- Miners sold over 110,000 BTC in a week; will it stall price rally?

- There was little room for growth before euphoria hit BTC markets per cycle tops indicators.

As a seasoned researcher with years of experience navigating the dynamic crypto markets, I find myself intrigued by the recent surge in miner sell-offs and its potential impact on Bitcoin’s price rally. The intensity of this selling pressure is reminiscent of past cycle tops, raising concerns about whether it could halt BTC’s journey towards the coveted $100K mark.

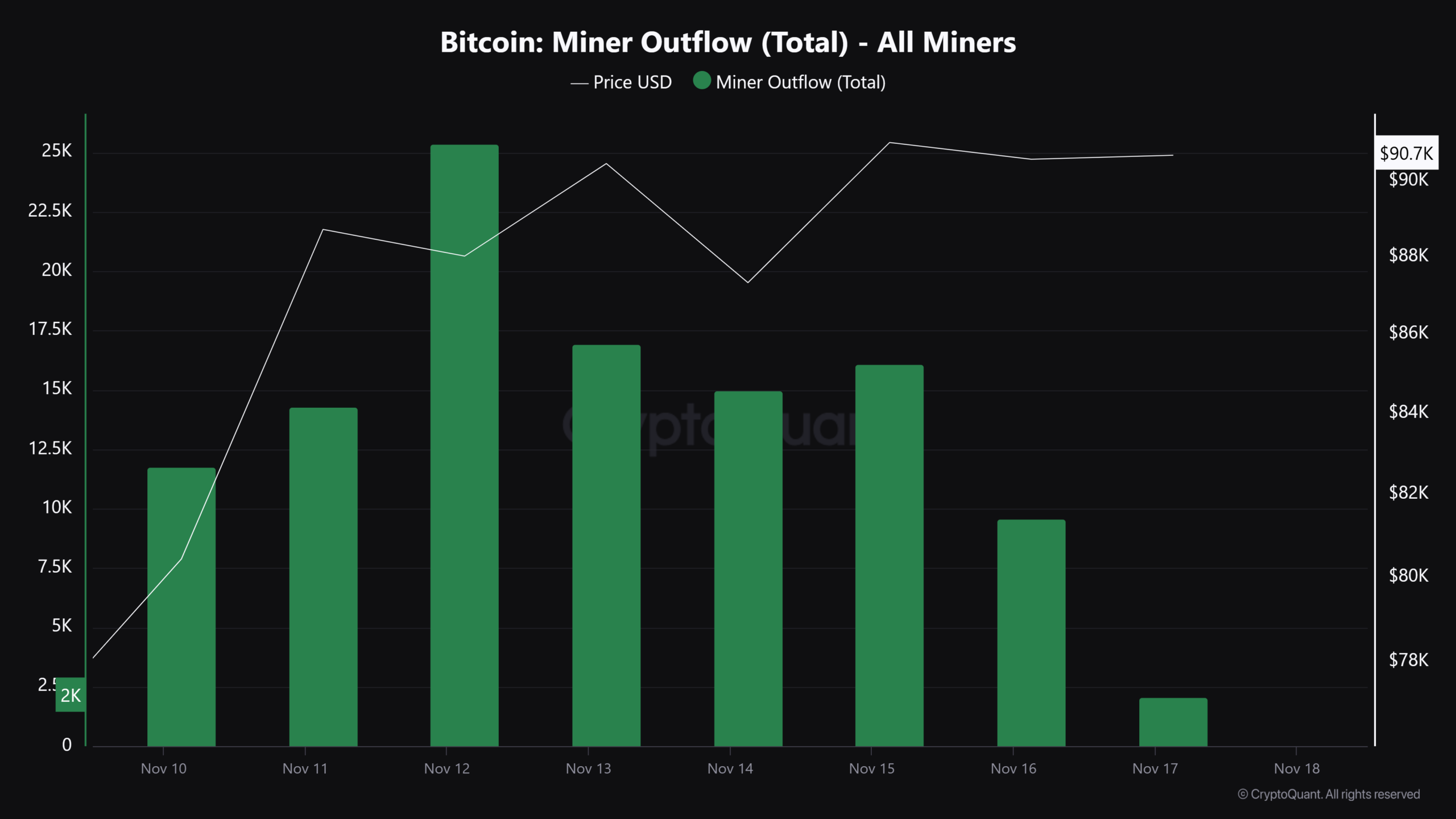

The increased selling by Bitcoin [BTC] miners has been evident as the value of BTC surpassed $90K. Over a period from the 10th to the 17th of November, these miners offloaded approximately 110,000 BTC, equivalent to around $10 billion, in just one week.

On November 12th saw the largest single-day Bitcoin sale of 25,367 coins, equivalent to approximately $2.2 billion, as the pace of miner-led sell-offs accelerated.

Since October, miner sell-off has been rising amid overall broader market recovery.

This week’s increased selling activity has sparked questions about whether Bitcoin will be able to surpass the $100K milestone due to potential setbacks.

Historically, an uptick in mineral sales and earnings has often signaled local and market peaks. Should the present trajectory and indications point towards a peak (market top), this could potentially prompt other owners to follow suit and sell as well.

So, what’s the current cycle status as BTC flirts with $90K and eyes $100K?

Decoding BTC’s cycle top

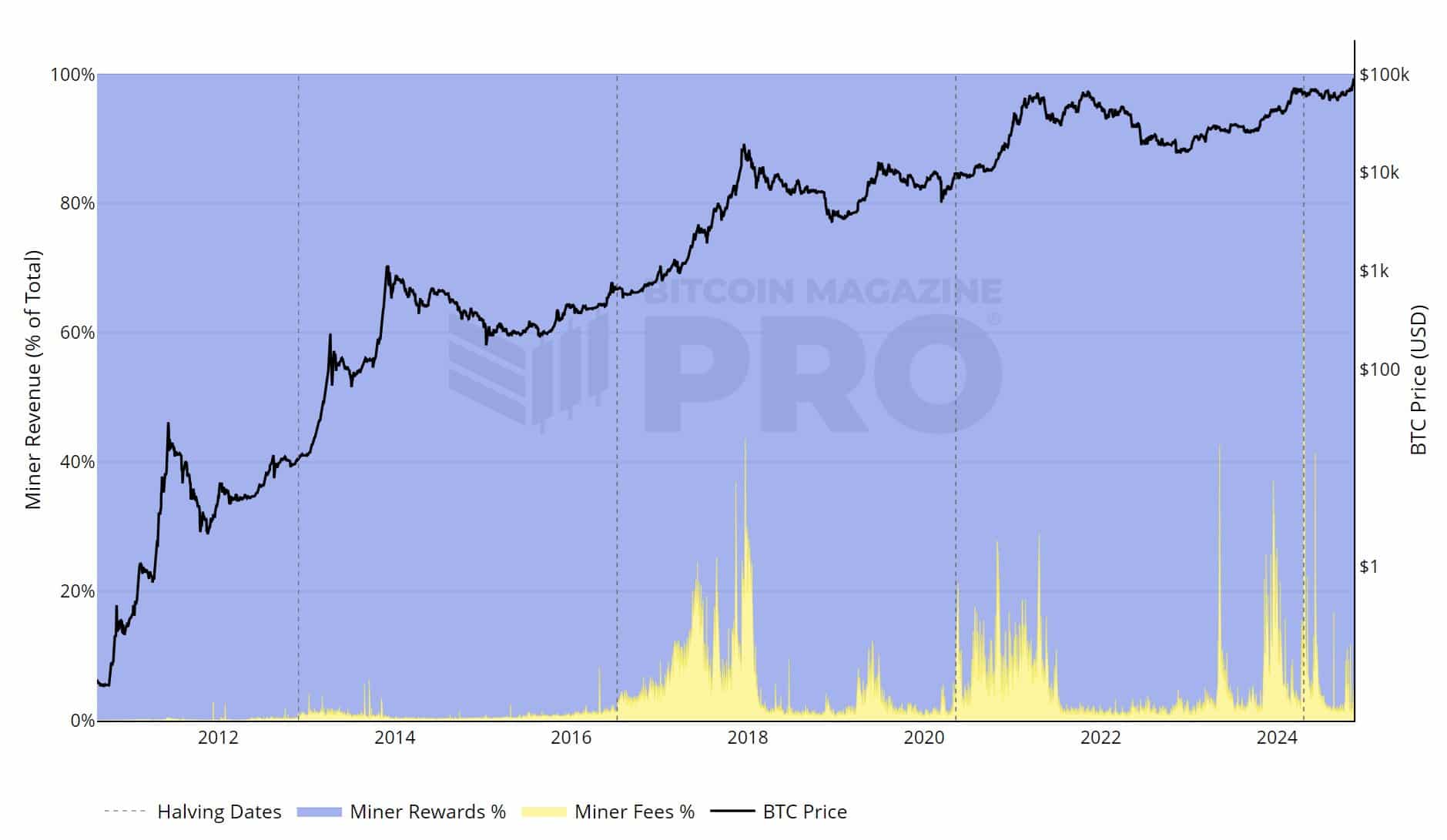

For a miner, it’s often observed that when miner fees (yellow) surpass 30% of overall income, this trend has historically coincided with the peaks in Bitcoin’s price cycles.

A large increase in Bitcoin (BTC) market readings indicates excessive joy or excitement, leading to significantly increased transaction fees compared to returns. This suggests the market is overheating.

In November, miner fees accounted for approximately 10% of the total income, indicating that the market was not yet experiencing excessive heat or inflation.

The Pi Cycle Top signal suggests that Bitcoin may not have much potential for further growth, as the market could soon become excessively heated.

Historically, when Bitcoin surpassed its 350-day moving average multiplied by two (represented by the green line), it often signaled the peak of the cycle, indicating that holders might want to consider selling.

Based on the reading of $120,000 on the green line, it might be considered as a sign to sell if Bitcoin surges beyond that level.

Read Bitcoin [BTC] Price Prediction 2024-2025

It’s worth mentioning that major players in the options market had predicted targets between $100,000 and $120,000 for the price of cryptocurrency. This observation was made by QCP Capital, one of the world’s largest crypto options trading desks.

Given Bitcoin’s strong surge following the U.S. election, it seems plausible that the price might reach between $100,000 and $120,000 in the near future.

As a crypto investor, if Bitcoin surges past the $120K mark, it might signal the start of the Pi Cycle Top. This could lead to an increase in profit-taking among all categories of Bitcoin holders, implying a potential 30% jump from the current price of $90K.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-17 20:07