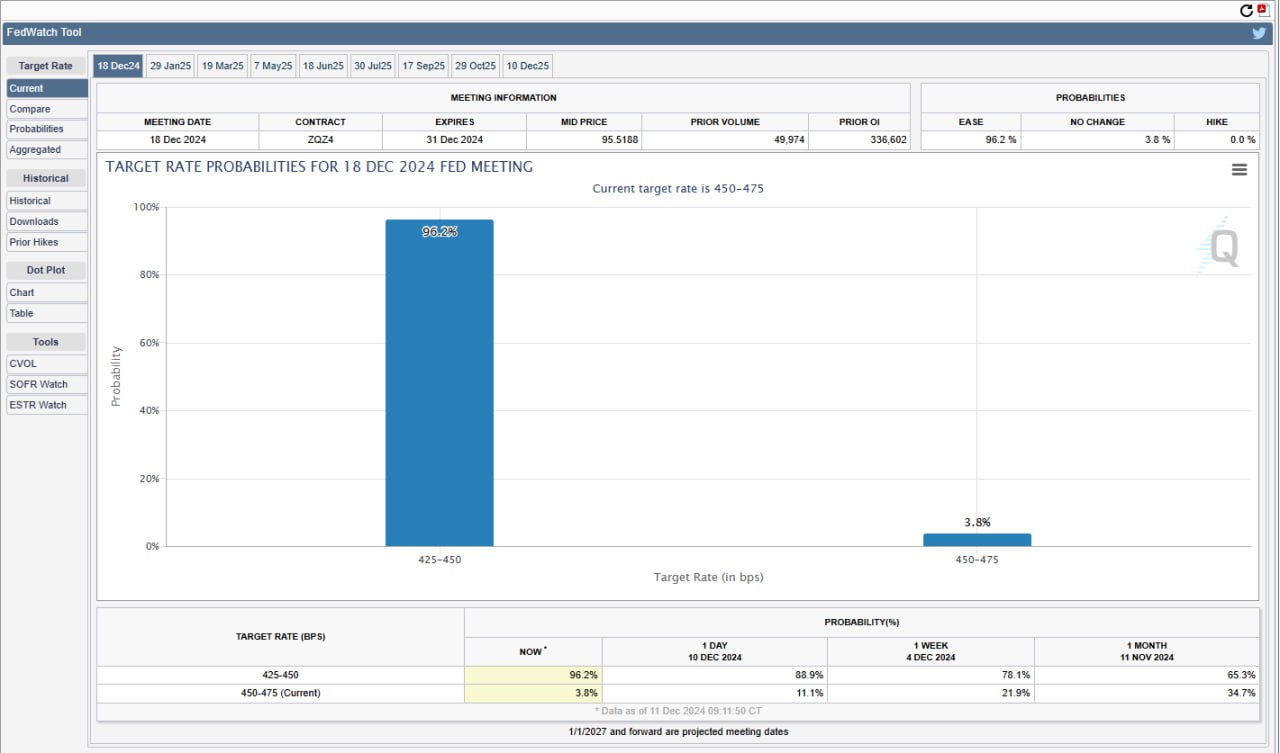

- The CME’s Fed Watch noted a 96% probability for a 25bps cut next week.

- Price action, liquidation zones and MVRV all signal potential rally continuation.

As a seasoned crypto investor with over a decade of experience under my belt, I can confidently say that the current market conditions seem to be shaping up quite favorably for Bitcoin [BTC]. The impending 25bps rate cut by the Federal Reserve, as suggested by the CME’s Fed Watch, has historically made cryptos more attractive. Lower rates reduce the appeal of yield-bearing assets and enable increased liquidity and institutional borrowing at lower costs.

According to the CME’s Fed Watch, there was a 96% likelihood that the Federal Reserve would reduce its interest rates by 0.25 percentage points in December.

This was an increase from 89% in the last 24 hours, as of press time, and 65% a month ago.

As a crypto investor, I should mention that there was merely a 5% possibility of no basis points (bps) change, and a mere 1% likelihood for an increase greater than 25 bps. This suggests a low expectation for such significant shifts in our investment landscape.

If inflation, excluding housing costs, is lower and overall inflation is slightly above the target, a reduction in the Federal Reserve interest rate might stimulate growth in alternative investment areas such as Bitcoin.

Historically, lower interest rates have made cryptocurrencies seem more appealing compared to traditional assets that offer returns (yield-bearing assets). This is because the lower rates reduce the attractiveness of these traditional assets. Consequently, this enhances the liquidity and affordability for institutions to borrow money at reduced costs when dealing with cryptocurrencies.

Therefore, an anticipated reduction in interest rates may indicate a positive trend for Bitcoin, implying that its price might keep rising as more money moves into this asset.

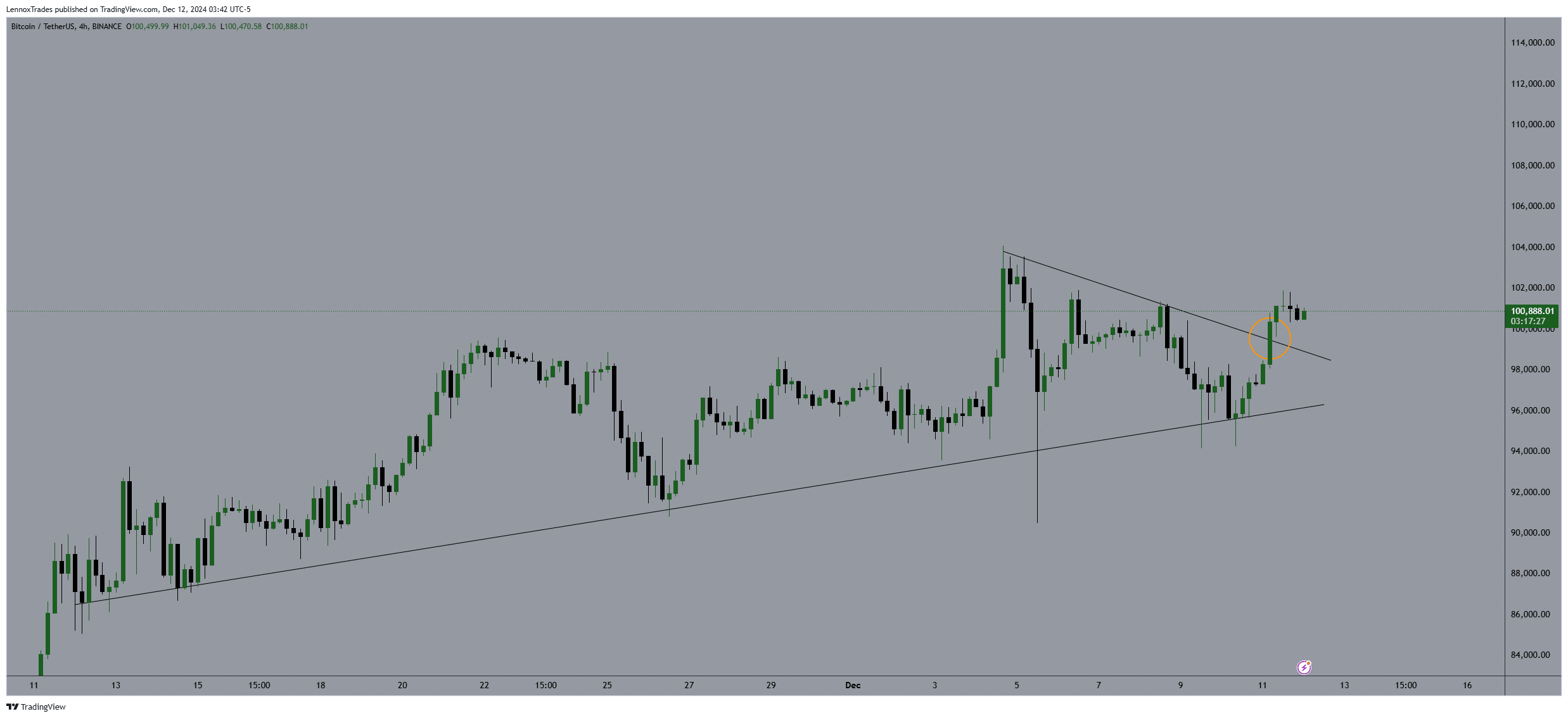

Price breaks from continuation pattern

Examining the 4-hour Bitcoin chart reveals a consolidation within a symmetrical triangle formation, a pattern indicative of ongoing price action, implying that the upward trend may persist.

The current direction of Bitcoin seems consistent with predictions that potential Federal Reserve interest rate decreases might trigger additional price surges.

The cost fluctuated more and more subtly as it bounced off two lines that were gradually coming closer, showing a period of consolidation prior to a significant shift. This upward shift hinted at a continued bullish trend.

Given that the Federal Reserve may lower interest rates, making the U.S. dollar less attractive, Bitcoin might seem more enticing for those seeking greater returns. If this rate cut happens as predicted, it could push Bitcoin’s value even higher.

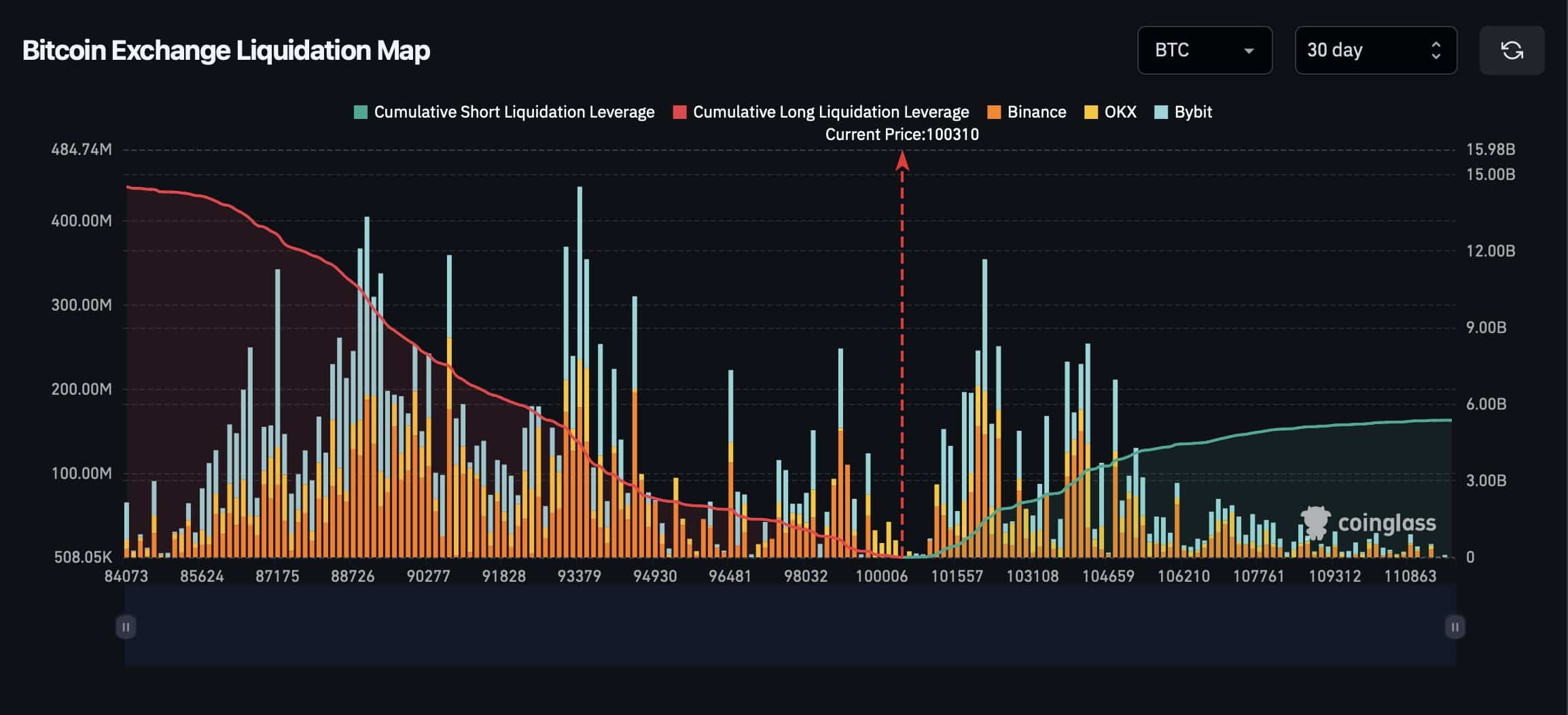

Liquidations and BTC MVRV

Once more, data from Coinglass revealed a significant clustering of leveraged trades potentially leading to liquidations at the present Bitcoin price level on platforms such as Binance, OKX, and Bybit.

Should Bitcoin climb above $105K, approximately $4.1 billion in Bitcoin short positions might face liquidation. This potentially intense selling by short sellers, forced to cover their positions, could further fuel the upward trend.

As the collective, prolonged bitcoin liquidation leverage continued to rise, it indicated a strengthening trend or surge in momentum.

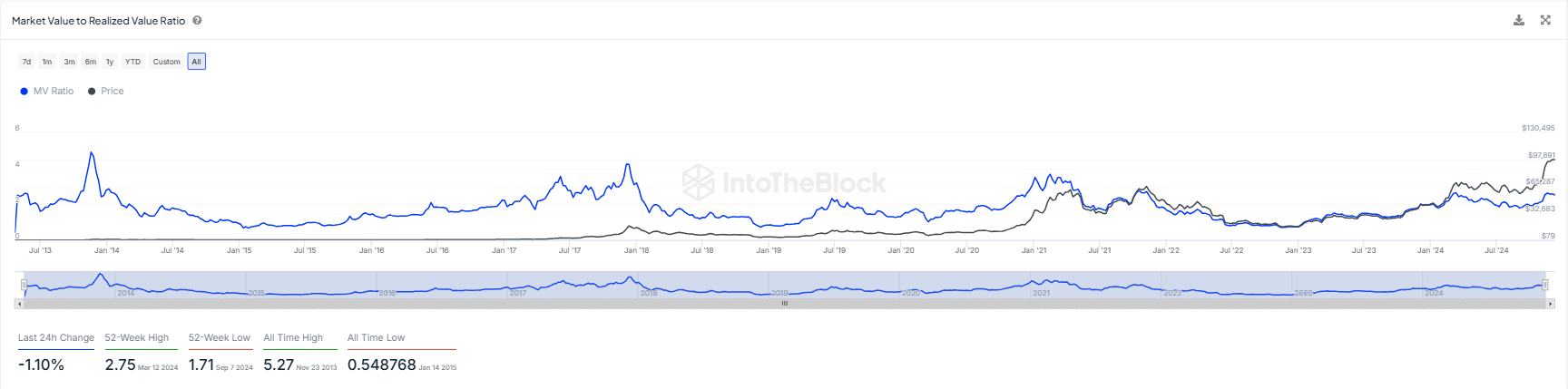

An examination of the MVRM (Market Value to Realized Value) revealed a figure of 2.53, implying that Bitcoin’s current market price was roughly 2.53 times greater than its actual worth.

During times of heightened market confidence, this ratio often reached its peak. Conversely, it would either stabilize or drop during the correction phases.

Read Bitcoin’s [BTC] Price Prediction 2024-25

It’s worth mentioning that the MVRV ratio hasn’t yet reached the highs seen in previous cycles, suggesting that Bitcoin’s current market value might not be at its peak.

Lowering interest rates by the Federal Reserve might stimulate interest in Bitcoin. Consequently, this could lead to an increase in its value and the MVRV (Market Value to Realized Value) ratio, as more investors pour money into it. This suggests a positive forecast for Bitcoin, although there’s currently no clear indication of a price peak.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-12 14:48