-

Bitcoin miners offloaded significant BTC after a mild surge, cashing in on gains.

If the market top slips, miner capitulation could rise.

As an analyst with over two decades of experience in the financial markets, I’ve seen my fair share of bull and bear runs. The recent Bitcoin miner selloff is causing a bit of unease, given their significant influence on the market.

Cryptocurrency miners specializing in Bitcoin (BTC) have lately offloaded a substantial portion of their stash, coinciding with the highest level ever reached by the mining difficulty.

At this pivotal juncture, if miners fail to express optimism about an upcoming recovery, it might indicate an approaching downtrend, potentially signaling a bear market.

Bitcoin miners are at a crucial juncture

Approximately 9% of all Bitcoins are owned by the mining community, which is currently increasing its operational capacity as mining difficulty reaches unprecedented highs.

In the past, when Bitcoin miners decide to leave their operations because they’re not profitable (known as miner capitulation), it frequently indicates that the local price has reached a bottom during an uptrend or bull market.

Previously, a similar event took place on July 5th. On that day, Bitcoin dropped to around $56,000 following a test of the resistance at $71,000. The fall was likely due to miners leaving the market because their profit margins were being squeezed, which in turn caused the price to hit its lowest point.

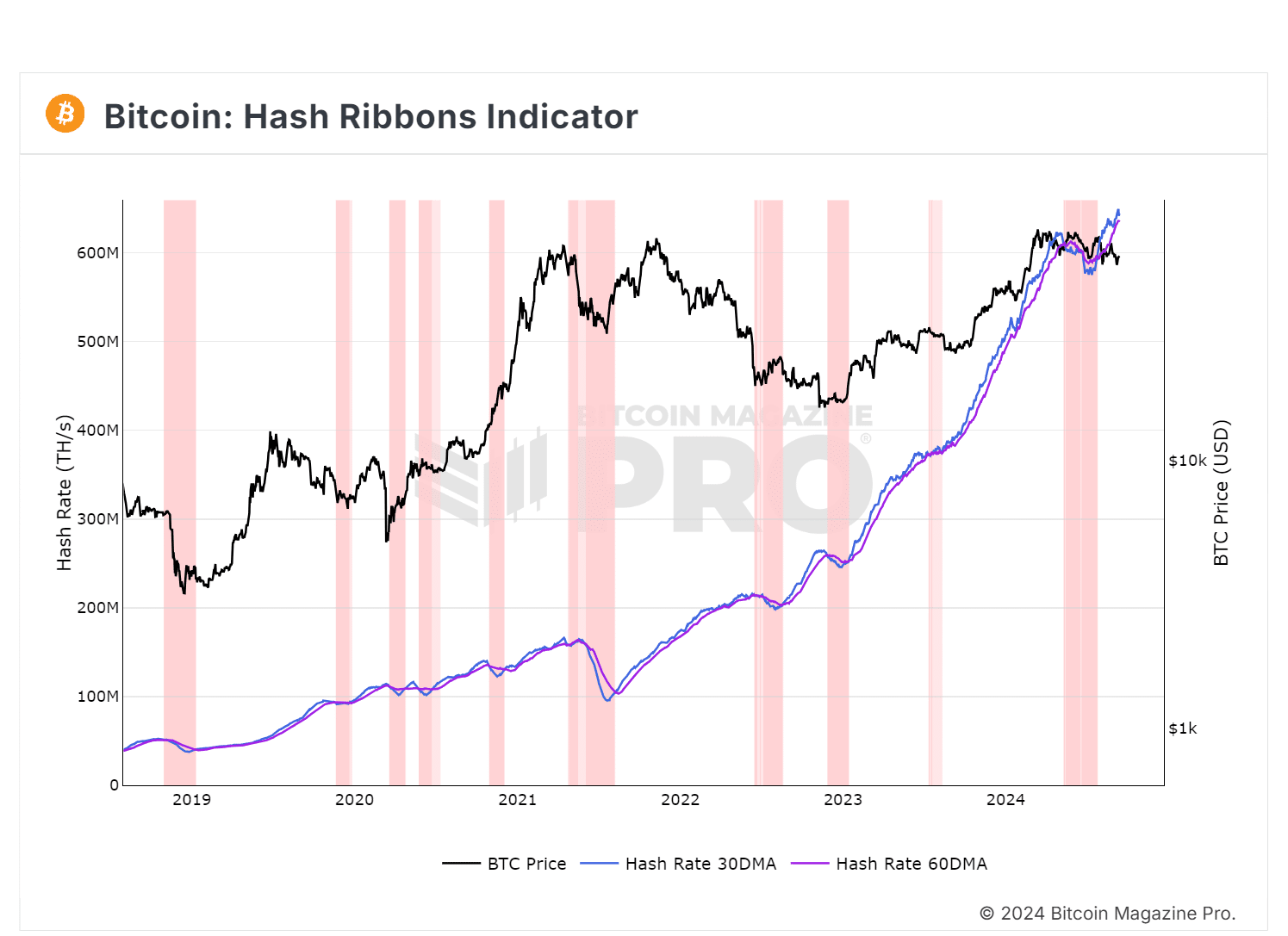

Source : Bitcoin Magazine Pro

The graph indicated that the moving average for the past 30 days was higher than the one for the previous 60 days, implying a bullish signal for the hash ribbon. This could mean that the widespread miner sell-off might have subsided, suggesting that miners are holding on even amidst market volatility.

Yet, a notable expert observed that Bitcoin miners appeared to have offloaded approximately 30,000 Bitcoins following its brief surge above $58,000, possibly aiming to secure substantial profits.

It could be beneficial to consider that surrender in the market can signal both peaks and troughs. The crucial aspect lies in identifying who surrenders first.

Falling reserves can signal market top

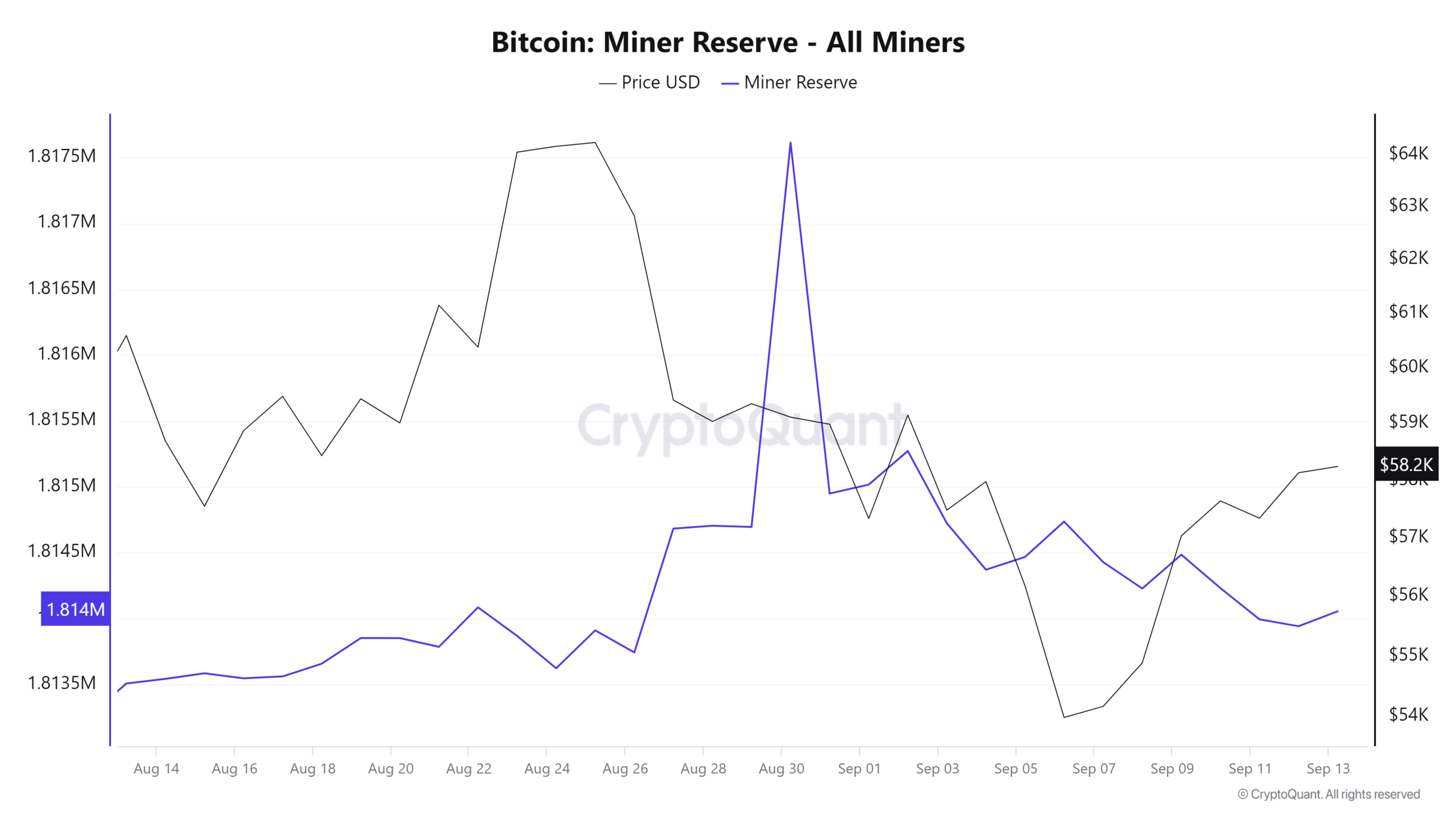

Instead of the graph indicating that miners tend to leave at market bottoms, AMBCrypto investigated if reaching a price peak might cause miners to depart.

It’s worth noting that as Bitcoin approaches $60K, miners seem to be decreasing their holdings, which might suggest they’re securing their gains or cashing out, supporting the idea.

Source : CryptoQuant

Due to the record-breaking challenge in mining, some miners may choose to sell their profits to meet their costs. This increased selling could potentially put pressure on Bitcoin’s price as it nears its next market peak.

On the other hand, individuals capable of enduring Bitcoin’s fluctuations might decide to keep holding it, given the buy signal.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The real concern is if BTC hits a market bottom and fails to hold the $57K range; miner capitulation could intensify.

In this situation, Bitcoin miners could sell substantial quantities of Bitcoin, not because they’re earning less, but as a strategy to prevent even larger financial losses.

Read More

2024-09-13 19:35