- ARB records highest negative chain netflow in past 24 hours as liquidity is drained.

- Large holders continue to offload their ARB holdings.

In the past 24 hours, Arbitrum [ARB] has lost about 10.28% as the selling pressure intensified. This downward movement added to its past week and month losses of 19.87% and 25.22%, respectively.

According to AMBCrypto’s analysis, ARB is likely to drop even lower from its current level as large holders and retailers continue to lose interest.

ARB faces threat as liquidity is removed

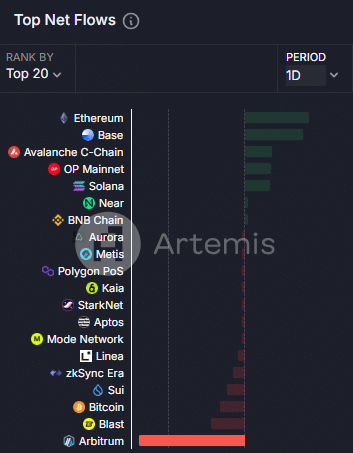

There’s been a massive chain netflow in ARB in the past 24 hours, with a total of $13.8 million worth of ARB withdrawn and sold during this period.

A chain netflow measures the amount of ARB circulating within an entire chain and its protocols. A negative netflow implies more ARB has been removed, while a positive netflow suggests more liquidity has been added.

With the former being the case, ARB will likely see a further decline, particularly if this liquidity removal continues.

AMBCrypto found that large transaction holders and retail investors have a key role in this liquidity outflow from ARB, as key metrics indicate.

Large and retail investors are selling

Large holders of ARB, controlling between 0.1% and 1% of the total supply, have been selling.

In the past 24 hours, 131 million ARB worth $58.79 million was transacted by this group, with sellers likely dominating as the price of ARB saw a downward push.

Retailers are also losing confidence in ARB’s ability to rally, as low activity from this cohort was recorded in the past 24 hours.

At the time of writing, the number of active addresses engaging and interacting with ARB has declined by 40.46% over the past week, with just 7,490 addresses now actively engaging.

A decline like this points to a lack of interest, increasing the likelihood of a further price drop.

Should whales continue selling ARB and interactions among retail investors remain low, further decline appears inevitable.

Read Arbitrum’s [ARB] Price Prediction 2025–2026

ARB targets November’s low

On the chart, ARB could see a further decline if its current daily candlestick closes below the support level and subsequently fails to reclaim it.

If this happens, ARB could trade down to its November 2024 low of $0.459, with a further decline to $0.42 — its all-time low — if selling pressure intensifies and an early rebound does not occur.

🐳 Whales and retailers are dumping Arbitrum’s ARB like it’s hot! Will it plummet to new lows? 📉💸

P.S. Don’t forget to bring your towel and sarcasm detector! 🧐🌴

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-02-02 19:09