-

Hayes tips a BTC break out as central banks start cutting interest rates.

However, the Fed’s meeting on 12th June could help define the next BTC price direction.

As a crypto investor with some experience in the market, I’m excited about the recent developments that could potentially lead to a Bitcoin breakout. Arthur Hayes, the founder of BitMEX and Maelstrom CIO, is one of the voices calling for a bullish outlook due to central banks starting to cut interest rates.

According to BitMEX founder and Maelstrom CIO Arthur Hayes, Bitcoin‘s [BTC] potential for a significant price surge could be imminent as major central banks initiate the reduction of interest rates.

Previously, Hayes anticipated that the market breakout would occur in August. But after the European Central Bank (ECB) and the Bank of Canada (BOC) implemented interest rate reductions, he has revised his perspective.

“This week, the Bank of Canada and European Central Bank initiated rate cuts in June. These actions could revive the cryptocurrency market, which has been sluggish during the summer months in the Northern Hemisphere.”

Central banks around the world, including the US Federal Reserve, are expected to initiate monetary policy easing phases based on Hayes’ prediction. Consequently, this push may compel the US to follow suit.

“I now recommend investing in Bitcoin with a long-term perspective, followed by other cryptocurrencies, also known as shitcoins. Previously held assumptions about the market have shifted, necessitating a modification in my investment approach.”

Macro outlook and key catalysts

Over the last two days, Bitcoin has maintained a position above $70,000. With favorable macro developments in the upcoming days, it could potentially test the resistance levels of $72,000 or even reach its all-time high from March.

Many experts in the financial market believe that the price trend of Bitcoin will become clearer following the Federal Reserve’s meeting on June 12th.

As a researcher exploring the current trends in the cryptocurrency market, I’d like to share an insightful perspective from Quinn Thompson, the founder of Lekker Capital – a renowned crypto hedge fund. According to him, the broader economic landscape presents several key themes shaping the crypto space:

‘The market needs conviction that Powell is going to cut in July. That could come from a weak jobs report Friday, weak CPI and/or dovish Fed next Wednesday.”

As a crypto investor, I understand that the potential lack of an immediate rate cut from the Federal Reserve doesn’t necessarily mean we can dismiss the possibility of increased money supply and subsequent market consequences. According to Hayes, the US response to Japan’s massive yen depreciation could inadvertently trigger similar outcomes.

Reacting to a reported Japan’s offloading of US treasuries to boost its Yen, Hayes noted that,

‘Uh oh, Bad Gurl Yellen got some work to do. $JPY must strengthen to prevent the UST apocalypse.’

As a crypto investor, I’ve noticed that the expansion of the US money supply is underway and many experts believe this trend will positively impact Bitcoin and other risk assets.

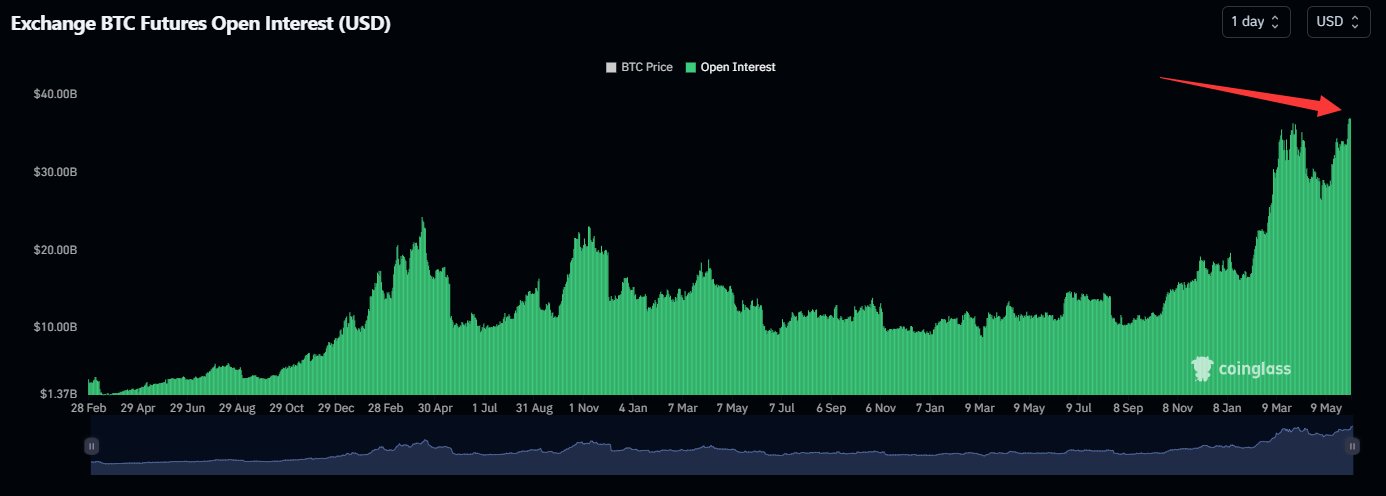

As an analyst, I’ve observed that Bitcoin’s Open Interest (OI) has surged to unprecedented levels recently. This significant increase in OI indicates a large infusion of liquidity into Bitcoin markets, suggesting active engagement from traders and investors. According to Coinglass, the data supports this observation.

‘#Bitcoin open interest hits all-time high of $37.66B’

As a researcher studying the cryptocurrency market, I can express that the recent surge in the Open Interest (OI) of the “king coin” indicates optimistic outlooks among traders. However, it’s essential to note that next week could bring more clarity regarding price direction following the Federal Reserve’s upcoming decision.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-06-07 13:11