-

BTC ETFs attracted inflows from Gold ETFs, per a VanEck executive.

BTC could be closer to a parabolic run following a key update on the US money supply.

As a seasoned crypto investor with a keen interest in market trends, I find the recent developments surrounding Bitcoin ETFs intriguing. The fact that Gold ETFs have seen outflows despite hitting record highs and rallying 14% this year is a significant indicator of investors’ shifting preferences towards digital assets like BTC.

Observant market analysts have long pondered the possibility of investors shifting funds from Gold Exchange-Traded Funds (ETFs) to Bitcoin [BTC] Spot ETFs in the US, given that this trend is now materializing, as confirmed by Jan Van Eck, CEO of VanEck.

During Paris Blockchain Week 2024, a VanEck executive spoke on the sidelines of the event, noting that gold ETFs experienced withdrawals even as they reached new peaks and registered a gain of 14% for the year.

Despite gold reaching new record highs and increasing by 14% in the US this year, there have still been withdrawals from Gold bullion ETFs.

According to Van Eck, a Google search analysis indicated a significant surge in investor curiosity towards Bitcoin over gold.

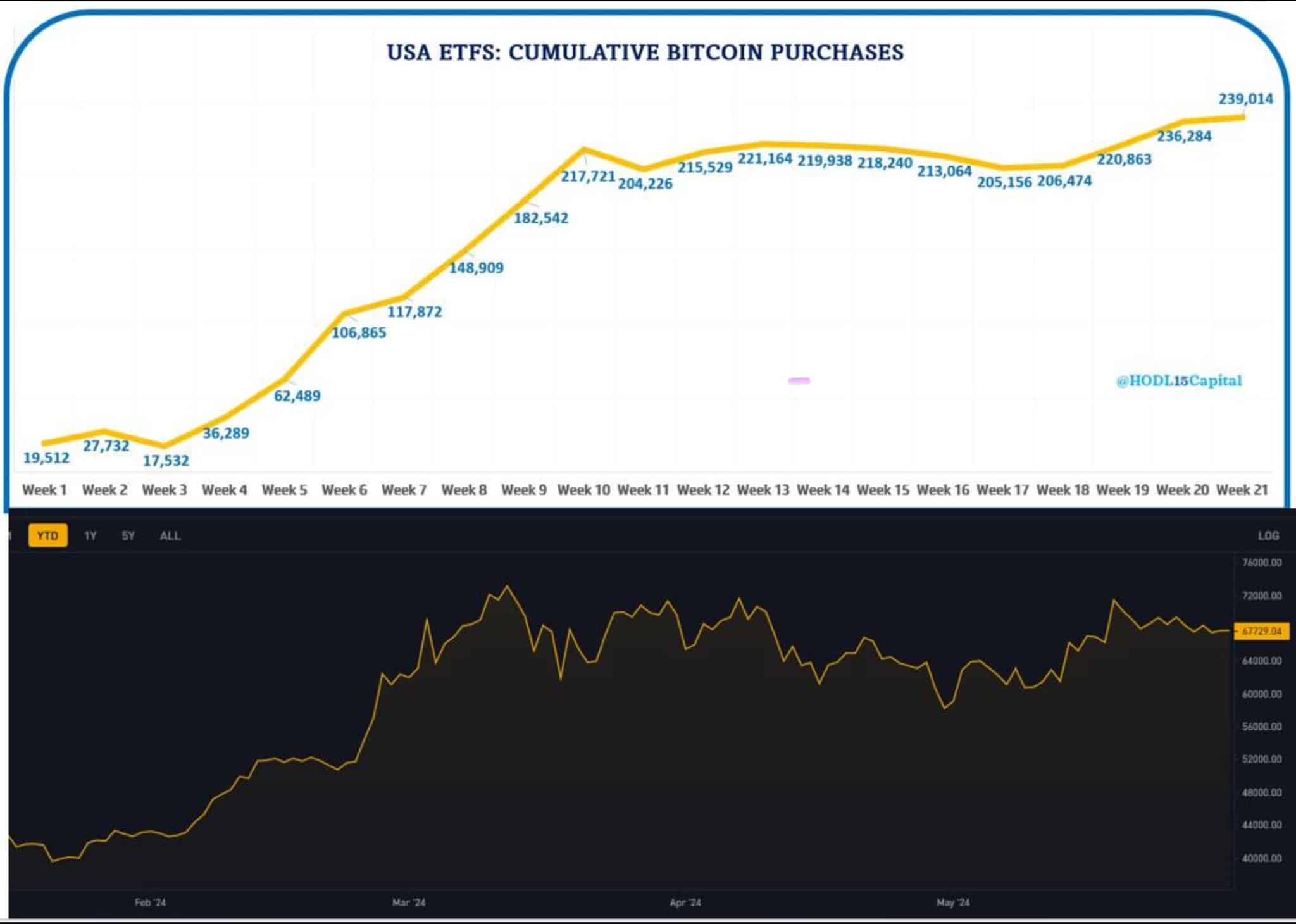

Although some noteworthy advancements occurred, US Bitcoin ETFs accumulated approximately 30,000 Bitcoins in May. However, the interest waned and demand remained sluggish.

Bitcoin ETF demand stagnates, but …

As a crypto investor, I’ve noticed an interesting development in May. US spot Bitcoin Exchange-Traded Funds (ETFs) experienced net inflows, drawing in approximately 29.5K Bitcoins into these funds. This increase took place despite the ongoing selling pressure from Grayscale Bitcoin Trust (GBTC).

On the 31st of May, there was a total inflow of approximately $48.7 million into Exchange-Traded Funds (ETFs) according to Soso Value’s data. Among these ETFs, BlackRock’s IBIT recorded the largest influx with around $169 million, while Fidelity’s FBTC saw a relatively smaller inflow of approximately $5.9 million.

As a researcher examining the recent trends in investment flows, I’ve noticed that while there were significant inflows into Bitcoin-related products earlier, Grayscale’s GBTC saw net outflows amounting to $124.3 million last Friday based on data from Farside Investors.

As a crypto investor observing the market trends, I’ve noticed that the demand for a cumulative spot Bitcoin ETF hasn’t shown significant growth when the Bitcoin price remains stagnant on the charts.

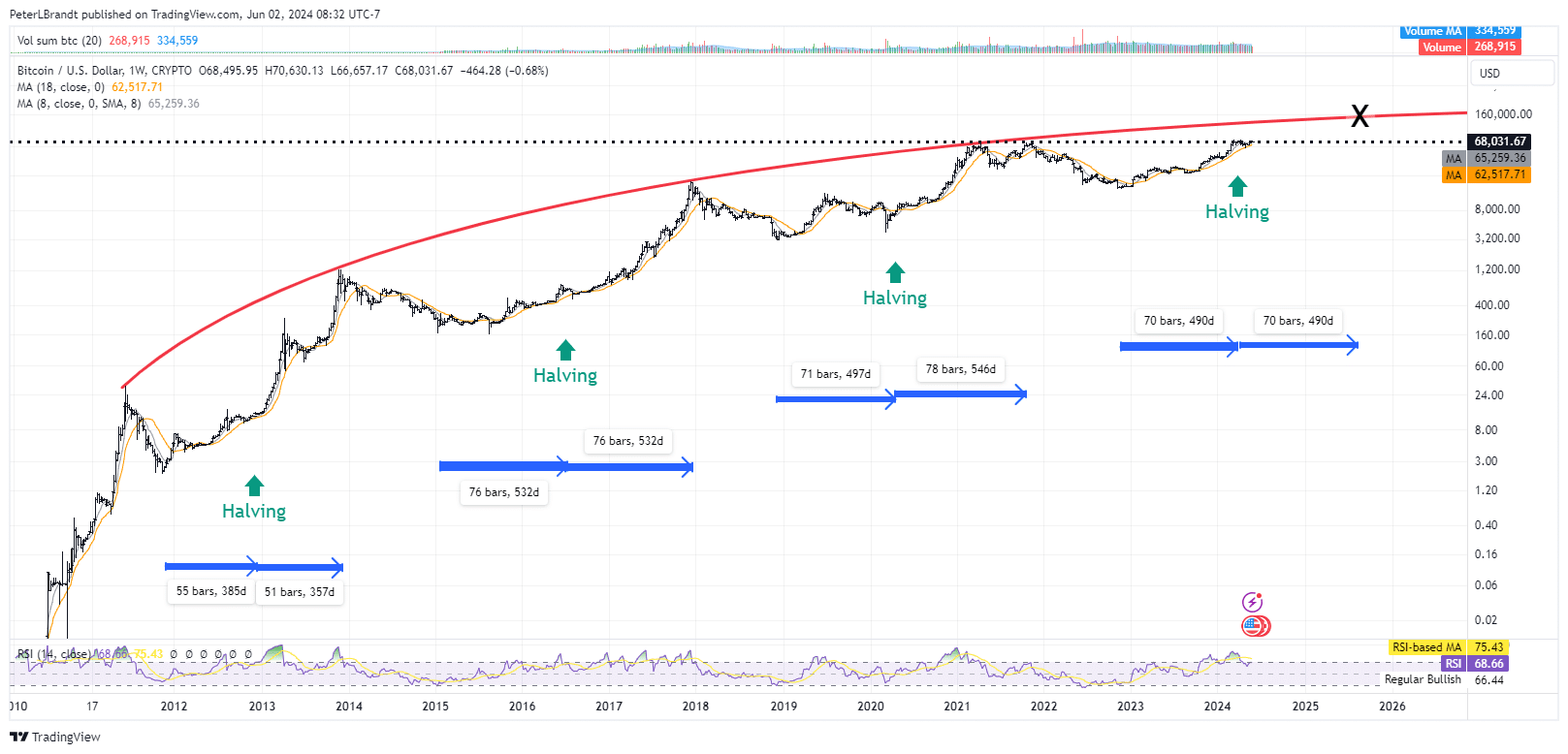

If BTC continues on its current trajectory, it may experience a parabolic rise, reminiscent of the surge seen before the historic price increase in 2017. Notably, this development was preceded by BTC surpassing the US money supply as a significant milestone. As per crypto expert TechDev’s analysis, we might be witnessing a similar trend unfold.

In 2021, the price of Bitcoin ($BTC) reached new record highs against the US dollar due to an expanded money supply. By contrast, in 2024, Bitcoin surpassed these heights based on its own demand and broke free from the M1 monetary metric. Considering the predicted growth in M1 this time around, it’s reasonable to anticipate that Bitcoin will exceed expectations, drawing on the momentum from its 2021 performance.

As a market analyst, I’ve studied historical trends and based on that data, I estimate that the price of Bitcoin could reach a peak between $130,000 and $150,000 by August 2025.

Btc has been trading within a price range for the past three months. To indicate a continuation of the upward trend, it needs to surpass this range.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-03 14:15