- Bitcoin short-term whales are underwater, which likely presented an ideal buying opportunity

- Metrics resembled how they were before the previous major bull run

As a researcher with experience in cryptocurrency markets, I believe that the current situation of Bitcoin (BTC) presents an intriguing opportunity for traders. The recent dip below the key demand zone at $60k and the high trading volume during this breakdown suggest that short-term Bitcoin whales might be underwater. This could make for an ideal buying opportunity.

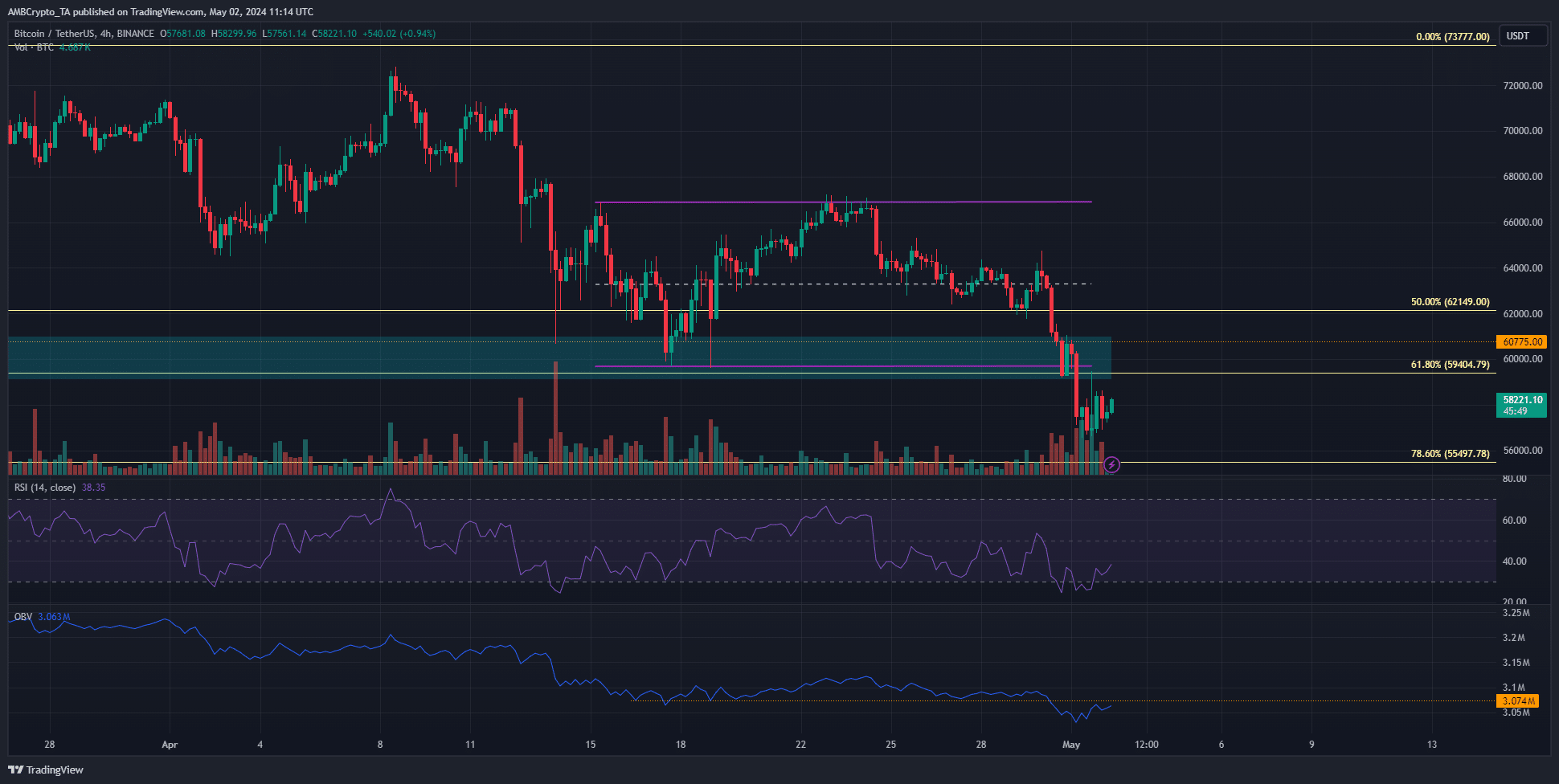

Bitcoin [BTC] sank below the key demand zone at $60k.

As a crypto technical analyst, I’ve noticed that this market sector has managed to keep potential sellers at bay for some time. However, it seems inevitable that we will experience a surrender at some point. Following the Federal Open Market Committee (FOMC) meeting, there is a strong possibility of a rebound towards $61k based on my analysis. I expressed this perspective in a recent post on X, previously known as Twitter.

As a crypto investor, I’m often pondering over potential price movements and considering my next steps in the market. Regarding the former support level at $60k in Bitcoin, there are two possible scenarios to consider:

The current breakdown has been on a high trading volume

In the immediate future, two significant price points can be identified: $59,400 and $60,700. These levels are likely to host a concentration of market activity, making them crucial spots where a potential downtrend may emerge.

Based on the current situation, it’s reasonable to anticipate further declines in the OBV (On-Balance Volume) as it now rests beneath the two-week support level. This indicates that selling pressure is currently more influential in the market.

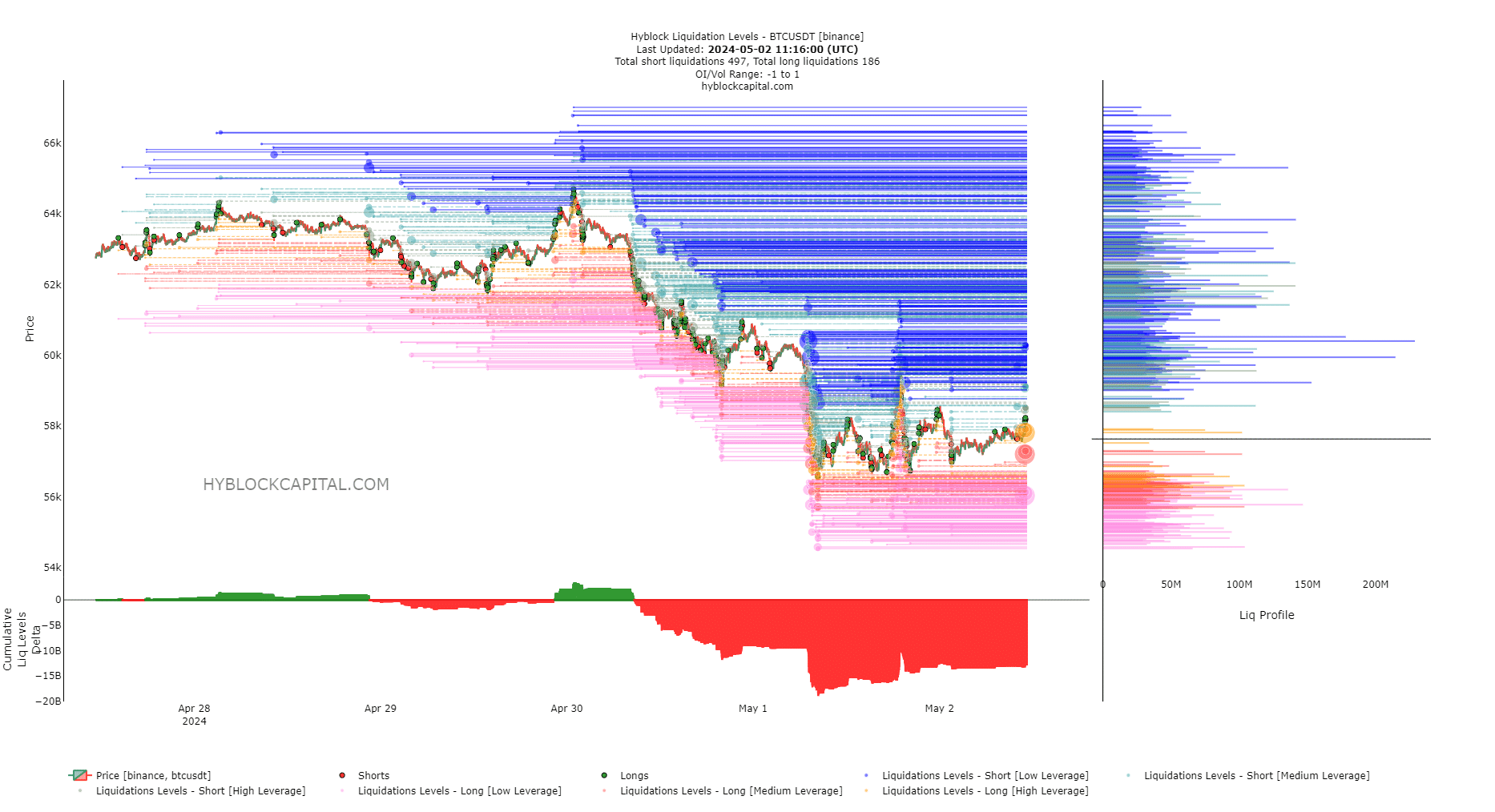

As an analyst examining the market data, I’ve noticed that the cumulative liquidation levels have shown a significantly negative delta. This means that there has been a substantial buildup of sell orders relative to buy orders. Consequently, it’s reasonable to anticipate a short-term price movement in the upward direction as market participants attempt to restore balance by buying back assets and reducing their net short positions.

Based on my analysis, the price levels at $60,500 and $63,800 have the most significant concentration of past liquidation points. Therefore, it’s likely that the price may approach these levels prior to any potential bearish trend reversal.

Of golden and death crosses

In a CryptoQuant Insights post, user CoinLupin pointed out an interesting development.

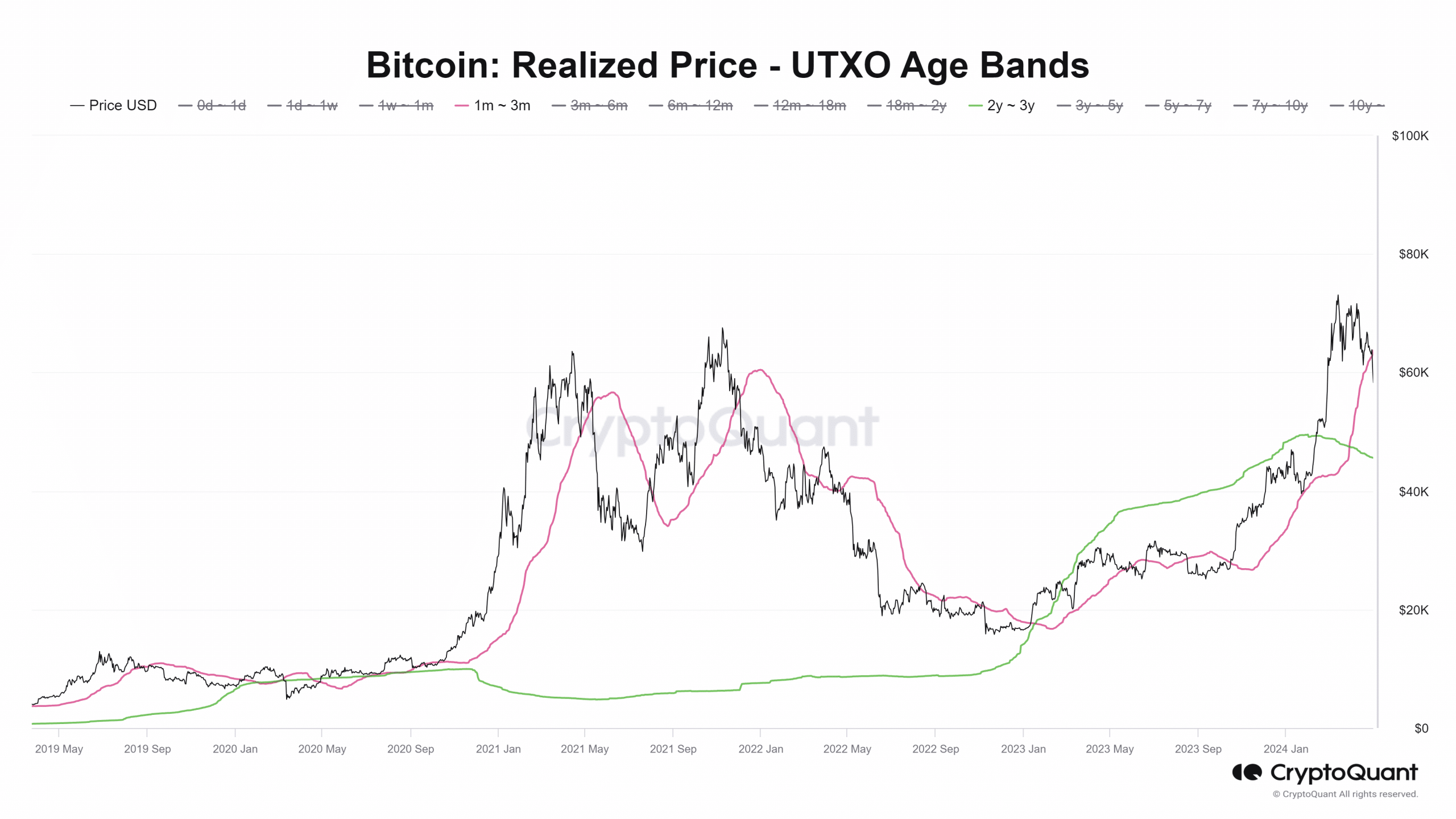

Based on an analysis of the actual UTXO (Unspent Transaction Output) age groups, significant cryptocurrency rallies began after the realized prices of the 1-3 month and 2-3 year cohorts underwent a refining or stabilizing phase.

From January to September 2020, this event occurred. Prices typically cluster around the actual prices for each age group during this time frame.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In the current cycle, there were not as many golden and death crosses between these two age bands.

The latest price drop in Bitcoin might lead to further declines, with experienced traders taking advantage of anxious sellers. According to the analyst, this could pave the way for a robust uptrend.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

2024-05-03 06:15