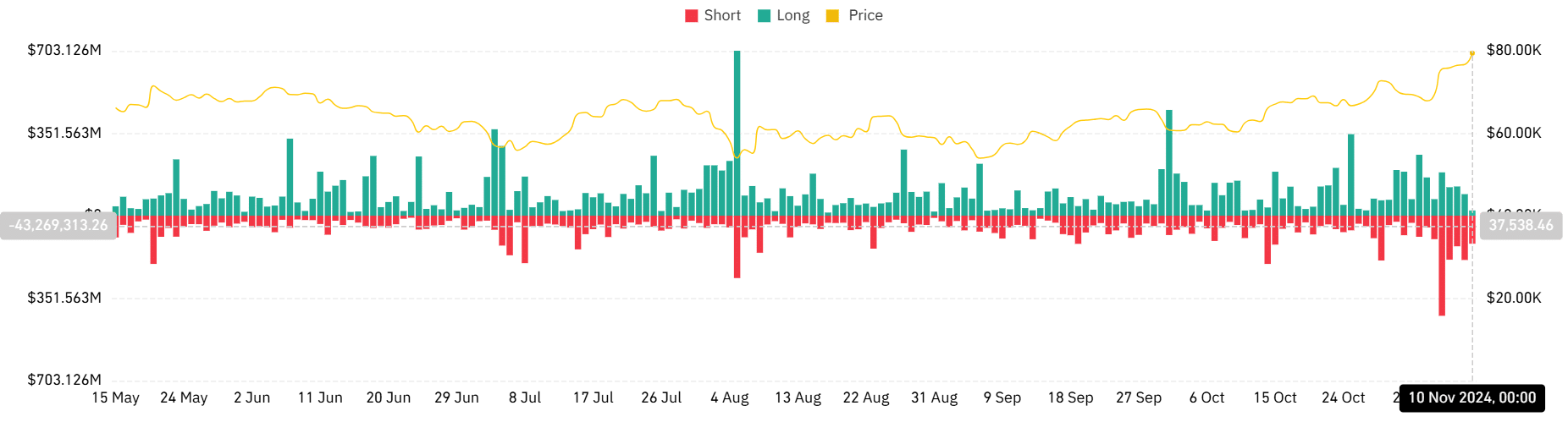

- In the last few days, short positions have taken consecutive hits.

- The market could see more liquidations as more assets break into new price levels.

As a seasoned researcher with years of experience navigating the tumultuous crypto market, I must say that the recent trend of consecutive liquidations has my attention. The rapid rise and fall of prices is reminiscent of a roller coaster ride, albeit one with potentially significant financial implications.

During the trading session on November 9th, a notable wave of sell-offs occurred across the cryptocurrency market, primarily influenced by fluctuations in prominent currencies such as Bitcoin (BTC) and Ethereum (ETH).

As a researcher, I observed a significant market response when these assets reached unprecedented price points. This triggered considerable liquidations, notably among those holding short positions.

As the Fear and Greed Index nears its highest or lowest extremes, investors are preparing themselves for possible additional selling off.

Market liquidations surpass $280 million

On November 6th, when Bitcoin hit an unprecedented peak of $76,000, the volume of market liquidations skyrocketed to more than half a billion dollars.

Approximately $427 million was liquidated from short positions, which is the largest amount in more than half a year. Meanwhile, long positions were liquidated to the tune of around $184 million.

Lately, on November 9th, the amount of market assets being sold off exceeded $280 million, continuing at a high rate.

Based on Coinglass’s statistics, it’s clear that short positions took the majority of the losses, contributing approximately $189 million to the overall liquidation amount.

To put it simply, the amount for long liquidations is roughly $92 million, whereas the current short liquidation volume is nearly $120 million; meanwhile, the long liquidation volume has been about $22 million.

This pattern indicates that individuals who have been short-selling (betting on a decrease) in the primary cryptocurrencies may be suffering substantial losses due to their assets’ continuous increase in value.

Major assets hit by market liquidation

In the last day, Bitcoin’s value has increased by over 3% and is now approaching the $80,000 milestone for the first time ever, setting a new record high price.

According to data from Coinglass, Bitcoin has been responsible for the highest volume of liquidations recently, amounting to more than $100 million over the last 24 hours.

In simpler terms, about $87 million worth of Bitcoin positions were closed early (short liquidations), while approximately $13 million of positions that were opened with the expectation of a price rise (long liquidations) were also closed.

During the same period, Ethereum’s liquidation volumes were significant, coming in second only to Bitcoin. Specifically, over $56 million was liquidated in short positions, while another $13 million was from long positions.

Additionally, Dogecoin, like other assets, was influenced by substantial liquidation activities. Specifically, it saw approximately $16.7 million in short liquidations and about $4 million in long liquidations.

Both Solana (SOL) and Sui (SUI) experienced significant amounts of liquidation, specifically in the form of short liquidations totaling approximately $13 million for Solana and nearly $13 million for Sui. On the other hand, long positions resulted in liquidations worth $3.7 million for Solana and $1.3 million for Sui.

What’s next for the market?

The current levels of market liquidation are influenced by heightened investor sentiment, as indicated by the crypto Fear and Greed Index. At the time of writing, the index stands at 78, reflecting a state of “extreme greed.”

The increased optimism, along with the worry of not being part of the action (fear of missing out or FOMO), is encouraging more traders to take an active stance. Consequently, this might result in further market sell-offs due to increased liquidation.

As the market shows signs of overheating, traders and investors should remain cautious.

As a crypto investor, I’ve noticed an uptick in trading activity, which could potentially lead to price increases. However, this heightened activity also means there’s a greater chance of liquidations if the market experiences a correction or reversal.

As Bitcoin approaches new peak values, other significant assets are also trending upward. However, this scenario maintains a high level of possible price fluctuations.

Should the Fear and Greed Index keep rising, it could lead to further significant sell-offs in the cryptocurrency market over the next few days, particularly for those holding leveraged positions.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-11 04:08