- Arbitrum hits $21.45 billion in monthly volume, signaling strong market demand and potential breakout.

- Daily active addresses and open interest surge indicate sustained investor confidence in ARB’s growth.

As a seasoned analyst with over two decades of experience in the crypto market, I’ve seen my fair share of bull runs and bear markets. Looking at Arbitrum’s [ARB] current performance, it’s clear that this project is making waves in the Ethereum scaling race.

Arbitrum’s [ARB] layer 2 network set a new milestone as it reached over $20 billion in monthly transactions on the Uniswap Protocol, ending November with an impressive total of $21.45 billion.

This achievement highlights Arbitrum’s increasing dominance in the Ethereum scaling race.

Moreover, ARB experienced a significant jump of 12.23% over the past day, currently valued at $1.08 as we speak. This price rise suggests a heightened investor interest, however, the key issue remains: will this trend persist or is it simply a temporary surge in an erratic market?

Is ARB on the verge of a major breakout?

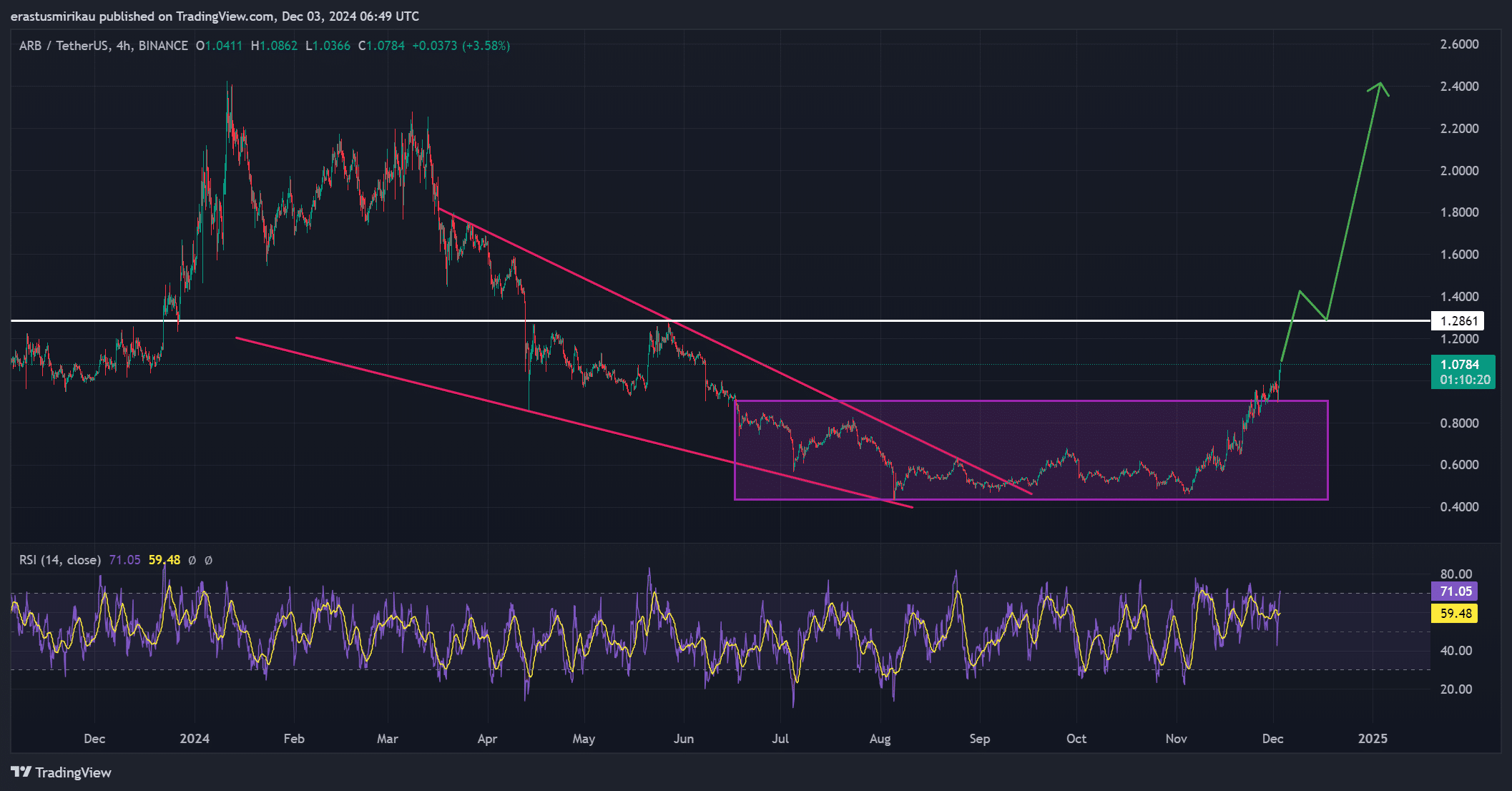

Based on Arbitrum’s price chart, there are indications of an imminent surge, suggesting a possible escape from a lengthy period of sideways movement. This development could signify a positive change in the market trend.

After the breakout, ARB retested previous resistance levels, confirming the strength of the move.

At the moment, ARB is nearing a crucial resistance point at $1.28. If it manages to surpass this barrier, we might witness a rise in its price towards $2.40, indicating a promising opportunity for growth.

Yet, it’s important for traders to exercise caution, since the Relative Strength Index (RSI) currently reads 71.05, indicating that the token may be overbought. This might lead to a temporary price drop, but the broader uptrend seems to be holding strong.

Are more users flocking to Arbitrum?

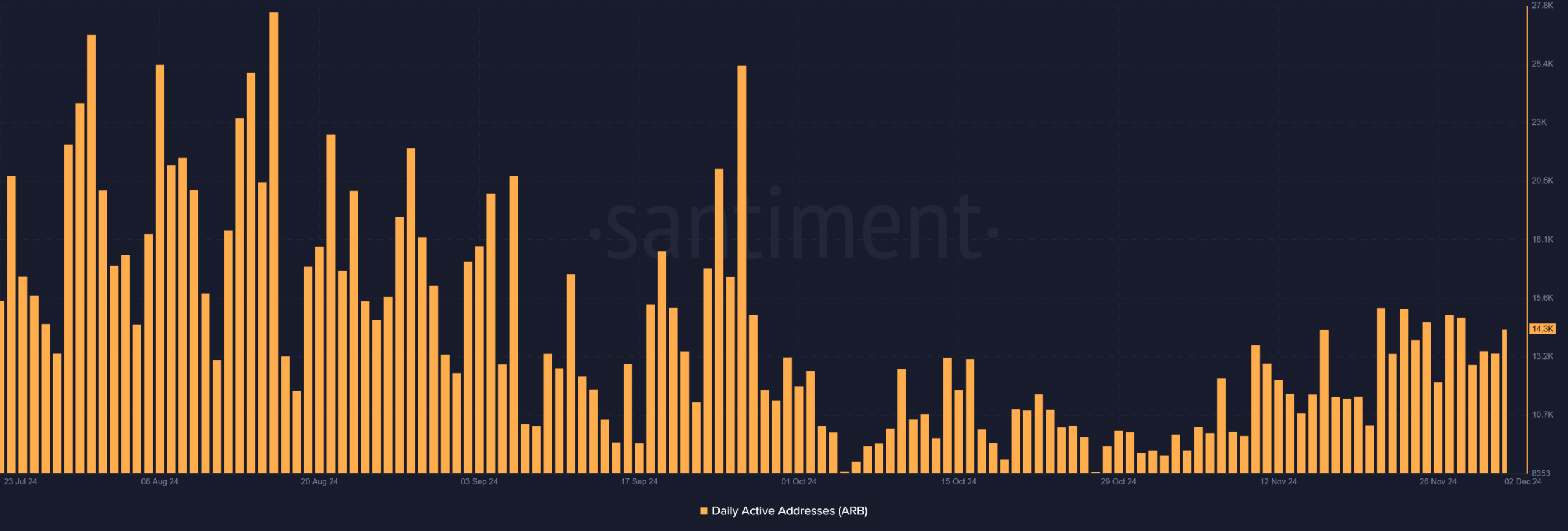

The number of daily active addresses (DAA) on ARB is exhibiting encouraging growth indicators. Yesterday’s count was 13,368, and today it stands at 14,386, suggesting an uptick in network usage and potential increase in user adoption.

This surge in active addresses suggests that more users are engaging with Arbitrum, which could fuel further demand for $ARB.

Consequently, the increasing number of users suggests that the network’s environment is becoming more extensive, which strengthens its long-term prospects.

What does the open interest surge mean for ARB?

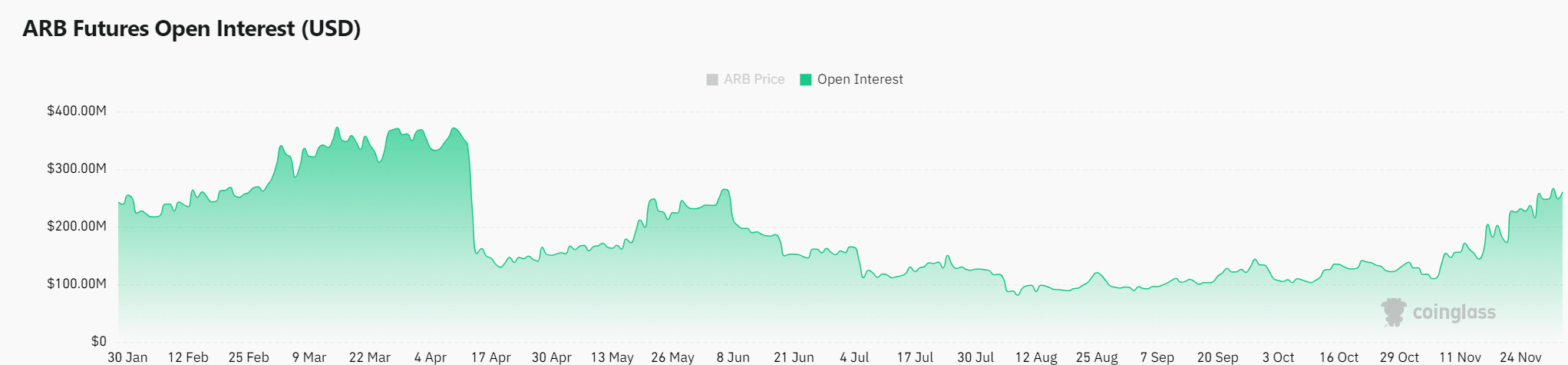

As a researcher, I’ve noticed an impressive surge of 16.35% in open interest, which now stands at approximately $285.07 million. This significant rise suggests that an increasing number of traders are strategically placing their bets, anticipating further price fluctuations.

Increased participation by investors in options contracts often reflects a boost in their conviction, indicating they expect continuous optimistic trends in the market. This increase might additionally bolster the market’s upward trend in the short-term.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

Can Arbitrum maintain its bullish momentum?

Currently, ARB’s impressive monthly volume of $21.45 billion and a 12.23% price increase suggest a robust market attitude towards it. With the significant level of resistance at $1.28 on the horizon, an increase in active addresses, and a substantial hike in open interest, ARB demonstrates promising signs for further expansion. Nevertheless, the RSI being overbought serves as a warning to exercise caution.

Consequently, even though it appears that the upward trend will continue, investors need to remain vigilant for any possible temporary downturns.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-12-03 15:35