- ARB is testing key resistance at $0.61, with bullish momentum pushing prices higher.

- Technical indicators favor a breakout, but on-chain data signals caution despite positive funding rates.

As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find Arbitrum (ARB) to be an exciting opportunity at the moment. The token is testing key resistance at $0.61, a level that has proven challenging in the past, but the growing bullish momentum gives me confidence that this could be the breakthrough we’ve been waiting for.

Arbitrum’s token (ARB) seems poised for an upward trend, with its current price hovering around $0.60. This optimistic outlook is bolstered by increasing bullish energy. As we speak, ARB is trading at $0.5995, representing a minor 1.76% drop over the last day.

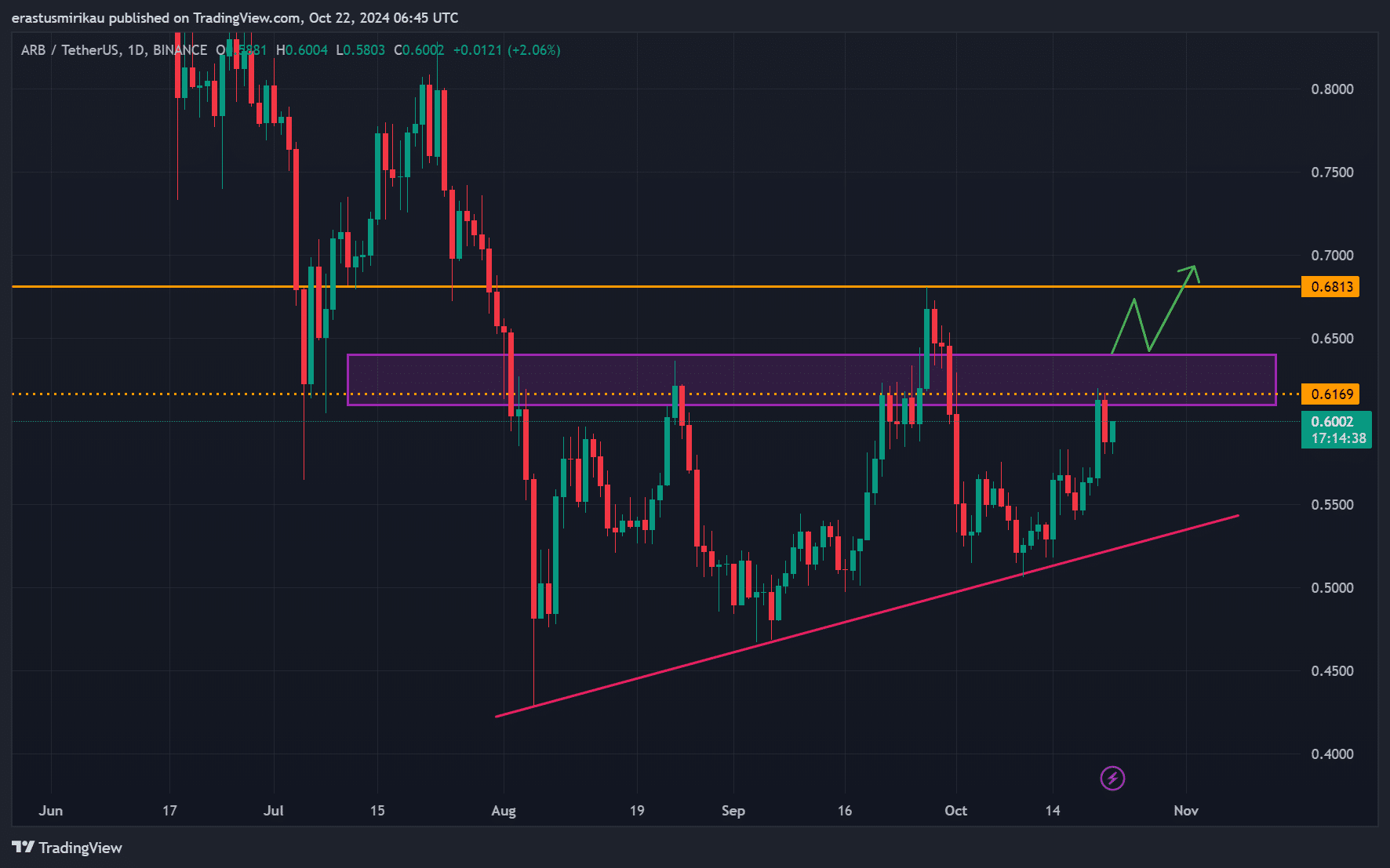

The chart for ARB’s price suggests that the token is encountering a significant resistance at approximately $0.61. This flat barrier has shown to be tough to surpass, but if ARB succeeds in closing above it, the route to around $0.68 becomes more straightforward. Meanwhile, the support level at $0.55 remains vital in this potential breakout scenario.

Moreover, the upward trajectory hints at persistent buying power, possibly leading to additional gains. Yet, if the price doesn’t surpass $0.61, there might be a brief correction, possibly dropping to around $0.55.

Analyzing technical indicators: Are bulls still in control?

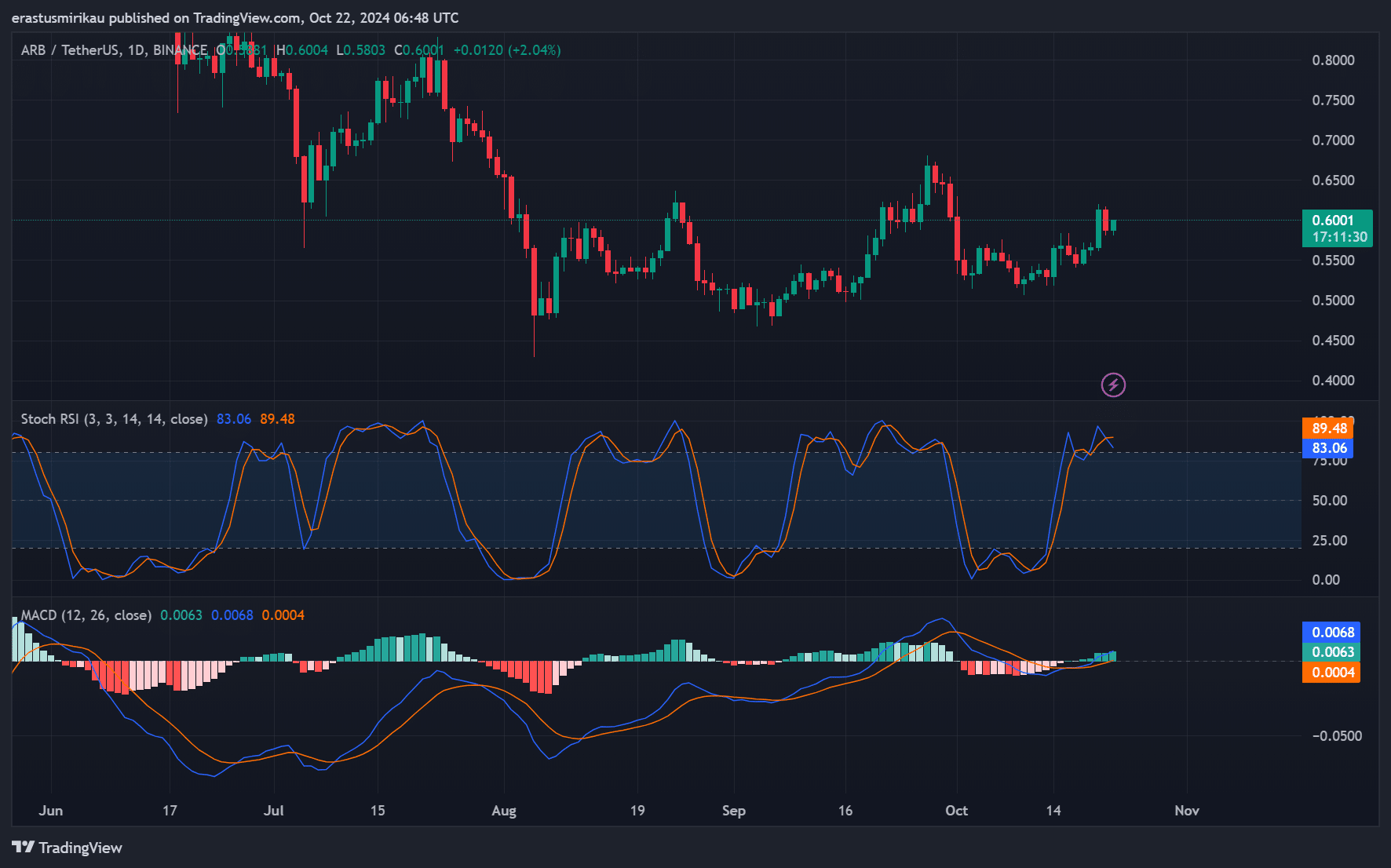

In simpler terms, the technical analysis suggests that Arbitrum’s future trend is generally positive. However, the Stochastic RSI value stands at 89.48, suggesting that the asset may be overbought, which could lead to a brief dip. Despite this, the upward movement is expected to continue afterwards.

Furthermore, the MACD indicates an upward cross, supporting the notion of further price growth. This suggests that while temporary declines might happen, the general direction appears to be bullish for ARB in the long term.

Evaluating on-chain data: Mixed signals for ARB

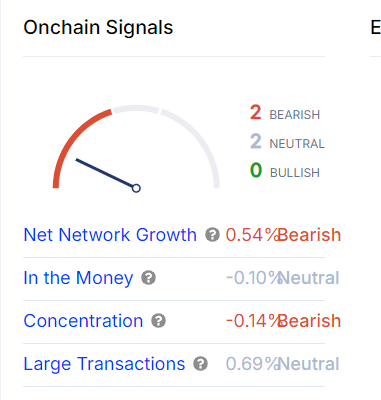

The signals coming from transactions on the blockchain suggest a somewhat cautious outlook for Arbitrum. There’s minimal expansion in the network, with only 0.54% growth, which hints at a slight downtrend. Furthermore, the dominance of large investors appears to be decreasing slightly, by -0.14%, suggesting that big players might not be buying up more Arbitrum at this time.

Even though the “in the money” and significant transaction indicators are currently stable, they don’t show any clear signs of market decline or growth. This suggests that the market may still have potential for recovery in the long run, despite some short-term doubts.

Is the OI-weighted funding rate supporting ARB’s bullish case?

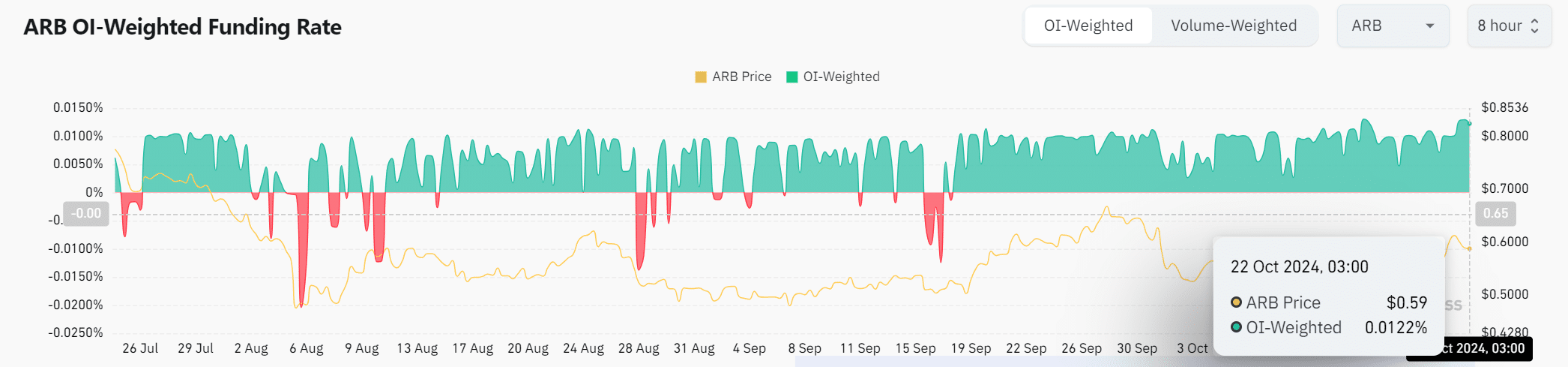

The OI-weighted funding rate remains positive at 0.0122%, signaling optimism in the futures market. This bullish sentiment in the derivatives market could support ARB’s price breakout if it can surpass its current resistance.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

Can ARB break out?

If Arbitrum manages to surpass the significant barrier at $0.61, it could be on the verge of a significant upward trend, given that technical and market signs generally suggest a positive outlook. However, traders should exercise caution as temporary pullbacks might occur due to indications of being overbought.

If Arbitrum maintains its present level of support, it’s more and more likely that we will see a test at around $0.68.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-10-22 14:15