-

Bitcoin remained in the $64,000 price range.

Close to 2 million addresses bought BTC in this price range.

As a researcher with experience in cryptocurrency markets, I’ve been closely monitoring Bitcoin’s [BTC] price movements and the underlying market dynamics. The recent drop in Bitcoin below its former support level at $66,000 has raised concerns about potential further declines.

Bitcoin’s price dipped beneath a significant support threshold it had maintained for some time lately. Despite breaching this threshold, there exists an unseen backup support.

As a researcher studying the cryptocurrency market, I’ve identified an important threshold for Bitcoin (BTC) that hasn’t been reached yet. Should BTC dip below this level, it may set off a chain reaction leading to further declines due to potential selling pressure from investors.

The price drop has led an unprecedented number of bitcoin miners to offload their coins, making the predicament even worse.

Bitcoin’s former support continues as resistance

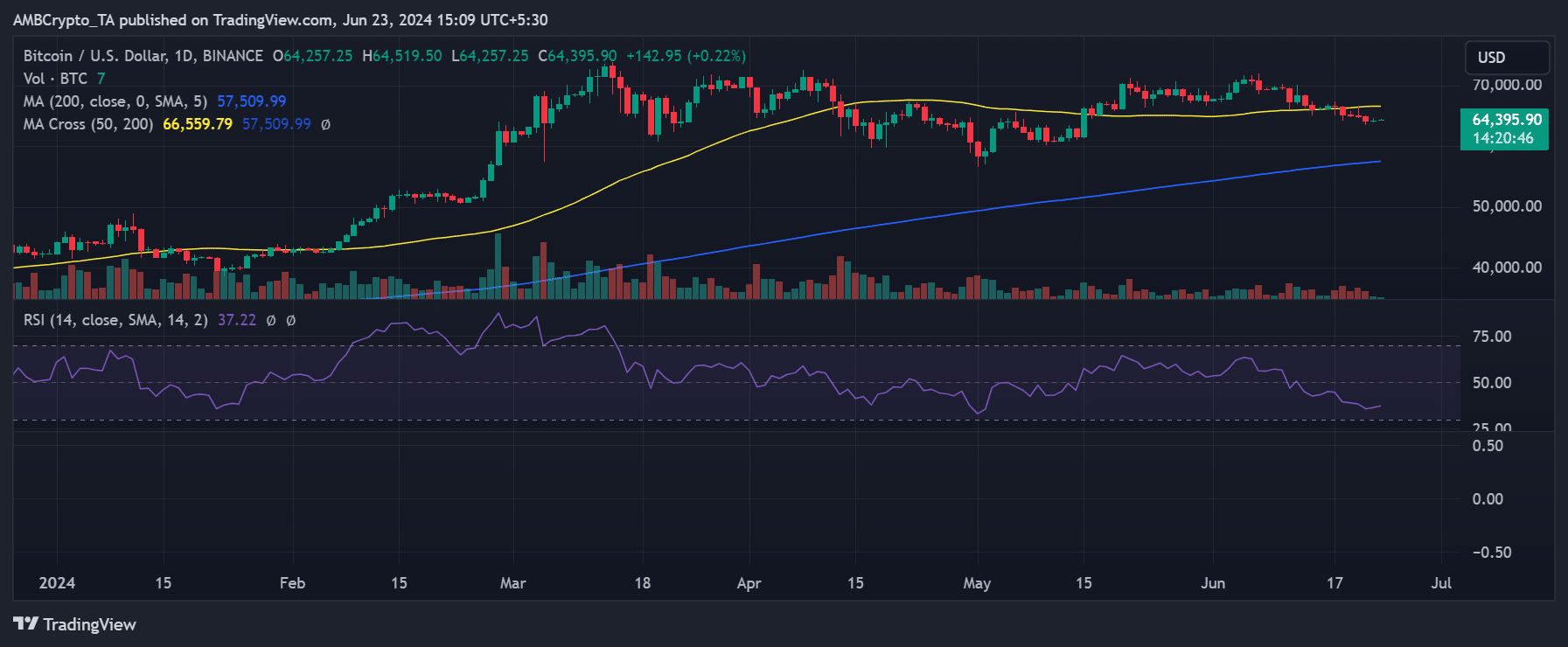

As a researcher examining Bitcoin’s daily price chart with AMBCrypto, I discovered that the cryptocurrency has surpassed its previous support level. This significant resistance had been set around the $66,000 price mark prior to this breakthrough.

The yellow line signifies the brief period during which this support held firm, remaining unchanged from around May 16th to June 17th. A break from this support level marked a substantial change in Bitcoin’s market dynamics.

The current price of Bitcoin as of the most recent data is roughly $64,380, representing a small uptick. Likewise, Bitcoin finished its trading session on the 22nd of June with a modest profit, reaching approximately $64,252 in value.

Despite this, Bitcoin’s current numbers fall well short of its previous support at $66,000, transforming it into a hurdle instead. This suggests it may be difficult for Bitcoin to surpass this price mark again soon.

The significance of Bitcoin’s price point around $66,000 is emphasized by the large number of Bitcoin addresses where transactions occurred at this price range.

As a researcher studying consumer behavior, I would describe this situation by saying that the large volume of purchases leads to a profound impact on both the psychological and technical aspects of pricing.

Just how many addresses bought Bitcoin in this range?

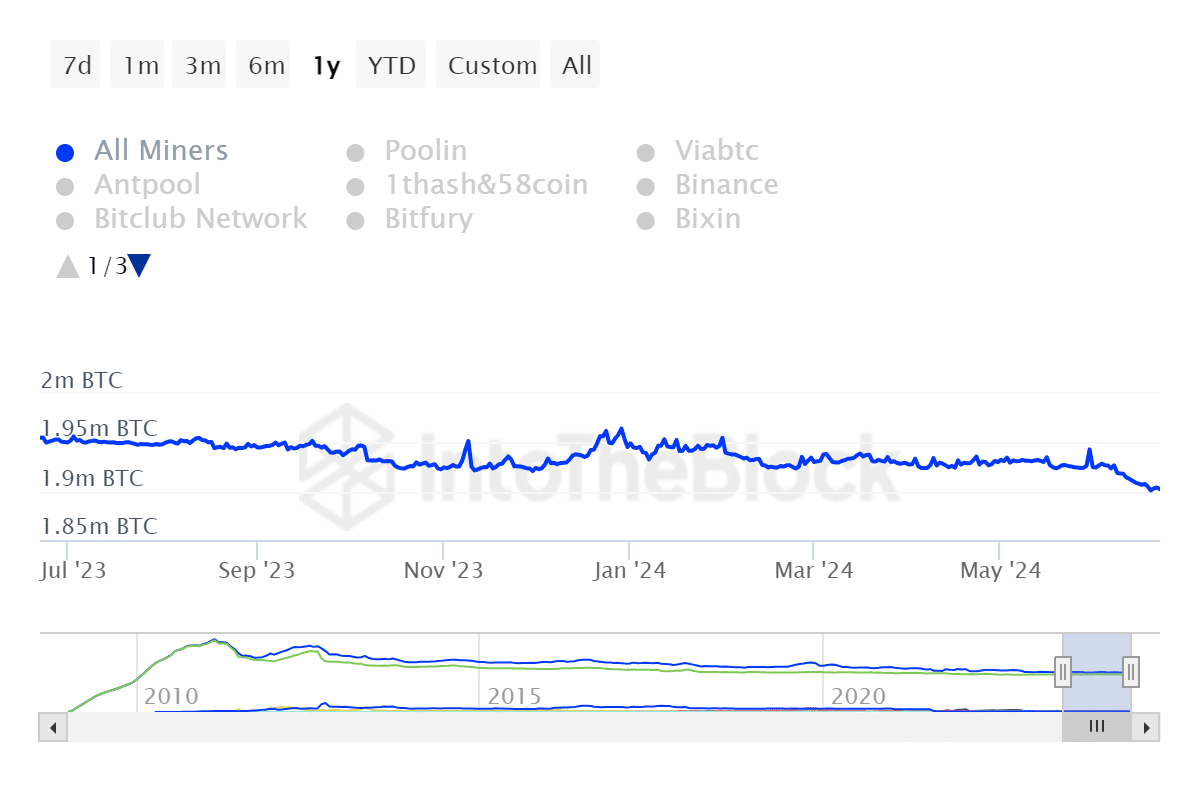

As a researcher examining data from IntoTheBlock, I’ve discovered an intriguing finding: a notable number of Bitcoin transactions are occurring within the price range of around $63,493 to $64,931. This price range holds significance due to the high involvement of addresses in these transactions.

Approximately 1.9 million addresses have transacted in buying Bitcoin within that price range, with an average transaction price of roughly $64,237.

his concentration of buying activity at these levels highlights their importance in the market.

These are important places in the Bitcoin market where large quantities of the cryptocurrency were exchanged. These transactions could impact the market’s future price trends by creating potential levels of resistance or support.

At the current price, there are numerous investors holding positions. This level can serve as a significant barrier for the price to advance if it attempts to return to that price point.

As a crypto investor, I might consider selling some of my holdings to reach the point where I initially invested, aiming for a break-even point. This action could put additional selling pressure on the market at current levels.

As a crypto investor, I could consider buying more coins if the price drops to a level where I previously held positions. This would allow me to lower my overall cost basis and potentially profit from any future price increases. Alternatively, I might choose to hold onto my current investments rather than selling at a loss during this dip, which could provide support for the market by reducing the available supply.

Miners panicking?

As a researcher delving into the latest cryptocurrency trends, I’ve uncovered some intriguing insights from IntoTheBlock regarding Bitcoin miners. It appears that these miners have noticeably intensified their selling actions since the commencement of the year.

Approximately 30,000 Bitcoins, worth roughly $2 billion, have been offloaded by miners since June – a figure representing the largest sale quantity from this group in over a year.

Miners may be heavily selling due to a number of reasons in the market, such as price instability or the requirement to meet their operational expenses.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin’s market behavior is significantly impacted by it, with particular influence on supply levels and pricing.

As an analyst, I’d highlight that the impact of significant Bitcoin sales by miners gains more weight when taking into account the distribution of Bitcoins among different wallets within the current price bracket.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-06-24 02:15