🐳 Whales or Small Fry? Bitcoin Wallets Hit 5-Month Low 🐳

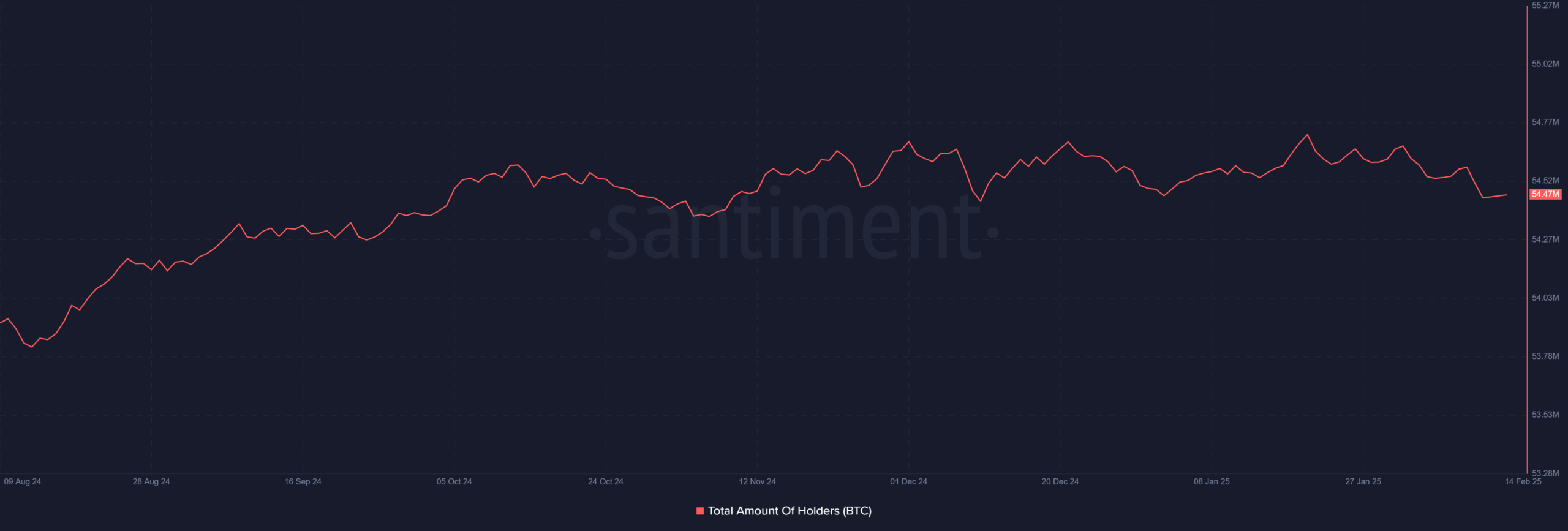

Well, well, well, it seems like Bitcoin’s[BTC] network has seen a significant decline in the number of active wallets, hitting a five-month low of around 54 million non-empty wallets. 📉

This drop signals increasing retail capitulation as smaller traders exit their positions, likely due to recent market uncertainty. 🤔

Retail Exodus and Its Impact 🛍️

Analysis of data from Santiment highlighted that the number of Bitcoin wallets holding a balance has steadily declined. 😱

The decline marked the lowest level since the 10th of December. As of this writing, it was around 54.7 million. 📉

Historically, such trends suggest that smaller investors are liquidating their holdings, possibly due to recent volatility. 🤑

Fear-driven selling often coincides with market bottoms, raising speculation about an impending price reversal. 🚀

Whale Accumulation on the Rise? 🐋

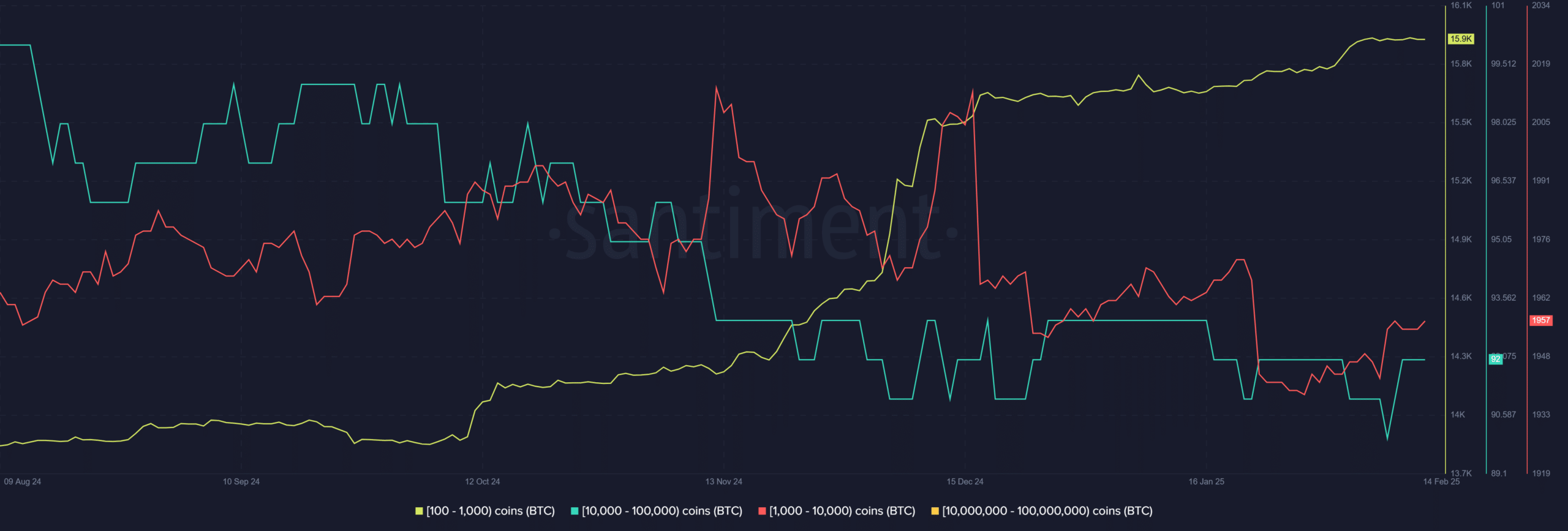

On-chain data from Santiment also showed that while smaller wallet counts are dropping, large Bitcoin holders—whales—are maintaining or even increasing their positions. 💰

Specifically, addresses holding between 10,000 and 100,000 BTC have remained relatively stable, while those with 100-1,000 BTC have shown a slight increase. 📈

This divergence suggests that institutional investors or high-net-worth individuals may take advantage of the dip to accumulate BTC at lower prices. 🤑

Network Activity and Market Sentiment 🌐

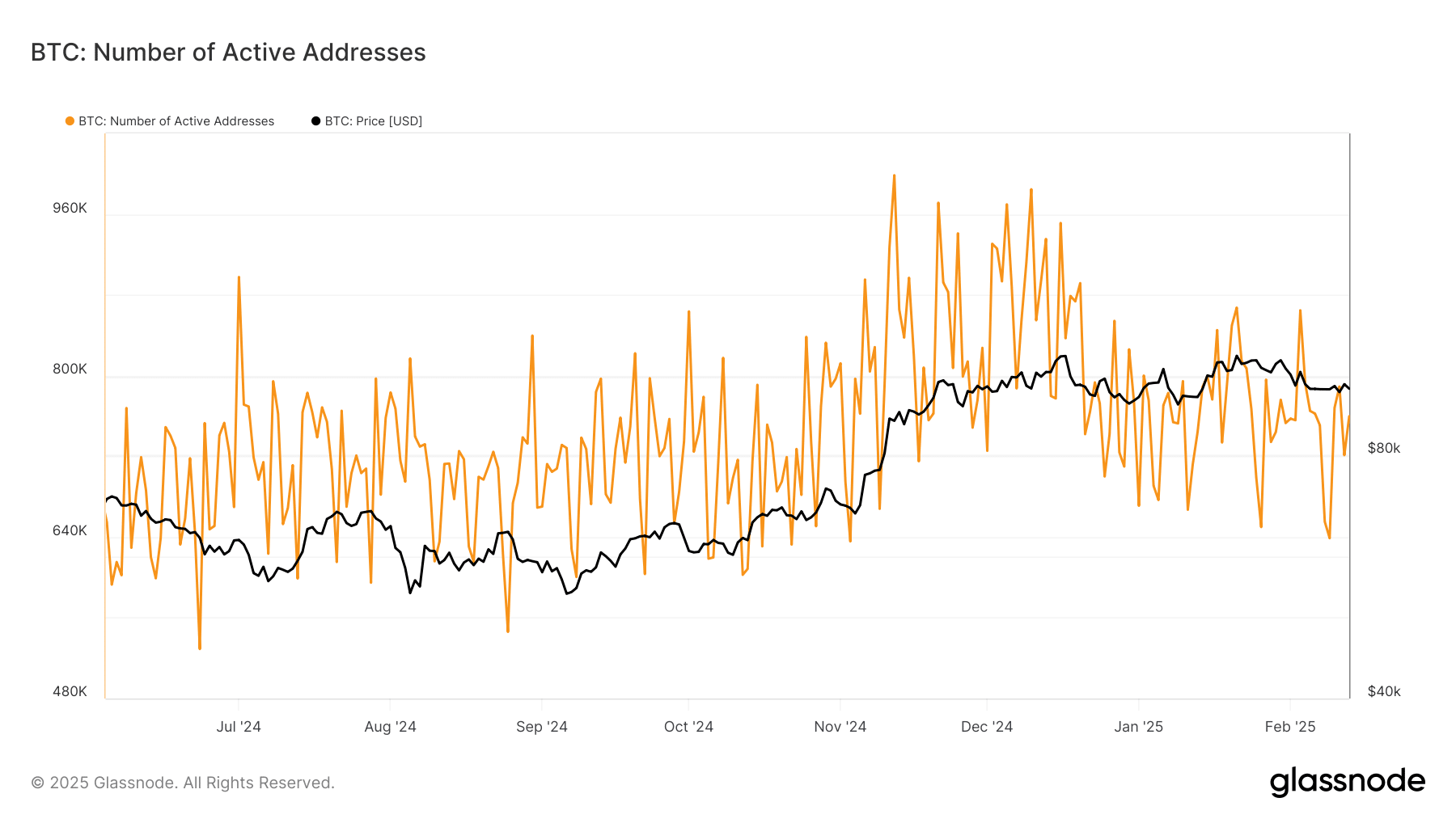

Glassnode’s data analysis revealed that Bitcoin’s number of active addresses has also remained subdued. The subdued nature of the metric reflects lower participation from retail traders. 😴

This aligns with the trend of wallet depletion and reduced market enthusiasm among smaller investors. 😔

However, similar patterns have historically preceded significant recoveries, especially when institutional accumulation picks up. 🚀

What’s Next for Bitcoin? 🤔

If whales continue to accumulate and retail-driven selling slows down, Bitcoin could find a strong support base and set the stage for a rebound. 📈

Traders should monitor signs of increasing whale holdings, stabilization in active wallets, and any resurgence in on-chain activity as key indicators of a potential trend reversal. 🔍

While short-term sentiment remains cautious, larger market players might be quietly positioning themselves for the next leg up. 🤫

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Rick and Morty Season 8: Release Date SHOCK!

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2025-02-15 05:18