- Bitcoin’s hash rate approached an all-time high, signaling miner confidence.

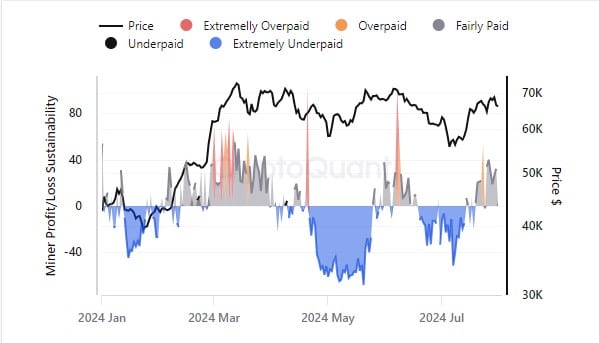

- Miners, in the meantime, transitioned from “extremely underpaid” to “underpaid” status.

As a seasoned analyst with years of experience navigating the volatile crypto market, I find it refreshing to see Bitcoin miners rebounding and the hash rate approaching all-time highs again. After months of struggle, this renewed optimism is a much-needed breath of fresh air in the industry.

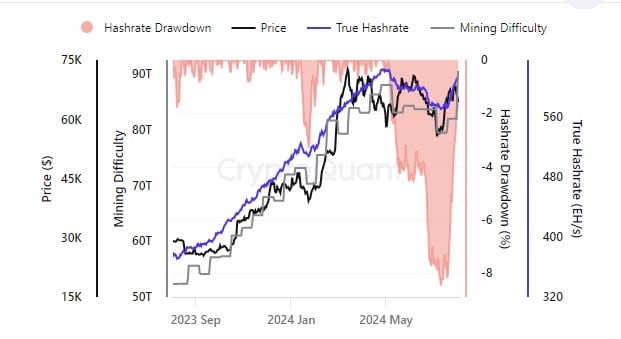

Bitcoin [BTC] miners are trying to recover and regain their momentum, with the hash rate approaching a record peak once more.

Despite enduring several challenging months, the Bitcoin hash rate found itself 2% below its record level as reported recently, signaling a resurgence of positivity within the network. This surge in optimism has led to an increase in the hash rate, consequently boosting miner profits.

In turn, this will reduce the selling pressure that has been weighing down the market.

Hash rate rebounds, but can it sustain?

The rate at which transactions are processed on the Bitcoin network (known as the hash rate) has seen a notable resurgence. As per CryptoQuant’s analysis, this rate is swiftly approaching its highest point.

As an analyst, I’m observing a resurgence in the industry after a period of decline. The inefficiencies within some mining operations led to their closure as they failed to generate profits. Now, we’re seeing these businesses re-emerge, likely with improved strategies and efficiency measures in place.

It seems that the latest increase in prices has attracted more miners, as the hash rate has become steady and is now increasing slightly.

Miner profitability is changing from dire to just challenging as mining activity increases.

According to an analysis by AMBCrypto using data from CryptoQuant, it appears that Bitcoin miners have not been adequately compensated since the 20th of April following the halving event.

Despite an improvement in prices, the profit-loss balance is now leaning slightly more favorable, hinting that miners could potentially regain stability and continue their operations.

Based on my personal experience as a long-term investor in Bitcoin, I believe that implementing measures to reduce the need for individuals to sell their Bitcoins to cover expenses could help stabilize the market. Over the years, I’ve witnessed numerous instances where sudden selling pressure due to financial necessity has caused significant price fluctuations. By finding alternative ways to manage costs, such as through savings or other income streams, we can potentially prevent these abrupt sales and maintain a more consistent Bitcoin market. This approach is not only beneficial for investors like myself but also for the overall health of the cryptocurrency ecosystem.

Easing selling pressure

The improvement in miner economics might result in diminished selling pressure for the industry.

In periods when Bitcoin’s profitability is low, miners often need to offload their mined Bitcoins to cover operational expenses. However, if current trends continue, miners might keep more of the Bitcoins they mine, potentially leading to an increase in the overall value of Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2024-25

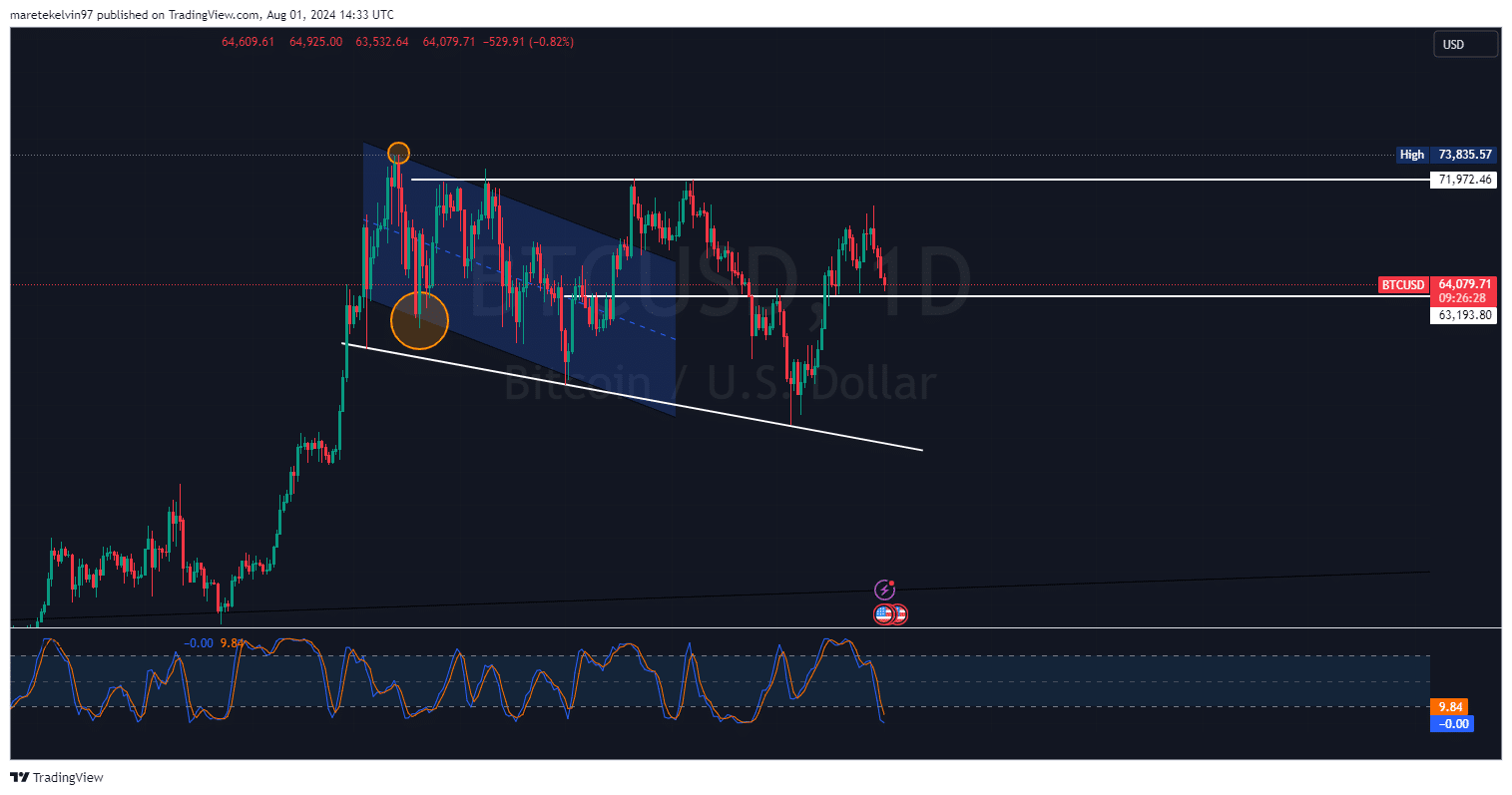

In simpler terms, the latest changes in Bitcoin’s value showed it was close to $64,000 and getting near a significant support zone. Reducing miner sales might aid in preventing any falls below the crucial support level of $63,000.

In the aftermath of the Bitcoin halving event, the expansion of mining hash rates, miners’ earnings, and the intensity of sales from miners will significantly impact the price trend. Whether Bitcoin can sustain its value above $63,000 or continue to drop down further depends on these crucial factors.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-02 11:05