-

PEPE’s recent price decline saw Arthur Hayes sell his stash at a $22,000 loss.

Despite this sale, PEPE exchange inflows remain subdued showing an unwillingness by the broader market to sell.

As a seasoned crypto investor who has weathered numerous market cycles and witnessed the rise and fall of many digital assets, I find the current state of PEPE intriguing. The recent price decline saw a notable figure like Arthur Hayes exit his position at a substantial loss, yet the subdued exchange inflows suggest that other traders are hesitant to follow suit. This paradoxical situation is reminiscent of the classic game of chicken, where one player jumps out just as the last moment, leaving the rest to ponder if they should hold on or follow.

As an analyst, I’m observing that my current analysis subject, PEPE [PEPE], has extended its downward trend following a 10% drop over the past seven days, currently trading at $0.00000886 at this moment. Volume activity also appears to be restrained, decreasing by 16% in the last 24 hours, according to CoinMarketCap data.

Arthur Hayes, one of BitMEX’s co-founders, has closed his position on PEPE following its recent dip in price. Previously reported by AMBCrypto, Hayes had made a bet worth $252,680 on PEPE after the token reached its monthly high on September 27th.

After owning the meme coin for six days, Hayes decided to sell it all on exchanges, resulting in a total loss of $22,000 as reported by SpotOnChain.

Even with the recent sale, the flow of trades indicates that other PEPE traders are hesitant to part with their tokens at the present price levels.

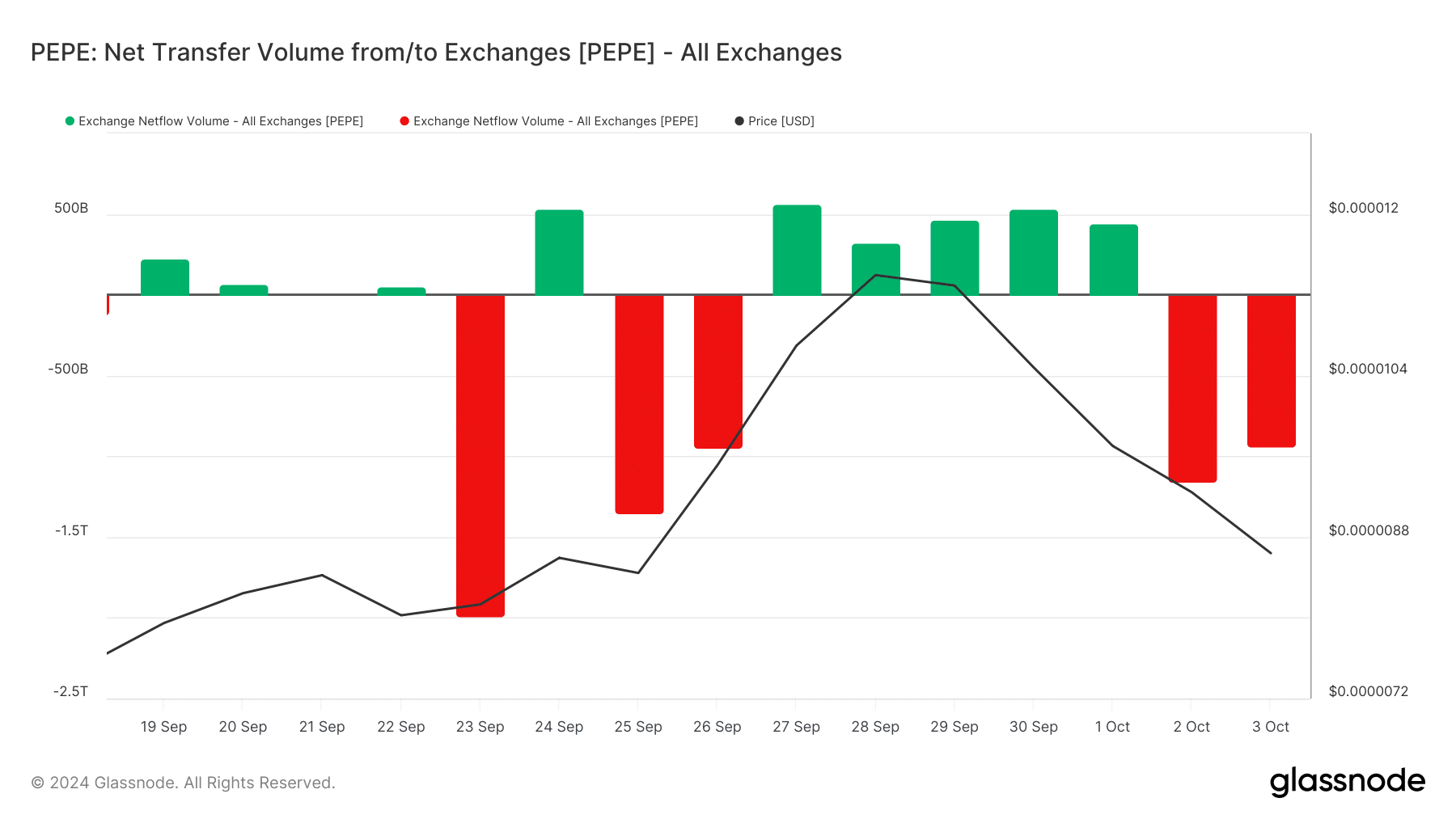

Based on data from the analytics platform Glassnode, over 2 trillion PEPE tokens were taken off exchanges in just the past two days. Moreover, PEPE’s outflow trend has now reversed, showing a negative net flow following five straight days of incoming tokens.

An uptick in transactions leaving PEPE (exchange outflows) may help reduce immediate selling demands, potentially paving the way for a rebound in PEPE’s price.

PEPE price outlook

Examining PEPE‘s daily price movements indicates that yesterday’s decline might be the market adjusting after extreme fluctuations in late September, possibly addressing any imbalances that had arisen.

Following a swift increase from $0.00000822 to $0.00001156 over just three days for PEPE, there emerged what’s known as a Fair Value Gap (FVG). As the market experienced a subsequent drop in price, it effectively addressed this temporary market inefficiency.

This places the meme coin in a unique position for a price recovery.

At present, PEPE is attempting to push through a potential resistance point situated right in the middle of its FVG at approximately $0.00000907. If it manages to surpass this level, such action might signal that buyers are taking charge, paving the way for potential future growth.

Following the completion of the gap, the Directional Movement Index (DMI) displayed a bullish trend as the negative DI approached and eventually met the positive DI.

This action indicates a lessening of the downward trend’s power, as an upward trend seems to be growing more robust.

Additionally, when the Relative Strength Index (RSI) reads 50, it indicates that the market is leaning neither strongly bullish nor bearish. However, traders should keep an eye on the RSI line crossing above its signal line as this could signal a potential uptrend, suggesting a bullish market movement.

As a crypto investor, if my coin doesn’t manage to breach the FVG midline and falls below the support level at $0.00000843, it might continue to slide down towards the potential liquidity collection point at $0.00000744, before making a significant move in either direction.

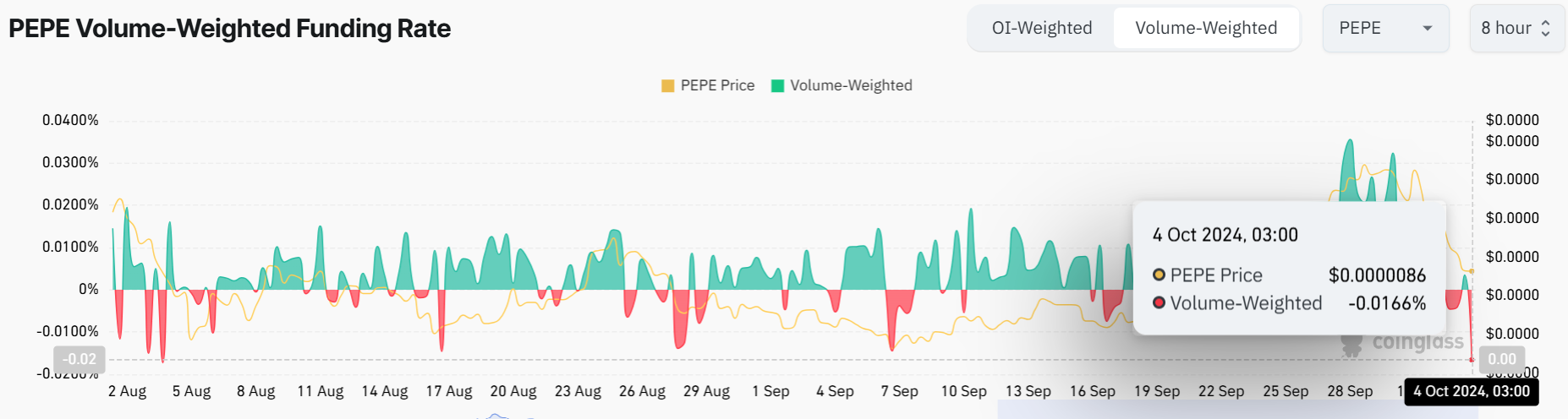

Funding rates flip to negative

At the moment, the funding rate for PEPE has turned into a negative value (-0.0166%) according to Coinglass, marking its lowest point since early August.

Read Pepe’s [PEPE] Price Prediction 2024–2025

The data indicates a trend where more traders are taking short positions, predicting that prices will continue falling in the market.

Although the trend appears bearish, an unexpected surge in PEPE‘s price might force short-sellers to purchase PEPE to cover their positions, which could lead to a ‘short squeeze’. Consequently, this situation might cause additional price increases.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The 5 Best Mission: Impossible Trailers Ranked

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- Is Trump’s Presidency a Game Changer for the US Dollar and Bitcoin?

2024-10-04 17:12