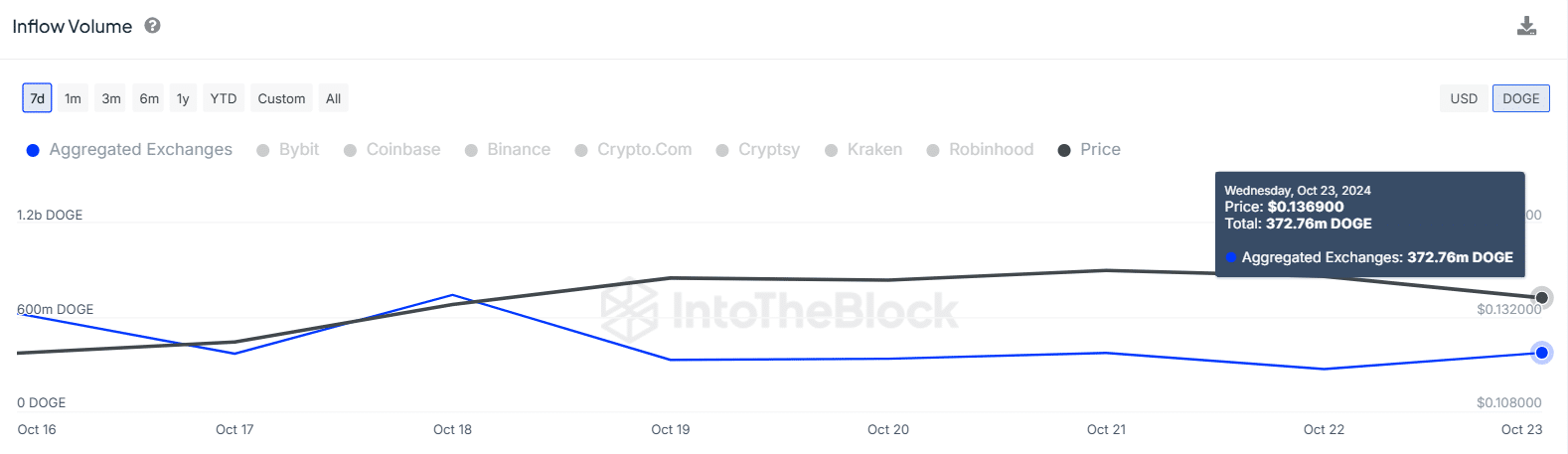

- DOGE inflows to exchanges increased by 38% in 24 hours after the rally showed signs of exhaustion.

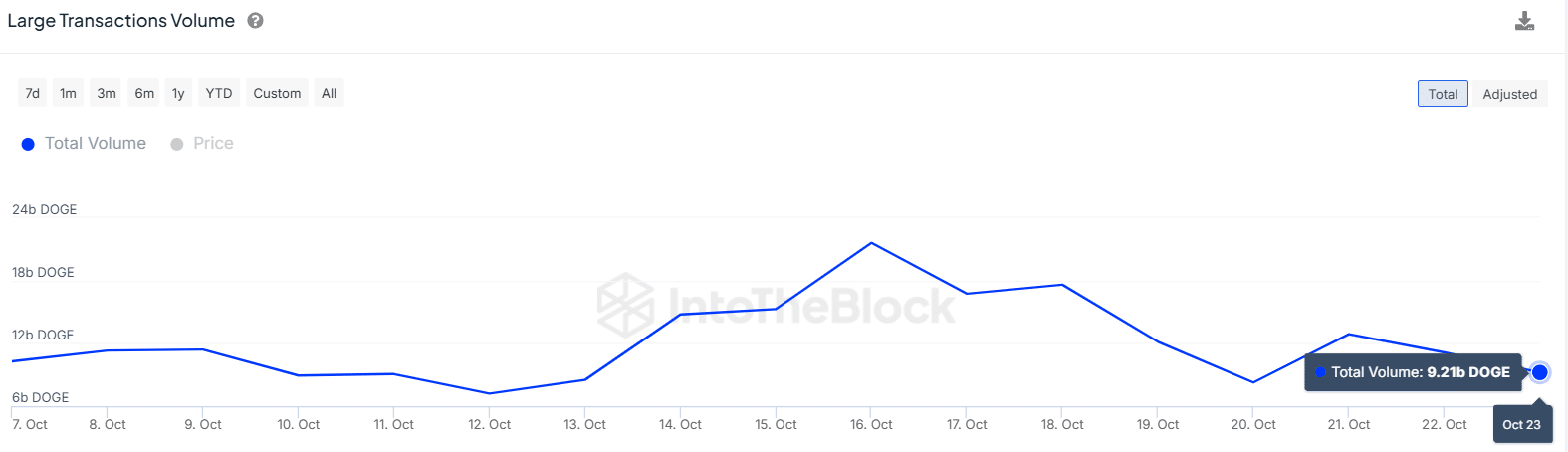

- Whales are also becoming inactive after large transaction volumes dropped from 17 billion to 9 billion in six days.

As a seasoned analyst with years of experience in the cryptocurrency market, I have witnessed numerous trends and patterns that have shaped the crypto landscape. The recent developments in Dogecoin [DOGE] are intriguing, to say the least.

Over the past month, the value of Dogecoin (DOGE) has risen by 26% due to increased attention from retail investors. This boost propelled DOGE to its highest point in over four months, peaking at $0.149 earlier this week.

However, at press time, DOGE had shed some of these gains to trade at $0.137.

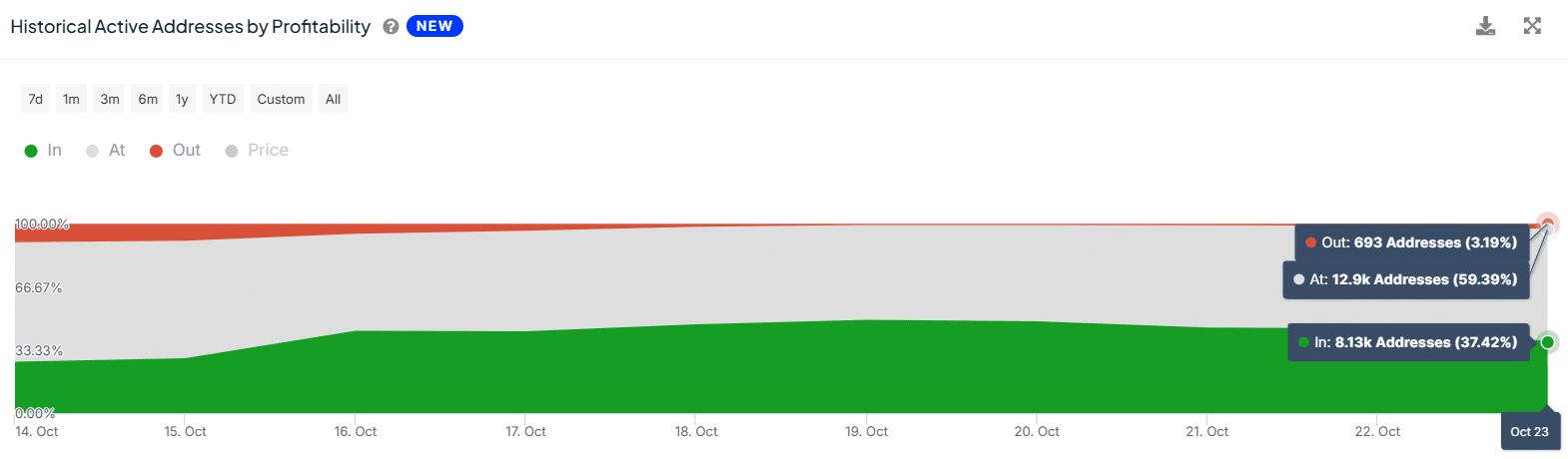

One possible factor for this decrease could be an increase in sell-offs or profit-takings, as many Dogecoin holders cashed out following the recent price rise, leading to a spike in wallets realizing their profits.

At the current moment, data from IntoTheBlock indicates that roughly 78% of Dogecoin (DOGE) owners, numbering approximately 5 million wallets, are enjoying a profit. Conversely, about 18% of these holders are experiencing losses.

However, a look at the active addresses by profitability showed a sudden drop. These addresses have dropped by 11% from 10,890 to 8,130.

At the same time, the active wallets in losses have increased by around 2%.

When the earnings for these digital wallets decrease, traders may feel compelled to cash out their gains. This cashing-out behavior could potentially slow down Dogecoin’s upward trajectory.

As an analyst, I’ve noticed a significant spike in Dogecoin (DOGE) deposits into exchanges. Yesterday, we saw approximately 372 million coins being deposited, marking a 38% rise compared to the day before.

If these inflows persist, Dogecoin could be set for a bearish trend reversal.

Dogecoin whale activity

This week, there’s been a notable decrease in significant Dogecoin transactions by ‘whales’, or large-scale investors. It seems these major Dogecoin holders have paused their buying spree, possibly because of doubt that arose when the upward trend began to falter.

Over the past six days, the number of significant DOGE transactions valued over $100,000 has decreased from 17 billion to 9 billion.

Based on my years of studying marine biology and observing whale behavior, I have noticed that when a whale rally shows signs of exhaustion, it tends to lose interest quickly. From what I have seen in my fieldwork, this is likely due to the fact that whales are highly intelligent creatures who can sense changes in their environment and adjust their actions accordingly. In my experience, when a whale rally reaches its peak and begins to show signs of exhaustion, it’s not uncommon for whale interest to wane as they move on to other activities or areas. This is just one example of the fascinating ways in which these magnificent creatures adapt to their environment.

As an analyst, I observe that a significant portion of Dogecoin’s supply is held by a few prominent investors, or “whales.” When these whales remain inactive, their lack of trading activity can potentially suppress market volatility, causing the price to stabilize and enter a phase of consolidation.

Read Dogecoin’s [DOGE] Price Prediction: 2024, 2025

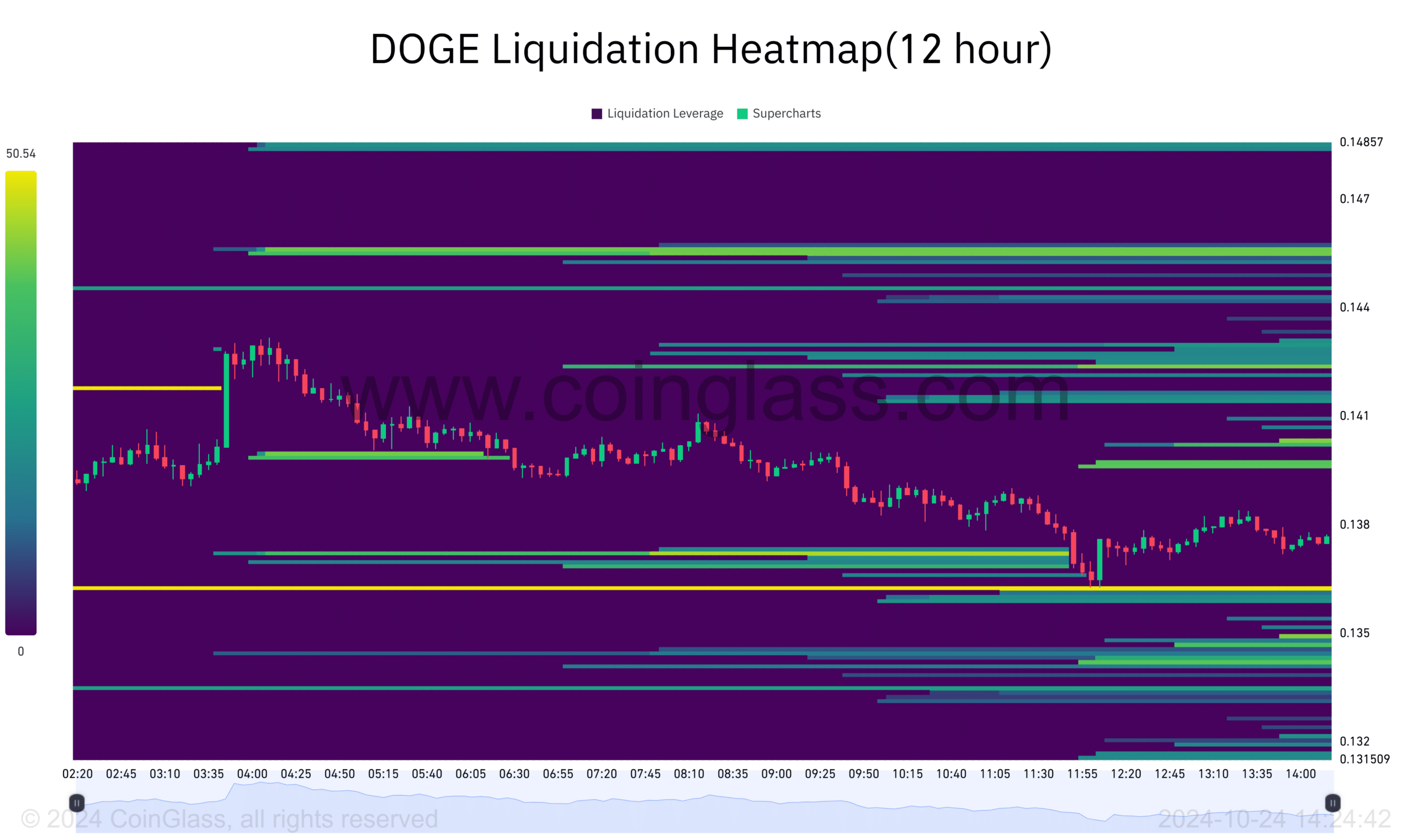

Liquidation zone could pull DOGE lower

Examining Dogecoin’s liquidation map reveals an intensely active liquidation area just beneath the present value, ranging from approximately $0.135 to $0.136. Such areas often exert a strong pull, potentially leading to price decreases.

If Dogecoin persists in its downward trajectory and the value decreases to that point, it may trigger more sellers to offload their holdings as they seek to exit their trades, potentially exacerbating the decline.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

2024-10-24 23:36