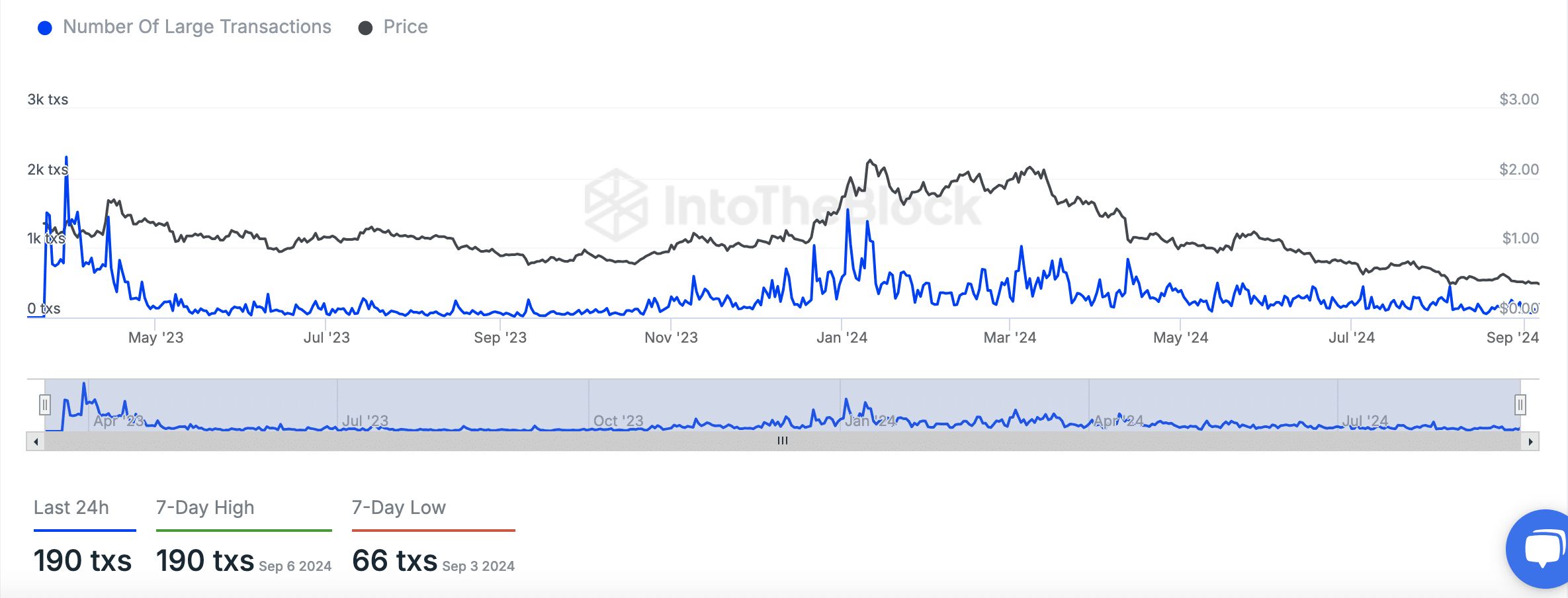

Arbitrum transactions and activity surge

Over the past 24 hours, ARB recorded 190 large transactions, matching the 7-day high observed on 6th September. This increase in large transactions suggests renewed interest and activity in the Arbitrum market.

Realistic or not, here’s ARB’s market cap in MATIC terms

On the flip side, the lowest point over a week was observed at 66 transactions on the 3rd of September, suggesting an increase in market activity recently.

Moreover, according to DeFiLlama, Arbitrum’s Total Value Locked (TVL) currently amounts to a staggering $2.514 billion. In this timeframe, there have been approximately 395,133 active addresses and an additional 22,995 new addresses joining the platform over the past 24 hours.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-10 00:07