- Arthur Hayes offloaded ETH at a loss and invested $2.8M in ENA

- With ENA’s price down by 15% in the last 24 hours, Hayes may be trying catching the bottom

As a seasoned crypto investor with over a decade of experience in this wild and unpredictable market, I find myself intrigued by Arthur Hayes’ recent moves. Despite his loss on Ethereum, he has poured $2.8M into Ethena (ENA), a move that seems to indicate confidence in the token’s potential growth.

Over the last month, I’ve noticed a notable surge in Ethena’s price (ENA), jumping by an impressive 65.13%. This substantial growth sets it apart from the broader crypto market, which saw a mere 9.40% increase during the same period.

This performance might be seen as an indication of increasing investor trust in ENA, given that at the point of this writing, Ethena’s stock price stood at $0.5941 – Evidence of continued market engagement.

Arthur Hayes accumulates 4.916 Million Ethena tokens

Arthur Hayes, the co-founder of BitMEX and CIO, currently manages a crypto portfolio worth approximately $33.167 million. A notable portion of this wealth is invested in Ethereum. Upon closer examination, it was found that 5,082 ETH, valued at around $16.9 million, are held directly. Additionally, 3,037 ETH, worth about $10.064 million, are staked as EETH. Furthermore, Hayes’ portfolio includes 5,053,000 ENA tokens, currently valued at approximately $2.89 million.

The latest transactions in the portfolio show two notable shifts: Hayes acquired approximately 4.916 million units of ENA valued at around 2.8 million dollars from Wintermute Trading, indicating a substantial increase in his ENA holdings. Before this, he transferred 874.9 ETH, also worth about 2.8 million dollars, to Wintermute Trading.

As a researcher, I’ve observed a shift in the distribution of capital, which indicates my own strategic decision to reinforce my investment in ENA.

The portfolio’s ETH allocation suggests that Hayes remains heavily invested in Ethereum. However, his move into ENA could signal confidence in the token’s future potential, especially after recent price fluctuations.

His ENA purchases underlined a belief in its growth, despite its latest price dip. Hayes seems to be positioning himself to capitalize on future upside, considering ENA’s drop of 15% in the last 24 hours. In fact, this could be perceived as an opportunity to “catch the bottom” for a rebound.

Can ENA Bounce from the 4-hour Fair Value Gap?

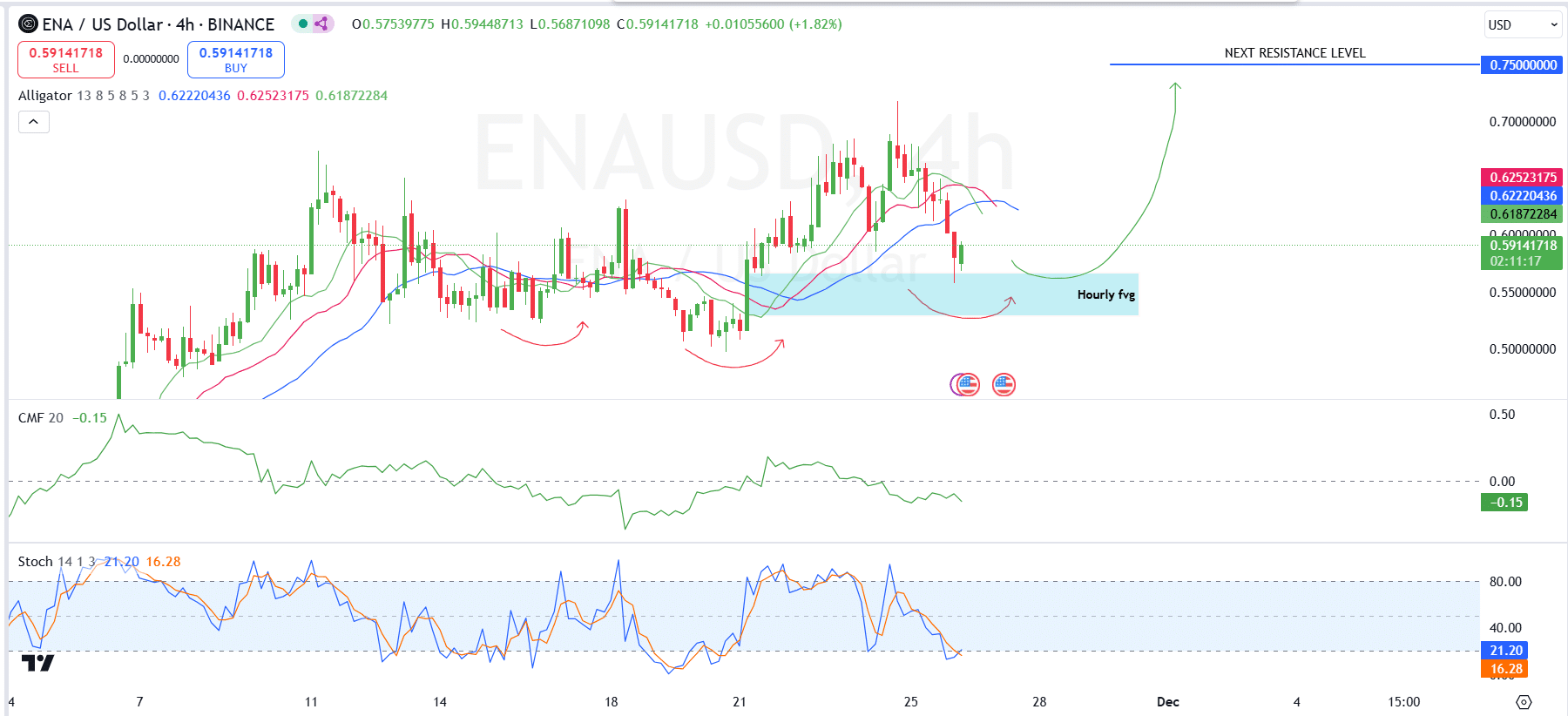

Starting from November 23rd, ENA has been strengthening and approaching the important support zone around $0.54 to $0.56 within the Hourly Fair Value Gap (fvg). This zone is significant as it could influence ENA’s future direction.

This dip might be an opportunity for institutional investors to amass additional long positions. By doing so, they can potentially enter the market at advantageous prices just before a significant price increase.

Furthermore, the current price fluctuations may be purging out weaker investors in preparation for an uptrend. The firm’s grip on the stocks could spark a push towards the $0.75 resistance level. A decisive breach above this point would suggest potential growth up to $0.80.

According to the Alligator indicator, the green line has dipped beneath the red line, signifying a change in momentum. Essentially, this means that there have been minor reversals in the short term, which hints at temporary corrections despite the market’s overall bullish trend.

As a crypto investor, if I find myself unable to hang on to my investments, it suggests a change in market direction, potentially leading to more losses. On the bright side, the Stochastic Oscillator and the Chaikin Money Flow (CMF) hint at a possible oversold condition, implying that a recovery might be imminent.

Large transactions surge for ENA

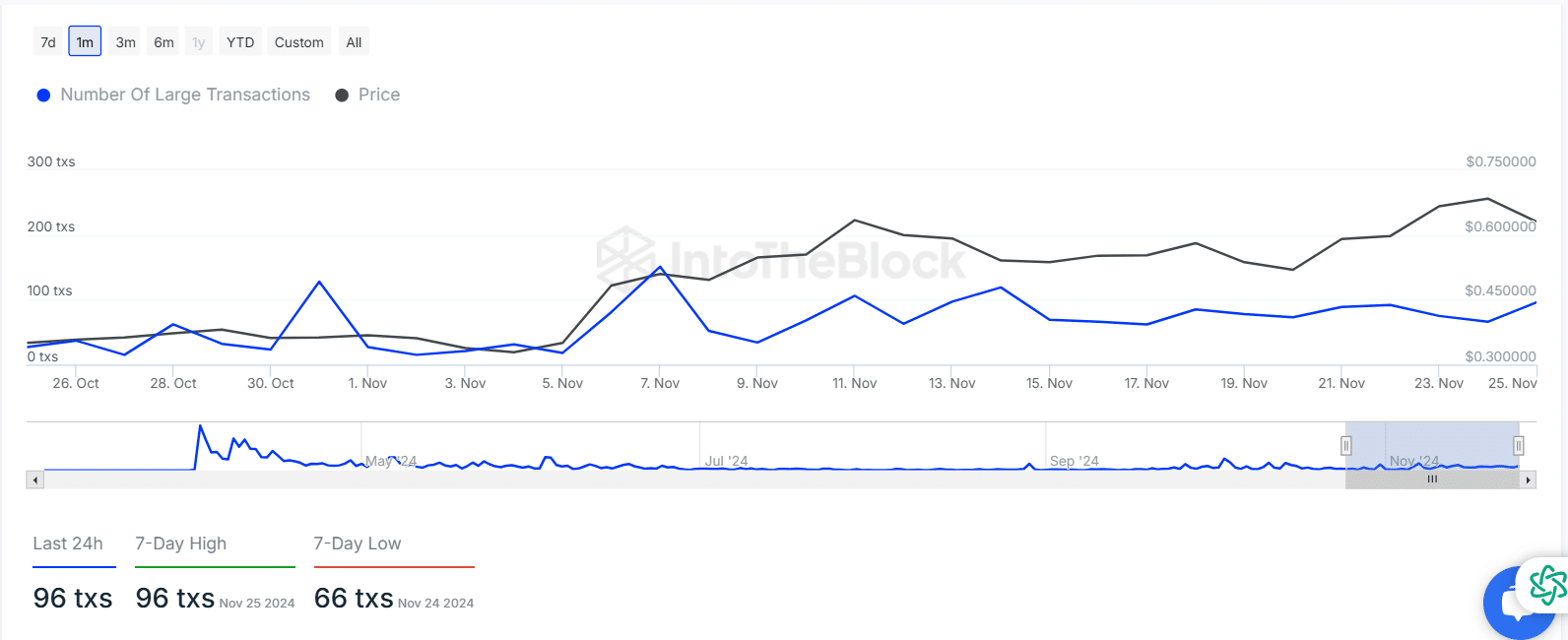

According to AMBCrypto’s examination utilizing data from IntoTheBlock, there was a significant increase in large transactions involving ENA throughout the month of November 2024.

The graph shows a substantial rise in the frequency of major transactions, peaking on November 1st, 5th, and 23rd – Suggesting a rising level of curiosity and action regarding the token.

Indeed, on the 25th of November, we saw an impressive 96 significant transactions, which marked a 7-day peak. This surge suggests robust buying activity, with the price point hovering steadily around $0.60.

The price of ENA has been gradually climbing, starting at around $0.32 at the beginning of the month and reaching $0.60 recently. This significant increase in price, along with a surge in trading volume, seems to indicate that large-scale investors or major players could be influencing the altcoin’s market trends.

An increase in significant transactions might be a preliminary indication that there’s a surge in interest towards ENA, potentially signaling the token is poised for more growth.

Significantly, there were 66 major transactions logged on November 24th, which falls toward the bottom of the past week’s activity. Yet, the general pattern suggests increasing trust in ENA, as the price continues to show strength near the $0.60 mark.

ENA’s rising Open Interest

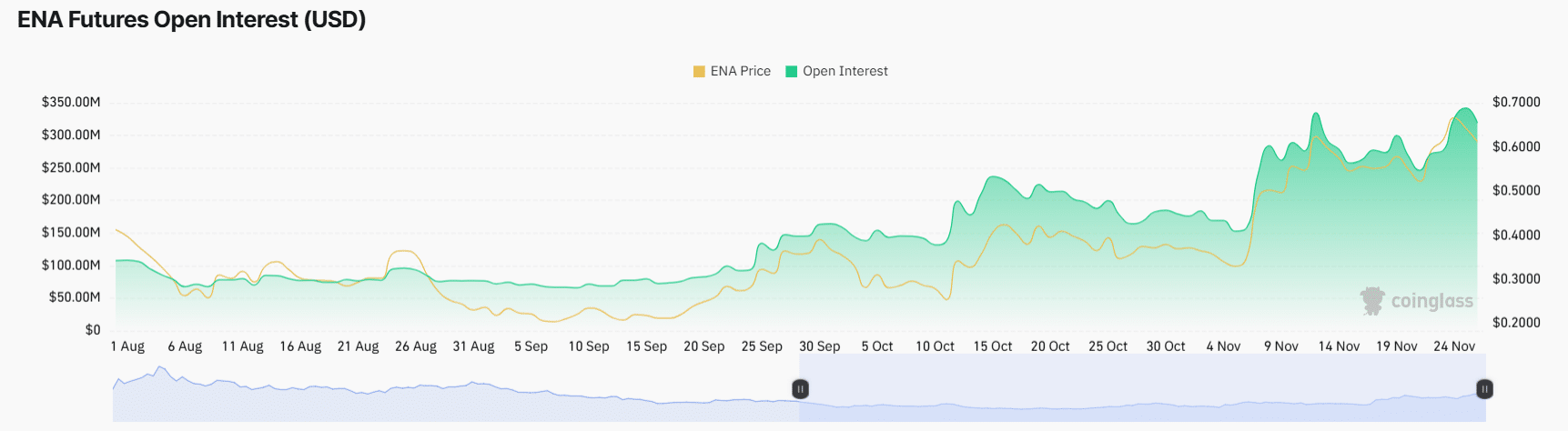

The interest and participation in ENA Futures contracts have been rising significantly since mid-September 2024. Initially, the Open Interest was below $100 million in early August, but it surged to over $350 million by late November, demonstrating a growing enthusiasm for these futures contracts among market participants.

Over the course of November, the price of ENA followed a similar trend, increasing from $0.20 to $0.70.

It appears that this hike in Open Interest on the hiking trail seems closely tied to the price jump, suggesting that traders are growing increasingly optimistic about ENA’s potential for long-term expansion. In other words, this trend may indicate that more and more positions are being established, as traders prepare for future market fluctuations – yet another indicator of a bullish outlook.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-27 13:44