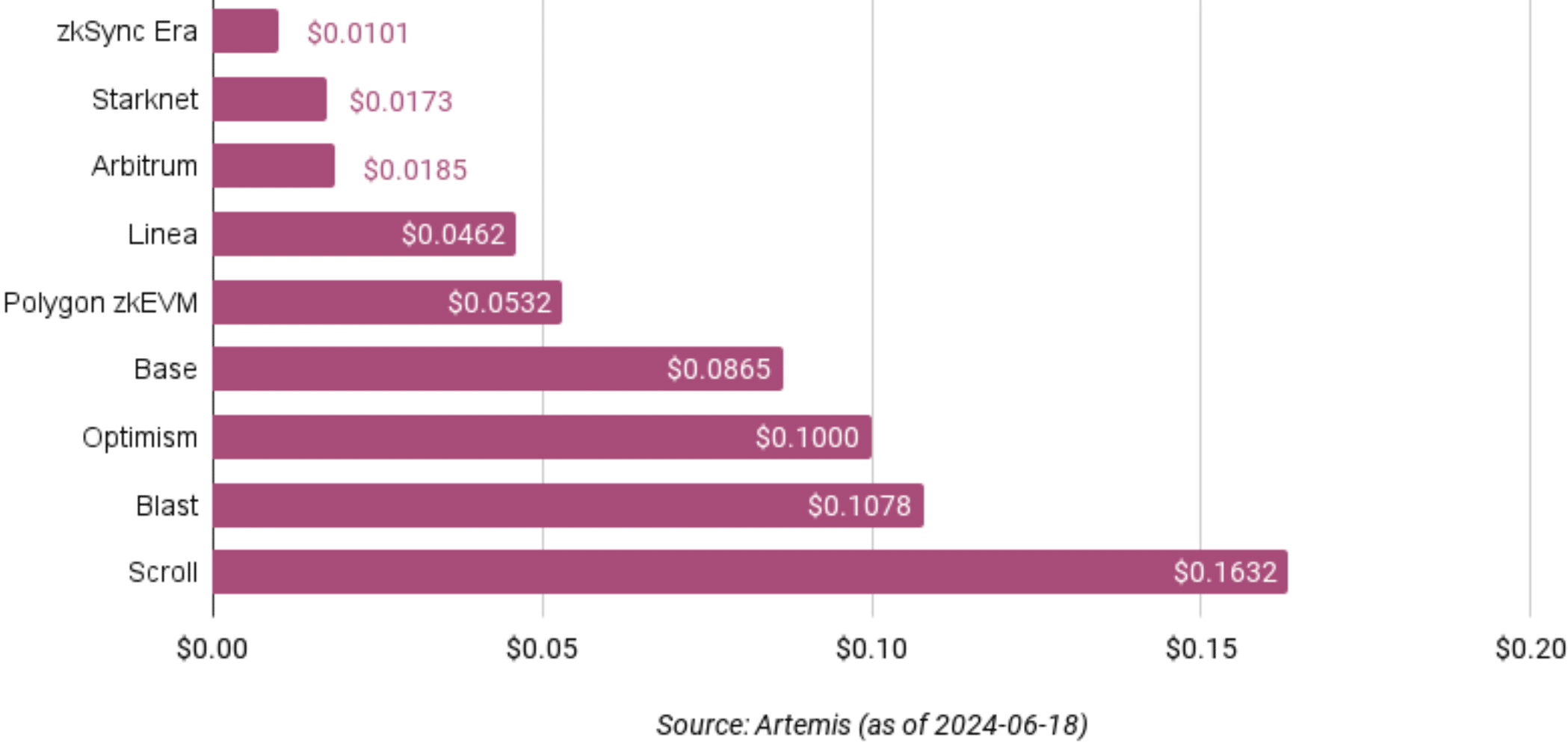

- Starknet and Arbitrum led the pack in user fees, surpassed only by zkSync Era.

- The price of both tokens declined despite positive protocol performance.

As an experienced analyst, I have closely followed the developments in the Layer 2 (L2) space and have been particularly intrigued by the recent surge in competition between Starknet (STRK) and Arbitrum (ARB). Based on my analysis of their user fees and network performance, it is clear that both networks have led the pack in this regard, with only zkSync Era surpassing them.

As a crypto investor, I’ve noticed a notable surge in competition within the Layer 2 sector since the recent Dencun upgrade. Among the standout networks are Starknet (STRK) and Arbitrum (ARB). These two platforms have been garnering considerable attention lately.

Low gas fees

As an analyst, I’ve observed that Starknet and Arbitrum have stood out among other networks when it comes to affordability for users, trailing only behind zkSync Era in terms of fees charged per user.

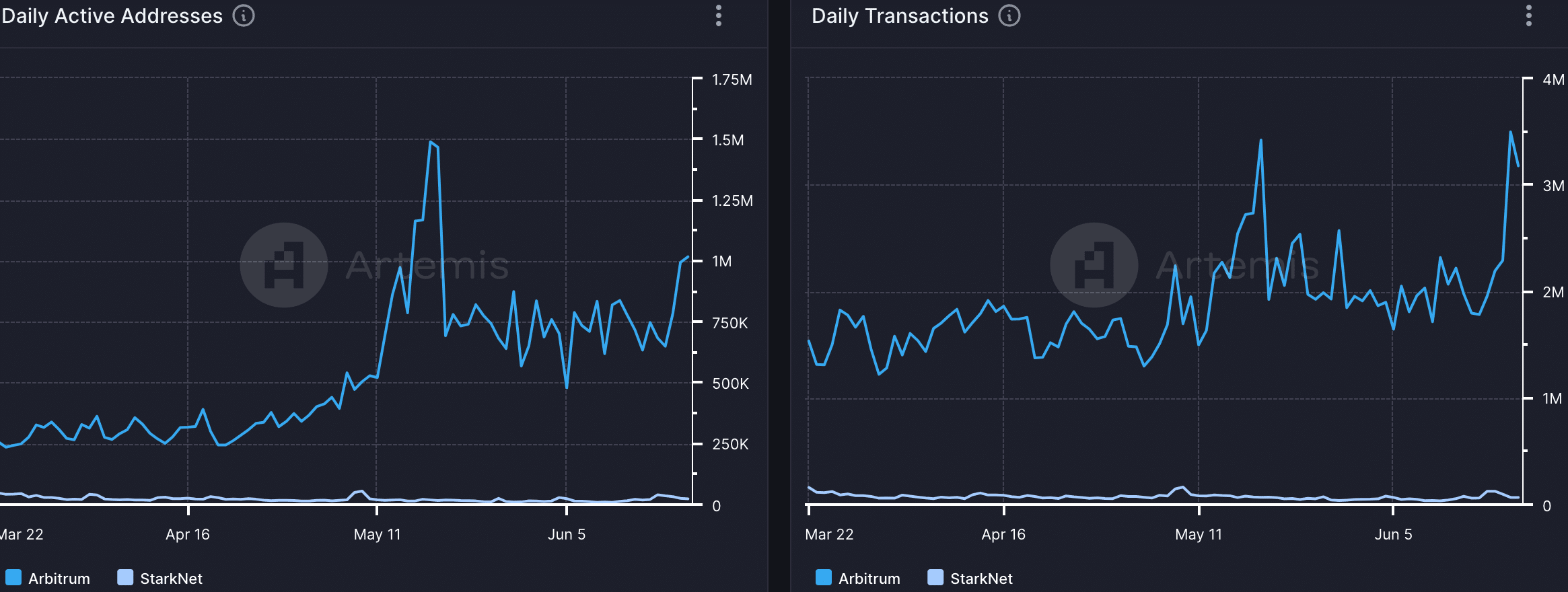

Although the costs were roughly equal on each network, there was a significant difference in the level of usage between the two protocols.

As an analyst, I’d highlight that Arbitrum has impressively drawn a substantial user base to its network, with daily active addresses surpassing the 1 million threshold – a clear indication of increased engagement and activity on the platform.

The number of daily transactions on the Arbitrum network increased significantly and exceeded the 3 million mark. Starknet experienced comparable growth; however, its transaction numbers fell short of Arbitrum’s figures.

To effectively hold its own in the second layer (L2) market, Starknet should manage to draw in a larger user base.

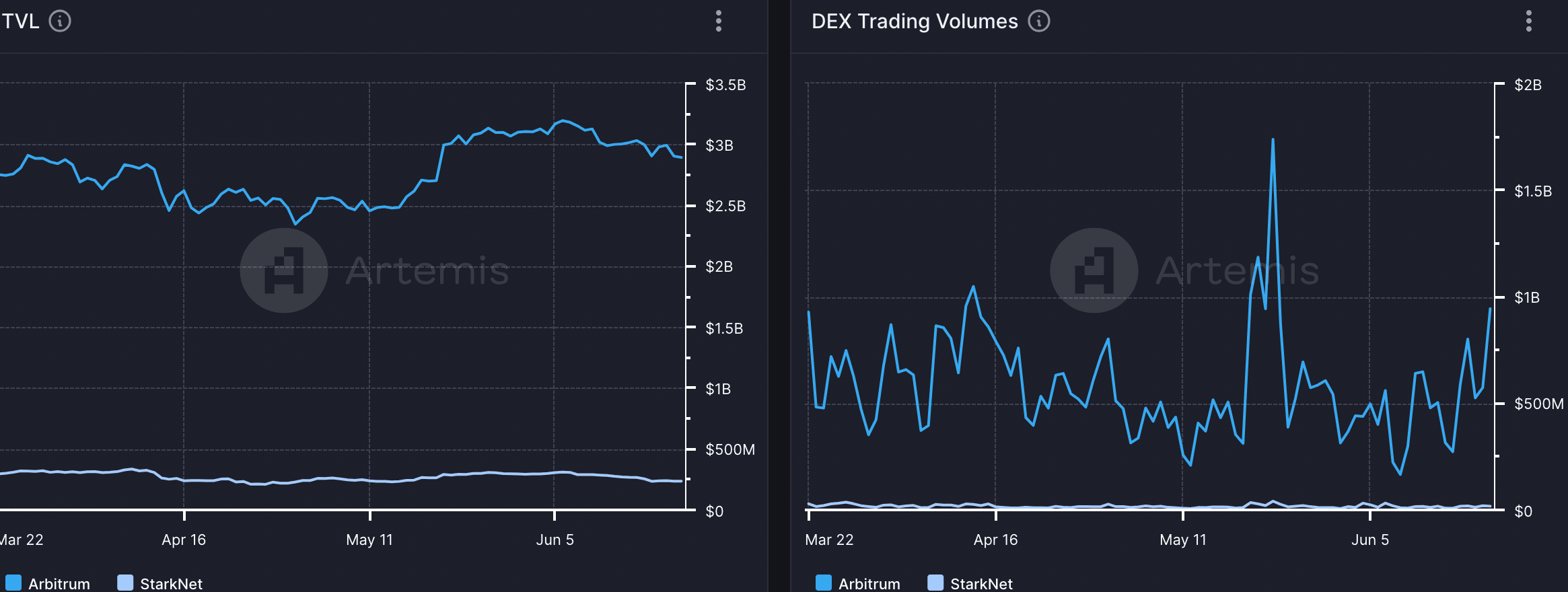

This same discrepancy was seen in the performance of both these protocols in the DeFi sector.

The total value in use for both networks didn’t change much. However, trading volumes on the decentralized exchanges associated with each protocol showed considerable variation.

STRK vs. ARB: Price movements

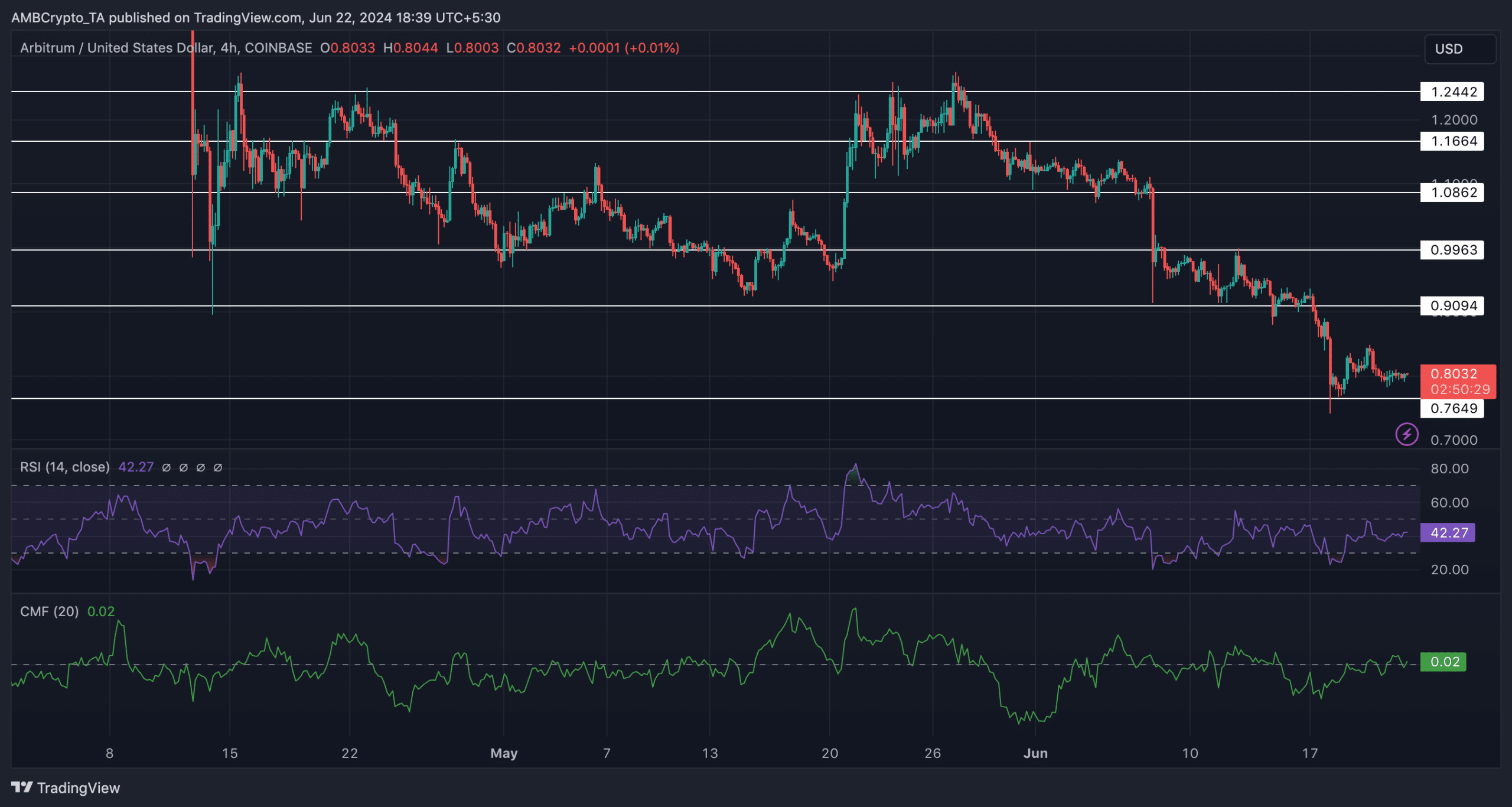

Regarding the price fluctuations, currently ARB is priced at $0.8017 following a 1.1% increase over the past 24 hours. However, since the 27th of May, its value has decreased noticeably with several successive lower lows and lower highs on the chart.

Despite a recent surge in ARB‘s price, it’s unlikely that this will mark a turnaround from the current downward trend.

At present, ARB‘s RSI, or Relative Strength Index, stood firm at 42.27, signaling a decrease in bullish energy. Yet, the Chaikin Money Flow (CMF) continued to register significant values, suggesting ongoing financial inflows into the network.

Realistic or not, here’s ARB’s market cap in BTC’s terms

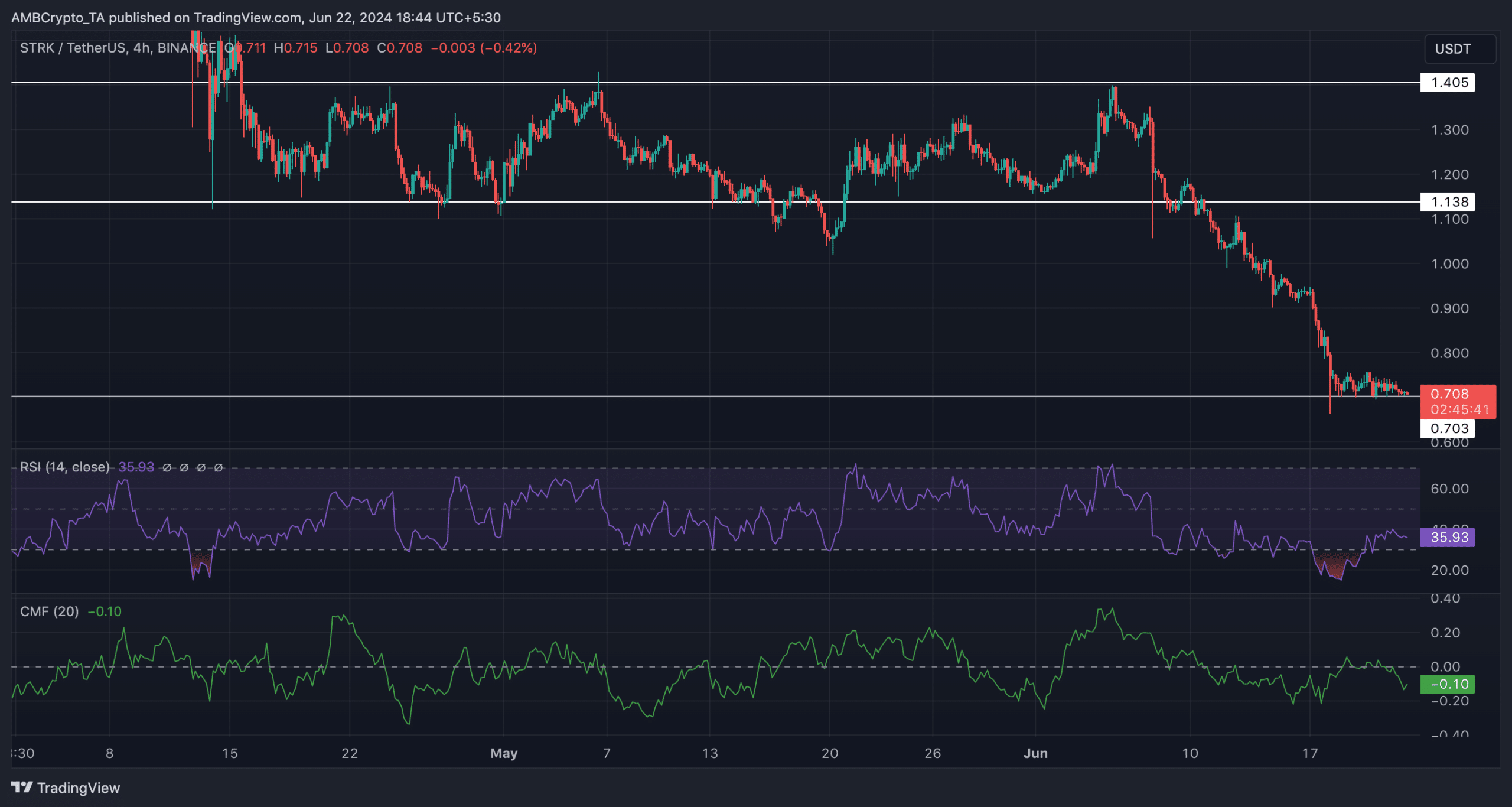

In May, STRK exhibited a pattern of price stability, with little upward momentum. However, towards the end of the month, the token experienced a considerable decline in value. No noticeable price increase was detected during this period.

The RSI, with a value of 35, and the CMF, at -0.10, indicated a pessimistic outlook for the token based on their readings. Currently, STRK is priced at $0.708 in the market.

Source; Trading View

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-23 12:07