- Miner capitulation and decreased stablecoin issuance are reducing crypto market liquidity.

- Significant outflows from ETFs are increasing selling pressure on Bitcoin.

As a seasoned crypto investor, I’ve witnessed my fair share of market volatility. The recent downturn in the crypto market, with Bitcoin dropping by nearly 8% over the last two weeks, is particularly concerning. Miner capitulation and decreased stablecoin issuance are reducing market liquidity, while significant outflows from ETFs are increasing selling pressure on Bitcoin.

I’ve noticed a substantial decline in the cryptocurrency market recently. The total market capitalization has plummeted from approximately $2.8 trillion to around $2.5 trillion within a few short weeks.

The significant decrease has made its way through the industry, causing major cryptocurrencies such as Bitcoin [BTC] to experience a 7.9% decline over the past two weeks alone.

As a market analyst, I’ve identified several key factors shaping the current market landscape.

Examining Bitcoin more closely, it is clear that its value has decreased by almost 8% over the past fortnight. Moreover, within the last day, Bitcoin has continued to face challenges and dipped an extra 0.1%, resulting in a current trading price of approximately $65,524.

What is behind this recent downturn?

Reasons behind the crypto plunge

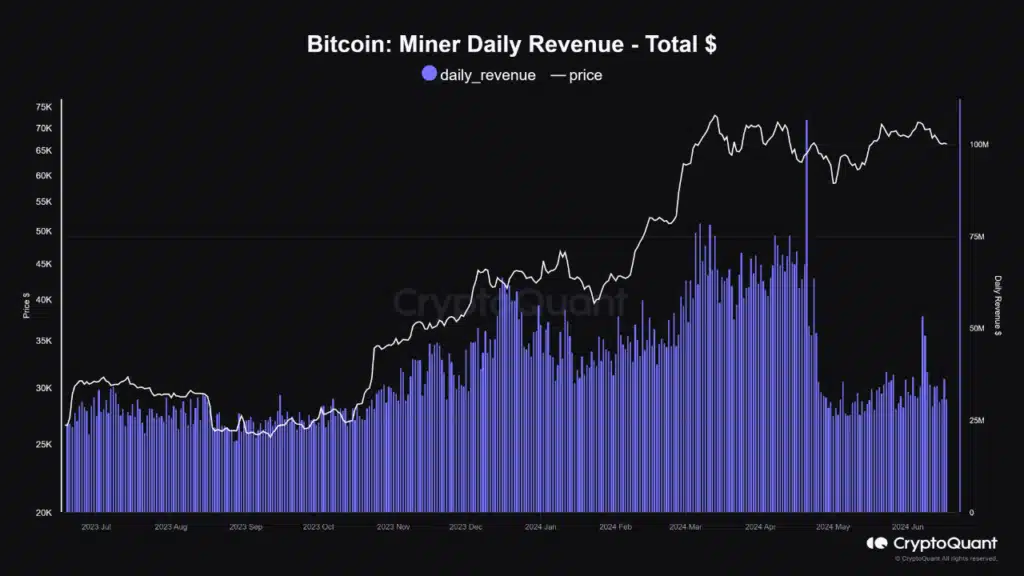

One key reason given by the CryptoQuant analyst for the recent cryptocurrency market downturn is that miners are giving up or selling their coins en masse.

A CryptoQuant analyst has noted that miners have experienced a substantial decrease in earnings, amounting to approximately 55%, leading them to sell off Bitcoin to meet their expenses.

When more Bitcoins transfer from miners’ wallets to exchanges, it frequently signals an upcoming price decrease. The reason being, the market experiences increased selling pressure as these Bitcoins become available for trading.

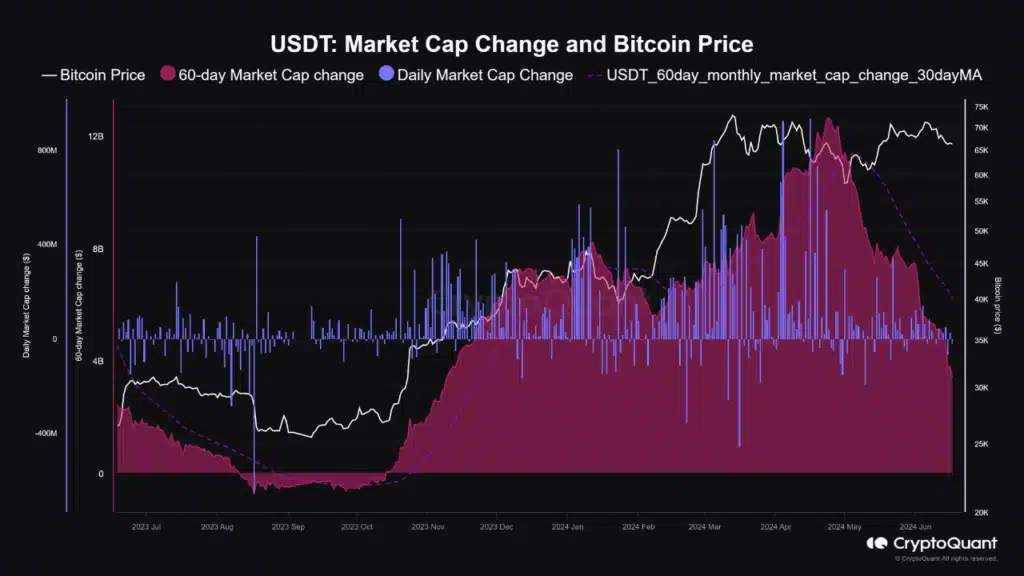

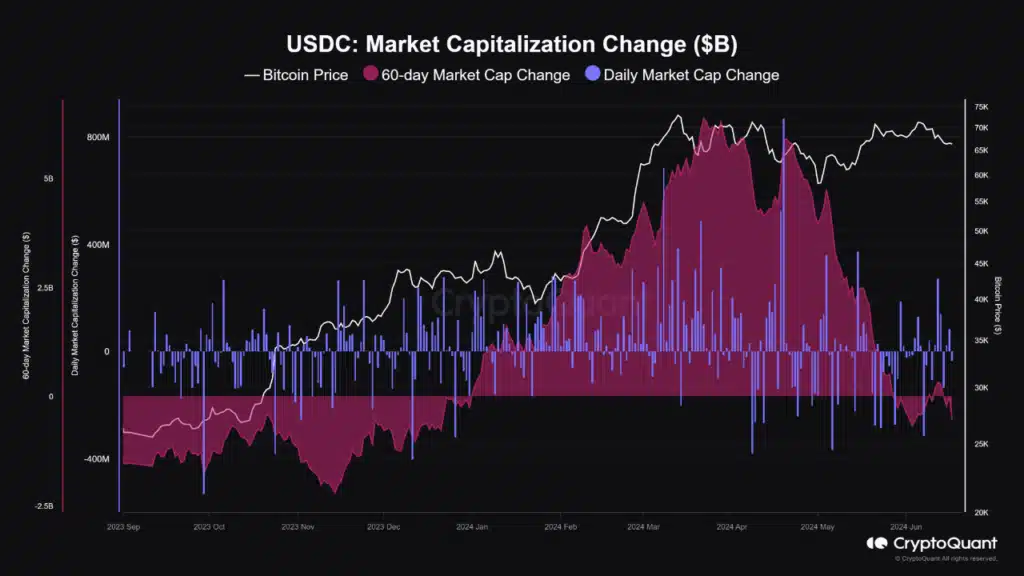

An absence of fresh supply from prominent stablecoins like USDT and USDC has led to a decrease in market liquidity.

Typically, the introduction of new issues signifies fresh funds flowing into the market, leading to increased trading activity and price stability.

With the decreased production of stablecoins, there’s a reduced influx of fresh funds to balance out selling forces, resulting in heightened market instability and downward price trends.

As a crypto investor, I’ve noticed that one factor putting pressure on the market is the substantial outflows we’ve seen from prominent cryptocurrency Exchange-Traded Funds (ETFs). These outflows suggest that investors are pulling their funds out of these ETFs, which could potentially lead to further selling and downward price movements.

As a crypto investor, I’ve observed some significant withdrawals that have left their mark on Bitcoin’s price action. For instance, more than 1,384 Bitcoins were taken out of Fidelity’s custody on the 17th of June – a move that underscores the selling pressure currently affecting the market.

The withdrawals signify a prevailing sense of wariness amongst cryptocurrency investors, with heightened apprehension being evident, especially in light of the unclear economic situation at large.

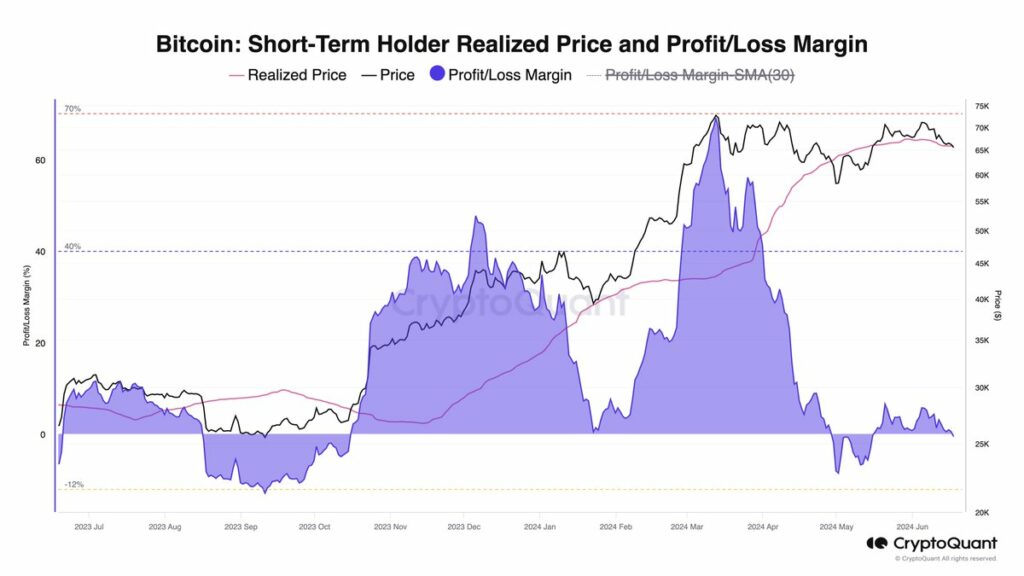

Institutional investors aren’t the only ones engaging in buying and selling activities; short-term holders also participate in this market behavior.

Based on current data, the Spent Output Profit Ratio (SOPR) for this particular group hasn’t attained the levels commonly observed during market peaks. This implies that we may not have reached the cycle top yet.

Long-term investors continue to have a significant presence in the crypto market, creating a robust foundation that might mitigate the impact of any potential price decrease.

Looking ahead

Despite the current downturn, there are indicators that the market might be nearing a bottom.

As a crypto investor, I’ve been closely monitoring the market trends with the help of CryptoQuant’s analysis. One of their experts, Julio Monero, pointed out on X (previously Twitter), that Bitcoin has slipped below crucial short-term support levels. This observation could be an ominous sign for further price drops, potentially leading us to around $60,000.

The trading activity among traders and large investors is relatively low, while the supply of stablecoins, which are often used to buy cryptocurrencies, is restricted. Additionally, there’s a decrease in demand from US investors, all contributing to a less vibrant atmosphere in the crypto market.

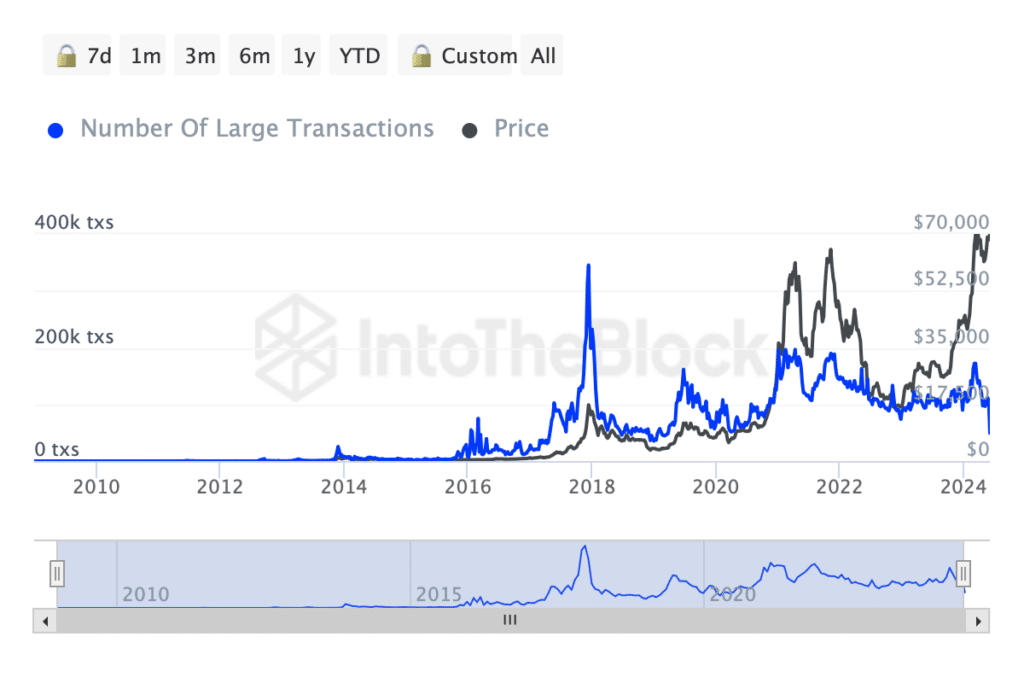

A closer look at the transaction data from IntoTheBlock uncovered a significant surge in Bitcoin transactions valued over $100,000. This trend indicates heightened activity among big-time investors, potentially suggesting a forthcoming change in market trends.

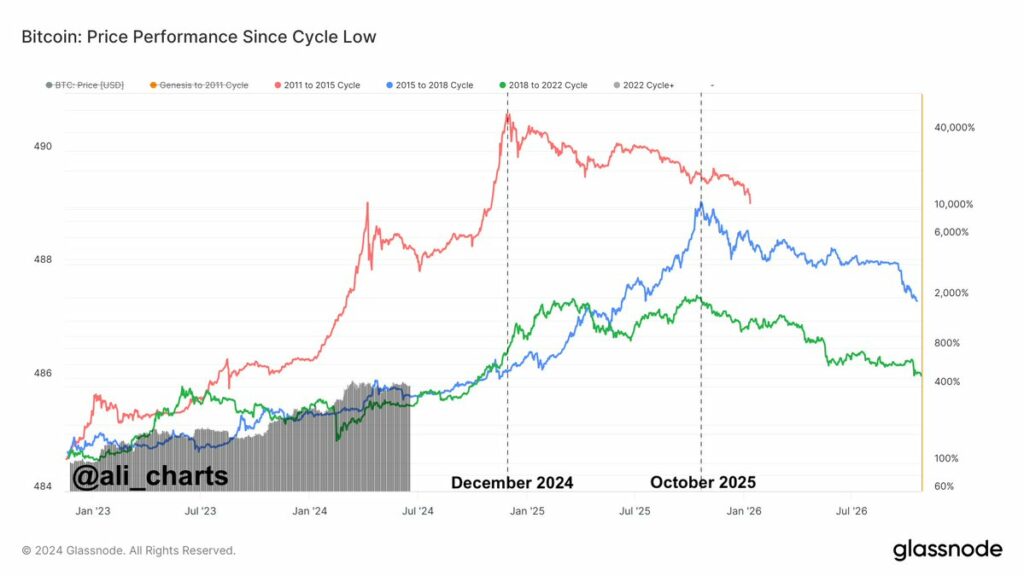

As a researcher studying Bitcoin’s price history, I have observed patterns from past market cycles that may provide insight into when we could potentially see a peak. Based on this analysis, it seems plausible that the current market cycle might not reach its maximum until late 2024 or even 2025.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

In simple terms, this analysis was presented together with a clear graph demonstrating Bitcoin’s price trend since its latest bottom.

Despite the current downturns mentioned in AMBCrypto’s latest report, the cryptocurrency market is still considered a bull market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-20 02:16