-

Galaxy research noted that since Dencun, transactions on Ethereum layer 2s have more than doubled, likely because of bots.

The Ethereum mainnet has also seen a notable decline in total revenue and ETH burned.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I’ve witnessed numerous shifts and trends that have shaped the digital asset landscape. The recent development surrounding Ethereum [ETH] post-Dencun upgrade presents an intriguing case study.

As a seasoned blockchain enthusiast with years of experience under my belt, I must say that the Ethereum [ETH] London Upgrade, implemented in March this year, has been both fascinating and concerning at the same time. On one hand, it successfully improved the scalability and cost-efficiency of layer 2 solutions, which is a significant leap forward for the blockchain ecosystem. However, on the other hand, I’ve noticed some unexpected drawbacks that have left me slightly apprehensive about its long-term impact.

According to a comprehensive evaluation conducted by Galaxy, the implementation of EIP-4844 significantly lowered the expenses associated with Ethereum rollups, leading to a surge in their utilization. Concurrently, this change redirected income previously earned on the Ethereum main network.

According to Galaxie researcher Christine Kim, the Ethereum network has experienced a drop in earnings and burn rate following the recent update.

According to data from Ultrasound Money, since the launch of the Dencun upgrade on the 13th of March, the rate at which Ether (ETH) is being destroyed through transaction fees has decreased by approximately 0.18%.

Bots driving transaction surge?

The combined value locked within Ethereum rollups, as reported by L2Beat, stands at approximately $33 billion. In the last year alone, this figure has seen a staggering increase of over 200%.

In addition to the rising Total Value Locked (TVL), Galaxy observed a notable jump in transactions on layer-2 platforms, reaching approximately 6.6 million since Dencun. This surge is accompanied by a substantial decrease in transaction fees as well.

However, the high transaction count has coincided with an increase in failure rates. Base has the highest transaction failure rate at 21%. It is closely followed by Arbitrum with a 15.4% failure rate and Optimism with 10.4%.

As a seasoned researcher with years of experience under my belt, I’ve noticed a troubling trend that’s becoming more prevalent: the surge of bot activity. In my line of work, transaction costs are typically minimal, making it easy for these automated programs to churn out large numbers of transactions. The issue here is that an unusually high volume of transactions per day, specifically over 100, is a red flag for bots. This phenomenon is not only affecting the smooth functioning of the systems I study but also raising concerns about data integrity and security. It’s crucial that we address this issue to maintain trust in our digital ecosystem and ensure fairness for all users.

Impact on ETH

As a researcher, I’ve observed that the dwindling income and gradual reduction in Ethereum’s burn rate have noticeably hindered the growth of ETH prices. Over the past 30 days, Ether has experienced a substantial drop of 22%, which is significantly more than Bitcoin‘s comparatively modest decline of 7.5%.

At the moment, Ethereum (ETH) was valued at approximately $2,668 following a 1.3% increase over the past day. An examination of the Chaikin Money Flow indicates growing buying activity, yet the overall trend appears to be softening.

At the moment of reporting, although the index was moving upwards, the Composite Market Flows (CMF) indicator pointed downwards, suggesting that traders could be selling and potentially entering the market.

Keep an eye on the crucial support point at $2,572 for Ethereum. If Ethereum can’t maintain this support, there could be a potential drop in liquidity down towards $2,200.

Ether’s rise is encountering a notable resistance point at around $2,689. So far, it hasn’t managed to surpass this mark since the 19th of August.

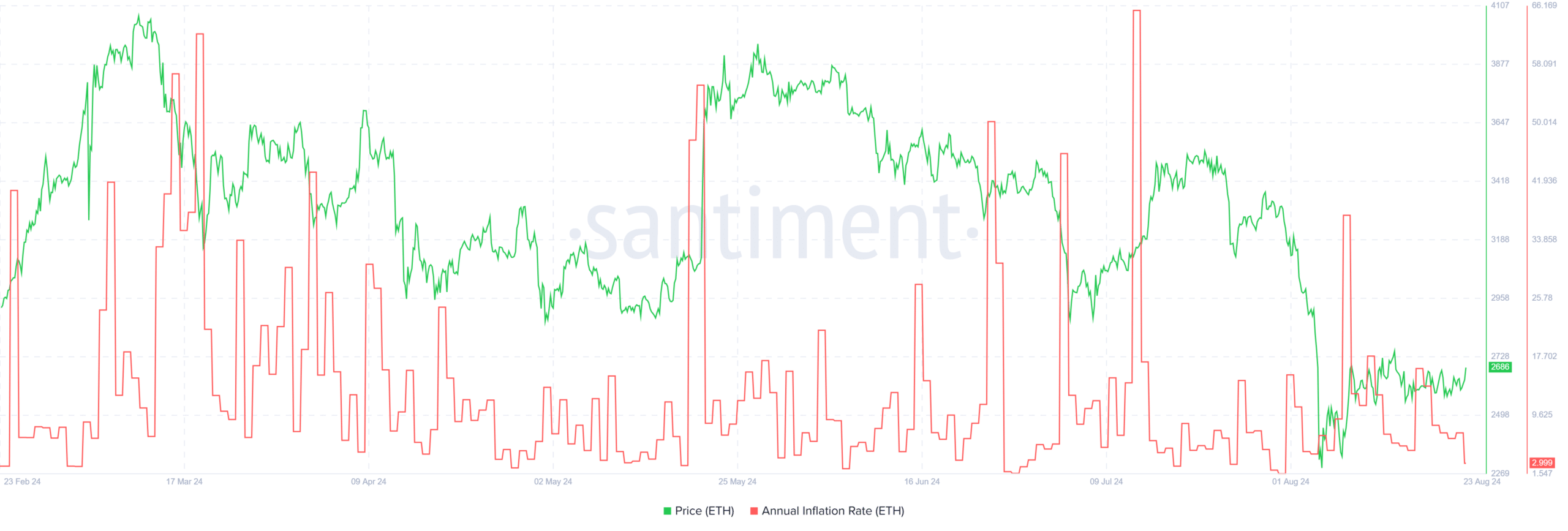

Although an increase in supply could potentially restrict Ethereum’s price movements, the fact that its annual inflation rate is nearing its monthly minimum suggests a promising outlook.

A drop in this metric tends to increase investor confidence and, consequently, price.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

2024-08-23 19:04