- ARB breaks below a key demand zone as technical indicators confirm continued bearish momentum.

- On-chain metrics and declining market sentiment highlight weak engagement and growing downside risks.

As a seasoned crypto investor with a few gray hairs to show for it, I must admit that the recent performance of Arbitrum (ARB) has left me feeling a bit like an old dog trying to learn new tricks. The break below the critical demand zone and the bearish technical indicators are reminiscent of the dot-com crash in 2000 – albeit on a smaller scale, thankfully!

The downward momentum seems relentless, with the next potential support level at $0.65 looming ominously. I’ve seen markets recover from worse, but as it stands, the lack of significant buying activity and the continued selling pressure make me hesitant to jump in.

However, I’m not one to give up easily. I remember when Bitcoin was trading at $0.10, and people were calling it a lost cause. So, who knows? Maybe ARB will surprise us all and start a new bull run. But until then, I’ll be watching from the sidelines with my popcorn ready.

On a lighter note, if ARB keeps dropping, maybe it’ll become so cheap that I can finally afford to buy a whole bag of it!

Currently, Arbitrum [ARB] is experiencing strong downward pressure, currently priced at around $0.72166. This represents a decrease of approximately 5.54% in the last 24 hours.

Based on my personal experience as a long-term investor in cryptocurrencies, observing the market trends closely, I believe that the recent drop below a crucial support level for this particular digital currency indicates mounting selling pressure and growing doubts about its ability to recover. This has been a common pattern I’ve noticed in other instances where similar events have occurred, and it often signals a potential downturn in price action. It’s important to stay informed and cautious in such situations, as the market can be highly unpredictable and volatile.

Based on my years of experience trading cryptocurrencies, I believe that the current trends in technical indicators and on-chain metrics point towards potential further declines in the market. If market conditions don’t improve swiftly, it might be wise to reconsider one’s investment strategies or hold tight and prepare for a possible downturn.

With ARB struggling near key levels, the coming sessions could prove crucial.

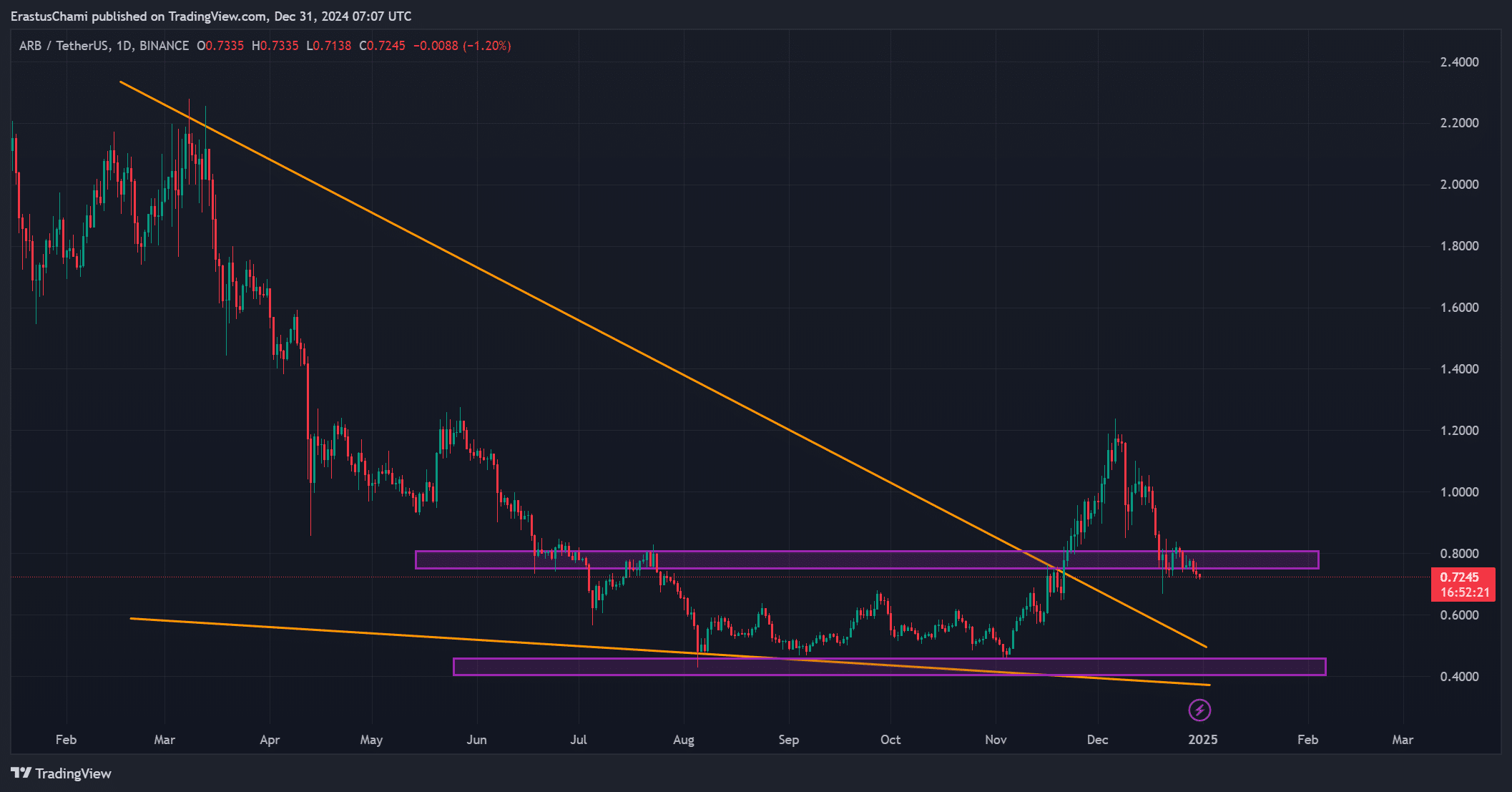

Breakout below critical demand zone raises concerns

The financial institution ARB has broken through an important level of resistance, indicating increased selling activity that matches its continuous downward trend since November.

The price might find its next possible floor near $0.65, as the long-term ceiling trend continues unbroken.

Based on my years of market analysis and observation, I see this downward trend as a clear signal that there isn’t much buying activity happening, which could potentially lead to even steeper declines. From my experience, it’s crucial to pay attention to such patterns in order to make informed decisions and navigate the market effectively.

Additionally, traders are keeping a keen eye out for any changes in trend that might help maintain the price where it’s currently sitting.

ARB technical indicators show bearish signals

As a seasoned investor with over two decades of experience in the stock market, I can confidently say that the current technical metrics for ARB do not fill me with optimism in the short term. The Relative Strength Index (RSI) at 37.13 is nearing oversold territory and suggests an increase in selling pressure. This indicates that the stock may have fallen too quickly, potentially due to panic selling or a lack of buyer interest. I’ve seen similar patterns before, and they often result in a rebound followed by further downward momentum. In my opinion, it would be prudent to exercise caution when investing in ARB at this time.

Furthermore, the crossing of the Moving Averages indicates a downward trend, as the 9-day average price is at $0.7682, while the 21-day average price stands at $0.8505.

The trends seem to indicate that the decline of ARB might continue if there isn’t an immediate increase in purchasing activity. This is backed up by technical signs, which show that the negative trend is still quite powerful.

On-chain metrics point to declining confidence

The data tracked by ARB on its blockchain supports a pessimistic view, indicating diminished user engagement and waning curiosity. Furthermore, a decrease of 0.98% in Network Growth suggests that the rate at which this ecosystem is being adopted is slowing down.

The “In the Money” figure fell by 0.22%, and the Concentration also decreased by 0.13%. This suggests a decrease in investor activity or involvement.

Transactions of significant size experienced a substantial drop by 14.73%, indicating reduced institutional engagement, in other words, less institutional involvement was observed.

Moreover, according to Santiment analytics, the Price DAA Divergence currently amounts to 14.89%, implying a noticeable disparity between user engagement levels and price movement.

These metrics suggest waning confidence in ARB’s near-term potential.

ARB market sentiment reflects trader hesitation

Market sentiment echoes the challenges, with open interest declining by 2.90% to $163.69 million.

This decrease indicates less involvement from traders and fewer fresh positions being initiated, suggesting a reluctance to enter into ARB at its current price points.

Additionally, the absence of significant purchasing activity indicates that the cryptocurrency may continue to experience downward pressure, making it susceptible to additional drops if public opinion doesn’t change dramatically.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

Conclusion: Downside more likely?

According to technical and blockchain analysis, it seems that Arbitrum (ARB) might face further price drops in the short term.

In simpler terms, with people feeling pessimistic about the market, less user interest, and warnings in the technical analysis, a turnaround seems improbable unless something very good happens. As it stands now, the downward trend looks set to persist further.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

2024-12-31 14:16