-

If NEAR overcomes selling pressure at its local resistance, it might set a trajectory towards $5.3.

Market sentiment was bullish as NEAR showed positive reactions within a descending channel.

As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I’ve learned to read between the lines when it comes to market trends. And let me tell you, Near Protocol [NEAR] has been catching my eye lately.

Over the past week, the value of Near Protocol (NEAR) has shown remarkable growth, climbing up by 11.51% to reach a current price of approximately $4.28.

Its trading volume followed suit, reaching $210 billion—a 4.21% increase.

As a crypto investor, I’m finding myself intrigued by the possibility that NEAR‘s price may still be climbing, given my observations at AMBCrypto. Several elements suggest that there could be more upward momentum for NEAR in the coming days.

NEAR is geared for a rally

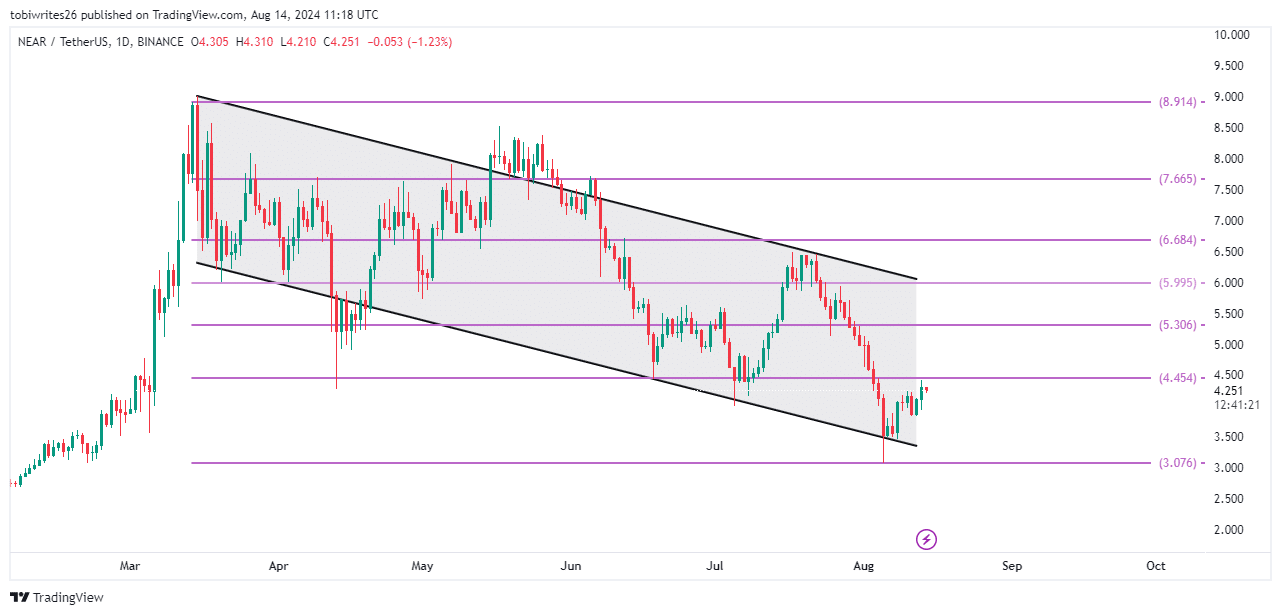

As an analyst, I’ve noticed that NEAR has been confined within a descending channel for several weeks, hinting at a potential breakout. Notably, it bounced back from the channel’s bottom line, causing a surge in its trading value. This rebound could be a sign of things to come.

An angled pattern called a falling or descending channel can be recognized by straight lines running parallel to each other and sloping downwards. These lines are drawn through successive higher highs (peaks) and higher lows (valleys), but lower highs and lower lows for the pattern. When the price reaches the bottom line, as in the case of NEAR, it typically initiates a brief surge or rally.

The possibility of NEAR experiencing an upward surge depends on it successfully breaking through the resistance level marked by the Fibonacci retracement at approximately $0.454.

Breaking this level could clear the path to $0.53, wherein lies notable selling pressure.

If NEAR doesn’t manage to surpass the resistance at $0.454, there’s a possibility it could drop more, leading to the formation of a new lower minimum price level.

Despite the fact that the market conditions seem favorable for an increase in price (bullish action), it suggests a significant number of buyers (bulls) are poised and ready to drive the prices upward, as evidenced by other signals.

Bulls are gaining ground

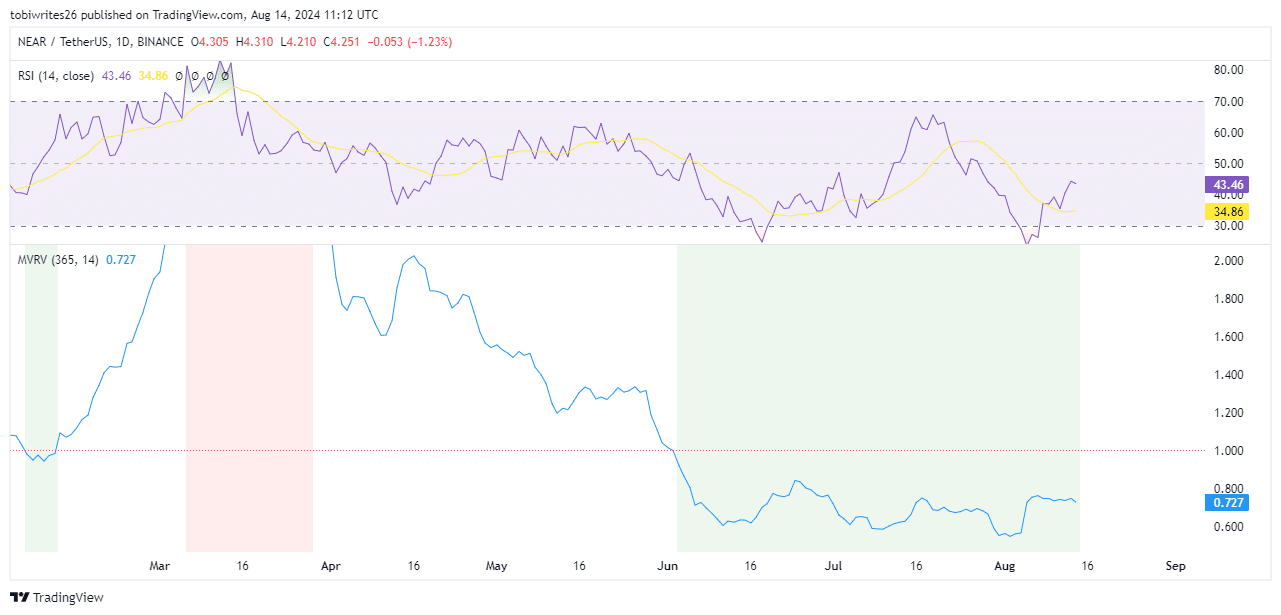

The Relative Strength Index (RSI) is a useful instrument for pinpointing situations where an asset’s price has risen too rapidly, indicated by values exceeding 70, which we call “overbought”; on the other hand, it highlights periods of excessive price declines, or “oversold” conditions, when the RSI falls below 30.

At present, the reading of 43.46 on NEAR indicates a growing bullish trend, which might propel the price towards the upcoming significant resistance point.

The Market Value to Realized Value (MVRV) ratio, which assesses whether an asset is overvalued or undervalued by comparing market capitalization to realized capitalization, stood at 0.727.

At the current moment, this suggests that NEAR is being underestimated, pointing towards an excellent chance for optimistic investors to make profitable investments.

Increasing interest among bulls

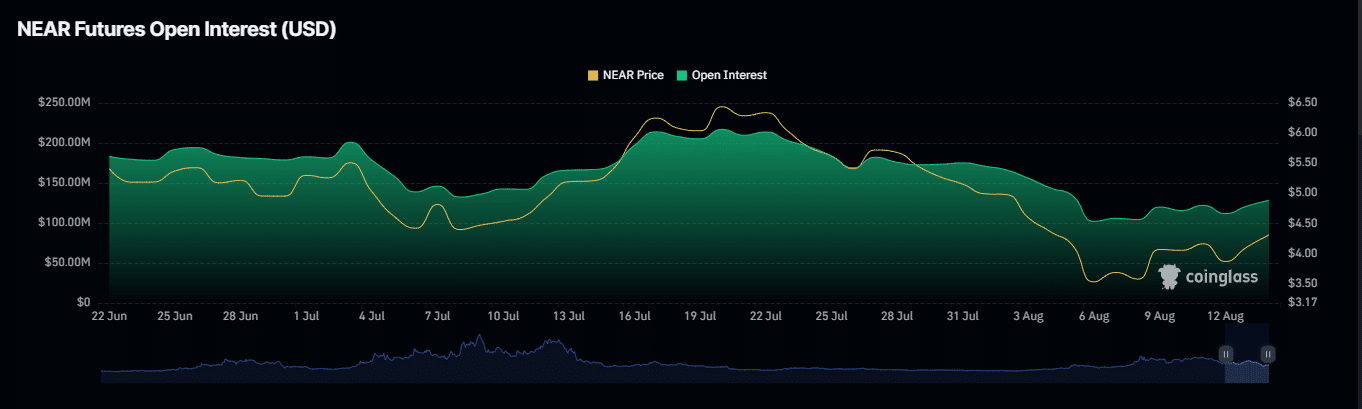

The value of Open Interest on the NEAR platform has noticeably risen, currently sitting at approximately $126.12 million following a 7% surge, as reported by Coinglass.

As an analyst, I find that open interest, which represents the outstanding number of unfilled derivative agreements like Futures and Options, offers valuable insights into market liquidity and investor attitudes. By revealing capital transactions happening within the market, it helps me gauge the flow of funds in our financial ecosystem.

As an analyst, I’ve observed a persistent upward trajectory in Open Interest since its dip on the 6th of August, which indicates a sustained level of investor enthusiasm and a continuous flow of capital. At this very moment, this trend has reached its peak.

Maintaining this current trend might have a substantial impact on the price of NEAR, potentially pushing it towards the next potential resistance level at around $0.53.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-08-15 11:07