-

Transactions on Litecoin increased across all levels, leaving Ethereum trailing

ETH and LTC prices fell in the last 24 hours, but they might surpass major milestones soon

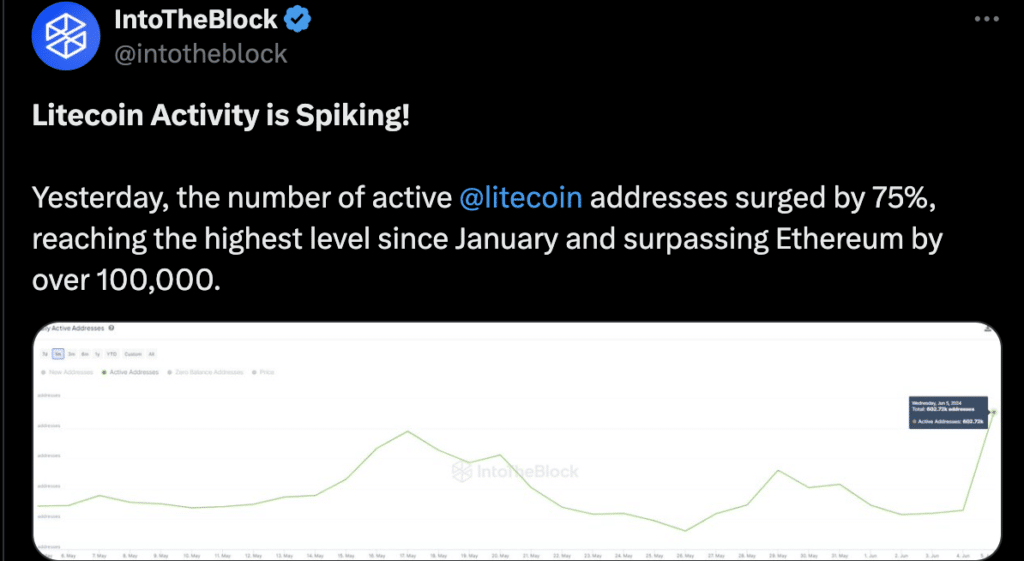

As a seasoned crypto investor with a keen interest in the market trends, I find the recent surge in activity on Litecoin (LTC) intriguing. The 75% increase in active addresses on Litecoin’s network, surpassing Ethereum (ETH), is a significant development that has caught my attention.

As an analyst, I’ve observed that it is uncommon for Litecoin (LTC) to outperform Ethereum (ETH) in any aspect. Yet, on the 6th of June, there was a striking increase of approximately 75% in the number of active addresses on Litecoin’s network.

As a researcher analyzing data from IntoTheBlock, I’ve discovered that there was a significant difference of over 100,000 between certain network metrics for Litecoin. This substantial gap amounted to a total of 602,720, marking the highest level of activity on the Litecoin network since January.

After Cardano, Litecoin takes Ethereum out

In simpler terms, the number of distinct wallets that have completed transactions successfully on a particular cryptocurrency’s blockchain has been higher for this coin compared to Cardano (ADA) in recent days.

It’s worth noting that the majority of transactions originated from wallets holding relatively small amounts.

In other words, individuals possessing LTC with a value between $10,000 and $10 million weren’t overlooked in the recent analysis by IntoTheBlock regarding X.

“The majority of the growth can be attributed to relatively small transactions under $10, but there’s also a discernible uptick in the number of transactions across all monetary ranges.”

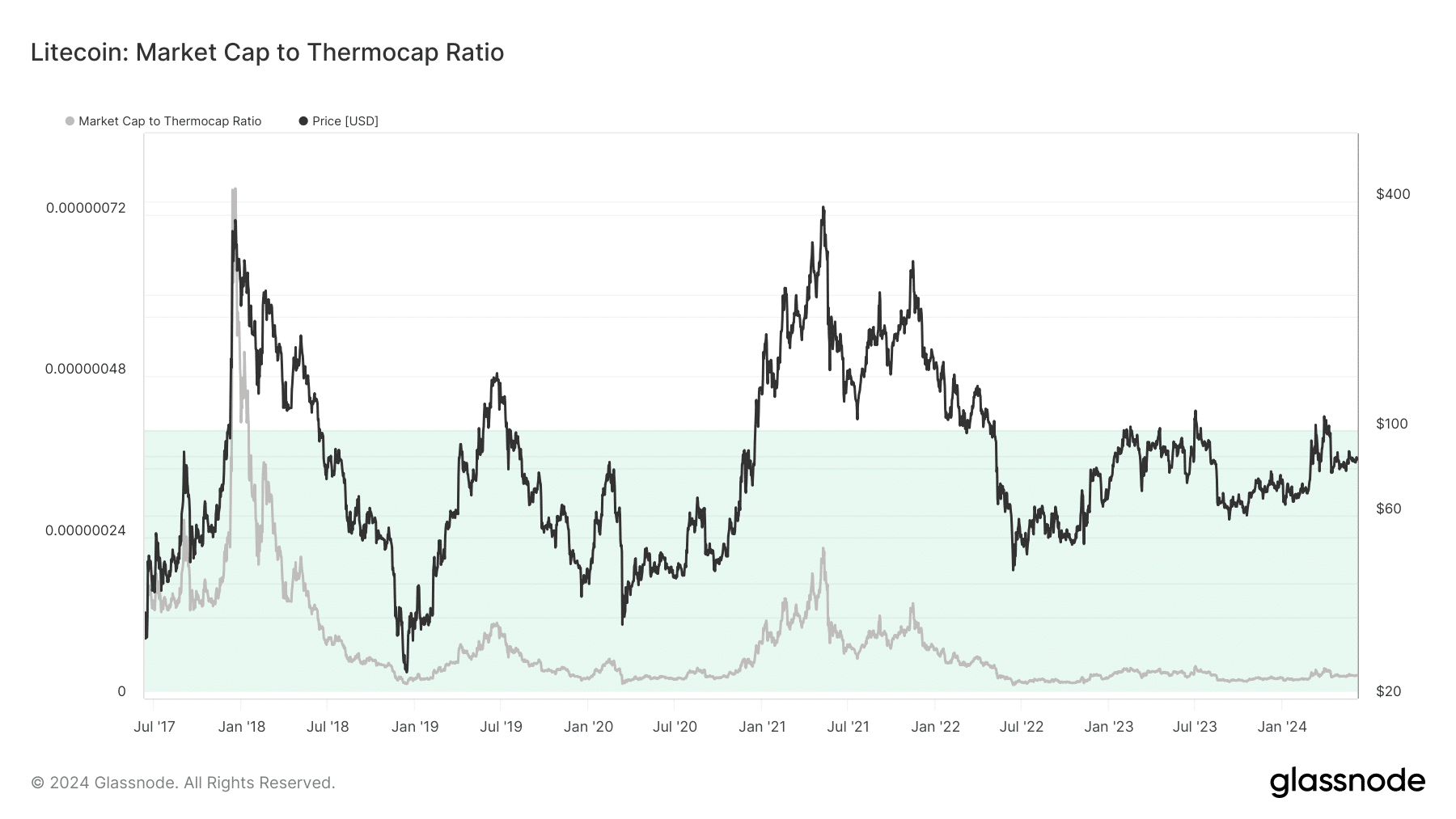

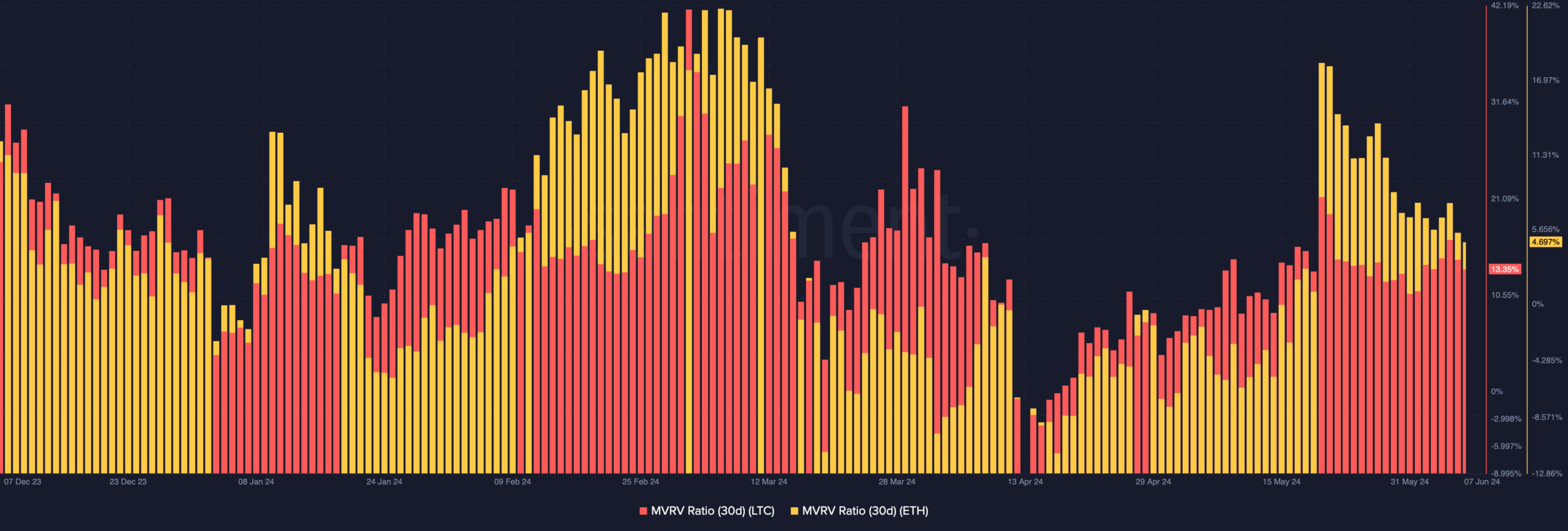

Are LTC and ETH at a discount?

Realistic or not, here’s LTC’s market cap in ETH terms

In the coming months, Ethereum’s value could exceed $4,000, while Litecoin may break through the significant barrier of $100.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-08 10:15