-

The historical correlation between Bitcoin and the U.S. dollar is set for another cameo this bull run.

Bitcoin is nearing fair value price as long-term holders accumulated more BTC.

As a seasoned analyst with years of experience dissecting market trends and patterns, I find myself increasingly optimistic about Bitcoin’s [BTC] future trajectory. The historical correlation between BTC and the US dollar is about to make another appearance, and this time, it could signal the final leg of a bull run.

Tendencies in the way prices fluctuate frequently reoccur, helping us make educated guesses about the future values of assets such as Bitcoin [BTC] and various cryptocurrencies. This means we can spot patterns that may repeat themselves in the future.

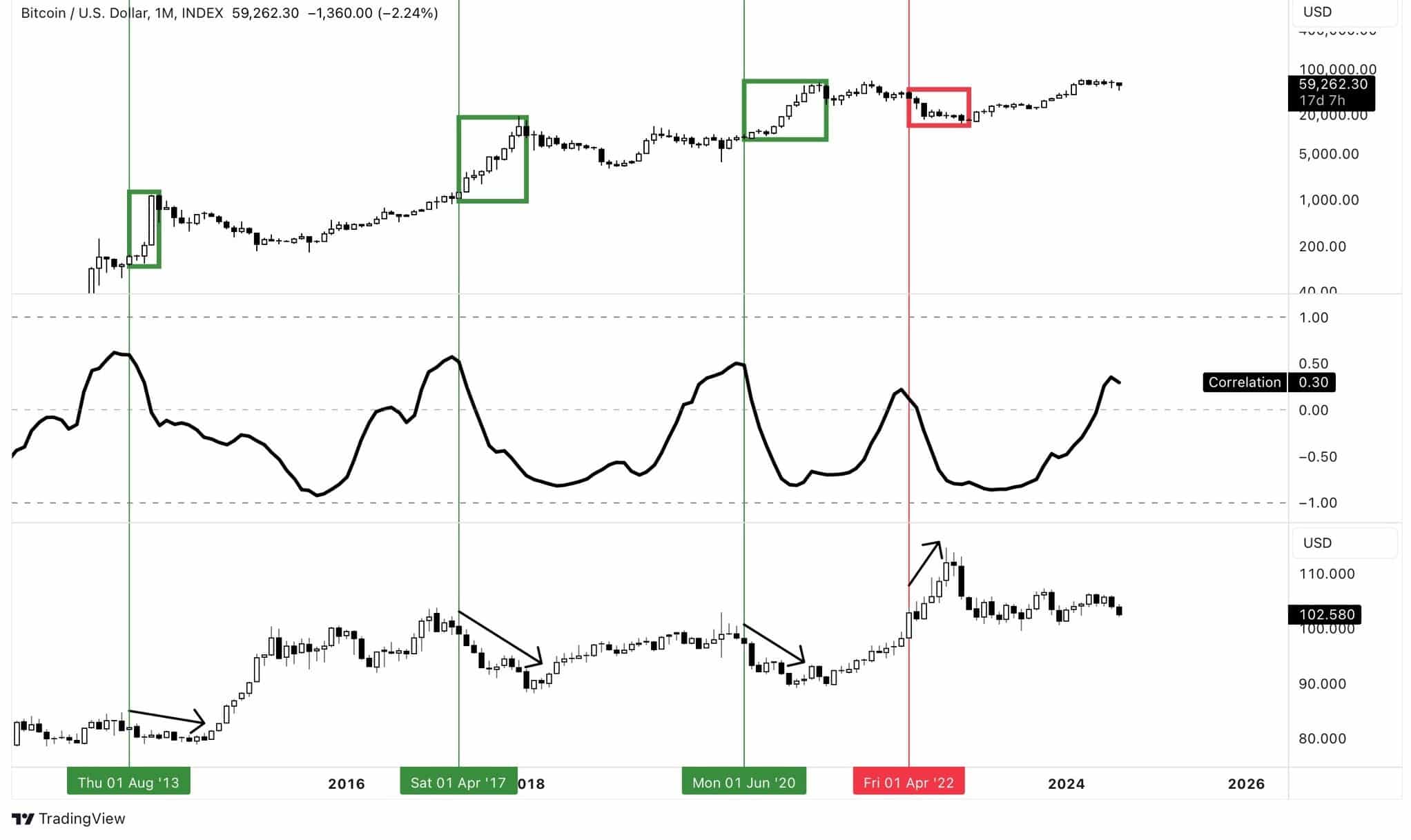

Examining Bitcoin’s (BTC) price chart in relation to the U.S. Dollar Index (DXY) and their correlation factor has uncovered an important trend: When BTC’s monthly correlation with the DXY shifts from a positive relationship, it typically indicates a significant change; however, the direction of this shift is not always clear.

Historically speaking, Bitcoin tends to complete its bullish phase about 75% of the time, while it experiences a decline during a bear market approximately 25% of the time.

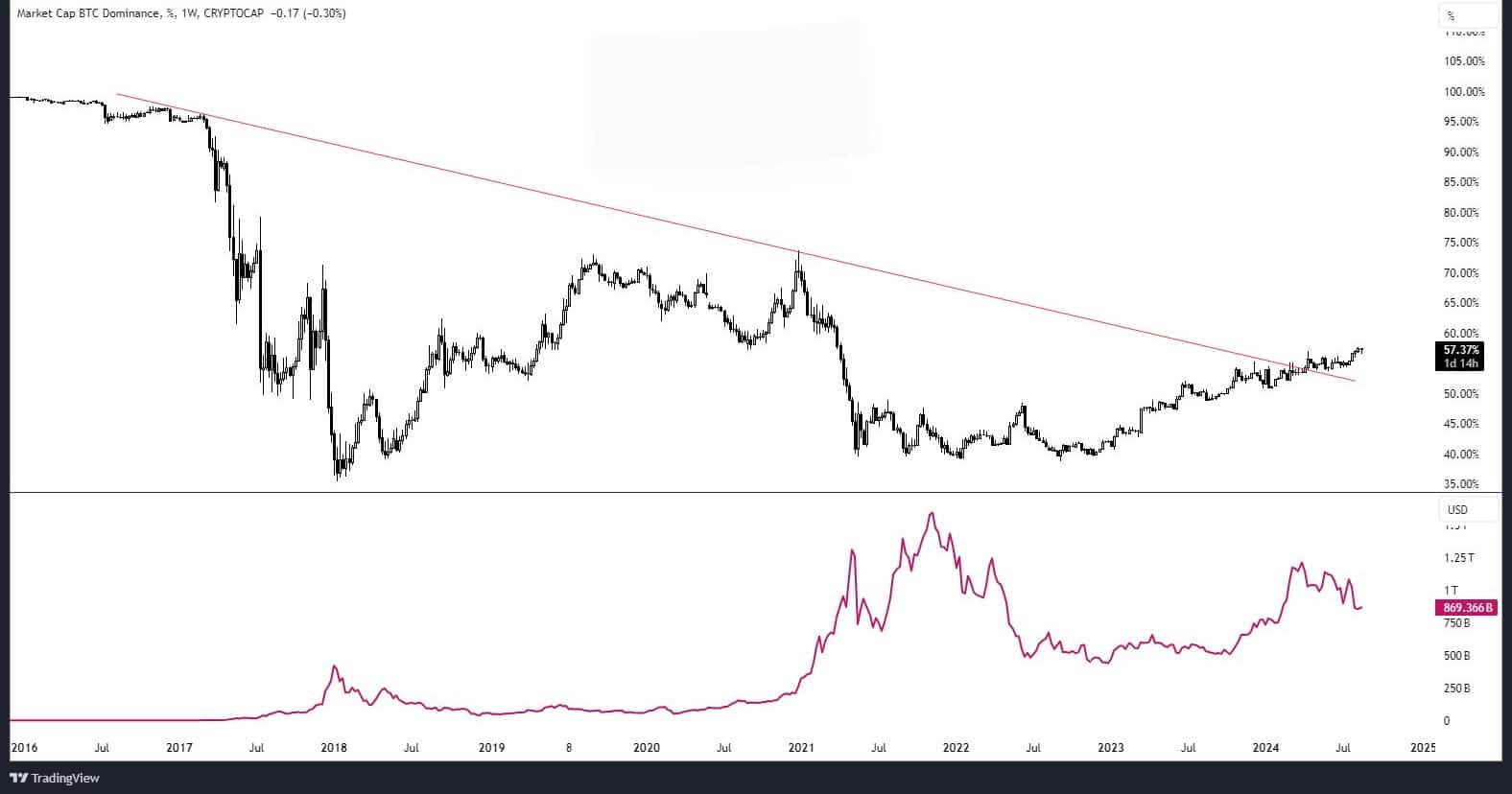

Several analysts are unsure about Bitcoin’s future trajectory, but AMBCrypto offers some insight. Initially, Bitcoin’s dominance chart for the week has broken free from a downward trendline, suggesting possible resilience or growth.

Regardless of the latest drops in Bitcoin’s price, it has managed to surge back up to around $60,000. In contrast, it seems that the market caps for alternative cryptocurrencies have reached their lowest points and are now showing signs of a rise.

From my personal observation and experience in the crypto market over the past few years, I strongly believe that Bitcoin and other cryptocurrencies may be gearing up for a substantial upward trend. The patterns and indicators that I have seen are reminiscent of previous bull runs, which have consistently led to significant gains for early investors. However, it is important to remember that the crypto market can be highly volatile, and while there is potential for impressive returns, there is also a risk of losses. Therefore, it’s crucial to approach any investment in cryptocurrencies with caution and careful research.

However, the Spot-Perpetual Price Gap on Binance from CryptoQuant remained negative, showing ongoing selling pressure on Bitcoin.

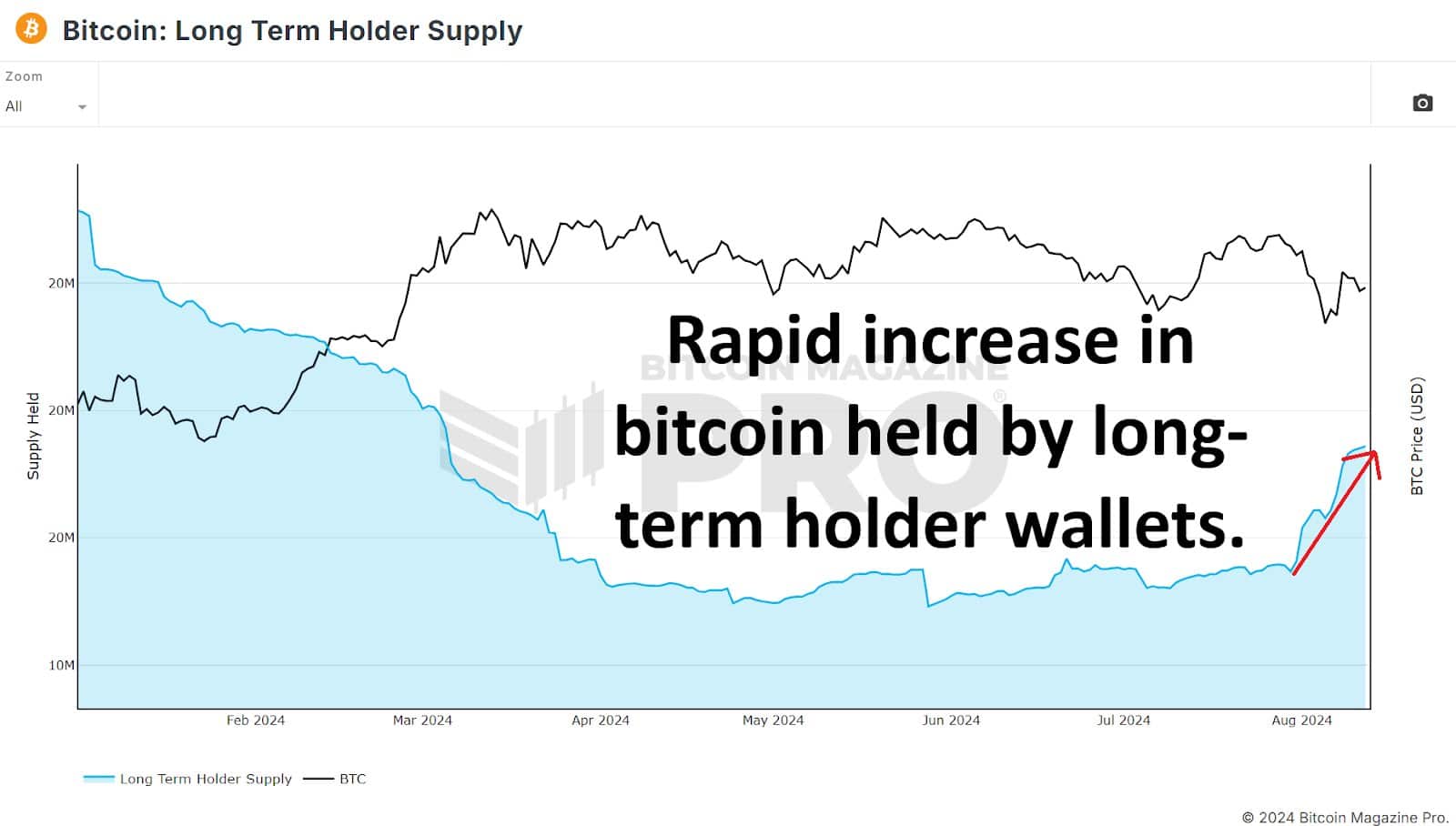

The substantial difference, fueled by forceful sell-offs and negative bets on the market, implied that the Bitcoin price might be approaching its true worth. This hinted at a possible investment chance for traders as Bitcoin seemed poised to rise further.

Bitcoin’s historical risk levels

The chart below highlights a risk level for Bitcoin, helping with long-term buying and selling points in the market. AT press time, the risk level was around 0.5, indicating low risk and a favorable buying opportunity.

In this area, it might be beneficial for traders and investors to explore the strategy of Dynamic Dollar-Cost Averaging, especially before risk factors escalate significantly, as indicators suggest that it could be advisable to sell more substantial amounts in the near future.

Furthermore, it’s worth noting that since July 30th, more than half a million Bitcoins have been transferred into long-term storage accounts. This suggests a positive outlook for Bitcoin as it indicates a growing demand and optimism among investors.

As a seasoned investor with over two decades of experience under my belt, I have witnessed various market trends come and go. However, the recent surge in Bitcoin accumulation by whales and institutions has caught my attention. Having seen the growth and evolution of digital currencies over the years, I am convinced that this development signifies a growing confidence in the future value of Bitcoin. In my opinion, this is not just a fad or speculative bubble, but rather a reflection of a fundamental shift in how we perceive and invest in value. As such, it is an exciting time to be part of this rapidly evolving landscape.

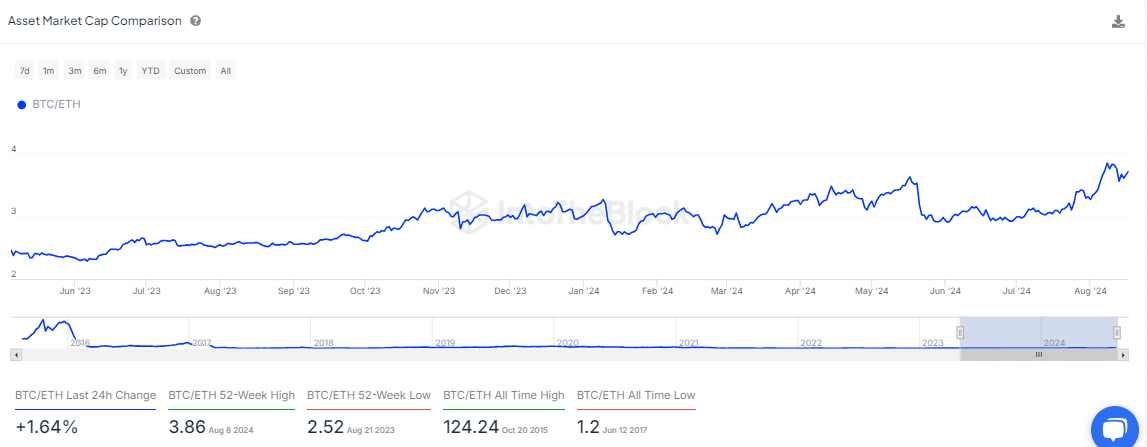

At the moment, Bitcoin appears to be growing more prominent than Ethereum. Over the course of August, we’ve seen a consistent rise in the Bitcoin-to-Ethereum (BTC/ETH) market capitalization ratio, suggesting a stronger buildup of the leading cryptocurrency.

This trend suggested that Bitcoin was poised for further upward movement.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-08-18 23:04