-

Ethereum’s price has fallen by nearly 9%, trading at $2,460 after peaking at $2,696 just a day earlier.

Analysts are divided on ETH’s next move, with some predicting a potential rebound and others warning of further downside.

As a seasoned crypto investor with a few battle scars and a well-stocked survival kit from the 2017 bull run, I find myself standing at the precipice of yet another market correction—this time with Ethereum [ETH]. The $2,460 price tag feels like a distant memory as we gaze upon the $2,696 peak just a day ago.

In the last 24 hours, Ethereum (ETH) has followed a similar pattern to Bitcoin‘s (BTC), experiencing a drop of almost 9%.

In my observations as a researcher, this recent economic slump caused Ether’s (ETH) value to dip significantly, reaching approximately $2,460 – a considerable decrease when compared to its peak of $2,696 that was observed merely the previous day.

The recent market behavior of cryptocurrencies has ignited intense debate and conjecture among industry specialists, revealing a range of perspectives about the potential future trajectory for the second most valuable cryptocurrency in terms of market cap.

Major rebound or further downside next?

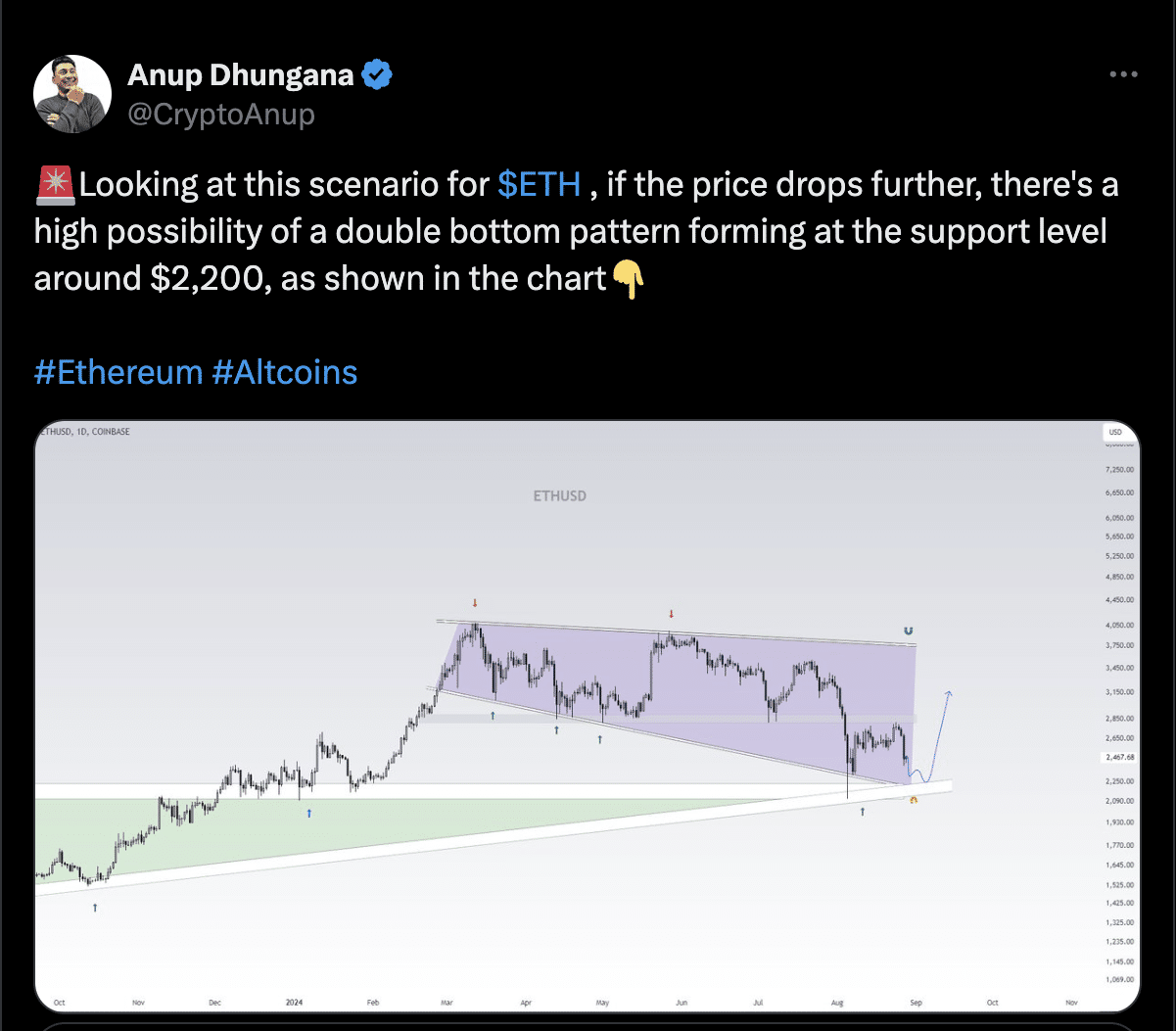

Notable cryptocurrency expert Anup Dhungana pointed out a possible decrease in the value of Ethereum.

Dhungana proposed that should the ongoing decline persist, there’s a possibility for Ethereum to create a double bottom formation around the $2,200 price floor.

At this price point, a pattern commonly interpreted as a sign of bullish reversal could indicate that Ethereum may establish a robust support base, possibly leading to an upturn in the near future.

As a crypto investor, if Ethereum manages to hold its ground at the $2,200 mark, it might indicate potential stability. Conversely, should it breach this support level, we could be looking at more downward price movements.

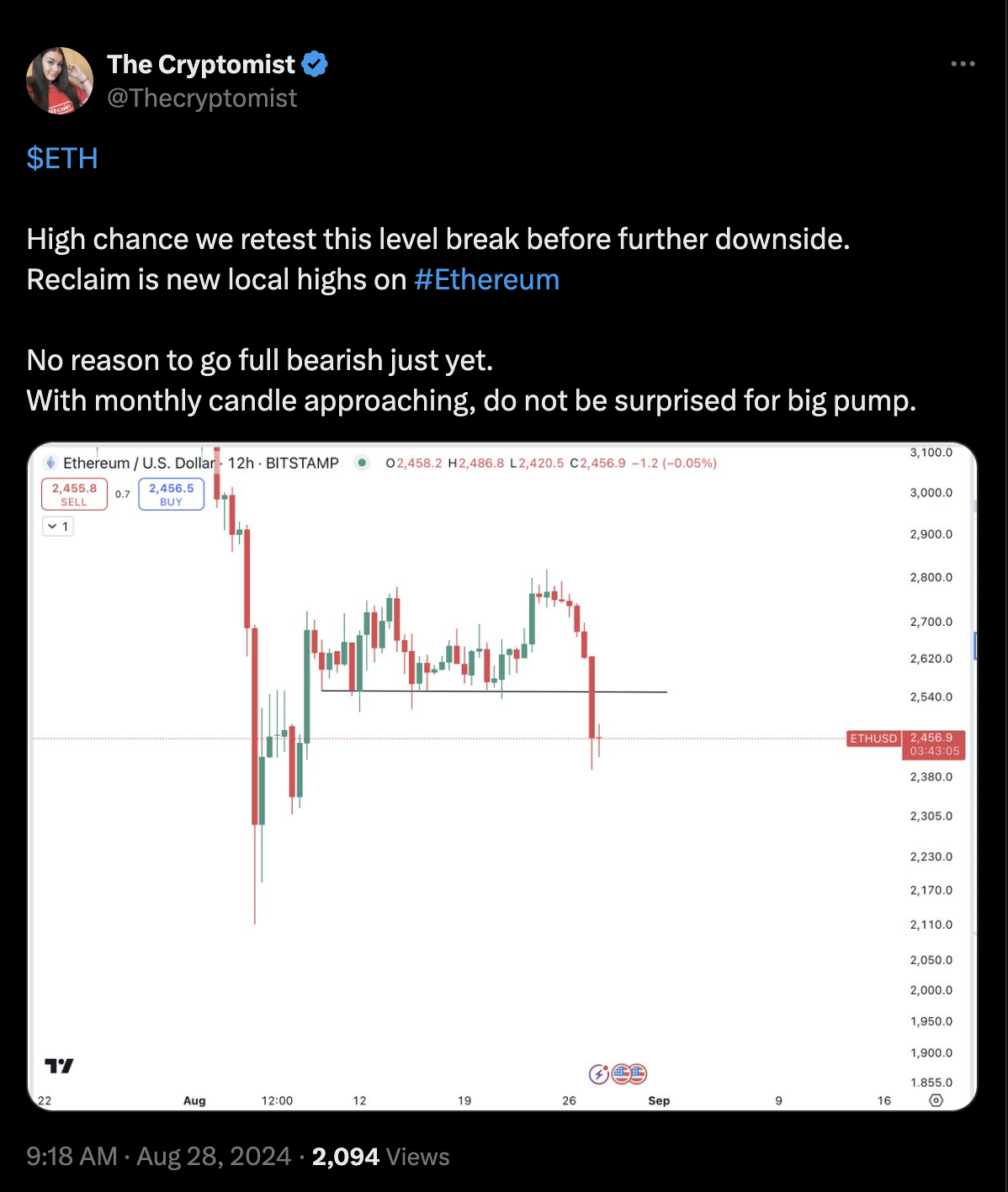

A popular analyst, often referred to as ‘The Cryptomist’, on platform X (previously Twitter), presented an alternative viewpoint, urging caution against becoming excessively pessimistic too soon.

Cryptomist observed that although it’s likely Ethereum might test its recent lowest point again, the approaching monthly price movement could potentially lead to a substantial increase in value.

From this perspective, it’s predicted that Ethereum could briefly recover before potential future drops, mainly because the market is preparing for the end of the monthly trading cycle.

What do Ethereum’s fundamentals suggest?

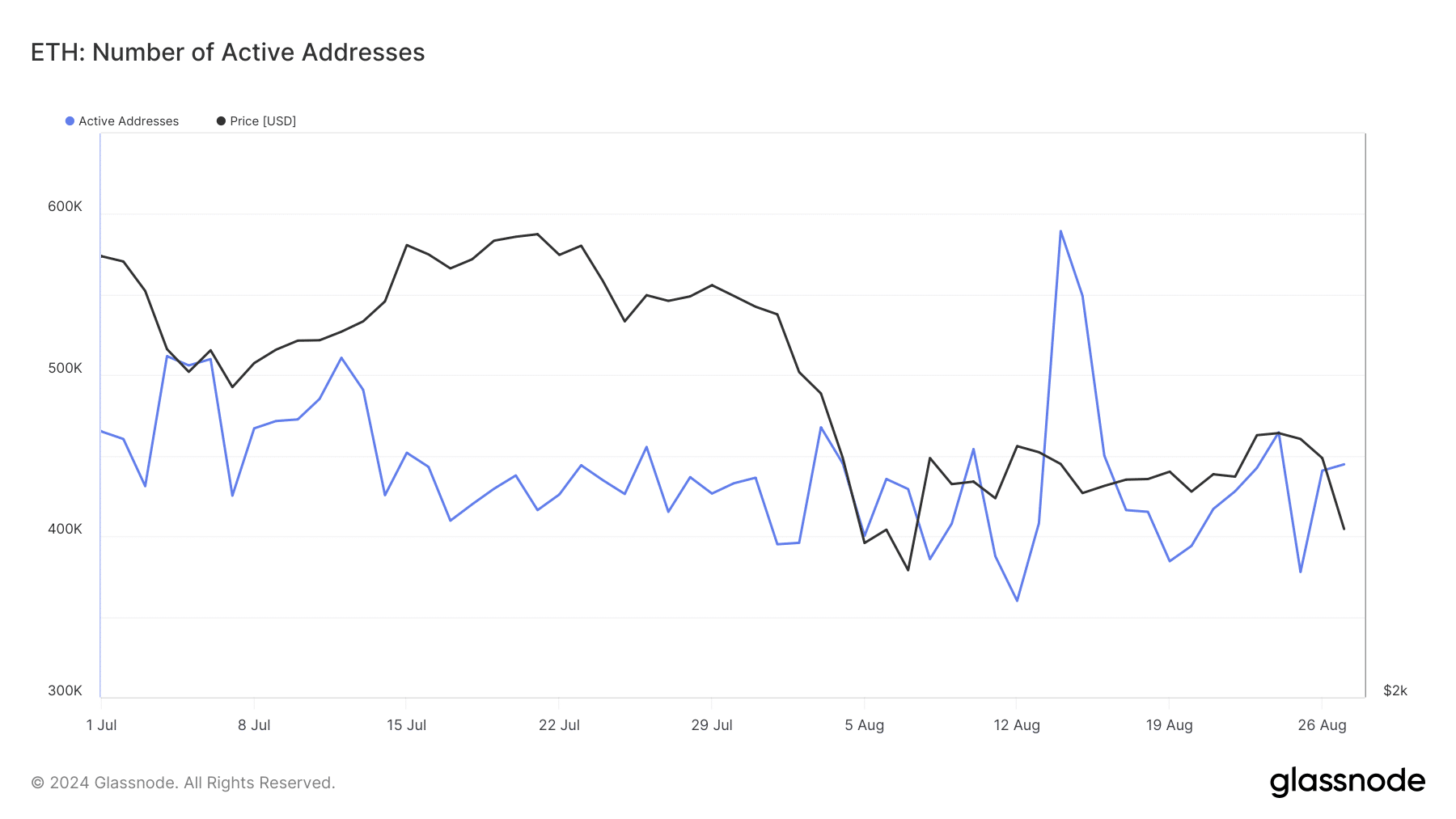

Besides examining its technical aspects, Ethereum’s underlying strengths exhibit a blend of positive and negative indications. As per information from Glassnode, the quantity of active Ethereum addresses has been erratic during the last month.

After a period of consolidation, this metric spiked to 589,000 on the 14th of August.

Since that point forward, I’ve observed a gradual decrease in the count of active addresses, with the figure standing at approximately 444,000 as we speak.

A potential reduction in active addresses may signal less network usage, which could potentially lower demand among users interacting with Ethereum, thus possibly leading to a decrease in its market value.

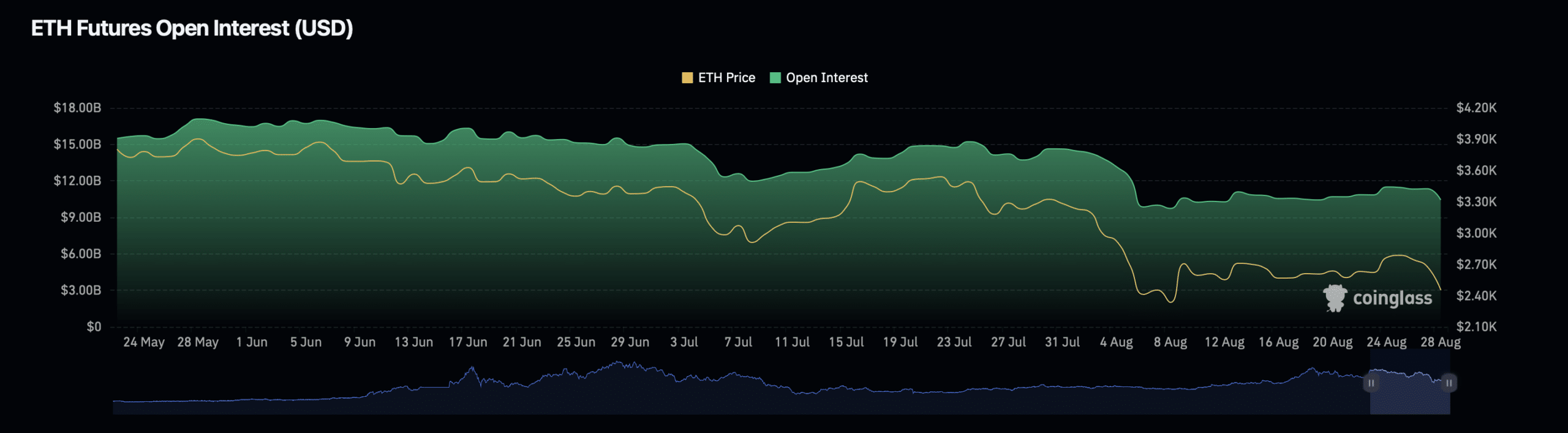

In contrast, Ethereum’s Open Interest data presented a more complex picture.

According to data from Coinglass, the amount of Ethereum derivative contracts currently in circulation, known as Open Interest, has dropped by approximately 7.42% within the last 24 hours. This decrease brings the current market value to around $10.60 billion.

A drop in Open Interest often indicates that traders are wrapping up their positions, possibly because they’re uncertain or lack faith in the immediate future price trends.

On the other hand, the Open Interest volume for Ethereum has experienced a substantial surge, escalating more than 100% to touch $38.97 billion.

Read Ethereum’s [ETH] Price Prediction 2024 – 2025

Although the Open Interest decreased, there was an increase in trading activity, suggesting a high level of speculation likely due to market participants reacting to the recent price decline.

Large amounts of trading activity tend to cause greater price fluctuations, so Ethereum may undergo additional significant price swings in the short run.

Read More

2024-08-28 18:16