-

APT was the second-highest loser in the last 24 hours, highlighting its current bearish momentum.

Market indicators and sentiment, however, suggest this downturn is just a minor setback.

As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the current state of Aptos [APT]. While it may seem like a rollercoaster ride at first glance, my analysis suggests that this is merely a minor hiccup in an otherwise bullish trajectory.

According to CoinMarketCap, Aptos [APT] has experienced a significant dip, losing approximately 8.09% of its value in the last 24 hours. However, its long-term perspective continues to look promising, as it has managed to increase by around 36.63% over the past month.

AMBCrypto has provided an in-depth analysis of why this growth is anticipated to continue.

APT is set for potential rally

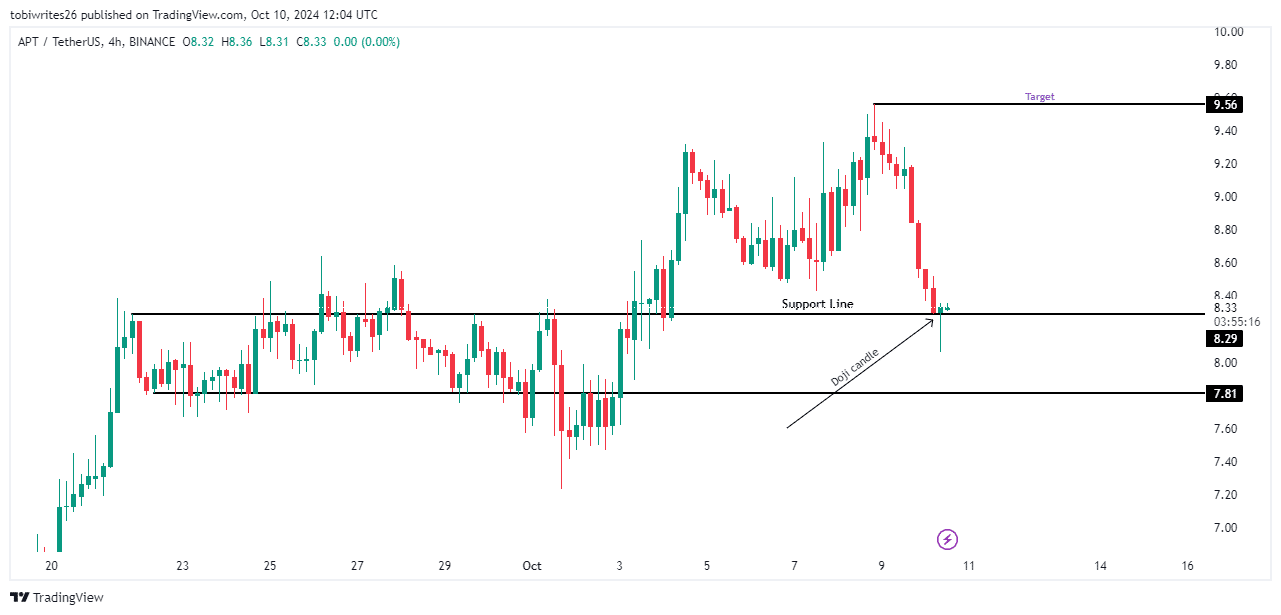

In simpler terms, over a 4-hour period, APT seems optimistic, as it’s retraced to a previous resistance level which may now act as a springboard for further growth.

At the $8.29 price point, a substantial influx of purchasing activity is anticipated due to its importance. This significant level appears robust, suggested by a bullish Doji candlestick formation, indicating a high level of buying intent at that price.

Should the current support hold firm, it’s likely that APT will return to its prior peak of $9.56, a point marked by a significant concentration of trading activity. If, however, this support weakens, APT could potentially drop and find temporary respite at $7.81.

Bullish signals strengthen for APT

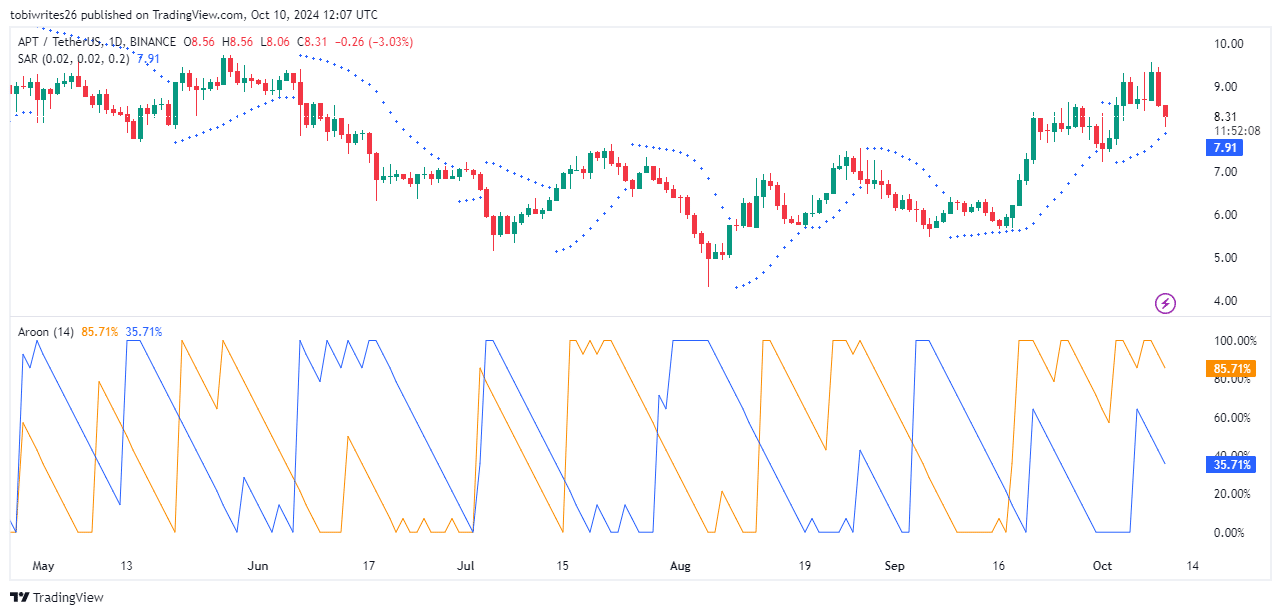

According to AMBCrypto’s analysis, while technical indicators such as the Parabolic SAR (Stop and Reverse) and the Aroon Line may initially seem bearish for APT, they indicate an underlying trend that continues to favor a bullish outlook.

In simpler terms, the Parabolic SAR (Stop and Reverse) is a tool that uses dots to show market movement. When these dots appear beneath the price line, it indicates an upward trend, meaning that the bulls (buyers) are likely still in control of the market’s direction.

Just like the Aroon indicator, which uses two lines, called Aroon Up (in orange) and Aroon Down (in blue), to analyze market trends, it suggests a positive or bullish perspective.

At the moment, APT is experiencing a bullish trend, and it might go even higher according to the Aroon Up line being above the Aroon Down line, suggesting positive momentum.

Mixed signals emerge, yet bulls may prevail for APT

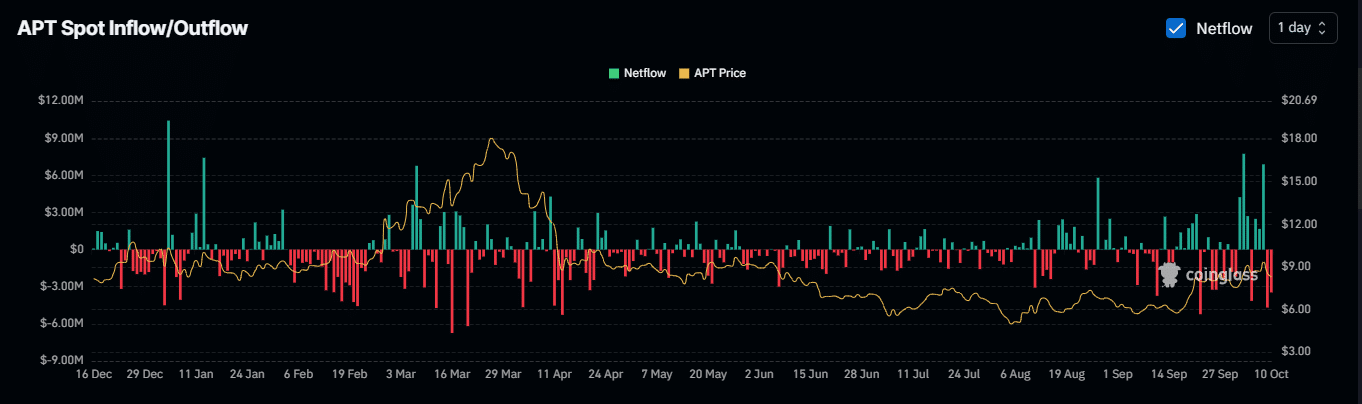

APT’s market presents mixed signals, according to the latest on-chain metrics.

Over the past day, the Open Interest decreased by about 10.72%, reaching $162.74 million as per Coinglass data. This decrease seems to indicate a bearish sentiment, implying that derivative contracts are currently leaning towards a downward trend.

On the flip side, the open market for APT is exhibiting positive trends. A large-scale withdrawal of more than $5 million in APT from various cryptocurrency exchanges is indicated by a negative Exchange Netflow.

Read Aptos’ [APT] Price Prediction 2024–2025

Engaging in this action could lead to a temporary increase in APT‘s cost and indicates a possible forthcoming scarcity of supply.

To see APT shift back to an upward trend, it’s essential that we witness a rise in the number of open contracts, particularly those held as long positions for APT.

Read More

2024-10-11 10:20