-

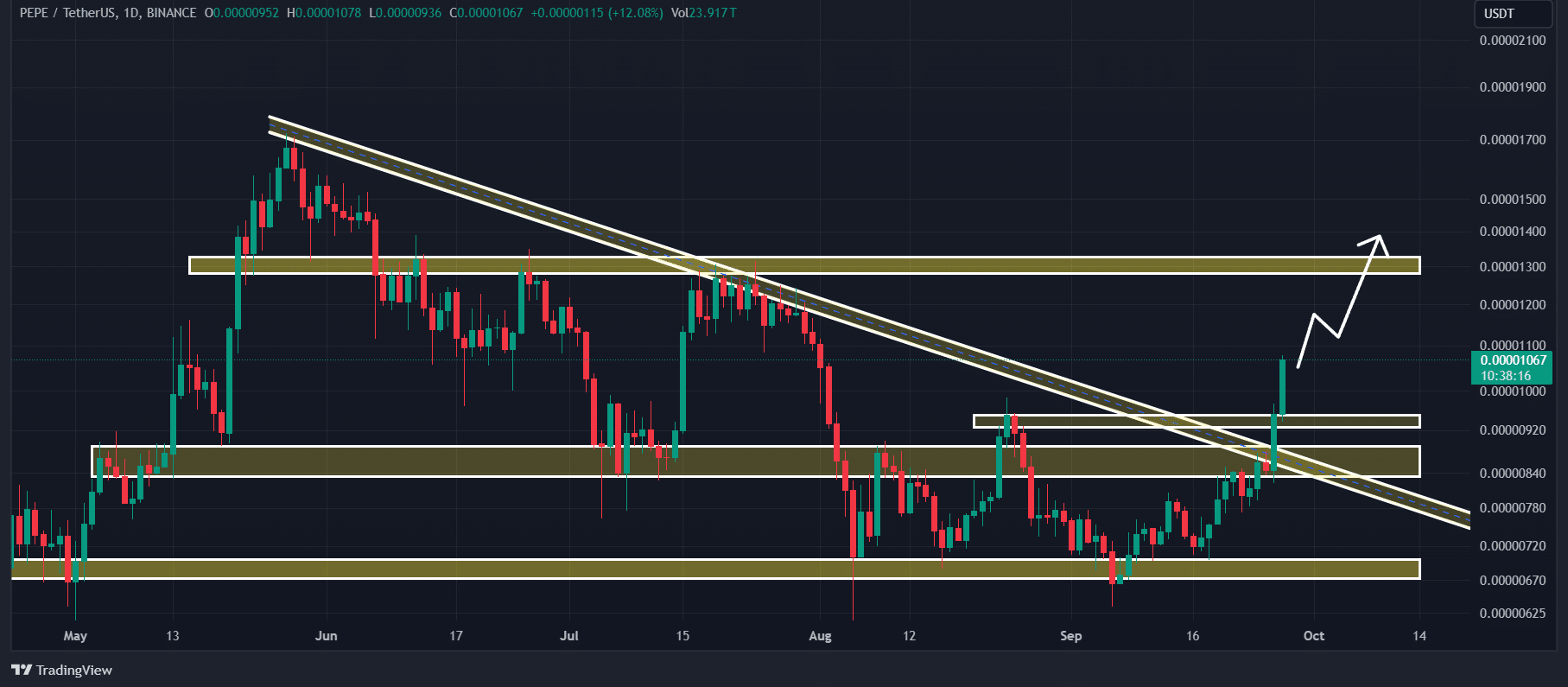

PEPE appeared super bullish and could soar by 30% to reach the $0.0000132 level

PEPE’s Long/Short ratio, at press time, stood at 1.084 – Indicating strong bullish sentiment among traders

As a seasoned researcher with over two decades of experience in analyzing market trends, I find myself intrigued by the recent surge of PEPE, the third-biggest memecoin. Having closely followed the crypto landscape since its inception, I can’t help but notice the parallels between this phenomenon and the infamous tulip mania of the 17th century – an era where speculation ran rampant and prices soared to unimaginable heights.

PEPE, currently the third-largest meme coin, has been generating a lot of buzz in the cryptocurrency world due to its substantial price increase of approximately 27% over the past two days. Interestingly, even Arthur Hayes, former CEO of BitMEX, seems to have been drawn into this surge, as he recently jumped on board with it.

Arthur Hayes’s big bet on PEPE

On September 27, 2024, the blockchain analysis company lookonchain disclosed that Hayes transferred a significant amount of 24.39 billion PEPE tokens, equivalent to approximately $252,680, out of Binance.

The substantial reduction in trading on the exchange might indicate that the surge of PEPE is merely getting started, and it could potentially skyrocket substantially in the near future.

Current price momentum

Currently, PEPE is close to $0.000001058 per unit, having experienced a significant price increase of approximately 17.2% within the past day. Simultaneously, its trading volume has risen by about 40%, as reported by CoinMarketCap, over this same timeframe.

PEPE technical analysis and key levels

Based on AMBCrypto’s technical assessment, it was anticipated that PEPE would show a bullish trend and potentially surge by 30% in the near future. However, this outlook has changed lately due to the breakout beyond the long-term downward trendline and a horizontal support level of $0.00000875.

Looking at past price trends, it’s possible that a slight pullback might happen after such a significant 27% increase within two days. Nevertheless, PEPE could potentially be highly bullish over an extended period, possibly rising by up to 30% and hitting approximately $0.0000132 in the near future.

PEPE’s bullish on-chain metrics

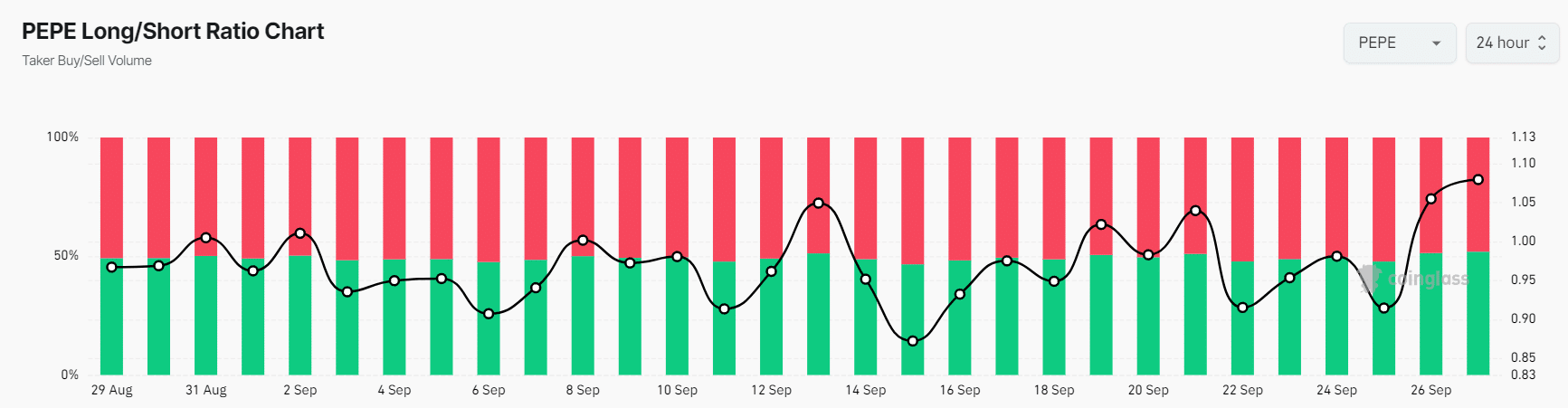

The optimistic view was reinforced by various on-chain indicators. As reported by the on-chain analysis company Coinglass, the long/short ratio for PEPE was 1.084, suggesting a robust bullish attitude among traders, implying they are more likely to buy rather than sell.

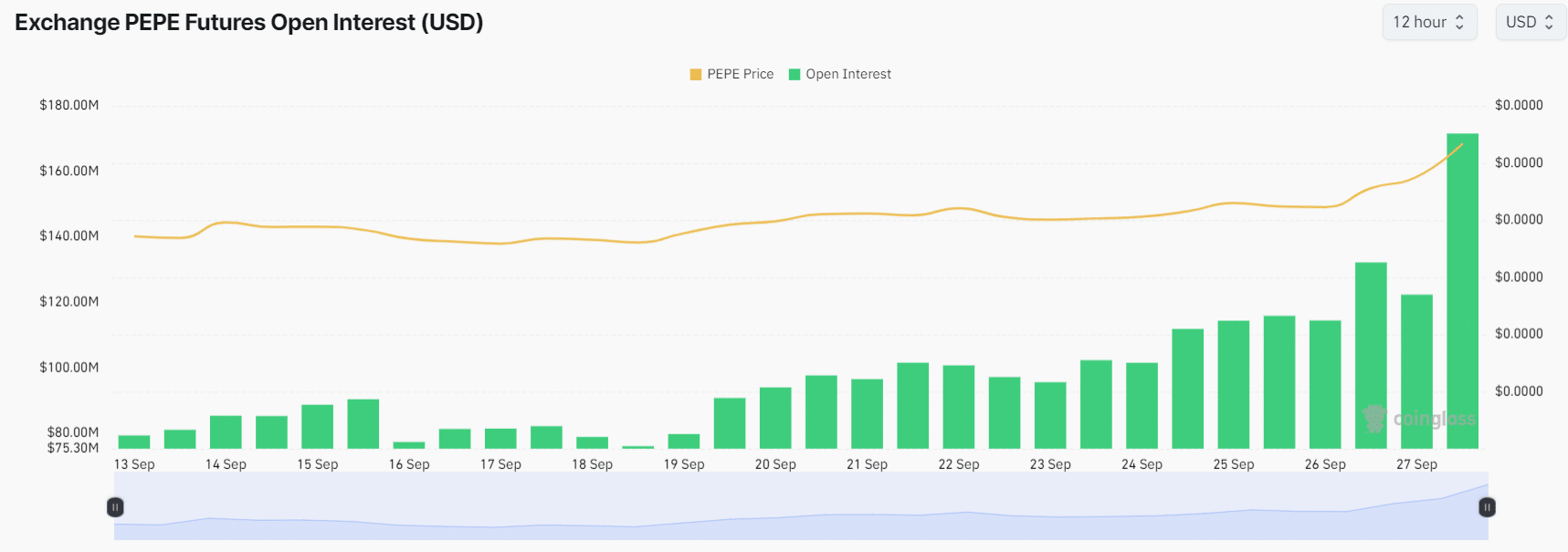

Furthermore, PEPE‘s Futures Open Interest saw a significant jump of 30%, and this trend has been consistently climbing upwards. This substantial growth in PEPE’s Open Interest suggests that the bulls could be accumulating more long positions than short ones, potentially indicating a bullish sentiment.

In many cases, investors and dealers prefer to construct long positions by considering the situation where Open Interest is increasing and the long/short ratio surpasses 1. At this moment, approximately half (51%) of leading traders are holding long positions, while nearly the same percentage (48.09%) are maintaining short positions.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-28 11:03