- Memecoins thrive when Bitcoin approaches exhaustion levels.

- Currently, investors are focusing on short-term speculation to maximize their returns.

As a seasoned analyst with years of market observation under my belt, I can’t help but notice the intriguing dynamics between Bitcoin and memecoins. It seems that when the king of cryptocurrencies approaches exhaustion levels, the memecoin kingdom thrives.

As a crypto investor, I’ve found that a successful trading approach often lies in buying when the prices are relatively low. This way, when the market rebounds, my potential profits grow significantly instead of trying to predict and time the exact peak of the market.

In the midst of Bitcoin’s volatile fluctuations and plunges in large-cap tokens, AMBCrypto notices a recurring trend suggesting that traders could be moving towards meme coins, seizing opportunities presented by panic-induced price dips.

Most memecoins in green

Over the last seven days, I’ve observed a challenging phase for Bitcoin as the bulls found it difficult to maintain the $62K support point. Consequently, its value dipped and hovered around the $60K mark.

At present, the price stands at approximately $60,820. The $61,000 level is drawing attention as a possible future support, though maintaining it could be difficult.

During this specific timeframe, approximately 70% of the top 10 meme coins by market capitalization displayed positive growth. Among them, NEIRO stood out as a front-runner, experiencing a significant upward trend of nearly 100%. As a researcher, I find these findings intriguing and worthy of further exploration.

The boost this provides indicates that memecoins could potentially help traders achieve their highest profits in a bullish market scenario, as the graph shows.

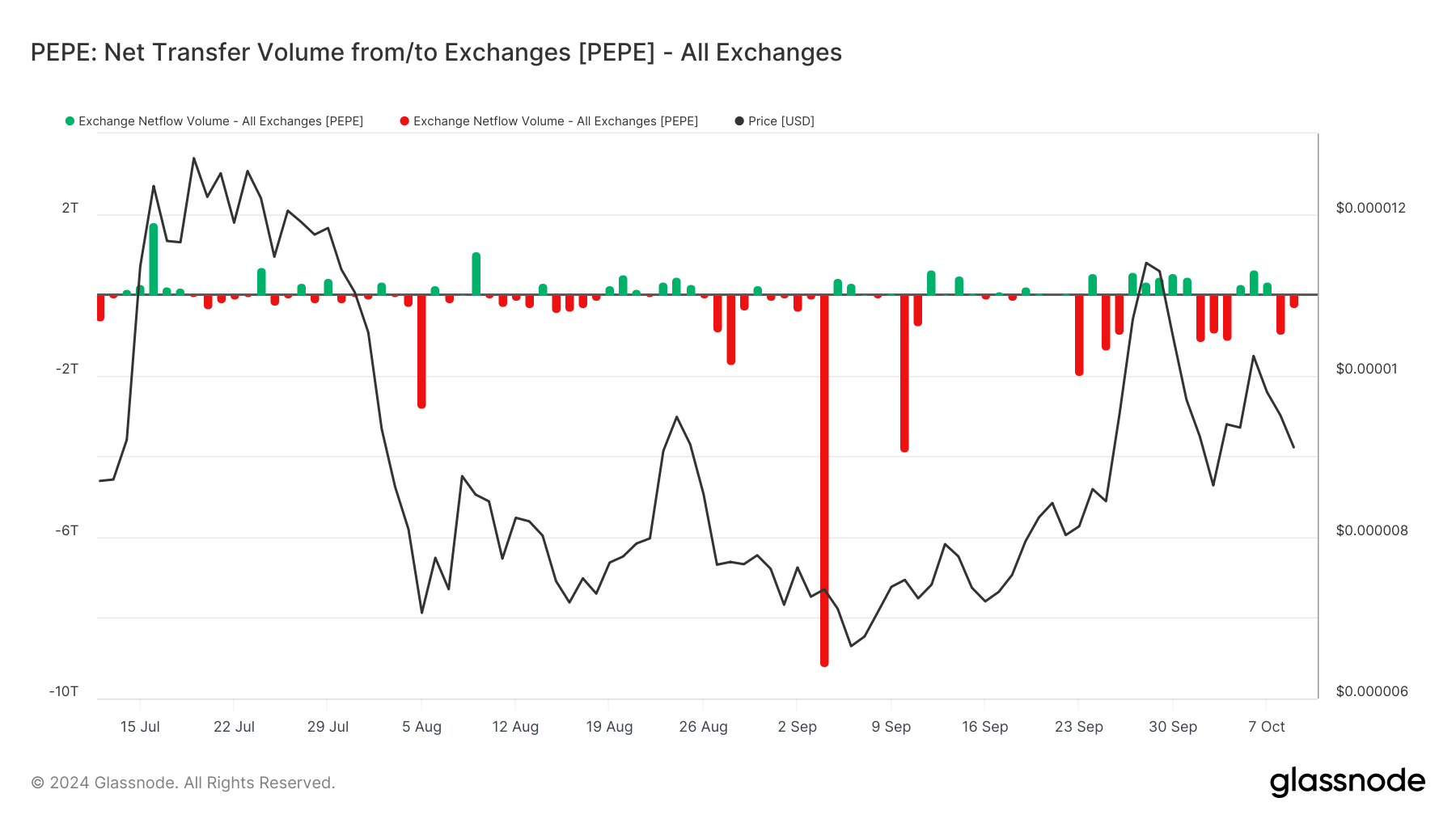

Source : Glassnode

It appears that more and more PEPE, the third-largest meme token by market value, is being moved back into individual investors’ wallets. This trend could signal that we might be approaching a low point in the market.

As a crypto investor keeping an eye on PEPE, I’ve noticed a pattern where major purchases of PEPE tend to occur when its price reaches a bottom, frequently leading to a price increase the next day. If history repeats itself, we might be looking at a potential correction for PEPE.

This behavior doesn’t just occur with PEPE; it’s a strategy used by traders in other meme-based cryptocurrencies too. They tend to purchase less expensive assets during periods of market uncertainty, and then sell once promising tokens start to rebound.

If Bitcoin (BTC) successfully maintains its current support levels without any significant bearish influence, it’s possible that we might witness a spike in profit-taking among the meme coins. On the flip side, an increase in the dominance of meme coins could hint at the possibility that Bitcoin might not be on the verge of a breakout quite yet, as investors may be shifting their focus elsewhere.

Investors might be looking for short-term opportunities

As an analyst, I’ve noticed that some meme coins are successfully breaking free from Bitcoin’s volatile trends, yet it’s interesting to note that these coins tend to experience a surge in momentum during Bitcoin’s bullish market runs.

In every bull market, meme coins typically follow Bitcoin’s lead in terms of daily returns. Yet, as the market matures, meme coins often record twice the daily growth rate of Bitcoin, mainly because Bitcoin’s volatility becomes increasingly pronounced.

In times when concerns about Bitcoin potentially decreasing increase, traders frequently shift their funds towards memecoins, hoping to reap higher profits.

Consequently, when Bitcoin touched the $63K level last week, many traders decided to leave, worried about a potential drop. On the other hand, meme coins saw substantial growth, indicating temporary trading prospects.

Source : Coinalyze

Based on AMBCrypto’s findings, it appears that memecoins can impact Bitcoin’s price movements, especially towards the close of a market cycle. This suggests that the upcoming “memecoin cycle” might coincide with Bitcoin reaching a significant resistance point at approximately $66,000.

Until then, investors are likely to engage in speculative trading for short-term gains.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-10 16:08