- Altcoin season could kick off in November, revealing strong investment opportunities.

- However, altcoins as an asset class continue to decline.

As a seasoned crypto investor who has weathered market cycles, I’ve learned to navigate through the chaos with caution.

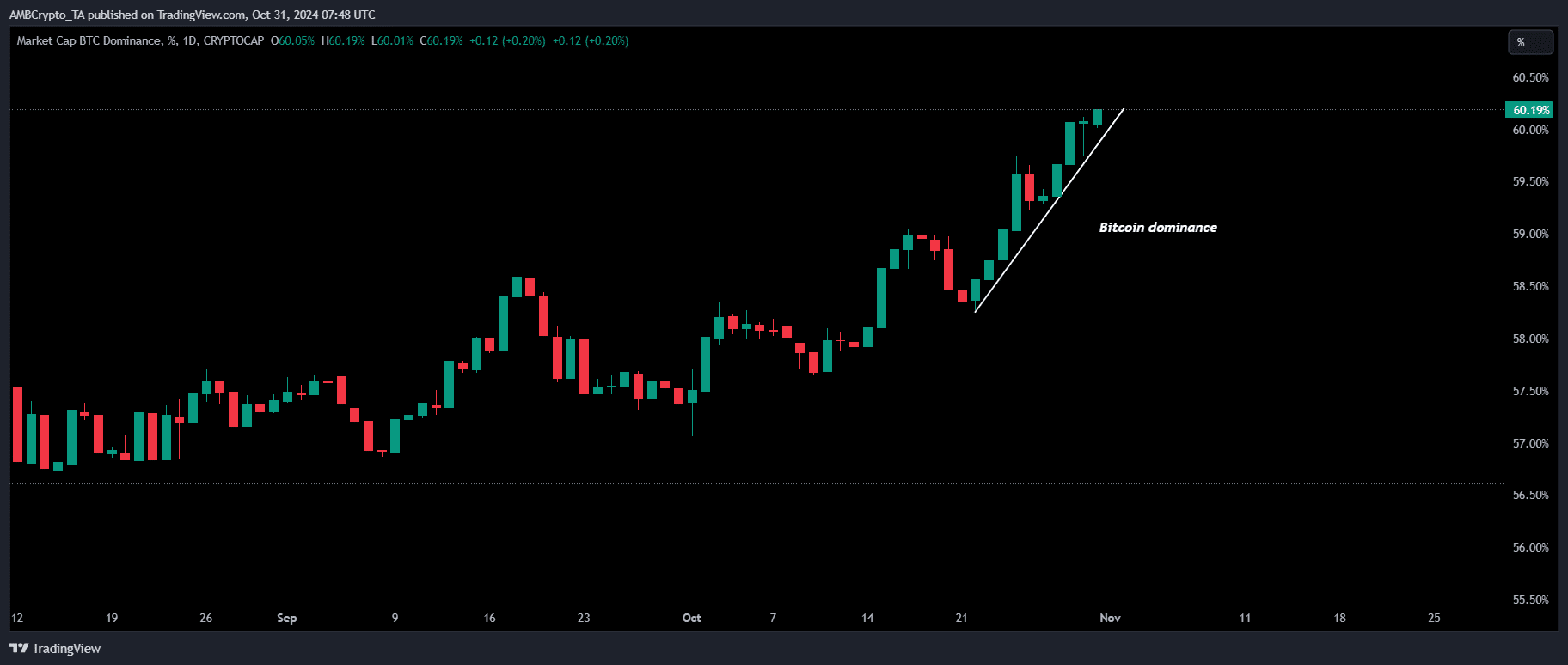

As the election results approach and potential changes in monetary policy loom, Bitcoin [BTC] is navigating a tumultuous path, attracting traders due to its perceived stability. This traditional trading tactic – finding shelter in Bitcoin amid market turbulence – has pushed BTC near its peak price of $73K, enhancing its control over the cryptocurrency market to more than 60%.

Could the continued prominence of Bitcoin encourage investors to sell, moving their profits into alternative cryptocurrencies, potentially triggering an “altcoin rally” or “altseason”?

Post-election cycle might kickstart an altcoin season

Previously, during periods like before Bitcoin hit its record high of approximately $73,000 in March, alternative cryptocurrencies experienced substantial increases as individual investors expanded their investment portfolios due to optimism and fear of missing out (FOMO). Yet, the present situation seems distinct.

According to a recent report from AMBCrypto, sharp increases in the process known as short liquidations have played a significant role in the recent rise in Bitcoin’s price.

This indicates a temporary optimistic trend for the market, but it might cause uncertainty among investors who are wary of the potential volatility stemming from the derivatives sector.

As an analyst, I observe that the market’s reactions seem rooted in a fundamental human response to unpredictability. Should this pattern persist, it could lead investors to reallocate their resources towards established high-value tokens, possibly paving the way for what some might call an ‘altcoin season’.

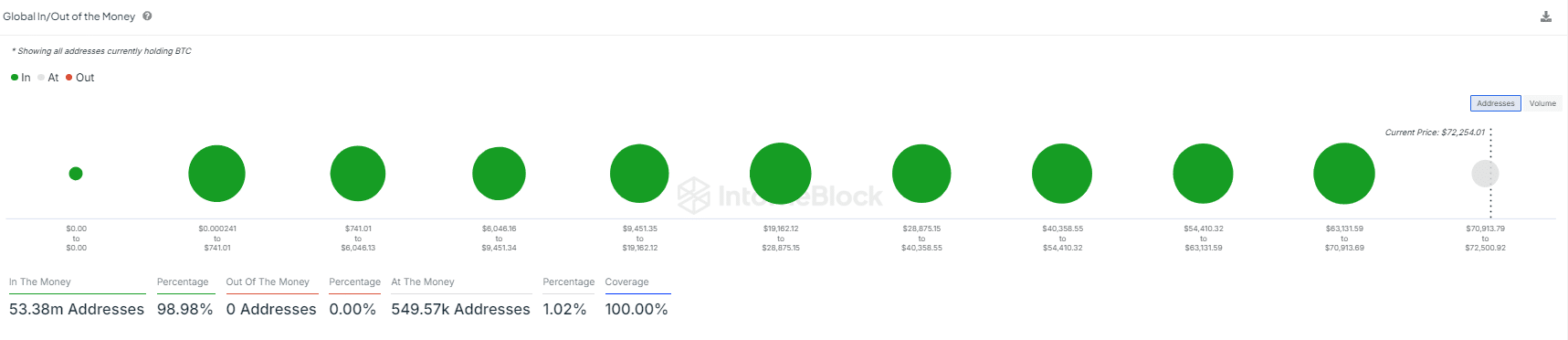

Source : IntoTheBlock

With 100% of Bitcoin cohorts currently in net profit, there’s a strong likelihood that altcoins could experience a surge by mid-November.

During this period, the end of the electoral season might coincide, causing investors to adjust their tactics based on fresh market tendencies that have emerged.

In simpler terms, when investors start making profits and the market mood changes, it’s possible that alternative cryptocurrencies (altcoins) may receive a larger share of investment funds, which could trigger what is known as an “altcoin rally” or “altseason.

But there’s a catch

In simpler terms, after Ethereum lagged behind other main competitors during the last phase, its recent significant weekly increase suggests that it’s getting back on track with past market patterns.

On the other hand, it’s evident that the overall performance of altcoins is not doing well. Although some individual tokens might show signs of growth, the general pattern suggests that the value of altcoins as a whole is decreasing.

Source : TradingView

Over the past period, as the overall market value climbed from $2 trillion to $2.4 trillion, it appears that a significant portion of the fresh investment has been directed towards Bitcoin. This shift in funds has caused a decrease in liquidity within altcoins, which is suggested by the increase in Bitcoin’s influence or dominance in the market.

It seems clear that Bitcoin and the broader market are gradually diverging into distinct realms. At present, just 14 alternative coins have drawn liquidity within the previous 90 days.

Furthermore, since the beginning of 2022, there has been a harsh drop in their value compared to Bitcoin. After about four years of poor performance, many altcoins have fallen to prices last seen in February 2021.

Read Bitcoin’s [BTC] Price Prediction 2024-25

To summarize, it’s evident that the flow of funds within cryptocurrencies has undergone substantial changes. Some altcoins could potentially yield returns in the period following the elections, as investors who have profited from Bitcoin might choose to redistribute their earnings. However, the idea of an altcoin boom persists more as speculation rather than a concrete reality.

This trend suggests that high Bitcoin dominance may no longer serve as a reliable precursor for an altcoin season.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-31 16:08