- SingularityNET, Fetch.ai,and Ocean Protocol native tokens merged to create the ASI cryptocurrency in July.

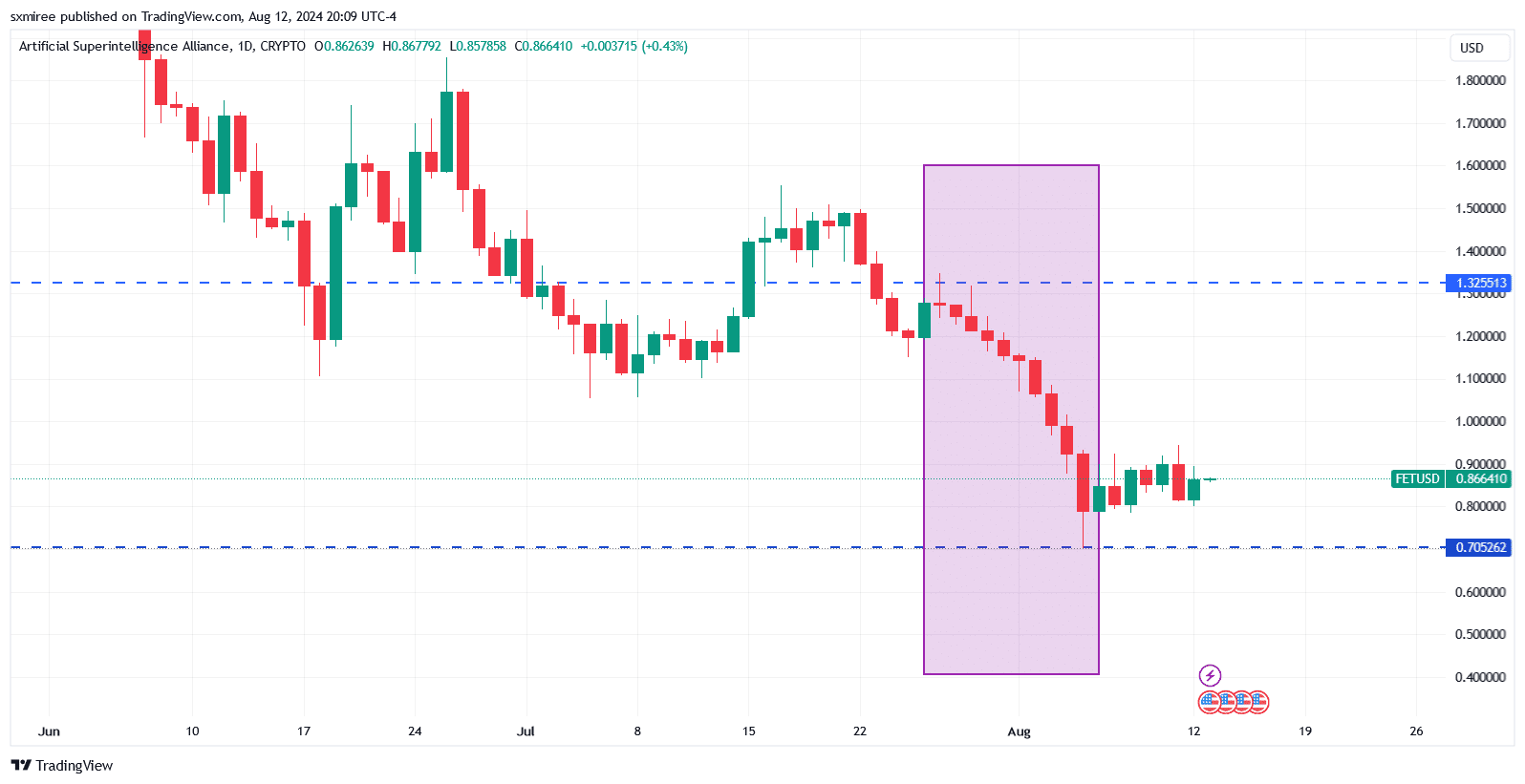

- ASI price has established a firm footing above the $0.76 level, which coincides with its most recent breakout zone.

As a seasoned researcher with over two decades of experience in the cryptocurrency market, I have seen my fair share of ups and downs – some so steep they could rival the Swiss Alps! The recent events surrounding the Artificial Superintelligence Alliance (ASI) token have certainly piqued my interest.

Over the past six weeks, the token issued by the Artificial Superintelligence Alliance (ASI), resulting from the fusion of Fetch.ai, SingularityNET, and Ocean Protocol, has failed to live up to traders’ anticipations.

From the 27th of July to the 5th of August, the alliance token related to artificial intelligence experienced a ten-day streak of daily declines, falling from $1.32 down to $0.72.

Significantly, the trading volume over a 24-hour span increased substantially during that heavy selling phase, peaking at more than $321 million on the 5th of August amidst significant losses.

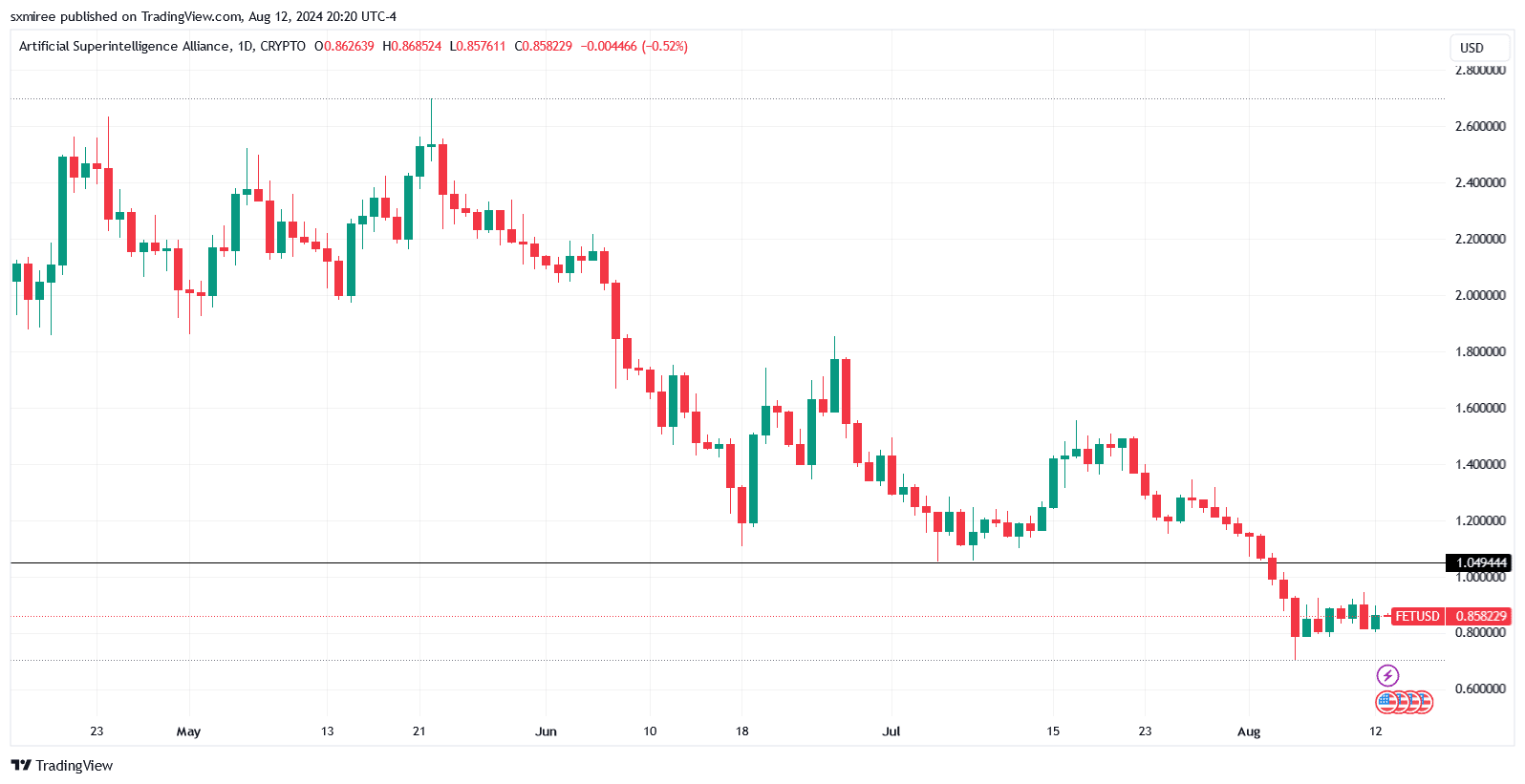

At the moment of publishing, ASI was being traded at $0.8475, marking a 27% decrease over the past month, and currently standing 75% lower than its peak in March.

According to CoinMarketCap’s data, Asiatic Chain (ASI) experienced a decrease exceeding 40% after the transfer of SingularityNet and Ocean Protocol’s native tokens to their joint cryptocurrency commenced on July 1st.

SingularityNET AGI supercomputer

Last week, SingularityNET disclosed plans for their upcoming AGI supercomputer, slated to go live in September. They anticipate that the full development and launch of the initial computational device will take place between the end of 2024 and early 2025.

1. The specific date is contingent upon when our suppliers deliver their goods.

ASI/USDT technical analysis

ASI token has been facing a strong downturn since May when it traded under the FET symbol.

Since the start of phase one of the merger on July 1st, the AI-related token generally stayed above $1.04. However, it dipped below this price for the first time on August 4th, due to a broad sell-off in both cryptocurrency and stock markets.

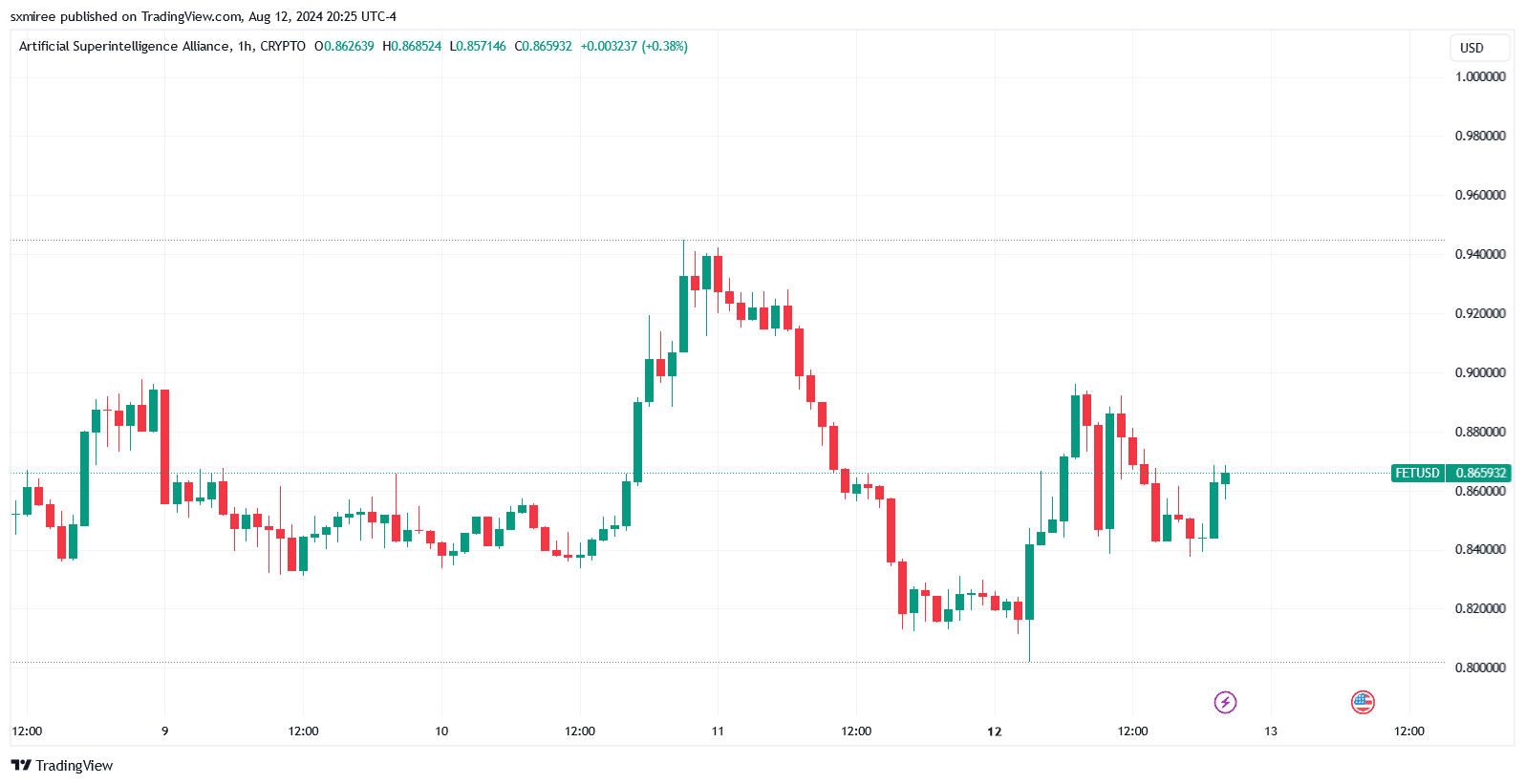

Over the weekend, the value of ASI came close to reaching the one-dollar figure, peaking at 0.94 dollars on Sunday, 11th August, but in the end, it failed to maintain those gains.

As a crypto investor, I saw the token drop back to $0.80 at the brink of the new week, but it bounced back and made an effort to surge past $0.90 yet again – only to be turned down on Monday, much like the previous attempt.

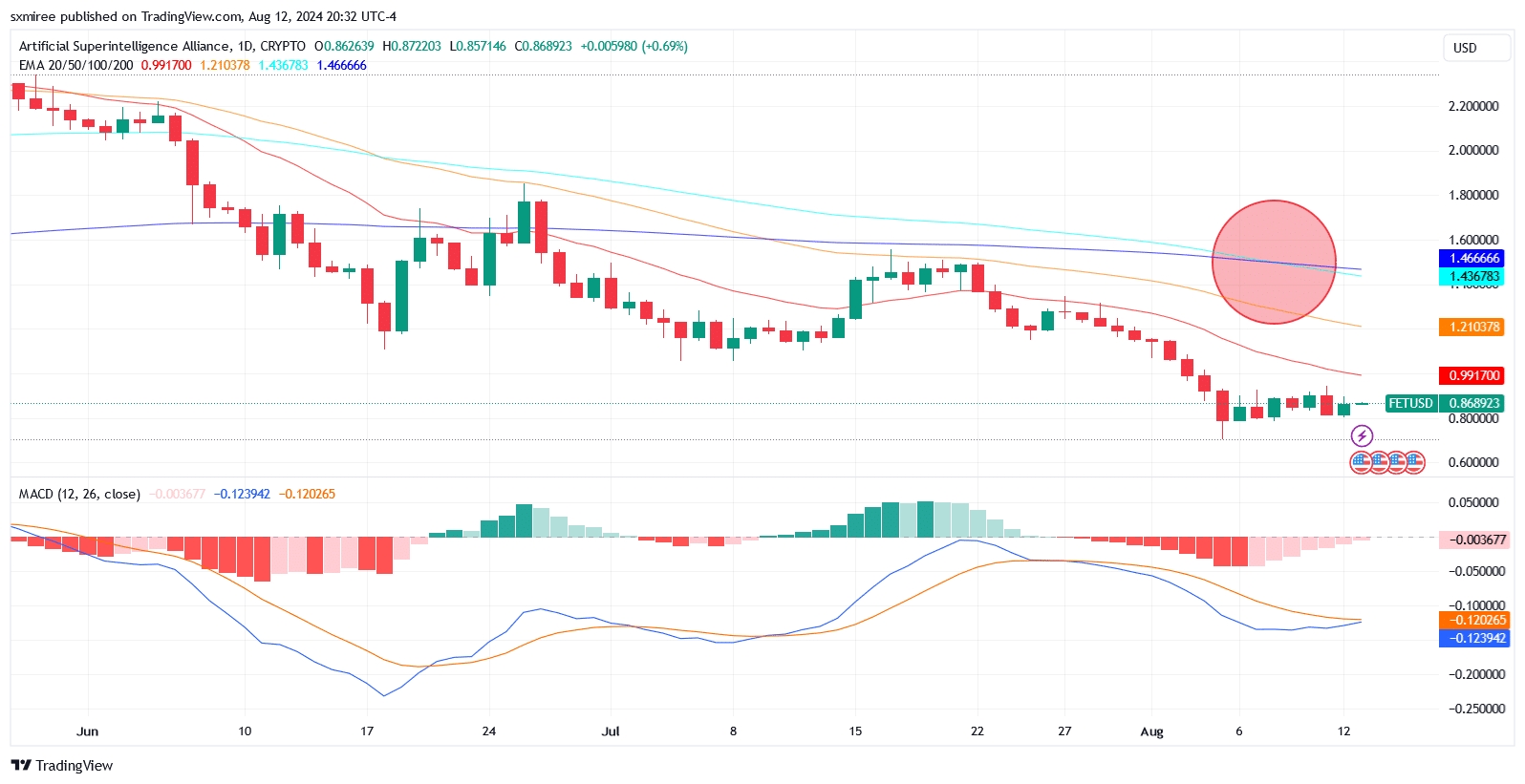

On the daily ASI/USDT chart, the pair appears to be moving within a bearish trend channel, with its upper limit hovering around the $1.6 level. This pattern in a declining parallel channel typically indicates persistent downward momentum.

As a crypto investor, spotting a break above the upper limit of the trading channel can be an encouraging sign of a potential trend flip and a promising moment to consider making a purchase.

At present, ASI is not keeping pace with its 20-, 50-, and 100-day exponential moving averages, which are trending higher. This suggests a period of weakness for ASI.

On the daily chart, the 100-day Exponential Moving Average dropped beneath the 200-day Exponential Moving Average on August 9th. This technical indicator often suggests that the market may continue to fall.

In the past week, multiple instances of declining Moving Average Convergence/Divergence (MACD) have been observed, indicating a steady increase in selling pressure over the buyers. This trend suggests that market demand is decreasing as sellers are taking control.

The graph shows the signal line moving higher than the MACD line, which implies a dominant bearish force and suggests a prolonged drop in prices might continue.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-08-13 11:36