- Bitcoin has fallen by 11.28% from its ATH, reducing miners profitability

- Miners could capitulate as profit/loss sustainability enters extremely underpaid zone

Since hitting a new all-time high of $109k nearly 3 weeks ago, Bitcoin [BTC] has dropped by approximately 11.28% on the charts.

⚠️ Market Meltdown? EUR/USD Braces for Trump Tariff Fallout!

Explosive analysis shows why EUR/USD could face extreme moves ahead!

View Urgent ForecastThis decline has not only affected short-term holders in terms of profitability, but also miners. In fact, the latest dip in BTC’s price charts has left miners struggling to keep up with the market.

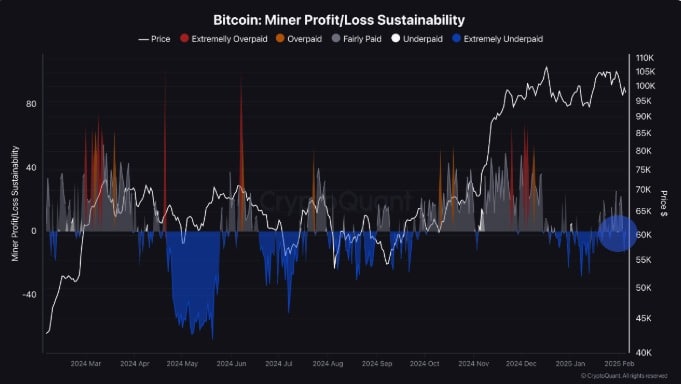

CryptoQuant analyst Frost, for instance, observed that miners are extremely underpaid right now, risking miners’ capitulation.

Bitcoin’s Miner Profit/Loss enters extreme underpaid zone

According to CryptoQuant, Bitcoin miners’ profit-loss sustainability has entered the extremely underpaid zone.

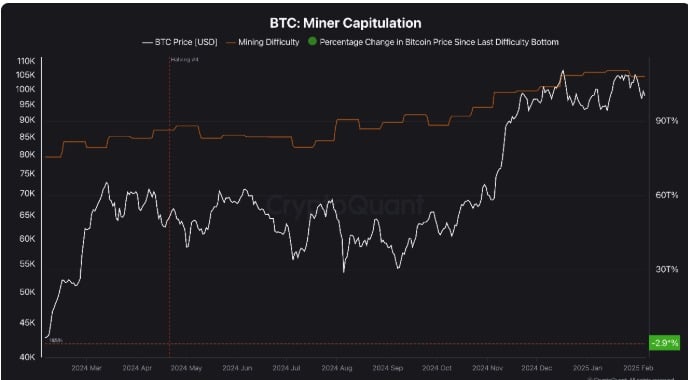

This, following the April 2024 halving which resulted in a rising mining difficulty. While it has become more difficult to mine, Bitcoin’s hash rate has continued to grow – A sign of the surge in competition among miners.

With Bitcoin continuing to decline since hitting its ATH, miners’ returns have been shrinking. On the contrary, the realized mining cost has been relatively high, compared to the last difficulty bottom.

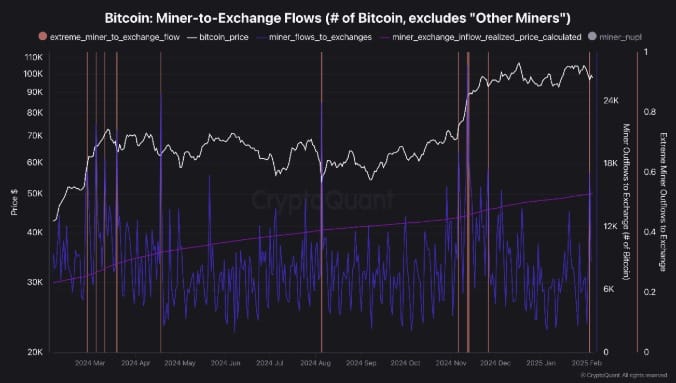

This market condition suggests that miners might start to capitulate soon. Historically, when miner profit/loss profitability turns negative, it is often followed by a mid-term positive price reaction. Simply put, miners have reacted by selling Bitcoin to cover costs.

With miners facing operational difficulties, they have responded by selling. Some could even be forced to capitulate temporarily.

In previous cycles, this situation has created accumulation zones for other market participants to re-enter the market.

Is miner capitulation ahead for BTC?

Hence, with miners’ profitability dropping, it’s essential to determine if capitulation for miners is ahead or not.

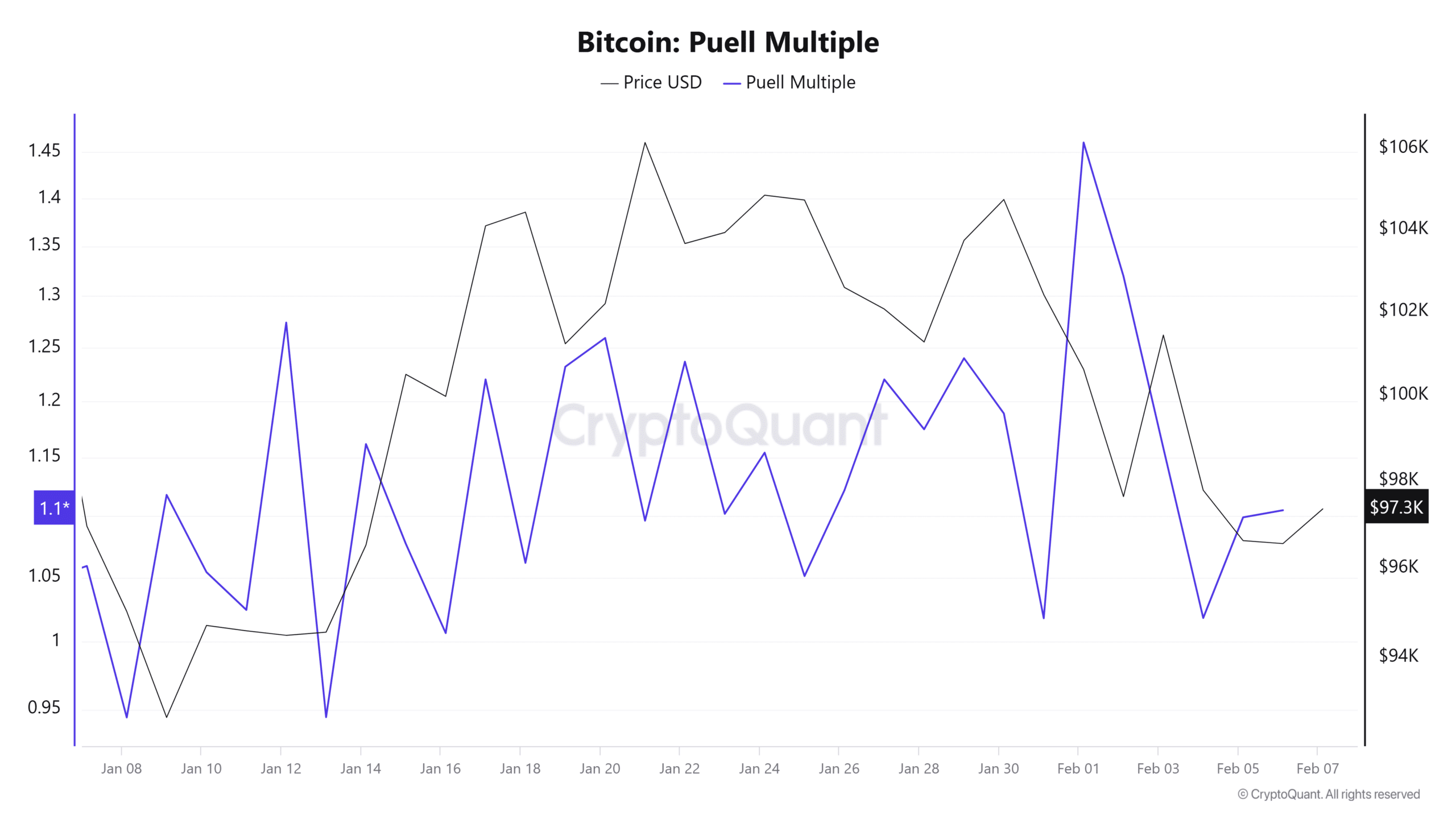

Look at the Puell multiple, for instance – This metric has remained above 1 since 13 January, dropping below 1 only twice in 2025, during the first weeks of the year. What this means is that although the Puell multiple has fluctuated, miner revenue remains moderately healthy.

Therefore, as long as this remains above 1, miners are less likely to capitulate. Hence, the drop could just be a healthy correction instead of weakness. This could imply accumulation by strong miners and investors.

What’s next now?

According to AMBCrypto’s analysis, for Bitcoin miners to avoid capitulation, BTC’s price has to recover to increase miner profit/loss.

If the price continues to fall, just as it has over the past week, miners’ capitulation could be next. Therefore, BTC must reclaim and hold above $100k for miners’ sustainability goals to be achieved.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Bobby’s Shocking Demise

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Gold Rate Forecast

2025-02-08 03:07