-

Bitwise submits the Ethereum ETF filing early, suggesting a mid-July launch.

Ethereum price drops but ETH holders are bullish with the potential for price surge.

As a researcher with extensive experience in the cryptocurrency market, I’ve closely followed the developments surrounding the Ethereum ETF filings and the recent delay in approval by the SEC.

As a crypto investor, I’m keeping a close eye on the developments regarding the potential approval of a spot Ethereum [ETH] ETF. Bitwise, being a forward-thinking asset manager, has taken the initiative by submitting an amended S-1 form ahead of schedule to address any potential issues and expedite the review process.

Bitwise move amidst unexpected delays

According to Eric Balchunas, a senior analyst at Bloomberg, the anticipated launch date for Ethereum exchange-traded funds (ETFs) was originally set for around July 2nd. However, following the Securities and Exchange Commission’s (SEC) announcement of a new deadline for firms to revise their S-1 applications, the ETF launch timeline has been changed to July 8th.

As an analyst, I would put it this way: The SEC’s inquiry on May 28th led to a delay in our filing process as we had to address the minor queries they raised in our S-1 submission.

Remarking on the same, Bloomberg ETF analyst James Seyffart said,

“We’ve received another modified S-1 filing from Bitwise Investments concerning their Ethereum ETF. Other issuers may follow suit with amendments throughout the remainder of the week. At this moment, we anticipate possible listings towards the end of next week or the week commencing on the 15th.”

Nate Geraci, ETF Store’s president, joined the ongoing debate and voiced his confidence in the ETF’s imminent approval. He speculated that the SEC might give its final nod as early as July 12, which could then initiate trading by July 15.

The delay was not required

Industry insiders have expressed great uncertainty about the exact approval date following this development. Nevertheless, Bitwise’s proactive submission of revised S-1 forms on July 3rd indicates that their products may be close to market release.

Providing further insights on the matter, Balchunas noted,

“Perhaps they merely wanted to finish dealing with it, and according to my information, the recent feedback session required minimal adjustments – it barely needed any time at all. Additionally, I have not been informed about the payment details, which I assume will be settled in the coming weeks.”

Criticism has been directed towards SEC Chairman Gary Gensler following this development. Some individuals believe that new leadership is needed at the SEC, as expressed by user Circuit among others.

“This is just Garry throwing this weight around one last time before he is out the door.”

Impact on ETH: Should you be concerned?

Regrettably, despite Bitwise’s attempts to expedite the Ethereum ETF approval process, Ethereum’s value experienced a setback. As per CoinMarketCap, Ethereum declined by 5.09%, with its price at $3,189.50.

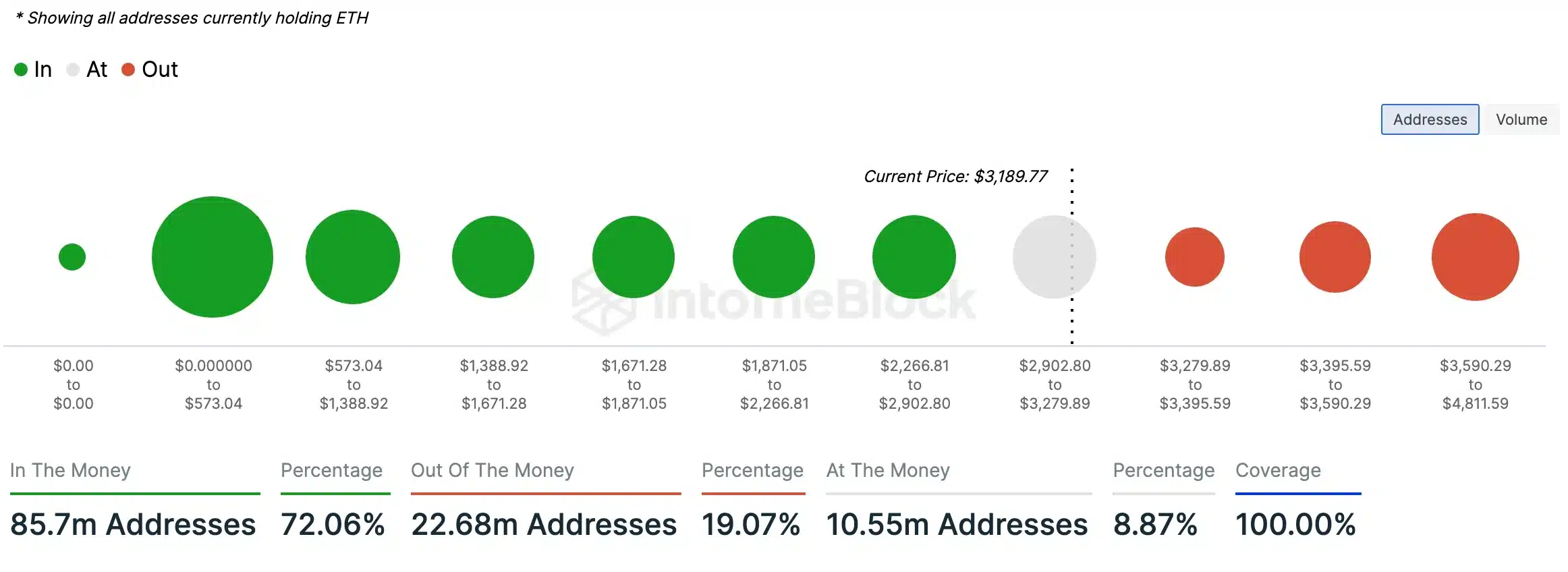

As an analyst, I’ve examined the data from AMBCrypto’s analysis of IntoTheBlock, and I can tell you that approximately 72.06% of Ethereum (ETH) holders currently possess tokens that are worth more than what they originally paid for them. In other words, these investors have realized a profit on their ETH investment.

On the other hand, approximately one fifth (19.07%) of Ethereum token holders are currently in a loss position, as the value of their tokens is lower than what they originally paid. This situation could indicate a positive outlook or impending price increase for Ethereum.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-07-04 22:15