- Bitcoin rebounded strongly, trading at $65,796.33 at press time, with a 5.26% weekly growth.

- BlackRock’s Bitcoin ETF garners $23 billion in inflows, showcasing growing market confidence.

As a researcher with over a decade of experience in the financial market, I’ve seen my fair share of bubbles and bull markets. Yet, the rapid growth and acceptance of Bitcoin are something that even my most optimistic predictions didn’t foresee. The recent surge to over $65,000, coupled with BlackRock’s entry into the Bitcoin ETF market, is a testament to the cryptocurrency’s increasing legitimacy as an investment asset.

Bitcoin (BTC) has shown a robust recovery, managing to surge back above the bullish zone following a drop to approximately $60,000.

Currently valued at $65,796.33, the top cryptocurrency experienced a 1.40% increase over the past day and a 5.26% upward trend during the last seven days according to CoinMarketCap’s data.

BlackRock CEO appreciates Bitcoin’s potential

Observing this rising trend, the CEO of BlackRock, Larry Fink, emphasized Bitcoin’s growing credibility as a financial investment, implying that it’s emerging as a potential substitute for conventional commodities such as gold.

Remarking on the same, during BlackRock’s Q3 2024 earnings call, Fink said,

“We believe bitcoin is an asset class in itself.”

In his statement, Fink highlighted the importance of focusing less on regulatory issues and more on boosting acceptance and market liquidity as key drivers for growth and development in the market.

He added,

I strongly feel that the issue isn’t about whether there should be more or less regulation. Instead, I believe the key lies in liquidity and transparency, just as it was back in the early days of the mortgage market and the high-yield market.

What’s behind this success?

This achievement is largely due to the BlackRock Bitcoin ETF, which, following a decade of dedicated work, was recently given the green light. Since then, it’s been attracting substantial investments.

He further highlighted how the successful launch of the iShares Ethereum Trust, which garnered over $1 billion in net inflows within its first two months of trading.

In a span of nine months, BlackRock has amassed inflows worth $23 billion alongside its iShares Bitcoin Trust.

Analyst Ben Budish posed a query about what impact a pro-crypto government in Washington might have on the market, implying that possible regulatory adjustments could create additional chances.

Instead, Fink emphasized that it’s the wider acceptance and legitimacy of digital assets, not political changes or regulatory tweaks, that will fuel market expansion primarily.

He said,

“I do believe the utilization of assets are going to become more and more of a reality worldwide,”

From my standpoint as an analyst, I’m emphasizing the optimistic viewpoint that BlackRock holds regarding cryptocurrencies. This perspective also highlights the strategic part that cryptocurrencies are expected to play in shaping the investing landscape of tomorrow, given their rapid evolution.

How BlackRock is helping investors?

To clarify, Fink underlined that these products align with BlackRock’s broader goal of making investing more straightforward and affordable for a worldwide market.

“We will continue to pioneer new products to be making investing easier and more affordable.”

As a crypto investor, I believe that, much like traditional markets, the digital asset landscape will expand with the development of sophisticated analytical tools and valuable data insights.

“And I truly believe we will see a broadening of the market of these digital assets.”

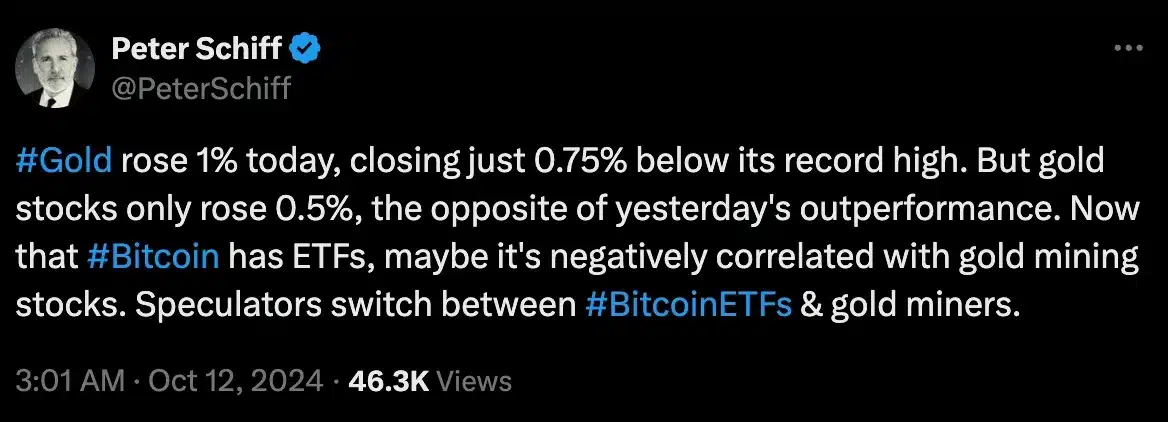

However, Bitcoin critic Peter Schiff voiced an alternative viewpoint when he said,

Schiff contends that, compared to Bitcoin, tokenized gold continues to be a more favorable choice according to him.

This viewpoint emphasizes the continuous discussion surrounding these two investments, as investors consider the potential advantages of Bitcoin’s increasing worth compared to Gold’s long-term worth.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Quick Guide: Finding Garlic in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- We Ranked All of Gilmore Girls Couples: From Worst to Best

2024-10-16 10:33