- Bitcoin nears record highs, just 1.8% away from its previous ATH, signaling strong bullish momentum.

- Increased accumulation by long-term holders and rising whale transactions suggest potential for a further rally.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed countless cycles of market ebb and flow. Yet, there’s something particularly captivating about Bitcoin’s recent trajectory that sets it apart from traditional assets.

Currently, the value of Bitcoin [BTC] is nearly touching its record peak, standing less than 1.8% below its all-time high of $73,737, which was achieved back in March 2024.

Currently valued above $72,000, Bitcoin has experienced a nearly 10% growth over the last week and a slight 0.2% increase within the past day. This steady upward movement suggests growing investor trust, reinforced by indicators pointing towards robust Bitcoin fundamentals.

Moreover, it seems that the current surge in prices is primarily fueled by long-term investors (LTI), who are aggressively amassing Bitcoin, according to Darkfost’s analysis at CryptoQuant.

Whales accumulate like never before

As a researcher, I’ve observed that, although Bitcoin is approaching its All-Time High (ATH), the LTH 30-Day Net Position Change – a metric that indicates whether long-term holders are accumulating or offloading more Bitcoin on a monthly basis – reveals a modest decrease rather than a significant shift.

Darkfost clarifies that the recent drop in net position change is “about twice as small as the decline observed at the prior all-time high.” This suggests that the current selling trend is less intense compared to the previous peak.

This pattern indicates that those who have held Bitcoin for a longer period seem to be showing faith in its immediate future prospects, choosing to keep their investment instead of cashing out.

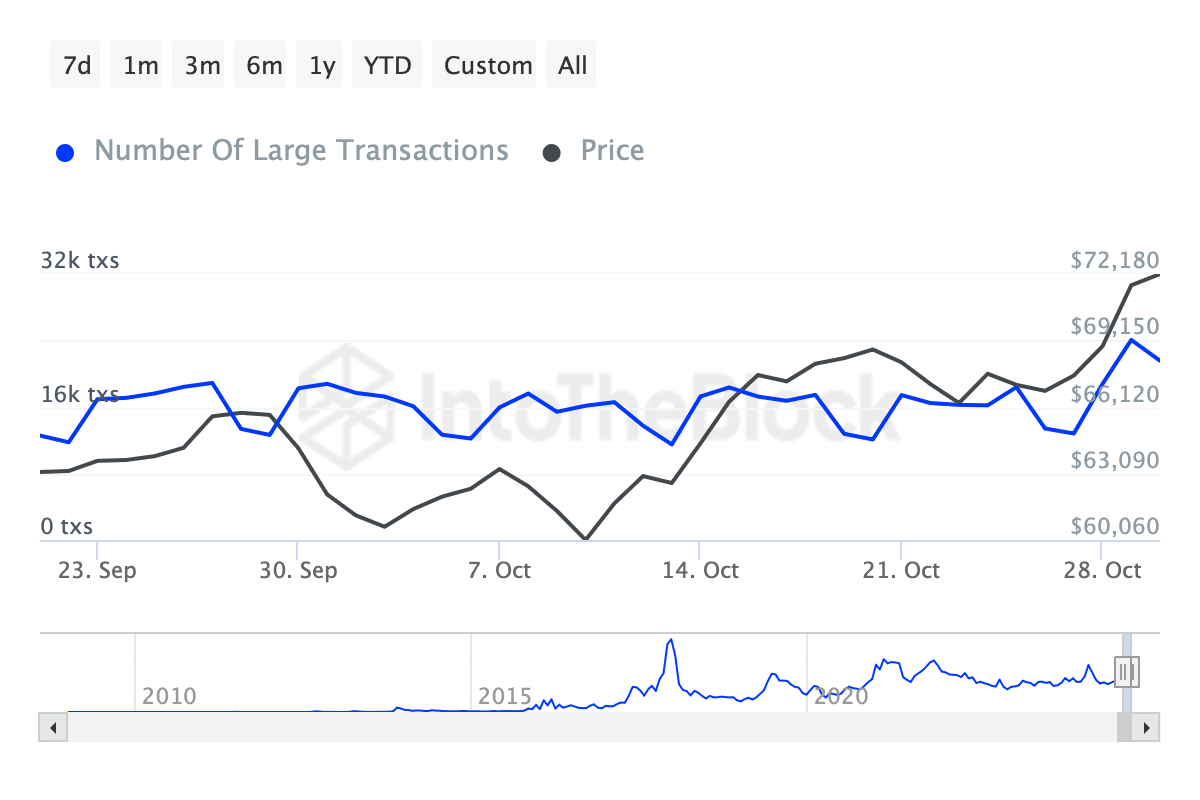

Besides the ongoing activity by long-term investors, Bitcoin is experiencing growing attention from significant investors, commonly referred to as “whales.” As reported by IntoTheBlock, the number of whale transactions has significantly risen, going from approximately 15,000 transactions last week to more than 20,000 at this current moment.

An increase like this in whale transactions often indicates significant investment in Bitcoin by major players, possibly preparing for additional price increases.

In the world of cryptocurrencies, the actions of large investors (often referred to as “whales”) can cause major changes in prices because they possess such massive amounts of coins. This gives them the power to sway market trends by affecting the balance between supply and demand.

Positive indicators align as Bitcoin approaches key price milestone

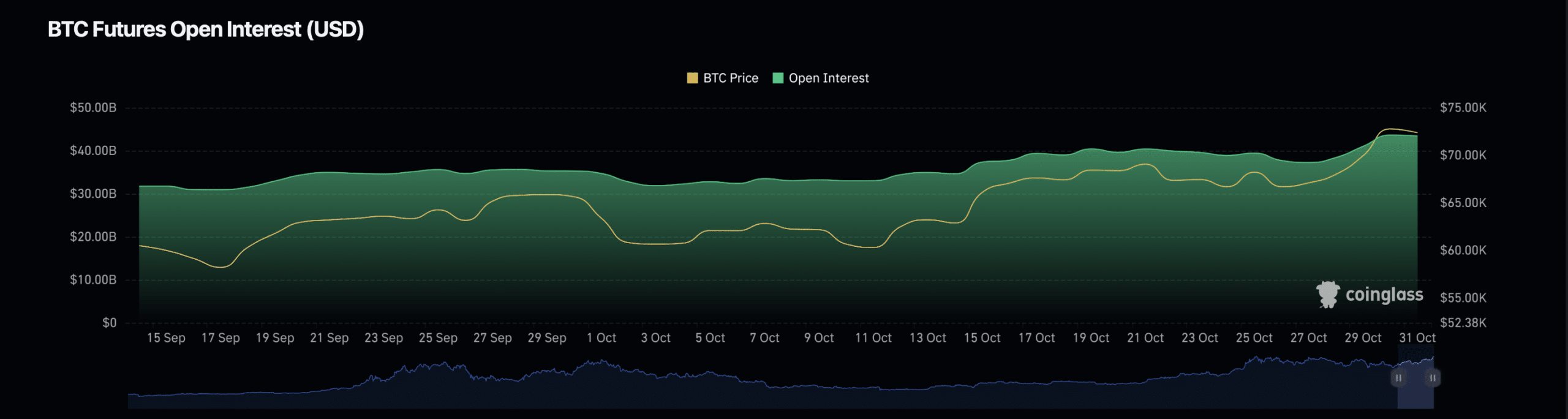

One important sign of positive investor confidence lies in the open interest of Bitcoin, a figure that represents the overall count of active derivative contracts linked with this digital asset.

According to information from Coinglass, the value of open Bitcoin (BTC) positions has experienced a minor growth, climbing by approximately 0.33% and reaching a total worth of about $43.59 billion.

On the other hand, the value of Bitcoin’s open interest has followed a different path, dropping by 37.63% to reach a total of $56.13 billion.

An increase in open interest typically means traders are actively involved with the asset, suggesting they’re anticipating further movements. Conversely, a decrease in trading volume might suggest that some investors are being cautious, perhaps holding back to observe more price indications before committing to larger transactions.

As a researcher, I’ve observed an intriguing alignment of elements that seem to be fostering Bitcoin’s sustained growth: the accumulation of long-term holders, the escalating attention from ‘whales’, and the surge in open interest. This combination appears to be laying a favorable groundwork for Bitcoin’s continued positive trajectory.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Strong investors remaining steady and not rushing to sell close to all-time highs indicates a general positive outlook among Bitcoin enthusiasts.

In simpler terms, Darkfost predicts that the gradual buildup of assets by long-term investors might signal an upcoming price surge in the coming days.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

2024-10-31 18:48