As a long-term crypto investor with experience in the market, I’ve seen my fair share of regulatory battles and price fluctuations. The latest development in the Ripple vs. SEC saga has left me feeling uneasy about XRP‘s future.

The conflict between Ripple (XRP) and the US Securities and Exchange Commission (SEC) over their long-standing disagreement remains unresolved.

In response to the SEC’s recent filing, Ripple’s arguments were contested and the regulatory body requested injunctions against the company. This legal clash has led to a shift in the trend for XRP back towards bearish prices.

SEC fires shots in latest reply to Ripple

The Securities and Exchange Commission (SEC) has responded in the ongoing legal dispute between it and Ripple, filing their final arguments regarding the case’s resolution. In this submission, the SEC contested Ripple’s assertion that they had acted without negligence during the proceedings.

The company contested the court’s earlier ruling that there was a lack of clarity concerning the legal classification of XRP, despite their unsuccessful attempt to use the “fair notice” argument in its defense.

In the past, it was decided that XRP did not qualify as a security, which went against the SEC’s perspective. Nevertheless, the SEC remained convinced that the company might repeat such behaviors in the future.

Based on previous experiences, the SEC maintains that its promises to modify conduct following a lawsuit are insufficient grounds for foregoing injunctions.

As an analyst, I’ve reviewed the most recent SEC filing, and I can tell you that the Securities and Exchange Commission (SEC) remains firm in its accusations against Ripple. The regulatory body is actively pushing for an unfavorable decision against the company.

In reaction, Ripple’s Chief Legal Officer, Stuart Alderoty, accused the Securities and Exchange Commission (SEC) of overlooking the law. However, he remained hopeful that the ongoing legal case would soon come to a close.

Ripple drops below the neutral line

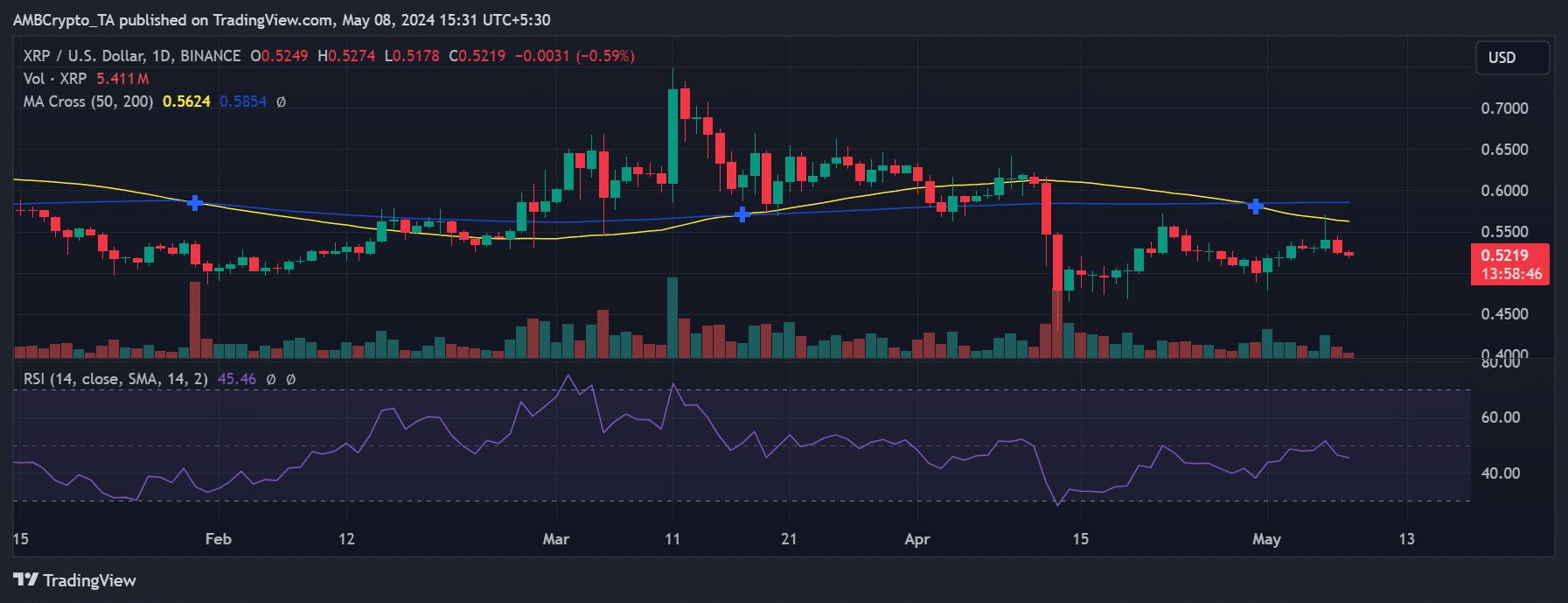

As a crypto investor, I closely monitor XRP‘s price movements through AMBCrypto’s analysis. On the 7th of May, I noticed a nearly 3% dip in XRP’s value. When I checked the daily timeframe chart, I confirmed a 2.83% decrease. At that moment, XRP was trading around $0.52.

The downward trend of Ripple was reinforced by this decrease, as indicated by its Relative Strength Index (RSI). Previously, Ripple had barely surpassed the neutral mark on the RSI due to a minimal 1.8% rise.

At present, the item in question was priced approximately at $0.52 during composition of this text, marking a minimal reduction of under 1%. Moreover, the Relative Strength Index (RSI) took a downward turn, moving even farther below the neutral threshold, suggesting an intensifying bearish tendency.

Volume remains in the $1 billion threshold

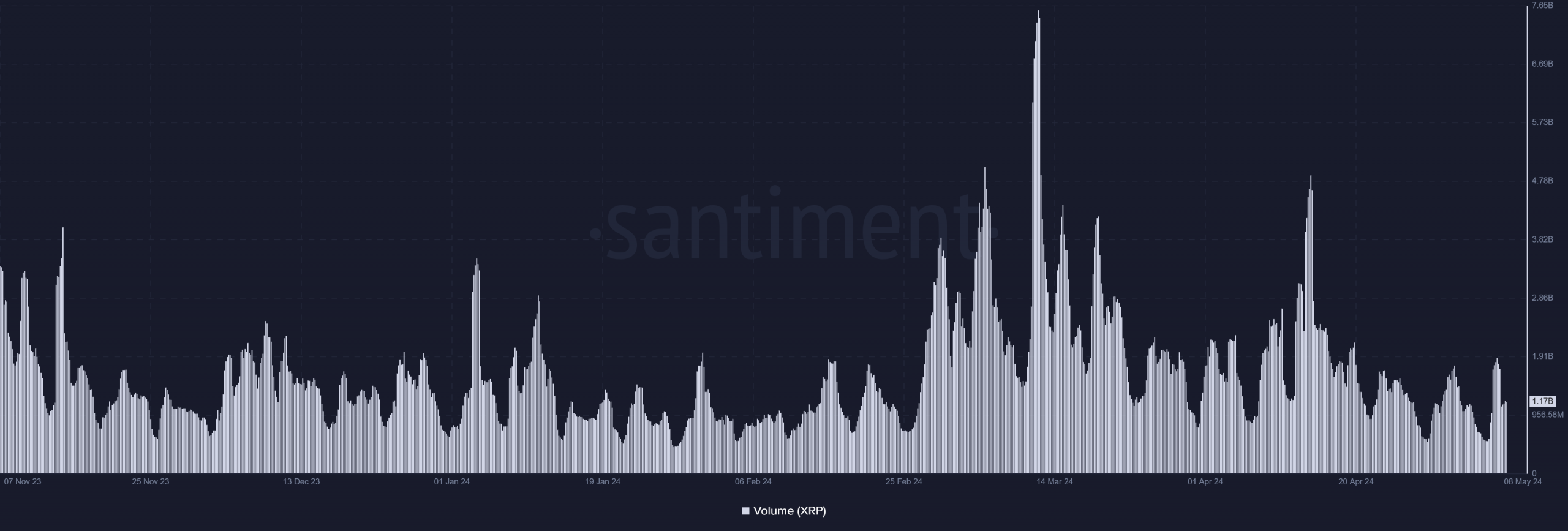

At press time, Ripple’s trading volume has notably decreased.

Realistic or not, here’s XRP market cap in BTC’s terms

The volume had decreased significantly, dropping from approximately $1.8 billion during the last trading session to around $1.17 billion when it stayed below the $1 billion mark.

The decrease in trading volume indicates a decrease in market activity for this asset, aligning with the downward trend noticed over the last few weeks.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-05-08 22:15