-

A significant increase in the number of new wallets fuelled AAVE’s recent price surge.

Despite the rally facing rejection at $180, more bullish signs are still in play.

As a seasoned researcher and cryptocurrency enthusiast with years of market analysis under my belt, I find myself intrigued by AAVE‘s recent performance. The surge in new wallet holders and the sustained buying momentum are undeniably bullish signs. However, as someone who has seen more than a few market cycles, I can’t help but wonder if we’re seeing a classic case of ‘too much, too soon.’

In the world of digital currencies, AAVE has been shining brightly, boasting a 20% increase over the past week as we speak.

Due to the recent rally, AAVE‘s market value has approximately doubled over a span of three months, reaching over $2.5 billion.

In Q3 of 2024, AAVE experienced growth amidst the volatile fluctuations in the wider market. This instability prompted a surge of interest, leading many traders to create new AAVE wallets in an attempt to capitalize on their earnings.

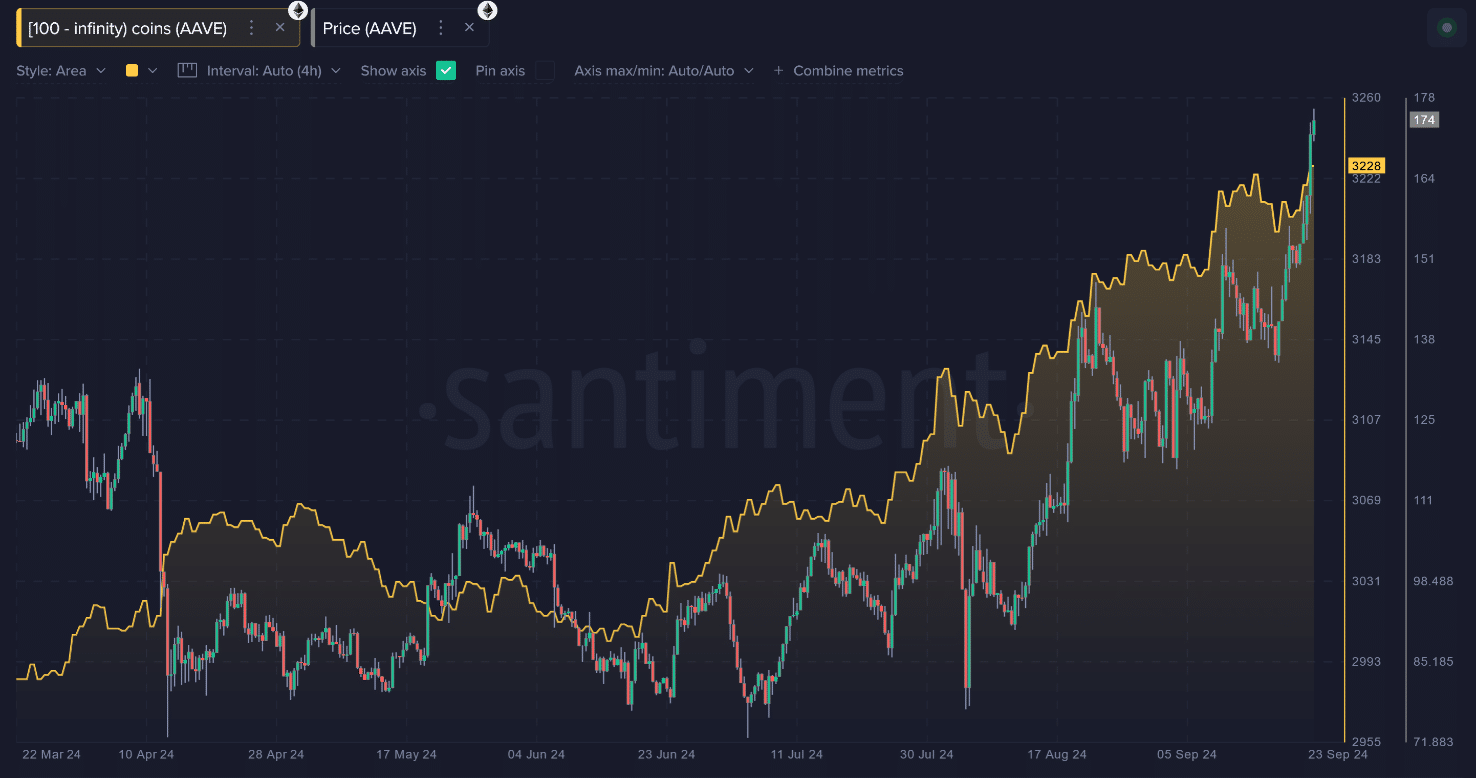

According to Santiment’s analysis, the number of cryptocurrency wallets containing over 100 AAVE tokens has risen by more than 7% since mid-June, reaching approximately 3,229 wallets. This growth in holders could be contributing to the buying pressure that has been driving up AAVE’s price.

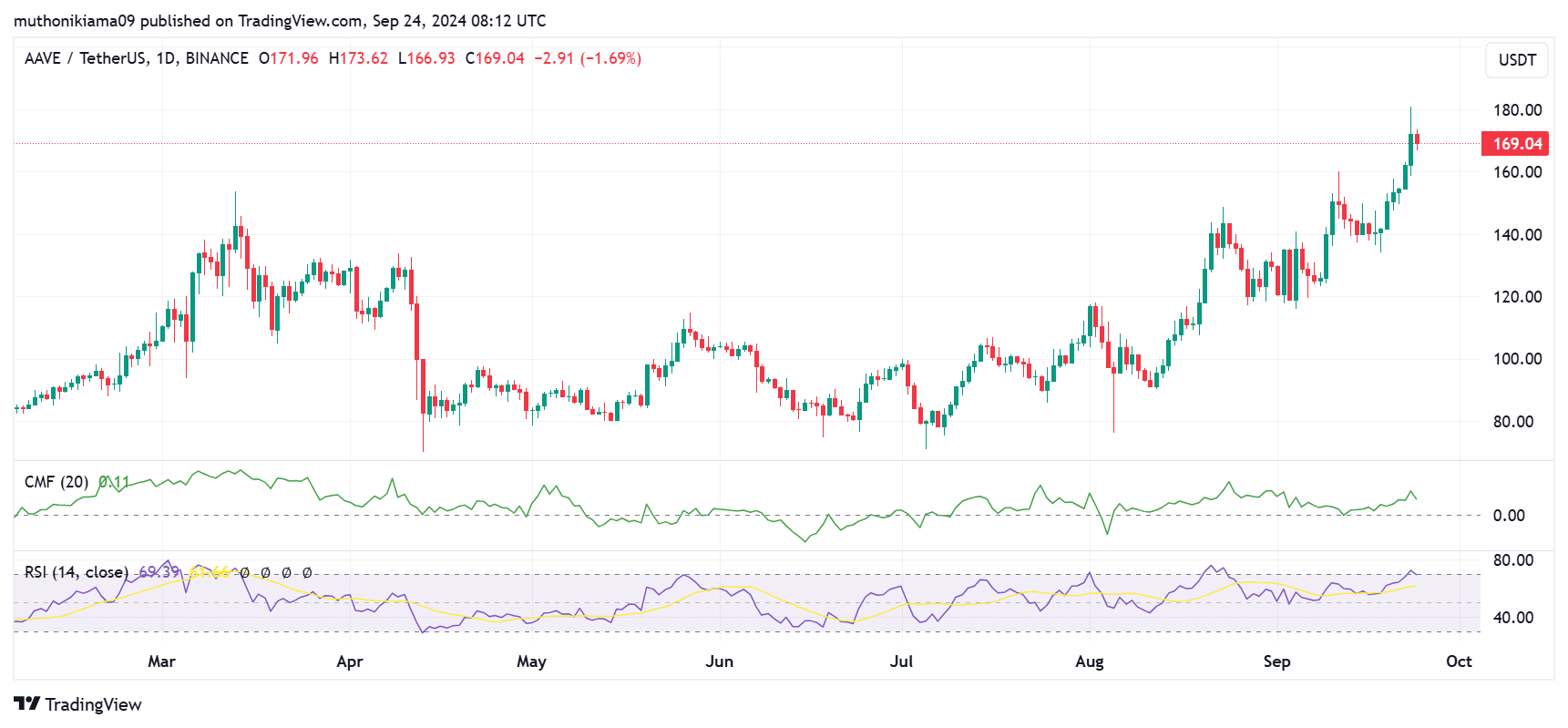

The direction of AAVE‘s price movement is primarily influenced by buyers, as demonstrated by the consistent positive reading on the Chaikin Money Flow (CMF) since August.

Additionally, the Relative Strength Index (RSI), which currently stands at 69, indicates that the bulls are still maintaining their upper hand, suggesting continued positive momentum.

Since AAVE‘s price has more than doubled since August, are there any clear indications suggesting that the token might be approaching an overheated state?

AAVE price prediction

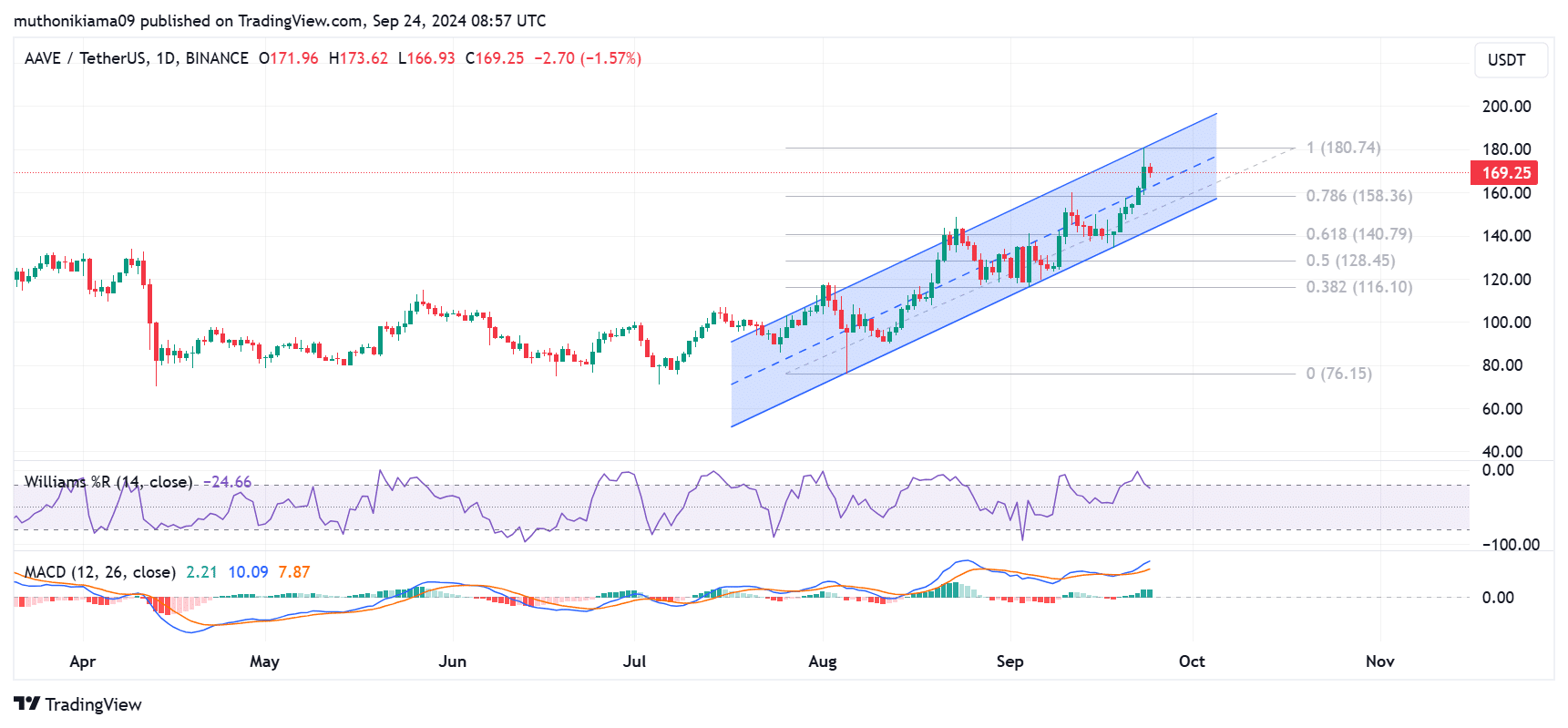

At the moment, AAVE was being exchanged for approximately $168, and it was moving upwards along a rising trendline on the daily chart, suggesting a positive trajectory.

A breakout from this channel failed after the altcoin encountered resistance at $180, causing a swift correction.

The upward momentum of AAVE was halted when it reached a certain price due to being overbought, as shown by the Williams %R indicator. Currently, this measure stands at -24, indicating that the surge in its value may have slowed down or even reversed.

Regardless of the decline, AAVE continued to trade above the median line of its channel, and there was a significant support level found at the 0.786 Fibonacci point, which corresponded to approximately $158.

In this area, there’s a likelihood that AAVE might make another push beyond its current boundaries, given that the buying pressure stays robust.

In other words, if AAVE can’t maintain its value above a significant support level at $148, there’s a possibility it might fall below the downward trendline of this channel, triggering a potential bearish trend change.

Investors who purchased during the uptrend might decide to sell if the current support weakens, as a strategy to limit potential losses.

Read Aave’s [AAVE] Price Prediction 2024–2025

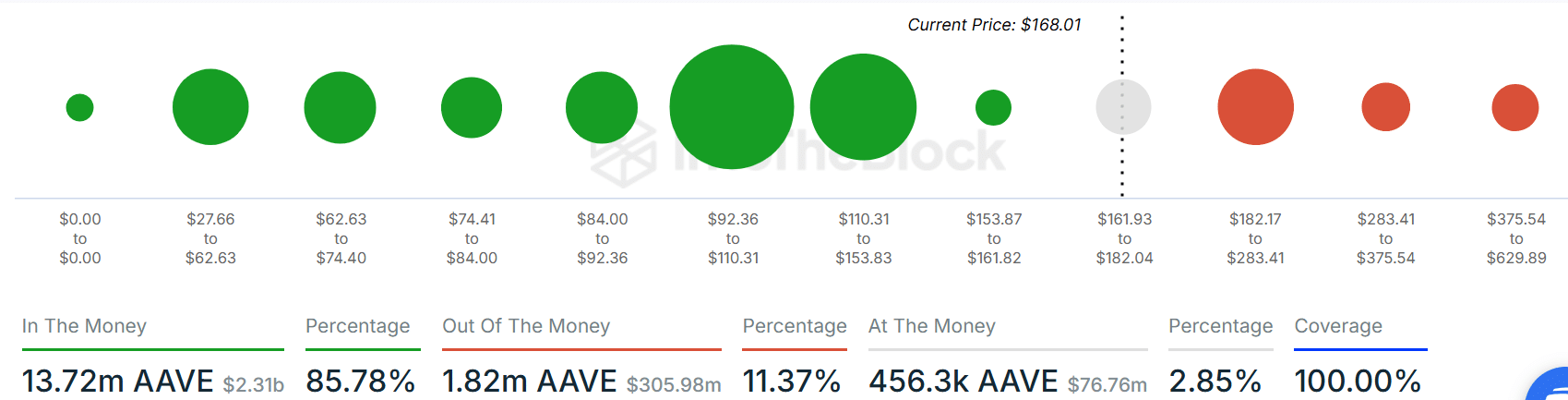

At the same time, more than 456,000 AAVE tokens were bought at the $161-$182 price levels.

Consequently, the trading activity in AAVE may show some fluctuations around these price points, as traders try to minimize their losses or boost their earnings.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-09-24 17:43