-

The German government has once again transferred a notable 1,000 BTC worth $55.8 million to crypto exchanges and unmarked wallets.

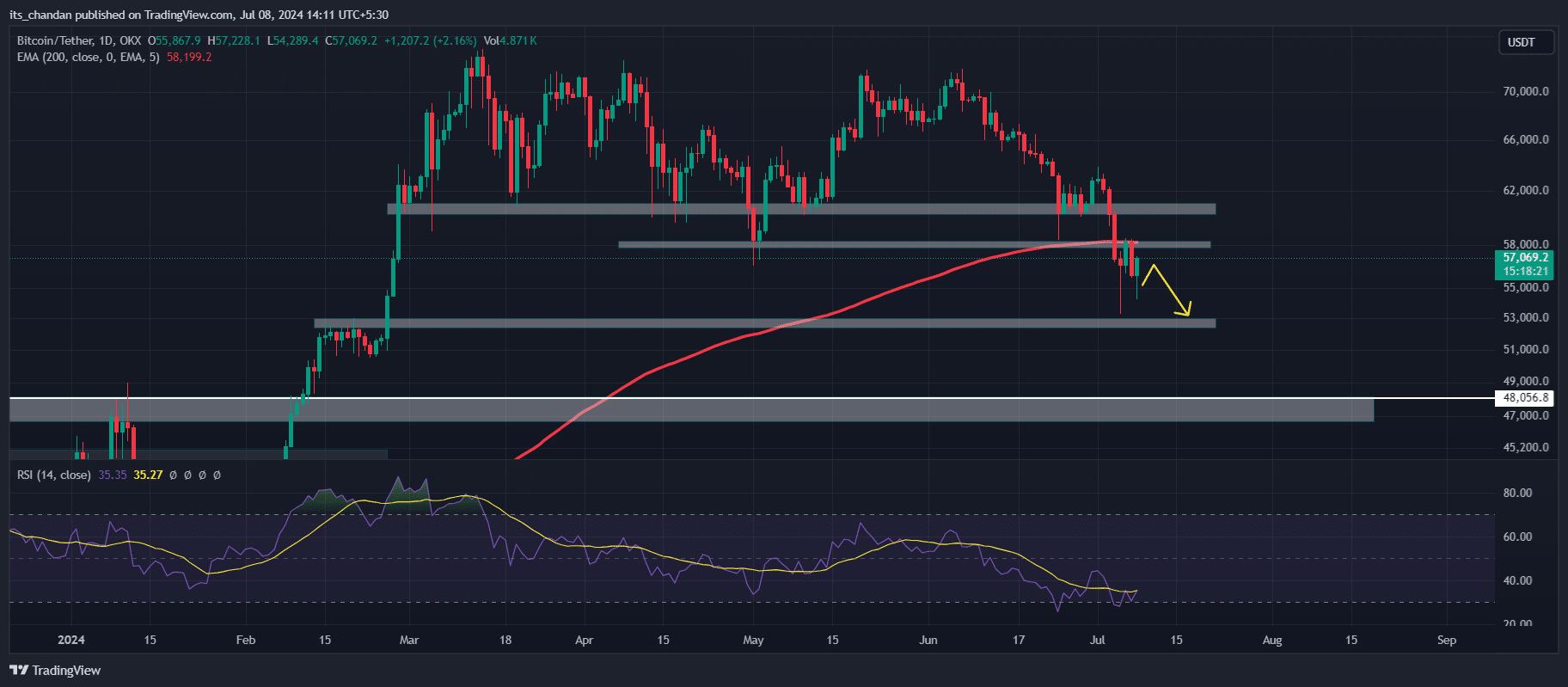

Bitcoin was bearish at press time, moving below the 200-day EMA, with a high possibility of hitting the $52,800 level.

As an experienced financial analyst, I find the recent actions of the German government regarding Bitcoin transfers to be concerning, especially during this bearish market phase. The continuous transfer of significant amounts of Bitcoin to exchanges and unmarked wallets has a negative impact on the market sentiment and can cause further price drops. In the last few weeks, we have seen Bitcoin falling by more than 15% since the German government started this trend.

🚀 Trump Effect: EUR/USD Primed for Wild Swing?

Expert predictions show massive EUR/USD reaction to Trump's latest tariff agenda!

View Urgent ForecastIn simple terms, the cryptocurrency market has shifted to a downward trend once more. Notable coins like Bitcoin [BTC], Ethereum [ETH], and Solana [SOL] have suffered losses of approximately 2.5% for BTC, 2.7% for ETH, and a significant 4.5% drop for SOL.

In the midst of the current market slump, I, as an analyst, can report that the German government has recently transferred a significant amount of Bitcoin, equivalent to around 1,000 BTC or approximately $55.8 million based on current market prices, according to data from blockchain intelligence firm Arkham.

German government dumps another 1,000 BTC

Based on Arkham’s analysis, I found that out of the 1,000 Bitcoin transferred by the German Government, approximately half – 500 Bitcoin – ended up in the digital wallets of cryptocurrency exchanges such as Bitstamp and Coinbase. This equates to a value of around $27.9 million.

At the same time, approximately 500 Bitcoins valued at around $27.9 million were moved to the unidentified wallet address “139PoP.”

As a researcher studying cryptocurrency transactions, I’ve noticed an intriguing pattern since the 19th of June. The government has moved substantial amounts of Bitcoin to various exchanges using the same wallet address.

As an analyst, I would interpret the given unmarked wallet address “139PoP” in the following way: This address could potentially be associated with an institutional or over-the-counter (OTC) services provider.

Impact of the dump

The ongoing transfers of Bitcoin by the German government have significantly influenced the cryptocurrency market.

Starting on the 19th of June, Bitcoin (BTC) experienced a significant decline, dropping by over 15% from its previous high of $65,200. The cryptocurrency reached its lowest point during this time at $53,269 as indicated by TradingView.

On the Fourth of July, Justin Sun, the founder of Tron (TRX), proposed a private purchase of approximately $2.3 billion worth of Bitcoin held by the German government to prevent market disruption.

However, it appears that the government has ignored Sun’s offer.

As an analyst examining historical data, I can observe that if the current trend of Bitcoin (BTC) transfers in the market persists, it’s likely that Bitcoin’s price may decrease significantly.

Bitcoin technical analysis and key levels

As an on-chain analyst, I’ve observed a bearish trend for Bitcoin based on its price action. Specifically, the cryptocurrency experienced a significant breakdown below key support levels around $58,000. After retesting that price point, it formed a large bearish candle, further solidifying the downward momentum.

Additionally, Bitcoin’s price trend deviated from the 200-day Exponential Moving Average (EMA) line on the daily chart, indicating a potential bearish outlook.

It’s quite likely that Bitcoin (BTC) will hit the $52,800 mark, acting as its next line of defense.

As a crypto investor, I’ve noticed the downtrend in the market based on the chart’s indicators. However, I’ve also observed that the Relative Strength Index (RSI) has dipped into oversold territory. This finding implies that the cryptocurrencies may have been undervalued and could potentially bounce back, making it an opportune moment for a strategic investment.

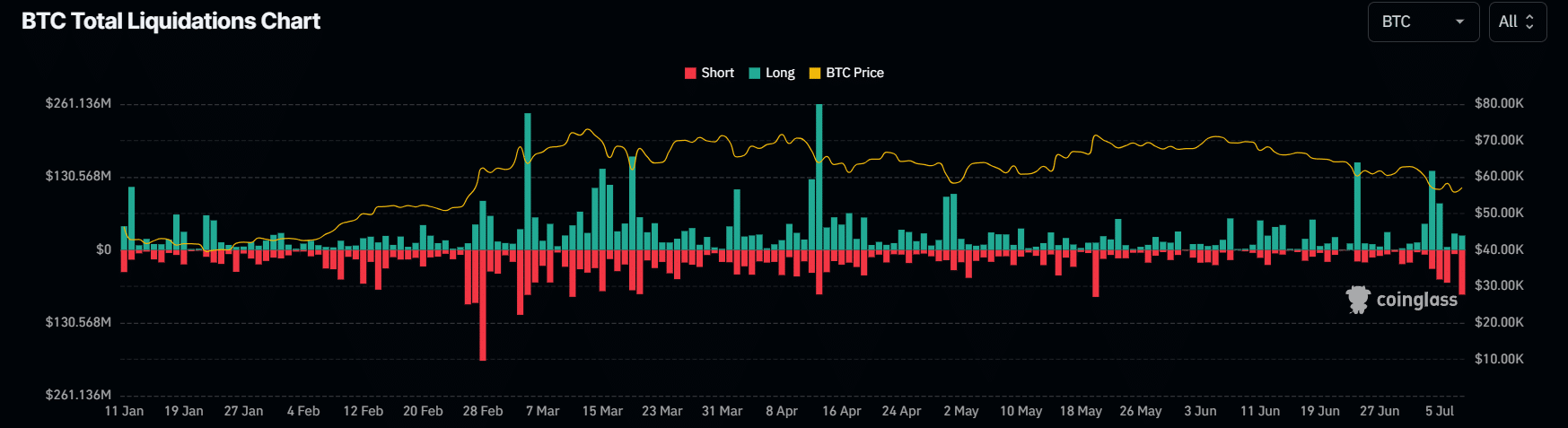

Short liquidation turns higher

In contrast, while bulls have sold off $46.97 million in long positions after the recent decline, short sellers have liquidated over $86 million worth of their short positions, as reported by data from Coinglass.

A larger-than-usual volume of brief market sell-offs suggested that buyers remained active in the market. Conversely, a decrease of 4.3% in Open Interest hinted at growing apprehension amongst traders.

Realistic or not, here’s TRX market cap in BTC’s terms

From my current perspective as a researcher, Bitcoin’s price stood around $56,000 at the time of writing this. However, within the previous 24 hours, there was a notable decrease of over 2.5%, causing the cryptocurrency to plummet down to a low of $54,400.

As a crypto investor, I’ve observed that Bitcoin (BTC) experienced a setback in the past week, with its value decreasing by approximately 10%. Moreover, over the past month, BTC has seen a more significant decline, shedding around 18% of its worth.

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

- Masters Toronto 2025: Everything You Need to Know

2024-07-08 13:44