- Argentina has intensified its scrutiny of the local crypto sector

- Crackdown a product of the international pressure on Argentina to curb money laundering

As a seasoned crypto investor with a keen interest in global market trends, I have been closely monitoring Argentina’s recent crackdown on its local crypto sector. Having witnessed similar scenarios unfold in other countries due to international pressure from organizations like FATF, I am not entirely surprised by Argentina’s decision.

As a crypto investor, I’ve noticed some troubling news coming from Argentina. The authorities have stepped up their efforts to regulate the local crypto market, and they’re urging us to disclose any cryptocurrency holdings, including Bitcoin [BTC], or risk facing penalties. It’s essential for investors like myself to stay informed and compliant with these regulations to avoid any potential repercussions.

The Financial Action Task Force (FATF) based abroad exerts significant influence on the crypto industry in the country.

The Financial Action Task Force (FATF) is a global intergovernmental body, part of the G7, tasked with combating money laundering and terrorism financing. It collaborates with organizations such as the World Bank and the International Monetary Fund (IMF) to achieve these goals.

Argentina’s crypto woes

Argentina’s cryptocurrency market is rapidly expanding, having recorded more than $85 billion in transactions in the year 2023. The sector’s surge can be attributed to several factors, primarily an unusually high inflation rate.

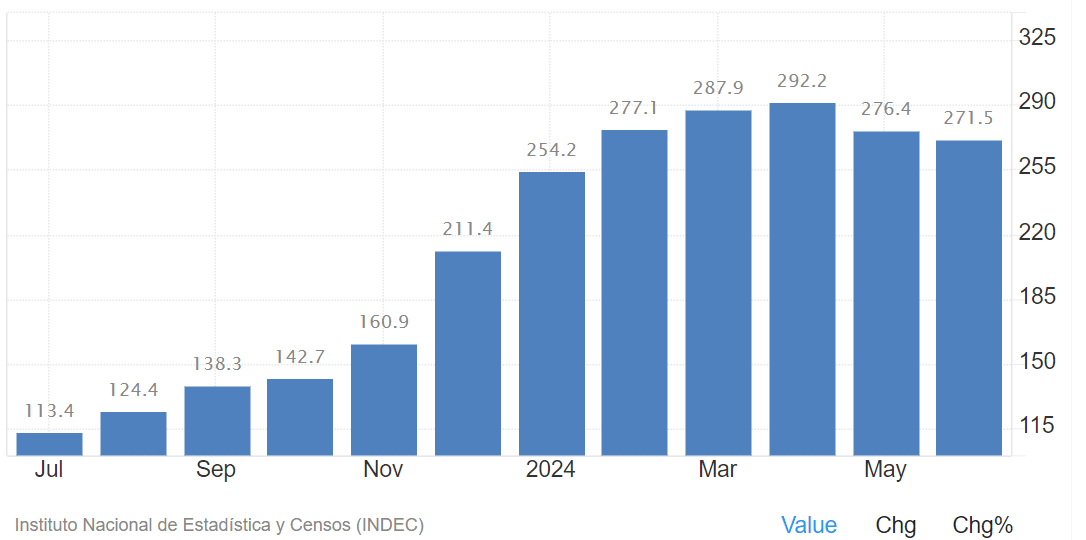

Despite the slight decrease in recent months, Argentina’s inflation rate continues to hover above the triple-digit mark, according to Trading Economics. The highest inflation rate was recorded in April at a staggering 292%, while it dropped to 271% in June of 2024.

Argentinian people, similar to residents in nations such as Turkey, have chosen to invest in cryptocurrencies, with a particular preference for stablecoins, as a means of protecting their assets from the impact of inflation.

As an analyst, I’ve noticed that the cryptocurrency sector has faced significant criticism recently. Allegations of tax evasion and money laundering have tarnished its reputation, leading authorities to take action. Consequently, the government has mandated crypto investors to disclose their holdings or risk facing penalties.

New crypto approach to avoid FATF’s greylisting

On Wednesday, it was reported that the government allegedly finalized a fiscal deal providing tax exemptions for investors holding $100,000 or more in assets, which includes cryptocurrencies.

In response to the tax amnesty announcement, Roberto Silva, Head of the National Securities Commission, observed,

“The tax amnesty could ease pressure from the FATF to regulate Argentina’s crypto market.”

According to reports, the Financial Action Task Force (FATF) warned Argentina that it would consider adding the country to its graylist if it didn’t take steps to control its cryptocurrency market. This potential action could lead to a decrease in foreign investment and harm Argentina’s reputation among esteemed financial organizations like the International Monetary Fund (IMF).

Based on Silva’s report, the government is currently working on making amendments to enhance money laundering and reporting regulations.

One approach involves requiring every cryptocurrency service provider and their users to register with the National Securities Commission.

One of the largest cryptocurrency exchanges in the country, Lemon Cash (only known as Lemon Cash hereafter), has recently upgraded its platform, enabling users to proactively declare their digital assets. It is yet unclear if other trading platforms will adopt a similar approach.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- PI PREDICTION. PI cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

2024-07-20 12:08