- One market analyst highlighted three pivotal factors contributing to the potential rally.

- Most notably, the USDT Treasury has minted 1 billion USDT during this crucial period, signaling a ripe opportunity for market growth.

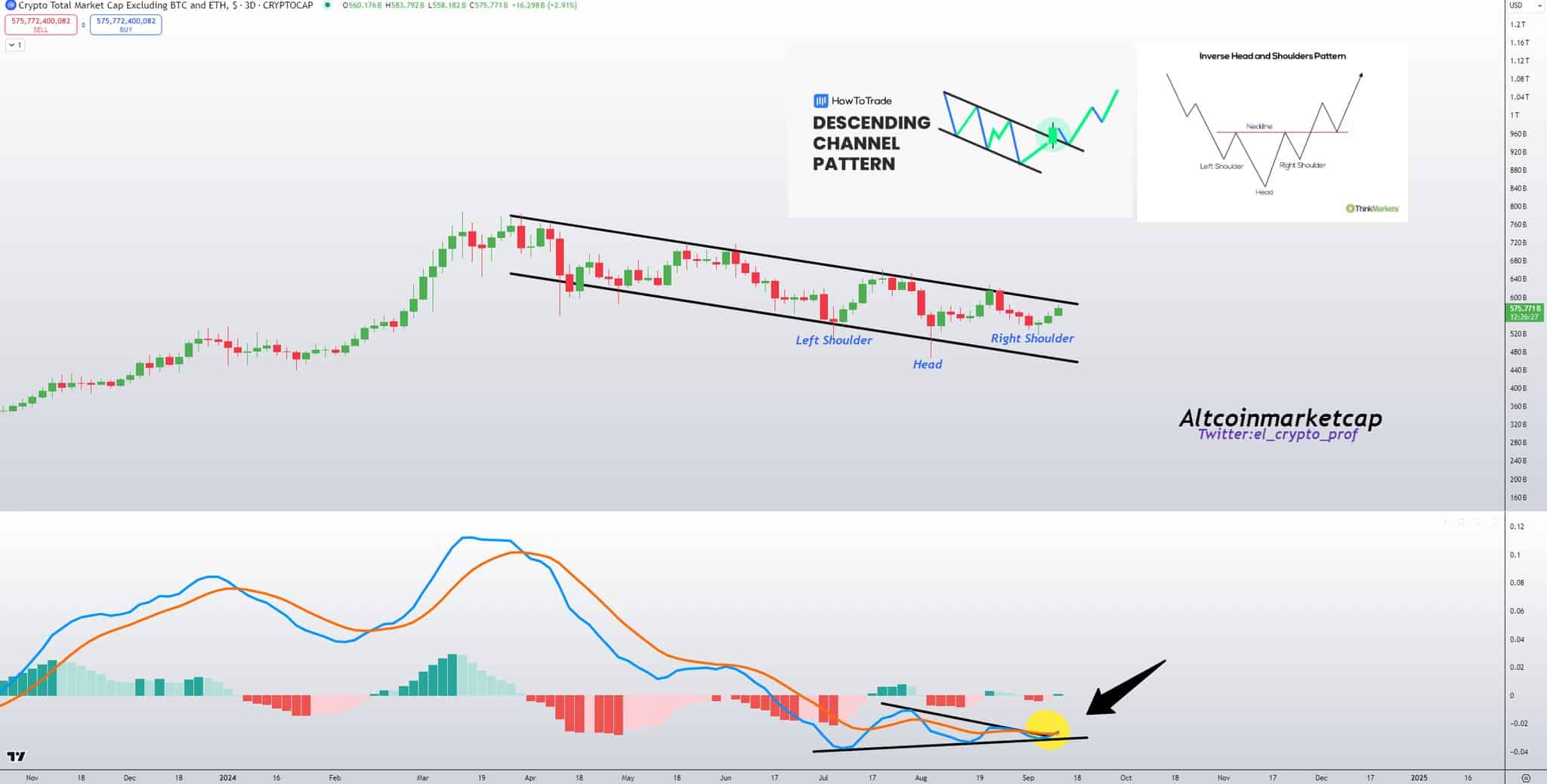

As a seasoned crypto investor with more than a decade of experience under my belt, I find myself intrigued by the recent analysis suggesting a potential altcoin rally. The convergence of technical alignments such as inverse head and shoulder patterns, the golden cross on the MACD, and channel dynamics certainly piques my interest.

Over the last day, there’s been a slight deceleration in the overall cryptocurrency market, resulting in a drop of approximately 2.87%. This decrease has lowered the entire market capitalization to about $2.04 trillion.

Altcoins have borne the brunt of this downturn.

Even with strong selling activity and a slight rise in Bitcoin‘s [BTC] market control by 0.28% during this period, analysts continue to be positive that the altcoin market will quickly bounce back in the immediate term.

Potential altcoin rally?

Crystal Ball Gazer Mustache anticipates an upcoming surge in the market for alternative cryptocurrencies, supported by various crucial technical configurations.

Based on his examination, a variety of elements seem to be coming together that historically have signaled significant price fluctuations.

The main sign we’re looking for is the appearance of reversal patterns known as “head and shoulder inversions” inside a falling trend line or channel.

As a crypto investor, I’ve noticed that a common pattern in the market involves the price moving between two diagonal lines – these lines are referred to as resistance and support. Typically, such a pattern is often followed by a significant breakout after the price crosses one of these lines decisively.

A burst like this usually drives the price up towards the top boundary or even above it, suggesting a positive turnaround for the market.

Enhancing the optimistic view, there’s a ‘golden cross’ spotted on the Moving Average Convergence Divergence (MACD), as indicated by the yellow circle. This suggests that the short-term moving average could potentially cross above the long-term moving average, a bullish signal.

The MACD’s blue line significantly moves above the orange signal line, which is a notable occurrence during a three-month descending triangle pattern in recent market phases.

Historically, this crossover is a strong indicator of rising momentum.

As an analyst, I find that the combination of a head and shoulders pattern, MACD crossover, and channel dynamics significantly boosts the likelihood of a substantial market rally.

As an analyst, I’d anticipate the unquestionable evidence of an uptrend to manifest through two key events: firstly, a breach from the downward trendline, or descending channel; secondly, a surge in the Moving Average Convergence Divergence (MACD), propelling the price into a bullish territory.

Increased liquidity inflow adds optimism to the market

The crypto market is witnessing an increase in fluidity due to the influx of more stable coins being circulated, indicating a rising level of investor engagement.

Notably, Tether Treasury recently produced a new supply of one billion US Dollar Tether (USDT), a move usually associated with increased interest in stablecoins.

Many investors frequently buy cryptocurrencies like Bitcoin and alternative coins using these investment vehicles, indicating a positive perspective on the market.

Moreover, as per Lookonchain’s report, approximately 50 million US Dollar Coin (USDC), which ranks second in terms of market capitalization among stablecoins, has been introduced into the market over the last few days. This injection has served to boost market liquidity even further.

As reported by AMBCrypto, both XRP and AAVE could potentially see substantial gains if the predicted breakout from current convergence patterns occurs, boosting their positions significantly in this trend.

XRP eyes major rally amid market resilience

Despite ongoing legal challenges with the U.S. Securities and Exchange Commission (SEC), XRP has maintained its position among the top 10 tokens by market capitalization, achieving a growth of 14.02% over the past year.

In the future, a major change in the altcoin market may catapult XRP to unprecedented levels, aiming for crucial liquidity points at approximately $0.74 and $0.936.

With increased momentum, XRP might revisit the $1 mark, a peak last seen in December 2021.

AAVE ready for growth with strong DeFi performance

Over the last month, AAVE has shown exceptional progress, making it a formidable candidate for the approaching Cryptocurrency boom, known as Altseason.

It recorded a substantial increase of 110.12% between the 5th of August to the 9th of September, although CoinMarketCap noted a monthly gain of 24.01%.

In my role as a researcher, I am observing the dynamic landscape of decentralized finance, and it’s clear that Aave stands out as one of the top players, holding the sixth position in market capitalization. With the current market showing signs of movement, there’s a possibility that Aave could reach unprecedented heights, potentially trading around $243.00 – a level not seen since April 2022.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Lucy Hale’s Sizzling Romance with Harry Jowsey: The Un serious, Fun-Filled Love Story!

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-09-17 01:12