-

Despite recent price troubles, the BTC market remained euphoric.

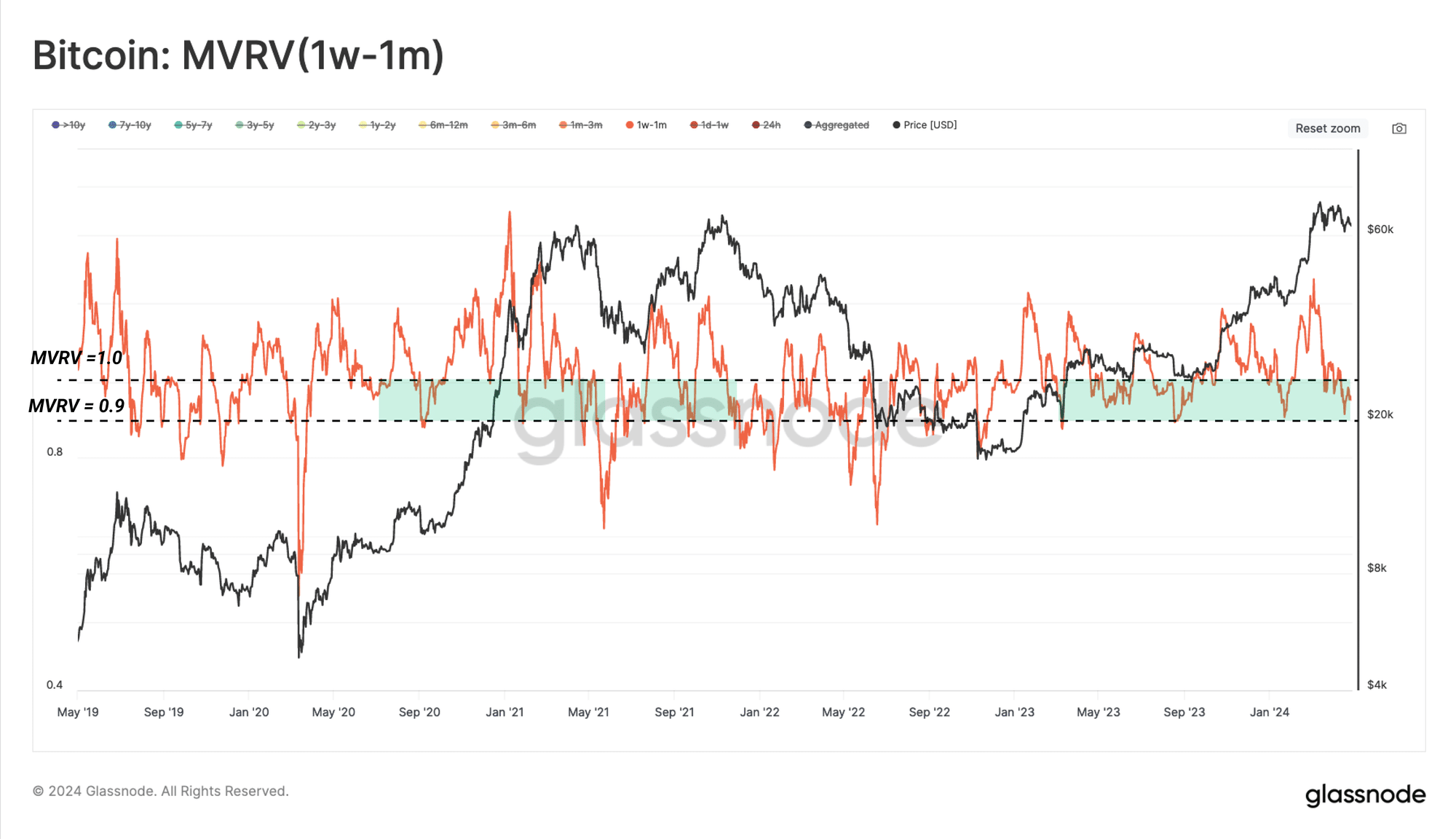

Readings from the coin’s MVRV ratio and Realized Loss metrics suggested that a local bottom may soon be discovered.

As an experienced analyst, I believe that the recent correction in Bitcoin’s price has caused some uncertainty among investors, but the market’s euphoric phase may not yet have come to an end. The high levels of unrealized gains among investors, as indicated by Bitcoin’s Net Unrealized Profit & Loss (NUPL) metric, suggest that there is still a significant amount of optimism and belief in the coin’s continued price growth.

🔥 Trump Tariffs Shock Incoming! EUR/USD in the Crosshairs!

Massive forex shifts expected — don't miss the crucial insights now unfolding!

View Urgent ForecastAccording to a recent analysis by Glassnode, Bitcoin‘s [BTC] Net Unrealized Profit & Loss (NUPL) indicator indicates that the digital currency’s market is currently in the euphoria stage, with many investors experiencing substantial unrealized gains.

As a researcher studying the Bitcoin market, I would describe an euphoric market condition as one where there’s a collective sense of excitement and faith that the value of Bitcoin will keep climbing without end.

During this time, the market experiences swift price escalation and heightened trading action driven by enthusiasm.

Based on Glassnode’s analysis, even though the market correction has lessened the intensity, Bitcoin’s NUPL (Network Upgradability Price Layer) being above 0.5 indicates that there are still signs of excitement or optimism among investors in the Bitcoin market.

Santiment said,

Using a different perspective, the past seven months have seen the Euphoria stage (NUPL exceeding 0.5) of this bull market in action. It’s important to remember that even the strongest uptrends undergo corrections. These interruptions provide essential insights into investor attitudes and behaviors.

Is the local bottom in?

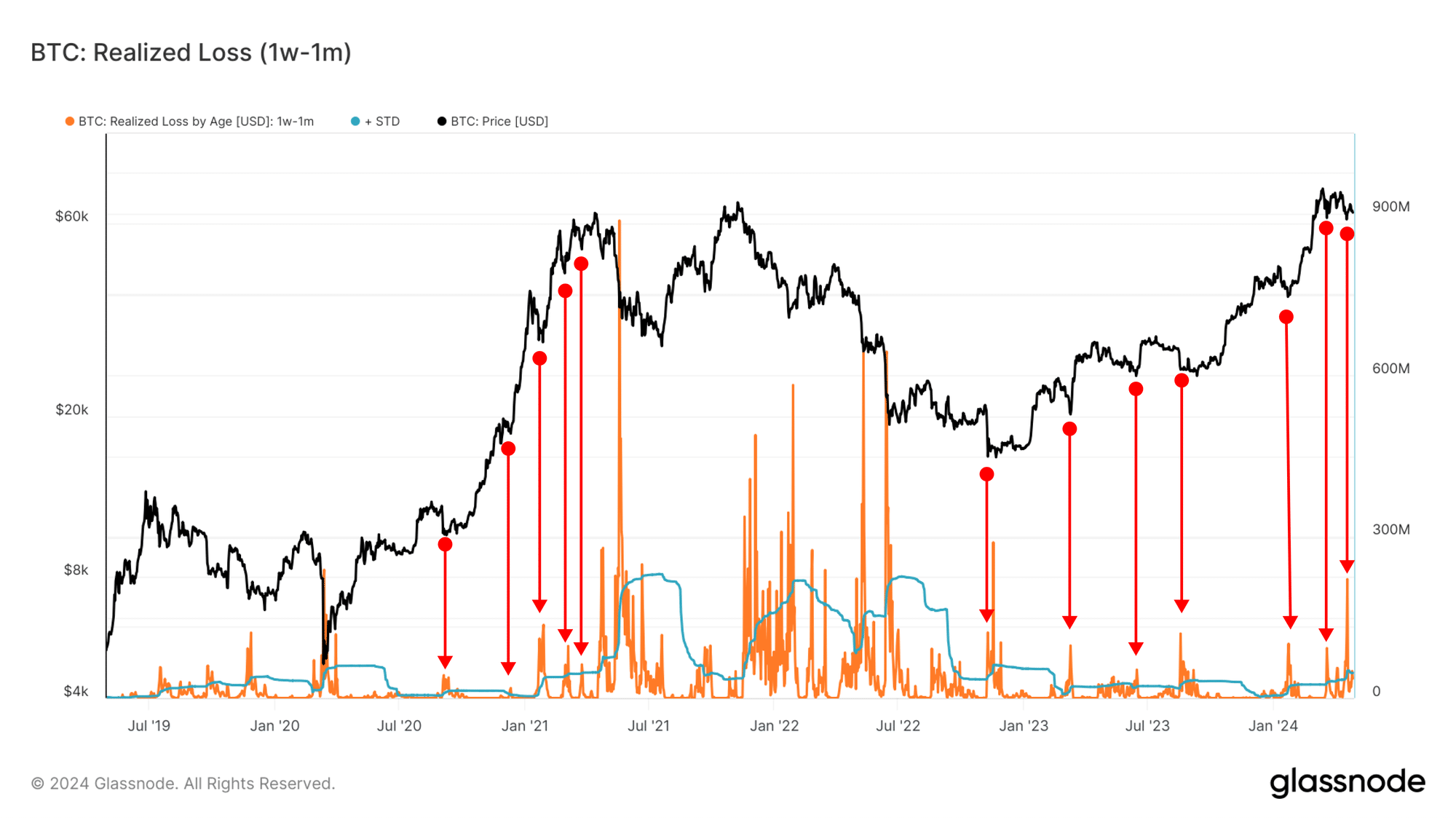

Based on Glassnode’s analysis, short-term Bitcoin (BTC) holders, specifically those who have owned their coins for a duration of one week to one month, have increased the pace at which they are disposing of their cryptocurrency following the recent price correction.

During market corrections like the present one, their distribution behavior is worth observing. It could signal possible purchasing points (low prices in a specific area).

As a seasoned crypto investor, I’ve noticed Glassnode’s intriguing analysis on the Mean Value Realized (MVR) ratio for coins held between one week and one month during market corrections in bull cycles. The MVRV ratio, which measures the profitability of coins, tends to dip into the 0.9-1 range during such periods. This suggests that it might be a prudent move for me to consider taking profits or even selling some of my less profitable holdings to minimize potential losses and preserve capital. However, this is just one perspective, and it’s essential to remember that investing in crypto involves risk and unpredictability. Always do your own research before making any investment decisions.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Investors who have held cryptocurrencies for a duration of one week to one month typically experience a loss of anywhere from 0% to 10% in value. Consequently, many choose to dispose of their assets during this timeframe.

The on-chain data provider also considered the Realized Loss by one-week to one-month-old entities.

Based on historical patterns, a reading above 1 for this metric indicates that large traders, also known as Significant Token Holders (STHs), may be selling off their tokens at a loss due to market panic.

Glassnode combined its readings from both metrics and concluded:

If the price stays between $60,000 and $66,700, meeting the MVRV requirement, it’s possible that the market is forming a local bottom. However, if the price drops below this range significantly, it could trigger panic selling and require the market to find a new equilibrium.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-05-02 06:15