-

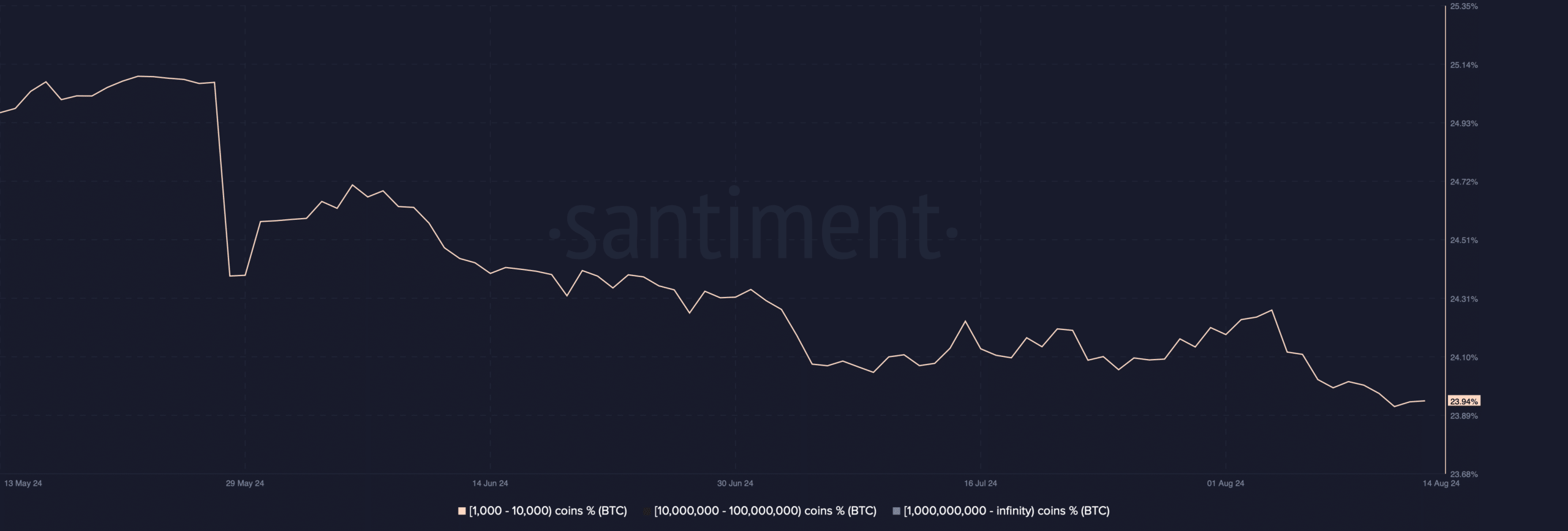

The number of BTC addresses holding 1k-10k BTC dropped over the last three months.

Market indicators and metrics remained bullish, hinting at a continued price rise.

As a seasoned researcher with years of experience tracking cryptocurrency markets, I’ve seen enough market fluctuations to know that every trend has its ebb and flow. The recent sell-off by BTC whales has indeed raised concerns about a potential price correction. However, it is essential to look beyond this single data point and consider the broader context.

Over the past week, Bitcoin (BTC) has seen its bullish trend prevail in the market. Yet, despite the increasing price, large investors or “whales” decided to cash out a significant part of their BTC holdings.

Does this mean BTC will fall victim to a price correction soon?

Bitcoin whales are selling

According to CoinMarketCap’s findings, Bitcoin’s price increased by more than 6% during the past week. Interestingly, even within the last day, the crypto leader experienced an uptick in value exceeding 4%.

As I pen this down, I find Bitcoin (BTC) currently transacting at approximately $61,298.02, boasting a market capitalization surpassing the $1.2 trillion mark.

According to AMBCrypto’s findings, while Bitcoin’s price increased, significant investors in the cryptocurrency market decided to offload their Bitcoin assets.

Over the past three months, a significant decrease has been observed in the number of Bitcoin addresses containing between 1,000 to 10,000 Bitcoins, according to our analysis of Santiment’s data.

Ali, a popular crypto analyst, recently posted a tweet highlighting the same story.

Over the last seven days, I’ve noticed that some massive Bitcoin holders, often referred to as “whales,” have dumped more than 10,000 Bitcoins, which translates to an estimated $600 million in today’s market.

As a seasoned investor with over two decades of experience in the financial markets, I have learned to read between the lines and interpret market signals accurately. The recent behavior of BTC whales, as I see it, suggests a lack of confidence in the coin’s future price movement. This is not an unusual occurrence in volatile markets such as cryptocurrencies, where large players often move in herds and influence the market direction. Given my experience with similar market patterns in the past, I am expecting a potential drop in BTC prices in the coming days. However, it’s essential to remember that cryptocurrency markets can be unpredictable, and this is not a guarantee. It’s always crucial to do thorough research and make informed decisions based on your unique investment strategy.

Will BTC’s price get affected?

Despite a few whale transactions occurring, the general trend in the market remained bullish. Earlier reports from AMBCrypto indicated that Bitcoin’s exchange reserves dropped to levels last seen in 2018.

As someone who has been closely following the cryptocurrency market for several years now, I have to say that the recent trend I’ve noticed with the coin is quite intriguing. Upon examining CryptoQuant’s data, it appears there’s an increasing buying pressure on the coin, which indicates a bullish sentiment among investors. This is not something I’ve seen in a while and it reminds me of my early days in crypto, when the market was still new and full of opportunities for those who could read the signals correctly. It’s exciting to see such positive movements again!

Based on my personal observations from past financial market trends, when the Accumulated Slope of Recent Price (aSORP) of Bitcoin turns green during a bear market, it could potentially signal a market bottom. This is because more investors are selling at a loss in such conditions. From my experience, this phenomenon often occurs when the sell-off has reached its peak and there’s a subsequent shift in sentiment towards recovery. However, it’s essential to keep in mind that market behavior can be unpredictable, and while this indicator might suggest a potential turning point, it’s always crucial to conduct thorough research before making any investment decisions.

Moreover, Binary CDD indicated a decrease in the activity of long-term holders over the past week compared to the norm. This trend, along with the other indicator, hinted at a possible continuation of Bitcoin’s rising price trend.

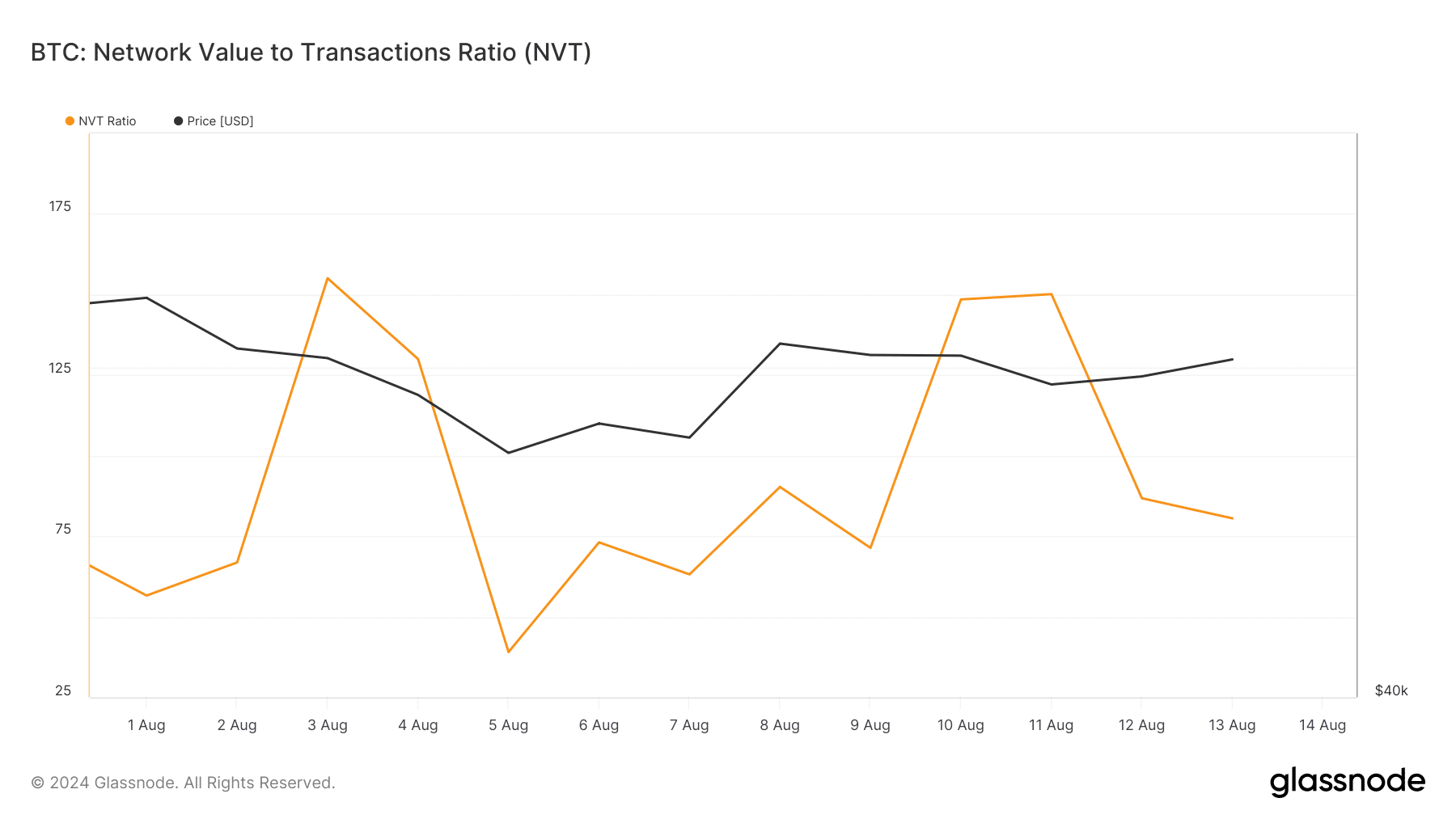

Additionally, AMBCrypto noted, upon examining Glassnode’s statistics, that Bitcoin’s Net Value to Transactions (NVT) ratio had decreased as well. Normally, a decrease in this metric suggests the asset is underpriced, potentially indicating an upcoming price rise.

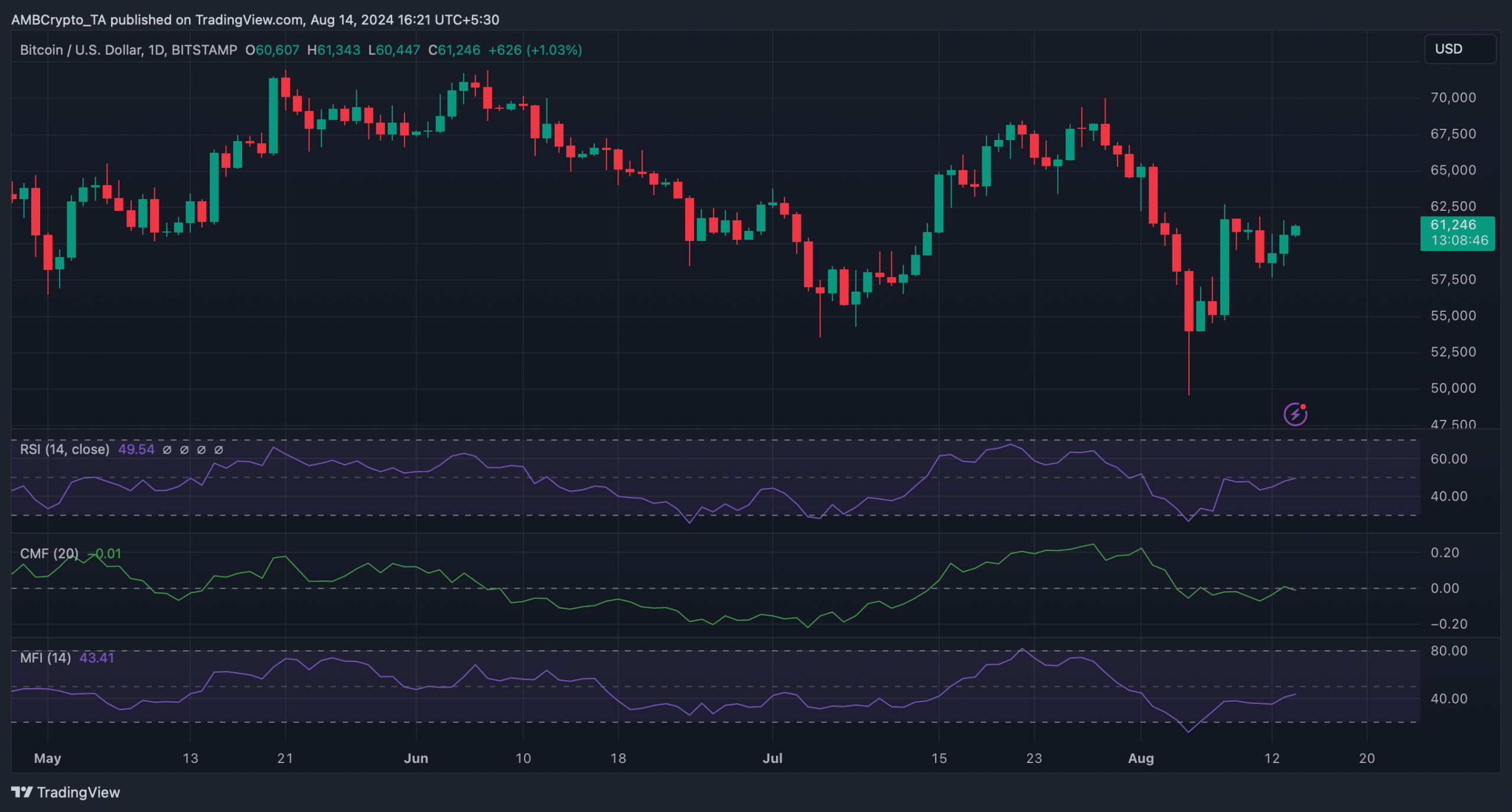

As an analyst, I took a closer look at the daily Bitcoin chart to get a sense of its intended trajectory. The technical metric, the Relative Strength Index (RSI), displayed a surge in positive momentum.

As a crypto investor, I noticed that the Money Flow Index (MFI) was on an upward trajectory, hinting at sustained price growth. However, the Chaikin Money Flow (CMF) started to show signs of bearishness, dipping slightly.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-14 20:38