-

PEPE tested key support levels, drawing parallels to its April price behavior for potential future gains.

Despite recent declines, PEPE saw an active trading with a 24-hour volume of $1.29 Billion.

As a seasoned crypto investor with battle scars from countless market cycles, I can confidently say that watching PEPE [PEPE] dance around its key support levels has become akin to a rollercoaster ride I never want to get off. The parallels drawn between current price behavior and April’s price movements have me reminiscing about the good old days when PEPE was just another memecoin trying to find its footing.

During the recent market slump, PEPE [Pepe] has proven to be one of the strongest cryptocurrencies. Renowned for its natural expansion, this meme coin has continued to exhibit a positive trend, catching the eye of financial experts.

Currently, PEPE is assessing a significant support point, prompting some analysts to liken its actions to those seen in April.

Key support levels and price action

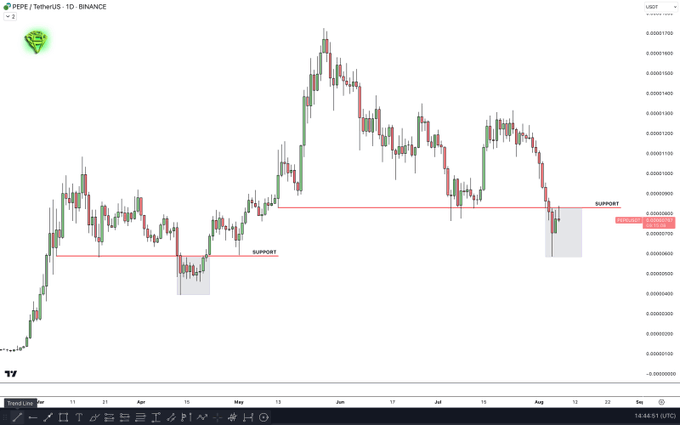

At the current moment, PEPE was making an effort to regain a crucial support point near 0.00000080 USD, according to analyst Sjuul’s analysis on AltCryptoGems.

On the platform X, formerly known as Twitter, Sjuul recently made an analogy between the present market conditions and the price fluctuations of PEPE observed in April. Specifically, he pointed out a resemblance.

“Observe PEPE‘s price chart from April, just before its remarkable surge to a record peak. Notice that it required a few days for PEPE to establish a solid base before it started increasing.”

Based on an examination by AMBCrypto using TradingView data, the token PEPE repeatedly checked a potential support point around 0.0000060 USD several times from March to May.

Following the establishment of its backing in May, I’ve observed a significant upward trajectory in the memecoin’s value. This historical trend provides a frame of reference for the recent price fluctuations and offers insights into possible future dynamics.

Sjuul’s analysis emphasized the importance of patience in market bottoms.

As I delve into the intricacies of market analysis, I’ve observed an interesting pattern: Prices tend to accumulate or consolidate for a while before making substantial shifts, much like how bottoms gradually form over time. This insight is derived from my examination of historical data.

Based on this understanding, it seems that PEPE might need some time to define a fresh resistance or support level before any possible uptrend could occur.

At this moment, the value of PEPE stood at $0.057725, representing a 4.14% drop in the last 24 hours, and a more substantial decrease of 26.84% over the previous week.

In the past 24 hours, there was significant trading activity amounting to approximately $1.3 billion, demonstrating active participation by investors even after a recent decline in price. Given that there are around 420 trillion PEPE tokens circulating, this translates to a market capitalization of roughly $3.3 billion for the token.

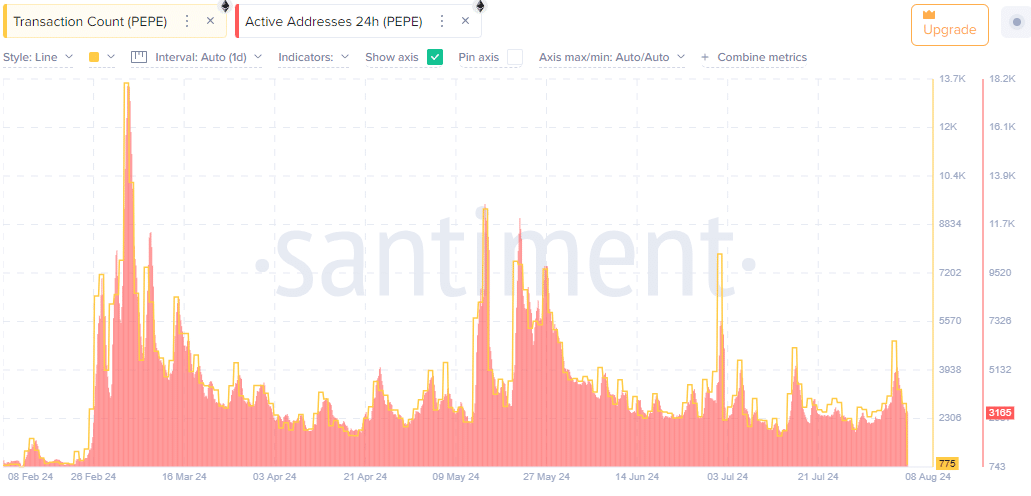

Over the course of the year, PEPE was associated with 775 active accounts and 3,165 transactions, exhibiting varying patterns that included significant surges at various points.

These statistics show active engagement within the PEPE network, even during a general market slump.

Market liquidity and open interest

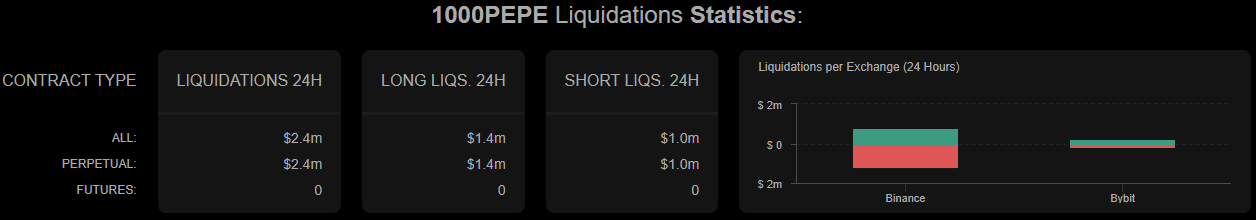

Over the last day, a total of $2.4 million worth of PEPE market assets were liquidated. Out of this figure, $1.4 million was due to long position holders, while short position holders accounted for $1 million in liquidations. This suggests that there has been substantial trading activity and the possibility of price fluctuations may be high.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

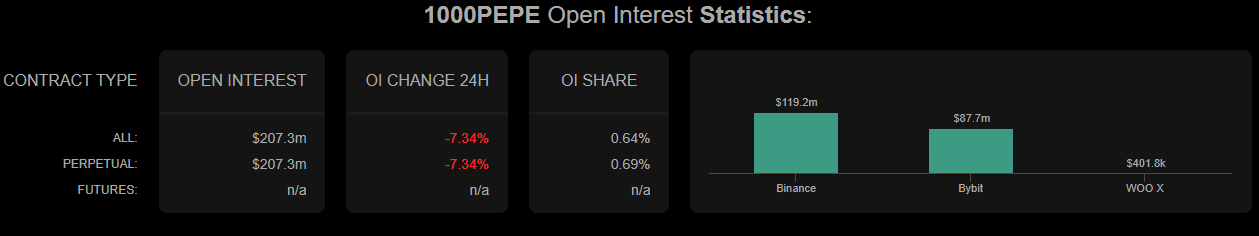

Moreover, according to data from Coinalyze, there was a 7.34% drop in open positions (OP) for the token PEPE within the past 24 hours.

As an analyst, I observed a decrease in Open Interest (OI) and a steady price trend, which hinted at a potential increased risk of a price drop for PEPE in the short run.

Read More

2024-08-09 00:40