-

The Bitcoin 2024 conference pushed BTC near $70K yet again.

Whales seem to have come to a standstill as bulls wait for BTC’s next moves with bated breath.

As a seasoned analyst with over a decade of experience in the crypto market, I have witnessed firsthand the ebb and flow of Bitcoin (BTC). The recent surge at the Bitcoin 2024 conference, pushing BTC near $70K, is reminiscent of the exhilarating bull runs we’ve seen before. However, it’s essential to maintain a balanced perspective and not be swayed by short-term market fluctuations alone.

As an analyst, I’ve observed a surge in Bitcoin’s (BTC) dominance at the onset of the week. The flagship cryptocurrency has shown a robust bullish momentum, positioning itself towards a potential milestone of $70,000.

1. This robust performance is a continuation of the enthusiasm generated by the Bitcoin 2024 conference and the politically fueled anticipation that dominated throughout the weekend.

The Bitcoin 2024 conference had a momentous impact on demand, and especially Bitcoin dominance.

Since mid-July, the second figure has been trending upwards and reached a peak of 56.76% – almost touching a fresh 3-year record of 58%.

In April 2024, Bitcoin’s market dominance reached a peak of 57.03%, marking a significant resurgence since its last high in April 2021.

Will the FED’s upcoming announcement favor Bitcoin dominance?

1. In a matter of days, a significant announcement from the Federal Reserve is imminent, which may potentially drive Bitcoin’s dominance to unprecedented levels in 2024. Specifically, the Federal Reserve will unveil its latest interest rate decision on July 31st.

96% of analysts anticipated that interest rates would stay the same during August, according to the prevailing market sentiment at the time.

As an analyst, I would interpret this as: If the Federal Reserve announces a rate cut, I expect demand for riskier assets like Bitcoin to increase significantly. However, if the Fed decides against a rate reduction, the announcement may not have a noticeable effect on asset prices.

Market sentiment is overwhelmingly in favor of a rate cut by 25 BPS in September.

More market confidence?

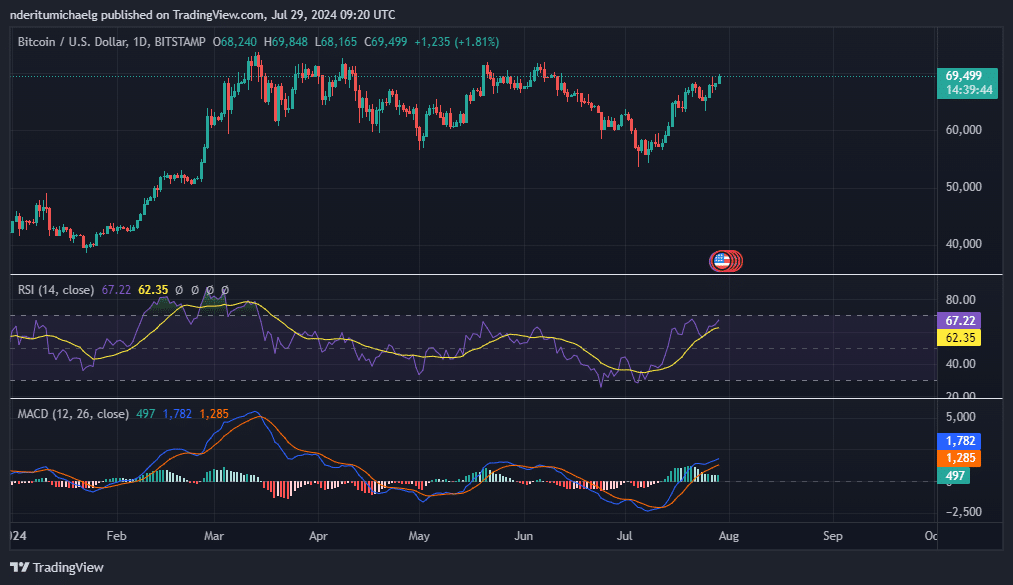

1. At the moment of reporting, Bitcoin was priced at approximately $69,503, marking a 1.81% growth over the preceding 24-hour period. AMBCrypto is intrigued to observe whether this positive momentum will build enough optimism to propel it beyond the $70,000 threshold.

At this price level, Bitcoin has encountered significant resistance and renewed selling activity since March.

1. From a technical perspective, surpassing $70,000 might lead Bitcoin into overbought territory based on the Relative Strength Index (RSI). At the current moment, the Moving Average Convergence Divergence (MACD) indicates that bullish momentum is starting to decelerate.

Based on these observations and the approaching resistance level, there was a hint of an impending price decrease due to short-term investors cashing in their profits.

After the Bitcoin conference, the long-term perspective remained optimistic, with heightened enthusiasm fueling increased confidence in various markets.

For example, Japanese firm Metaplanet has reportedly purchased Bitcoin worth over 1 billion Yen.

Metaplex’s stock has experienced a remarkable surge, with estimates suggesting a gain of over 1,300% this year. A significant portion of these price increases took place in July, coinciding with the company’s increased acquisition of Bitcoin. Currently, they own approximately 246 Bitcoins.

While this indicates a degree of faith within the market, whether Bitcoin can surpass its present resistance area hinges on the strength and duration of demand that develops beyond these levels.

Read Bitcoin’s [BTC] Price Prediction 2024-25

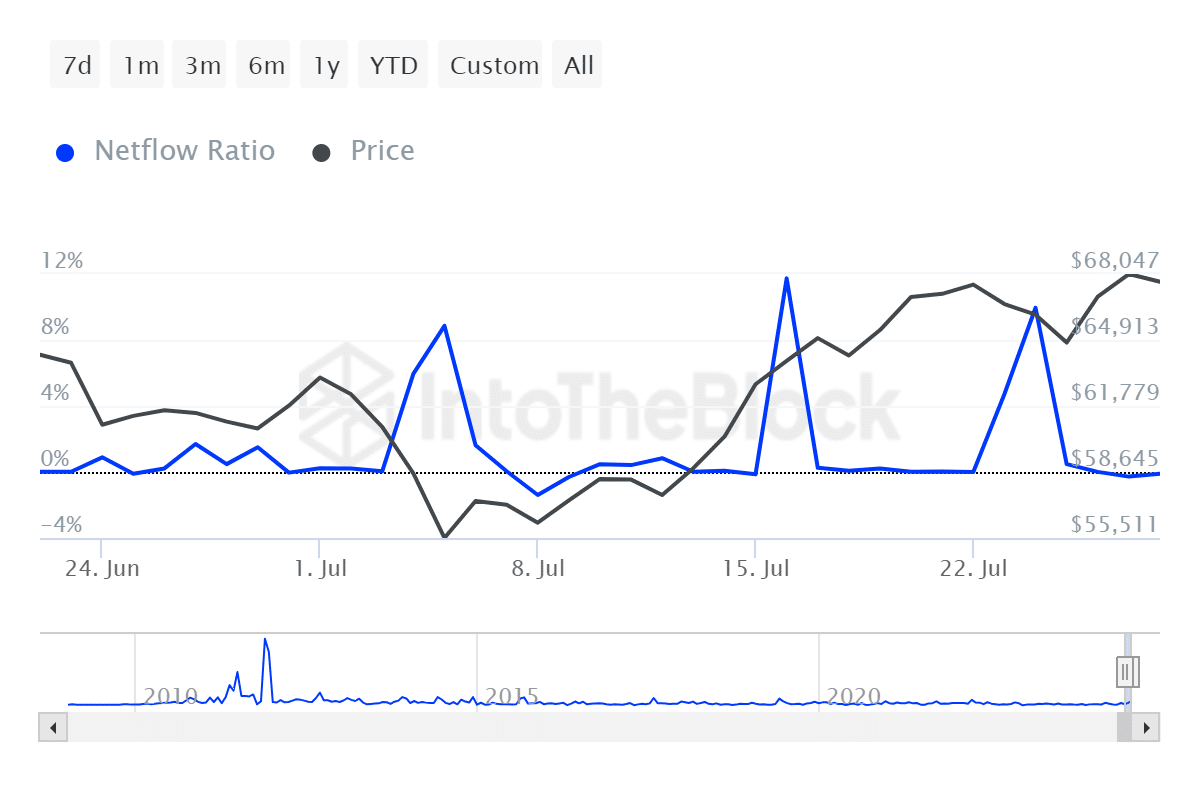

As a crypto investor, I’ve been keeping an eye on Bitcoin’s large holder to exchange outflow ratio. The latest data suggests that whales aren’t transferring significant amounts of their Bitcoins to exchanges just yet.

We will closely watch this indicator at AMBCrypto to evaluate the possible trends affecting Bitcoin’s market share and value over the coming days.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-07-30 03:37